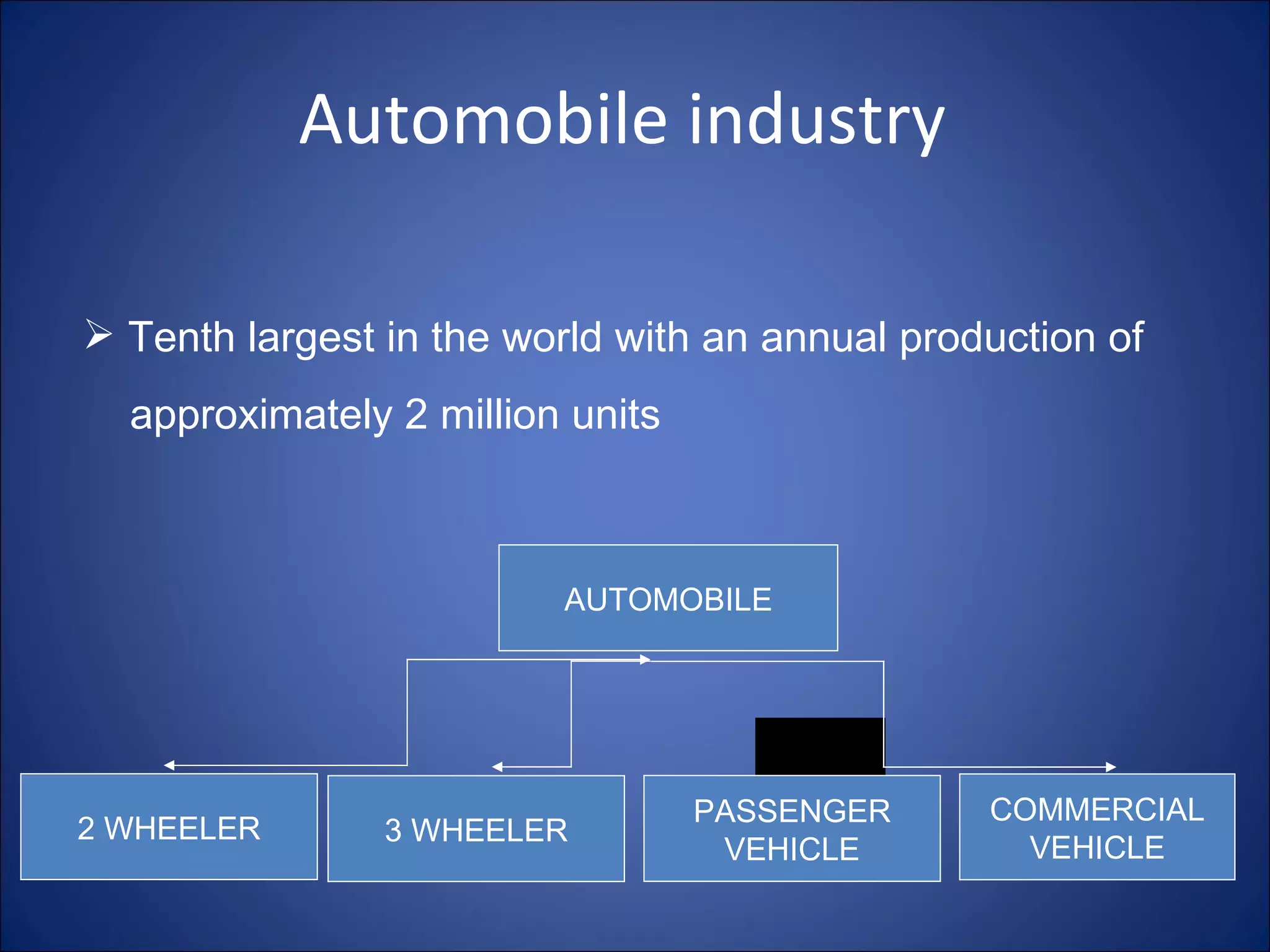

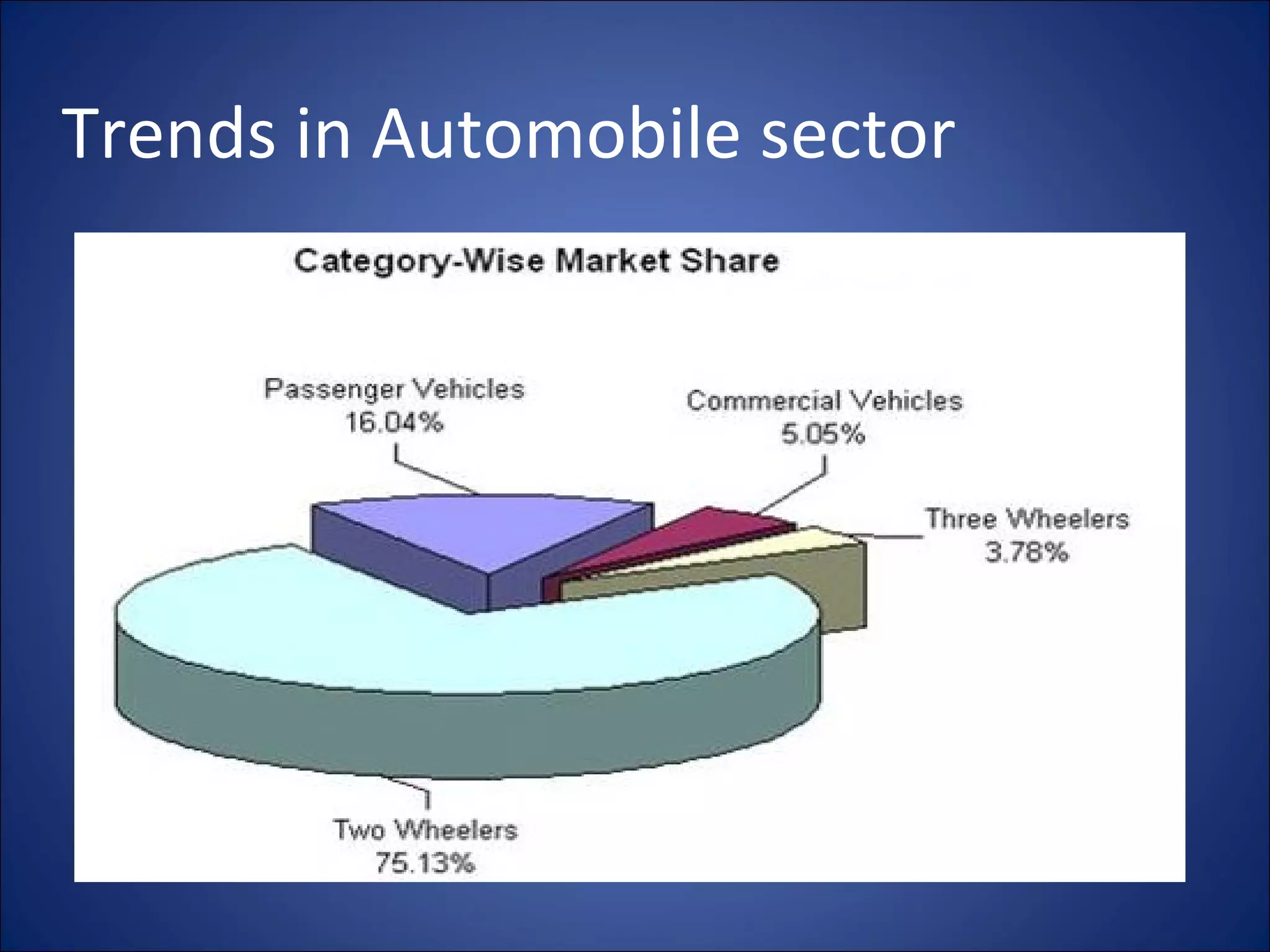

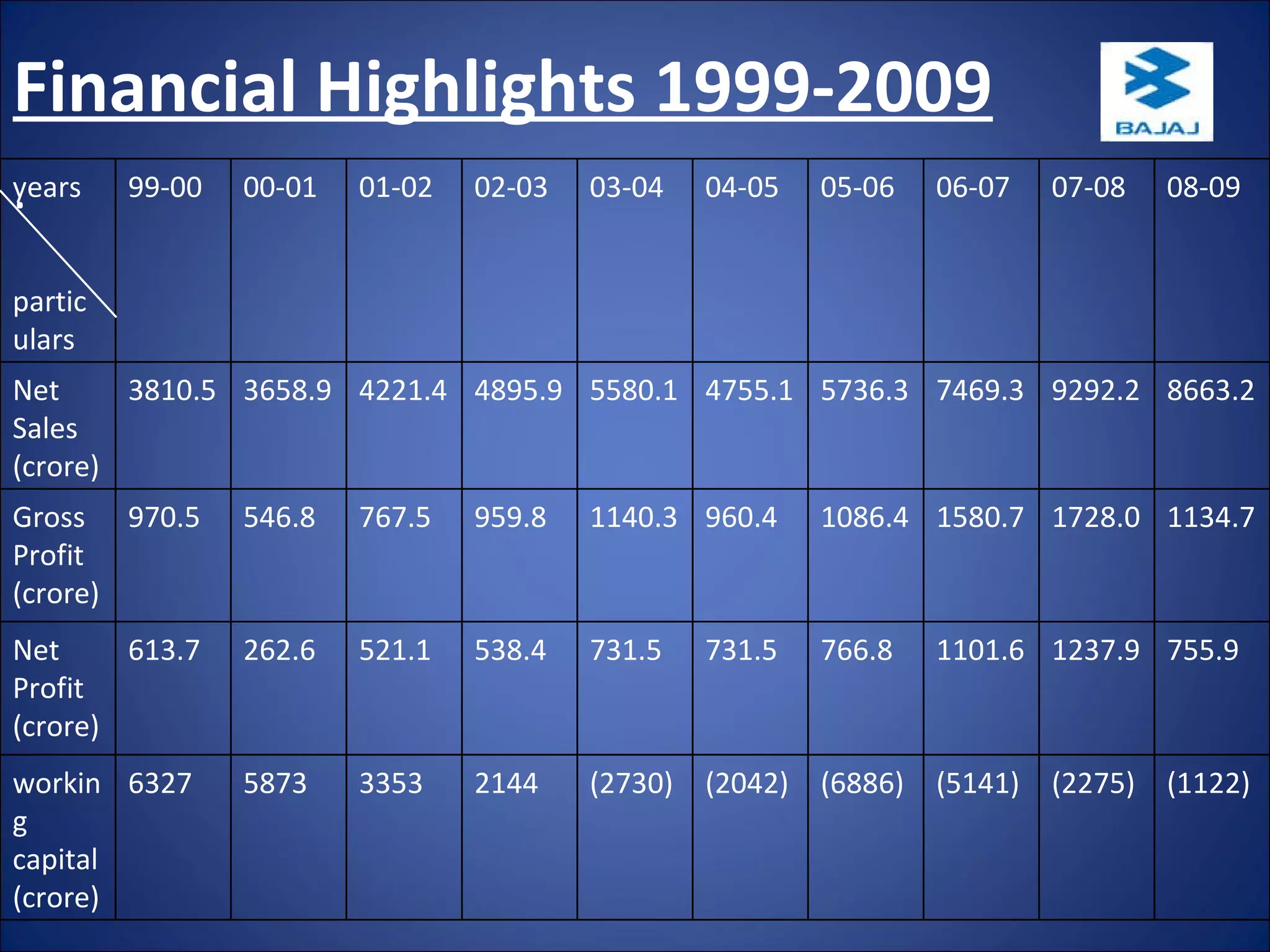

