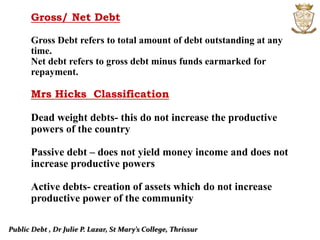

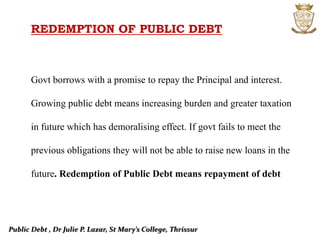

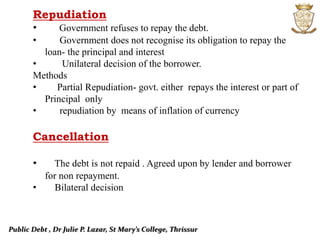

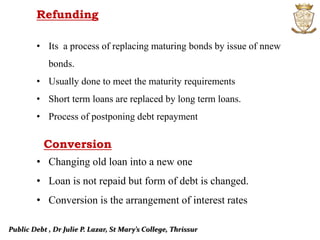

The document discusses public debt, detailing its definitions, objectives, and various classifications including internal/external, productive/unproductive, and redeemable/irredeemable debts. It highlights the causes for public debt, such as covering budget deficits and financing welfare programs, and explains methods of debt repayment, including sinking funds and terminal annuities. The implications of growing public debt, including increased taxation and potential repudiation, are also emphasized.