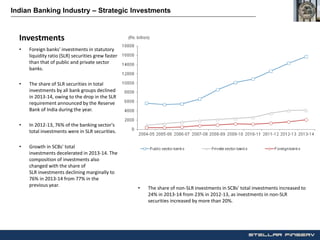

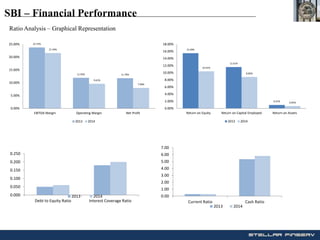

The document provides an overview of the Indian banking industry. It discusses advances, deposits, investments, non-performing assets, operating expenditures, net profit margins, and major players like SBI and ICICI Bank. The banking industry has grown at a healthy pace with advances increasing at a 17% CAGR. Deposits have also increased steadily. While NPAs pose some challenges, the future outlook remains positive due to government initiatives and increasing penetration of banking services.