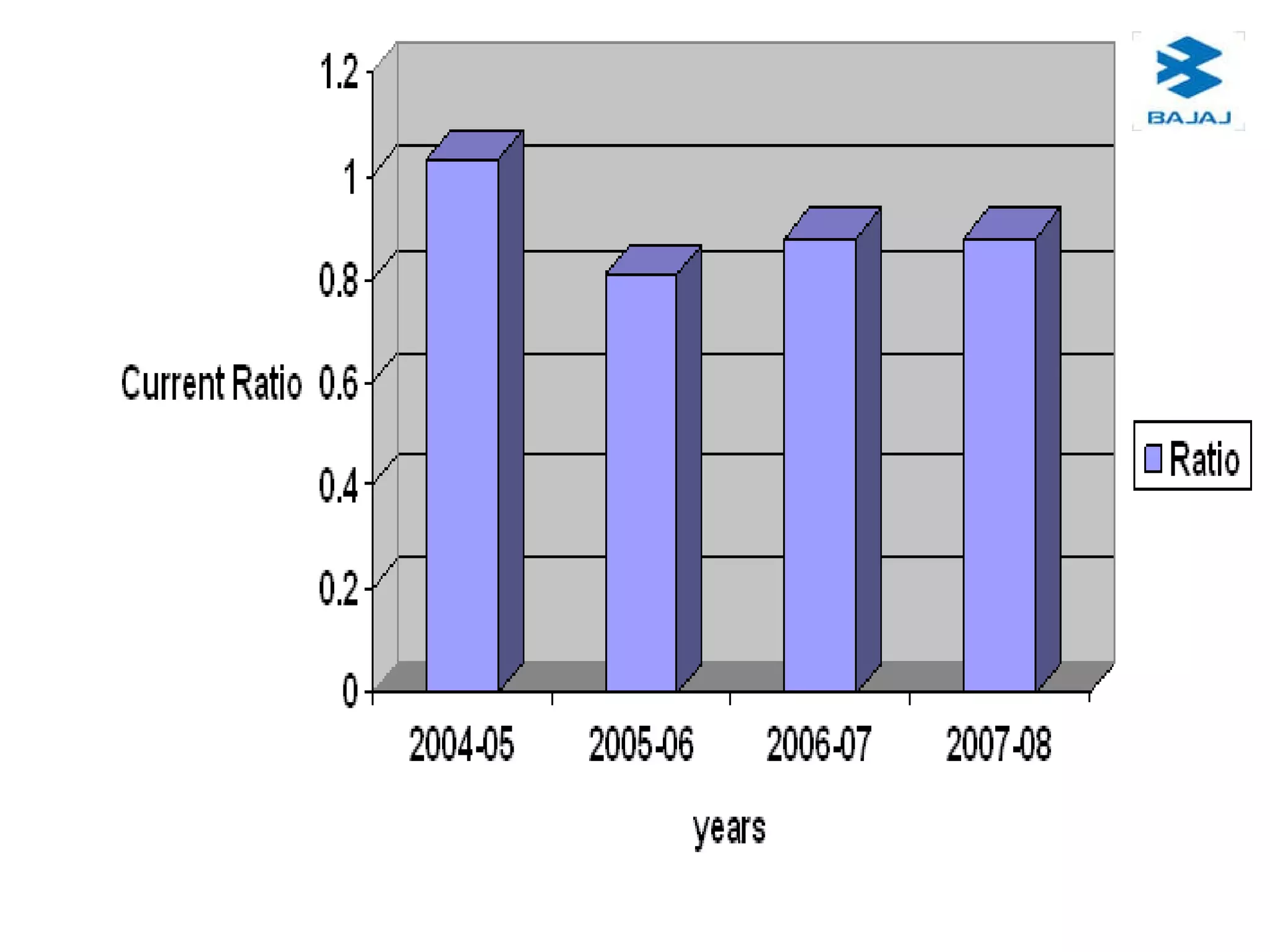

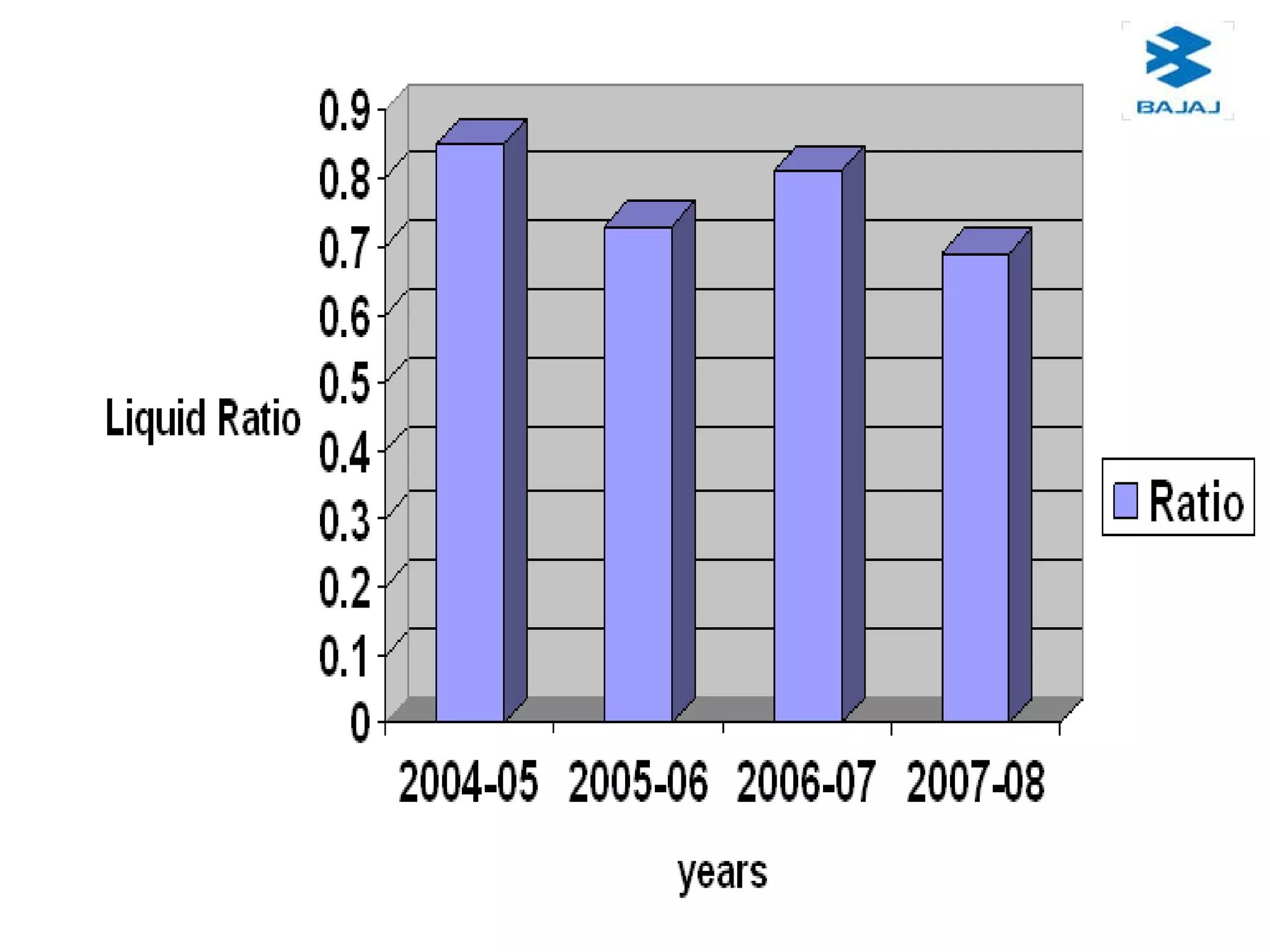

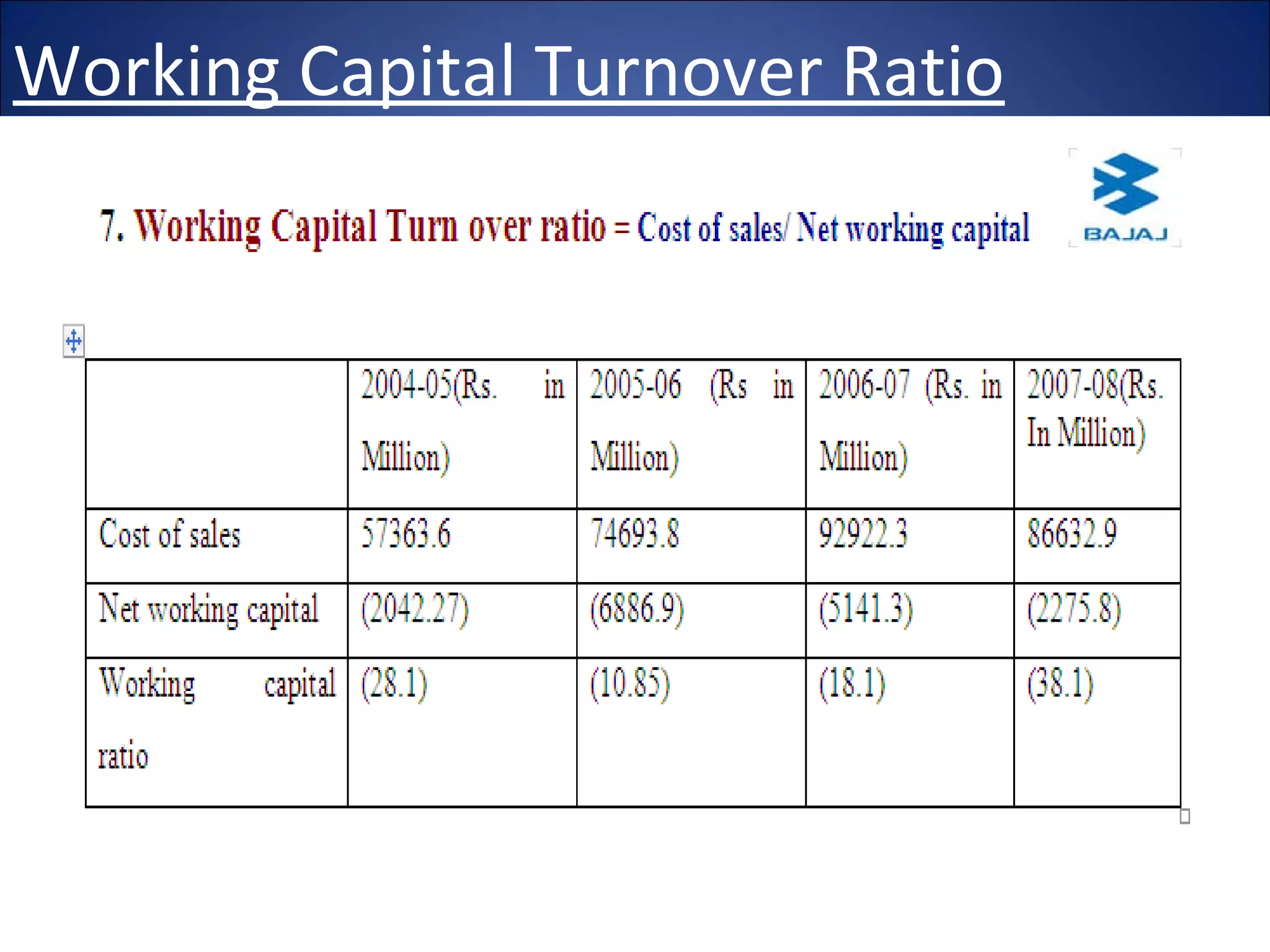

