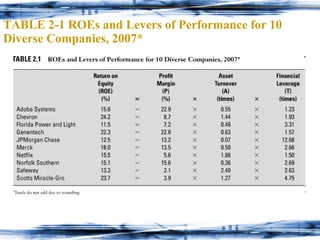

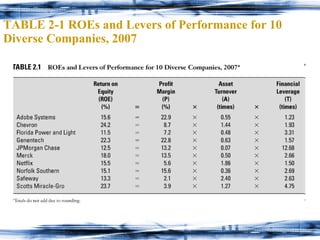

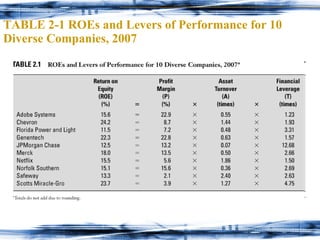

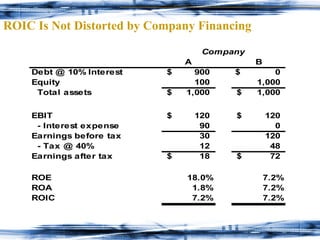

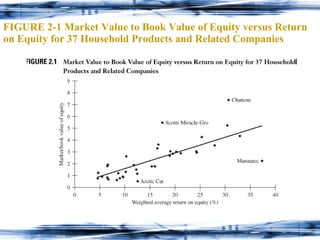

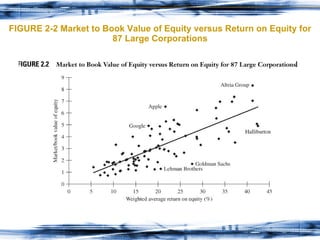

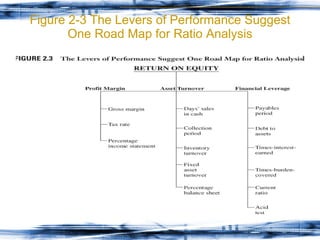

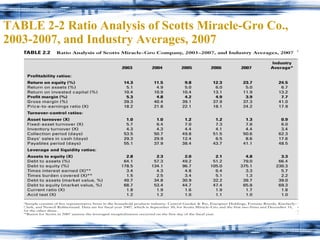

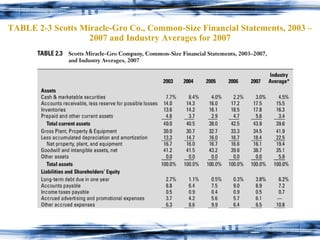

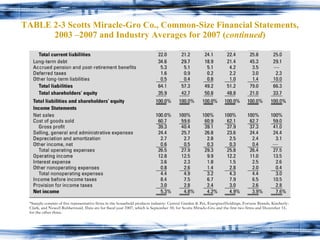

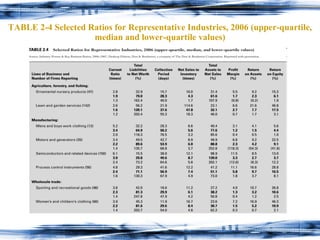

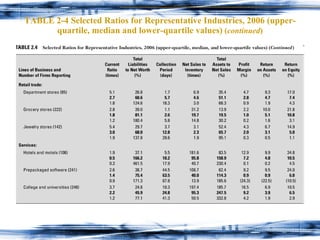

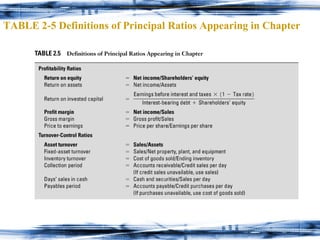

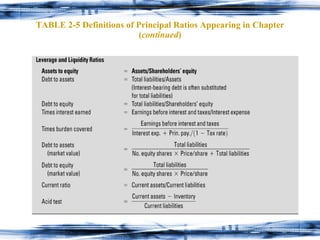

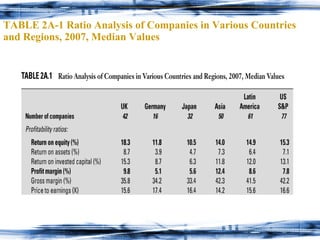

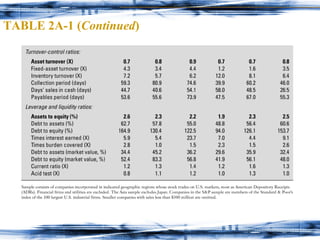

This document provides an overview of key financial performance metrics such as return on equity (ROE), return on assets (ROA), profit margin, asset turnover, and financial leverage. It discusses how these metrics can be used to evaluate and compare the financial performance of different companies. Tables of example data on multiple companies are presented to illustrate the concepts.