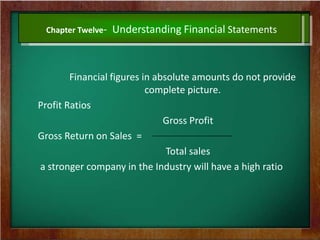

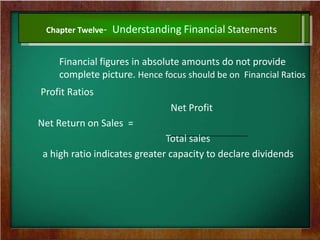

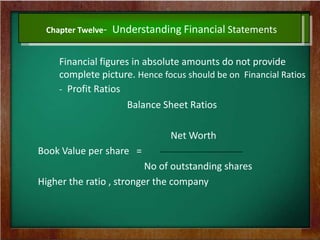

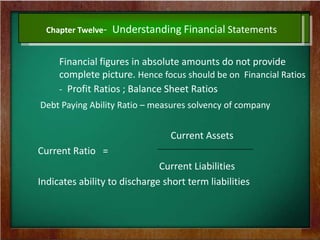

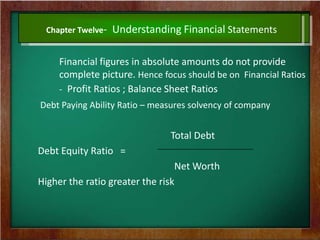

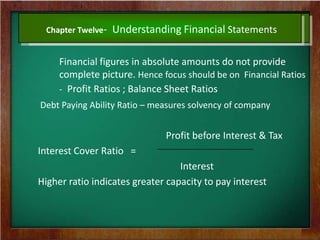

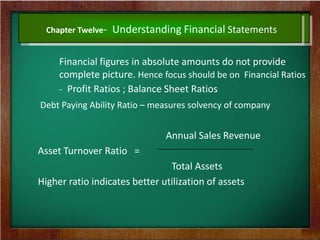

Chapter twelve discusses the importance of understanding financial statements, emphasizing that absolute financial figures alone do not provide a complete picture of a company's performance. It highlights the necessity of analyzing trends over time and using financial ratios, such as profit ratios and debt-paying ability ratios, to gauge profitability and solvency. Ultimately, a comprehensive understanding of financial statements requires a deep grasp of accounting techniques.