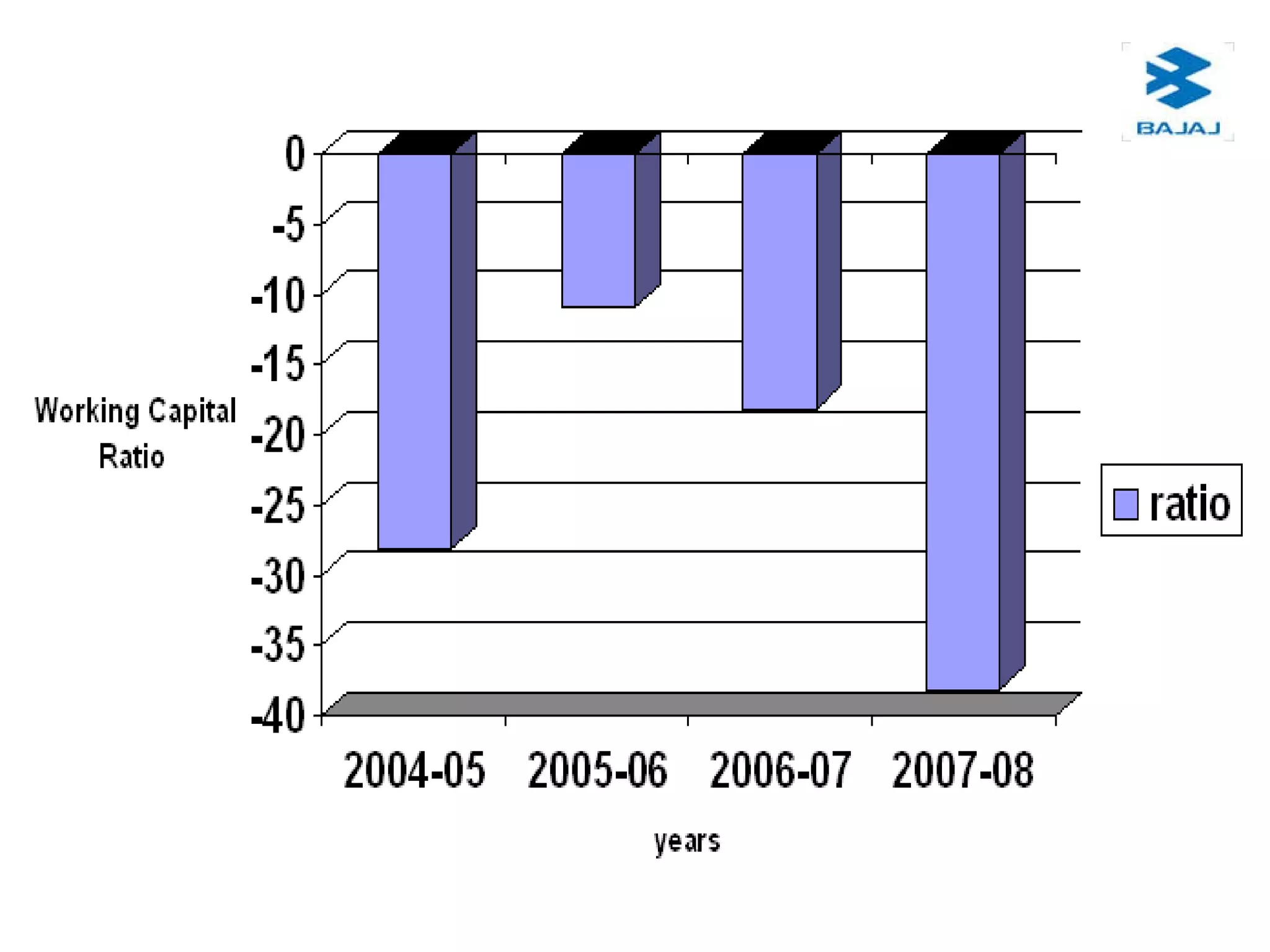

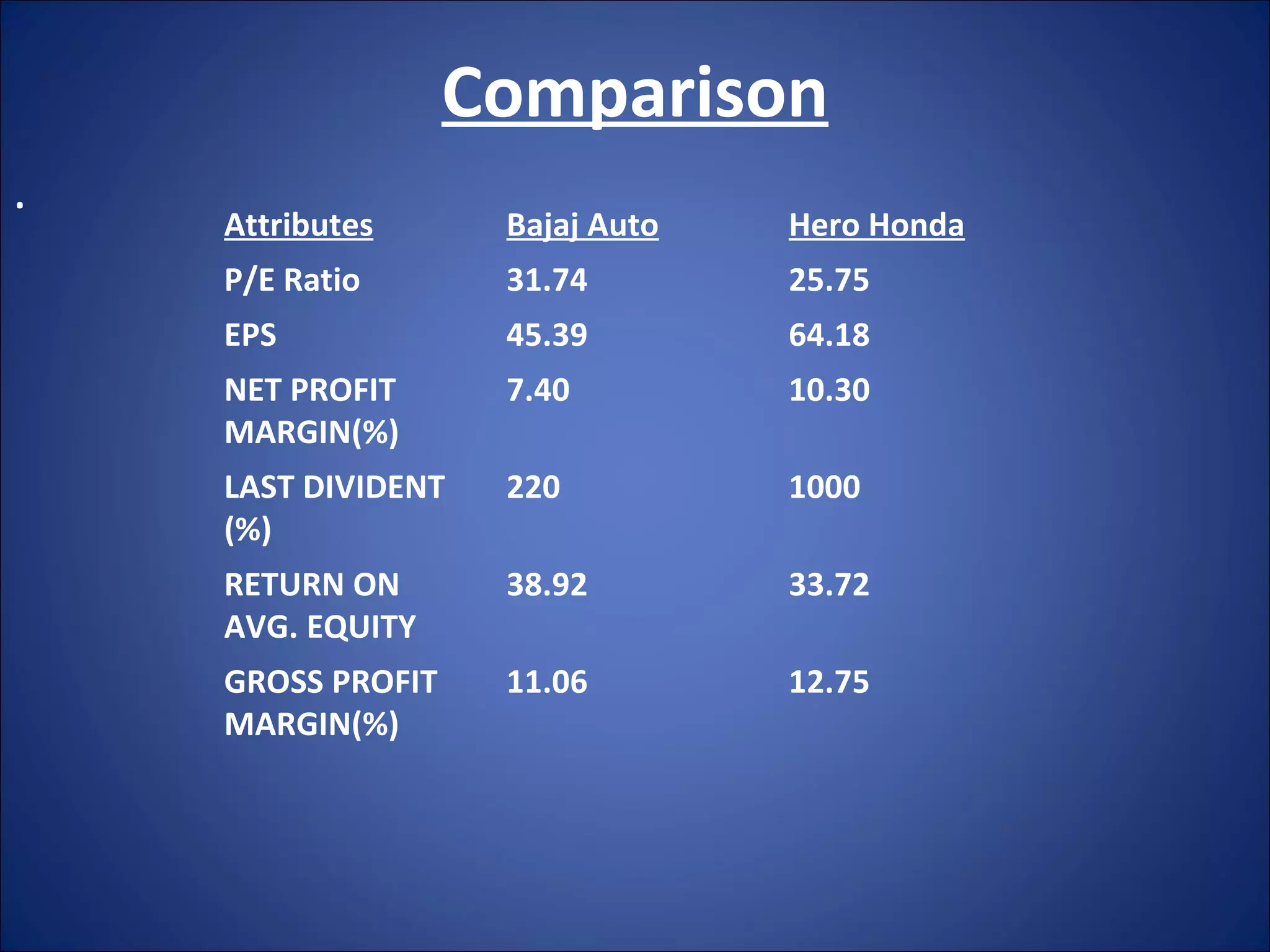

