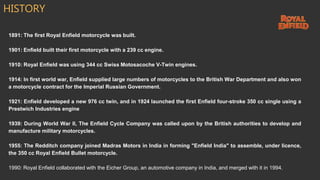

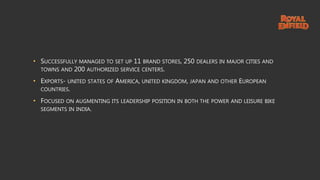

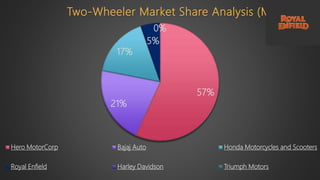

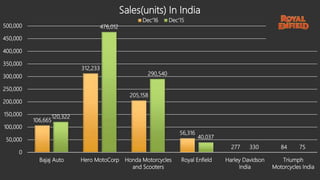

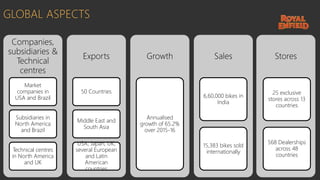

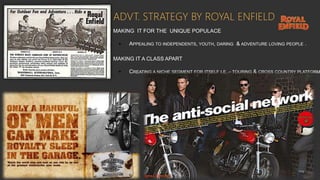

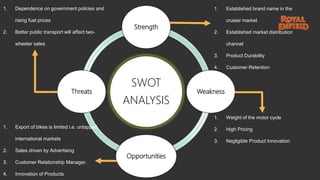

Royal Enfield, founded in 1891, evolved through significant milestones including military contracts during WWI and a merger with Eicher Motors in 1994, becoming a staple in the Indian motorcycle market. The company successfully modernized its products while retaining a vintage appeal, establishing a robust distribution network and community outreach. Despite challenges like pricing and market competition, Royal Enfield continues to leverage its brand strength with a focus on niche segments and customer engagement.