Embed presentation

Downloaded 606 times

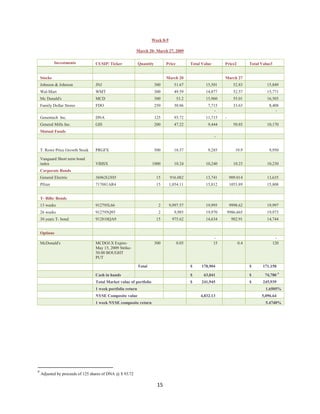

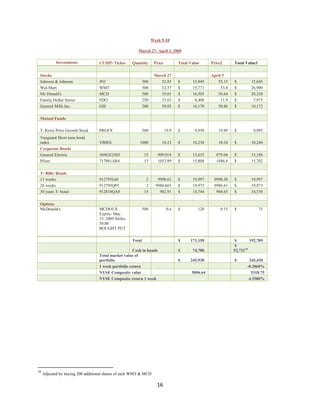

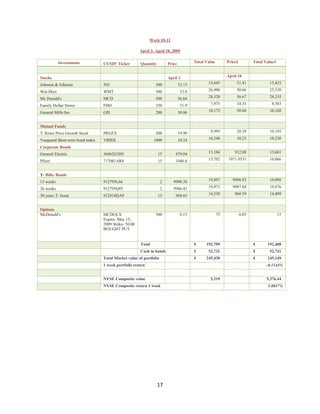

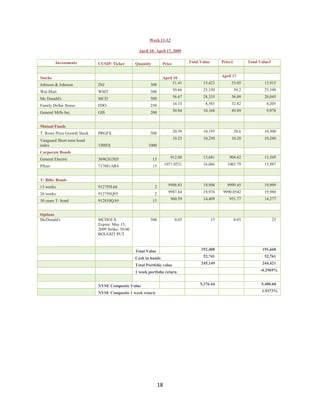

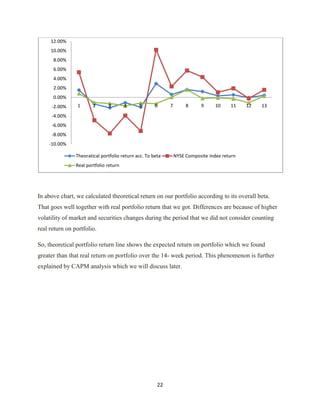

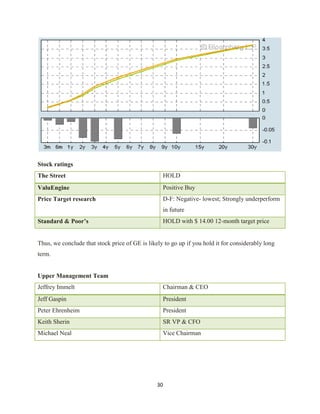

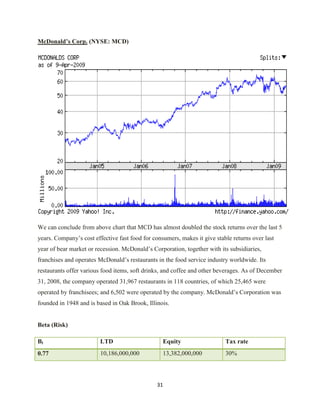

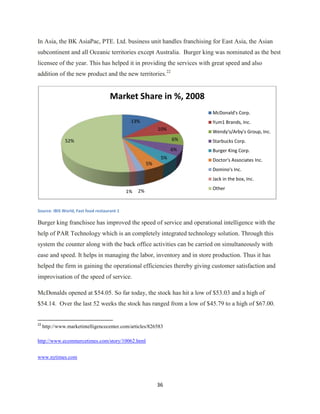

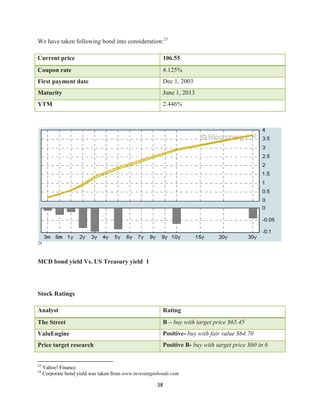

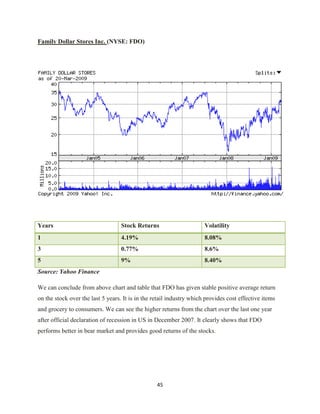

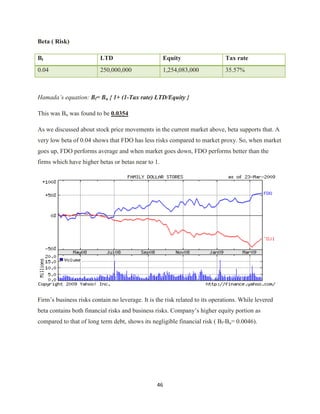

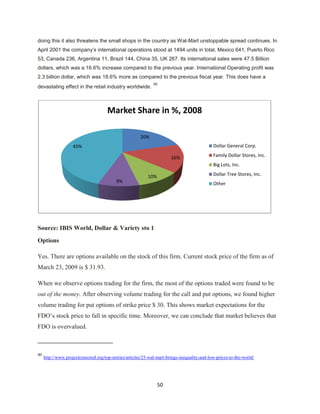

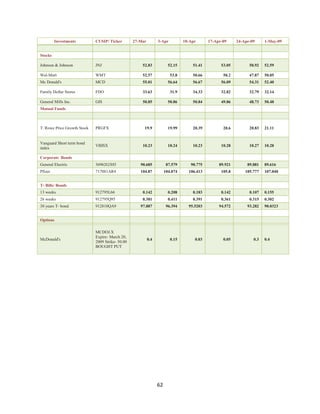

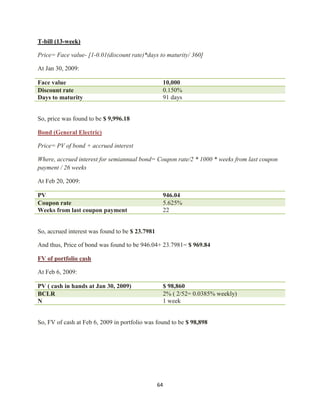

