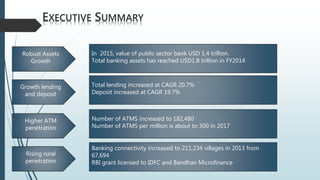

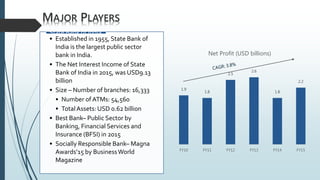

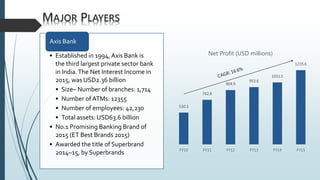

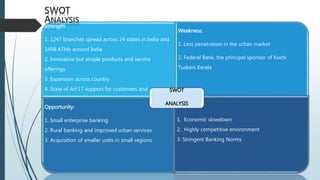

The document provides an overview of the banking sector in India, highlighting the robust growth in assets, lending, and deposits, with public sector banks valued at USD 1.4 trillion in 2015. Major players like State Bank of India, HDFC Bank, and Axis Bank are detailed, emphasizing their branch and ATM network, total assets, and notable achievements. Additionally, a SWOT analysis for a specific bank indicates strengths, weaknesses, opportunities, and threats in the competitive banking landscape.