Bajaj Auto is an Indian motorcycle and auto rickshaw manufacturer. It is the world's sixth largest motorcycle manufacturer and second largest in India. Some key points:

- Headquarters in Pune, India with plants also in Aurangabad and Uttarakhand

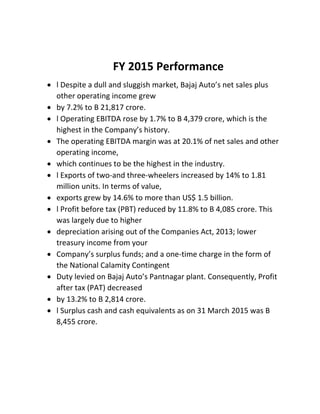

- Market cap of ₹640 billion as of May 2015, ranking it as India's 23rd largest public company

- Targeting 27-30% market share of India's motorcycle market through new launches in coming months

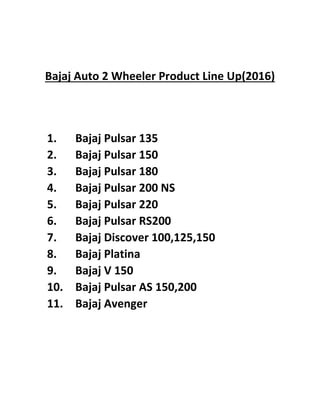

- Products include Pulsar, Discover, Platina, Avenger motorcycle brands and auto rickshaws

- David Pieris Group is the authorized dealer and reseller of Baj