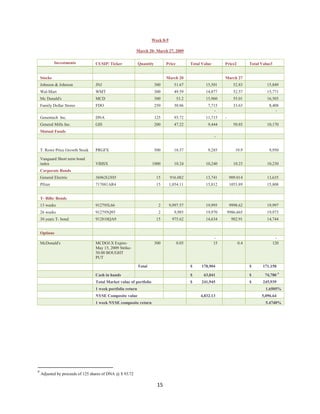

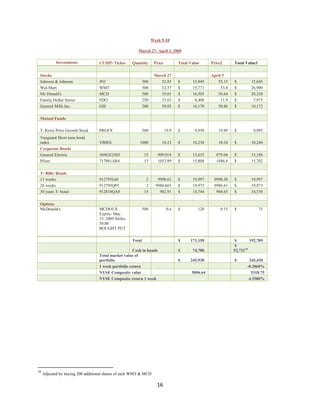

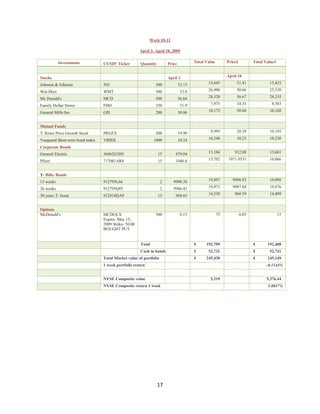

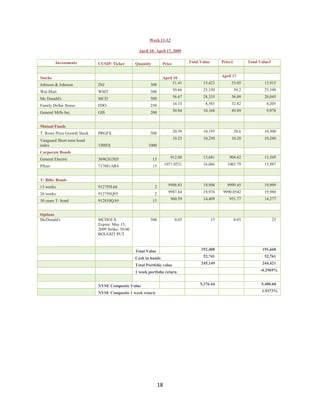

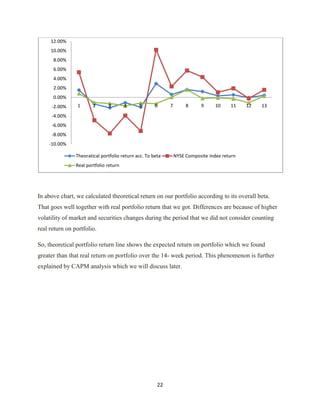

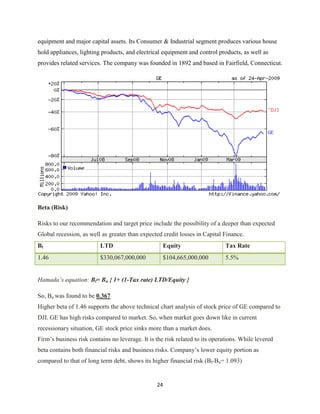

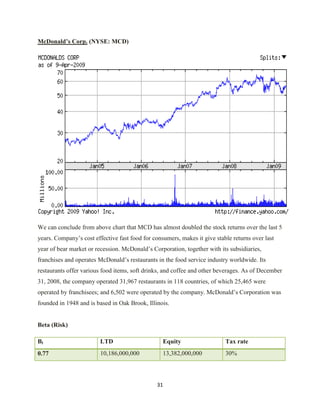

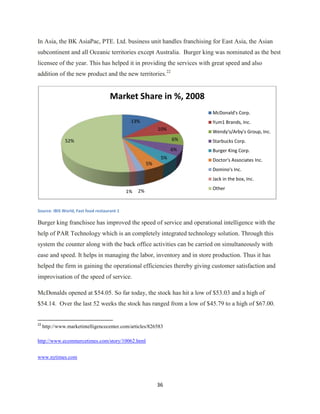

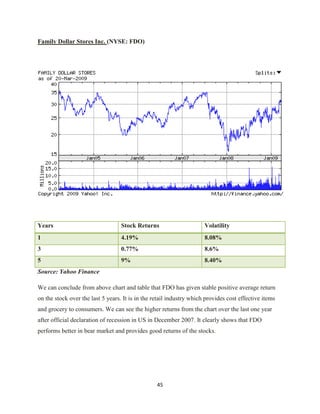

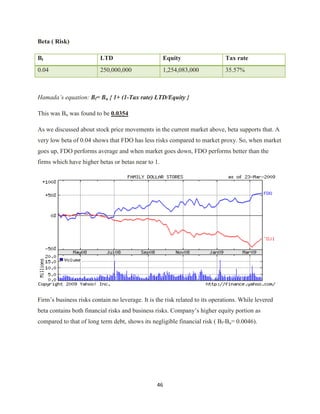

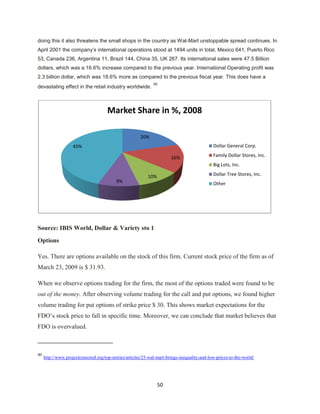

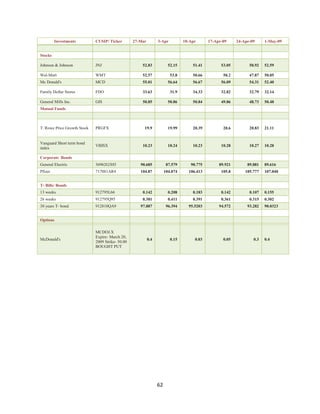

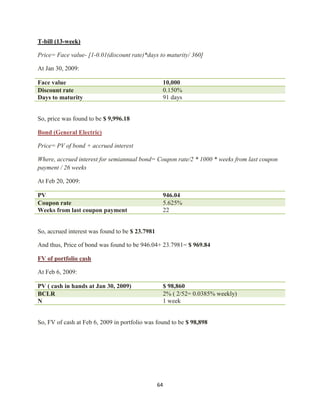

This document analyzes an investment portfolio over 14 weeks from January 30, 2009 to May 1, 2009. The portfolio was managed with the goal of preserving capital given the economic recession. Key points: - The portfolio was diversified across stocks, mutual funds, bonds, bills and held some cash. Individual securities like GE, McDonald's and Family Dollar were chosen for their lower beta and defensive nature. - The portfolio beta was approximately 0.3, much lower than the market beta of 1, indicating it would be less volatile. - The portfolio largely preserved capital, declining only 3.07% while the market rose 7.18%. The low beta strategy helped meet the goal of capital preservation in the volatile