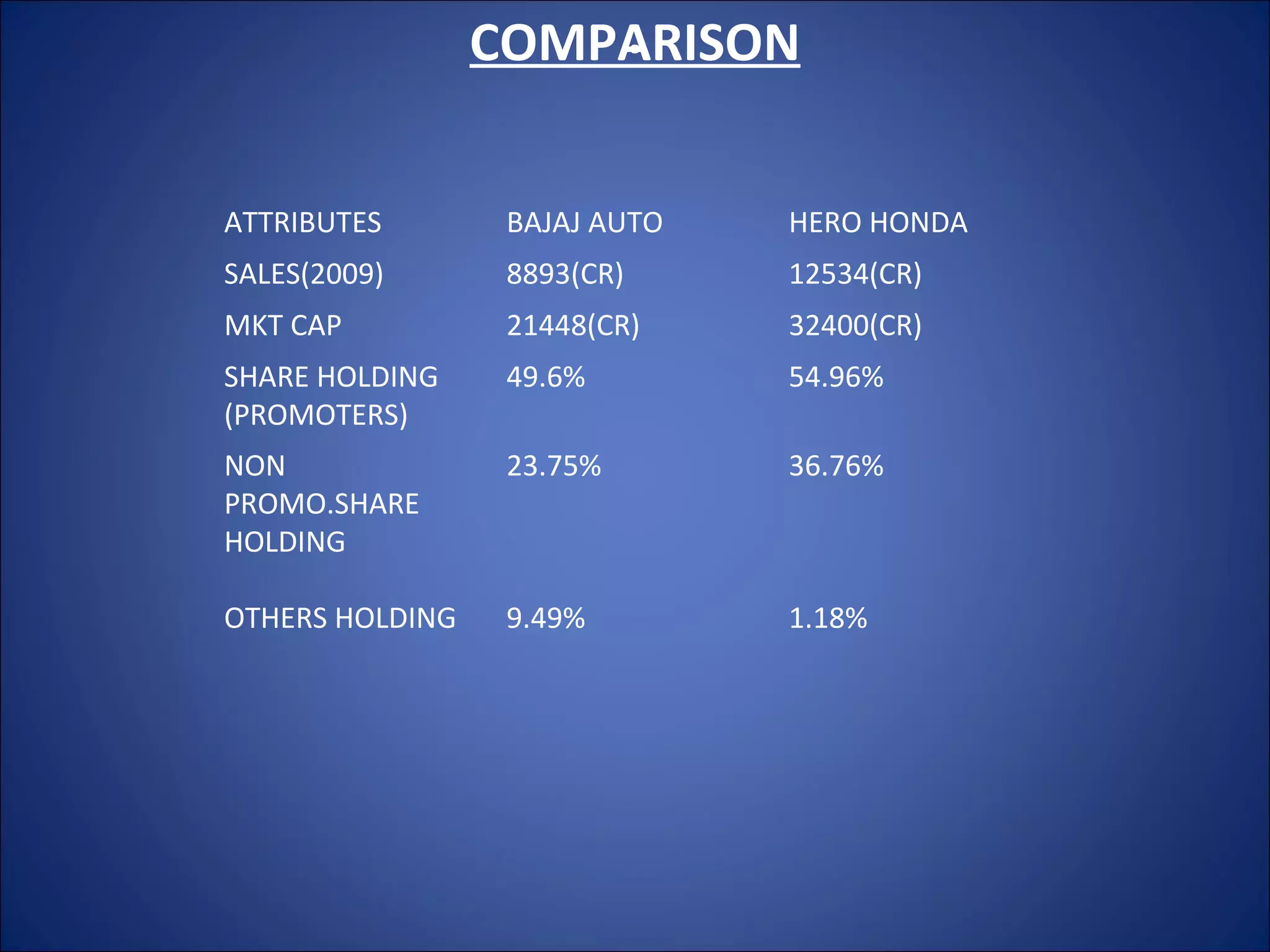

Bajaj Auto was founded in 1926 and initially manufactured sugar before diversifying into vehicle manufacturing in 1945. It is now India's largest two and three-wheeler manufacturer and the world's fourth largest. Bajaj Auto has experienced steady growth and released many new vehicle models over time. While its financial position is not as strong as competitor Hero Honda, with lower profit margins and negative working capital, Bajaj Auto remains an important player in India's large automobile industry and continues community service initiatives.