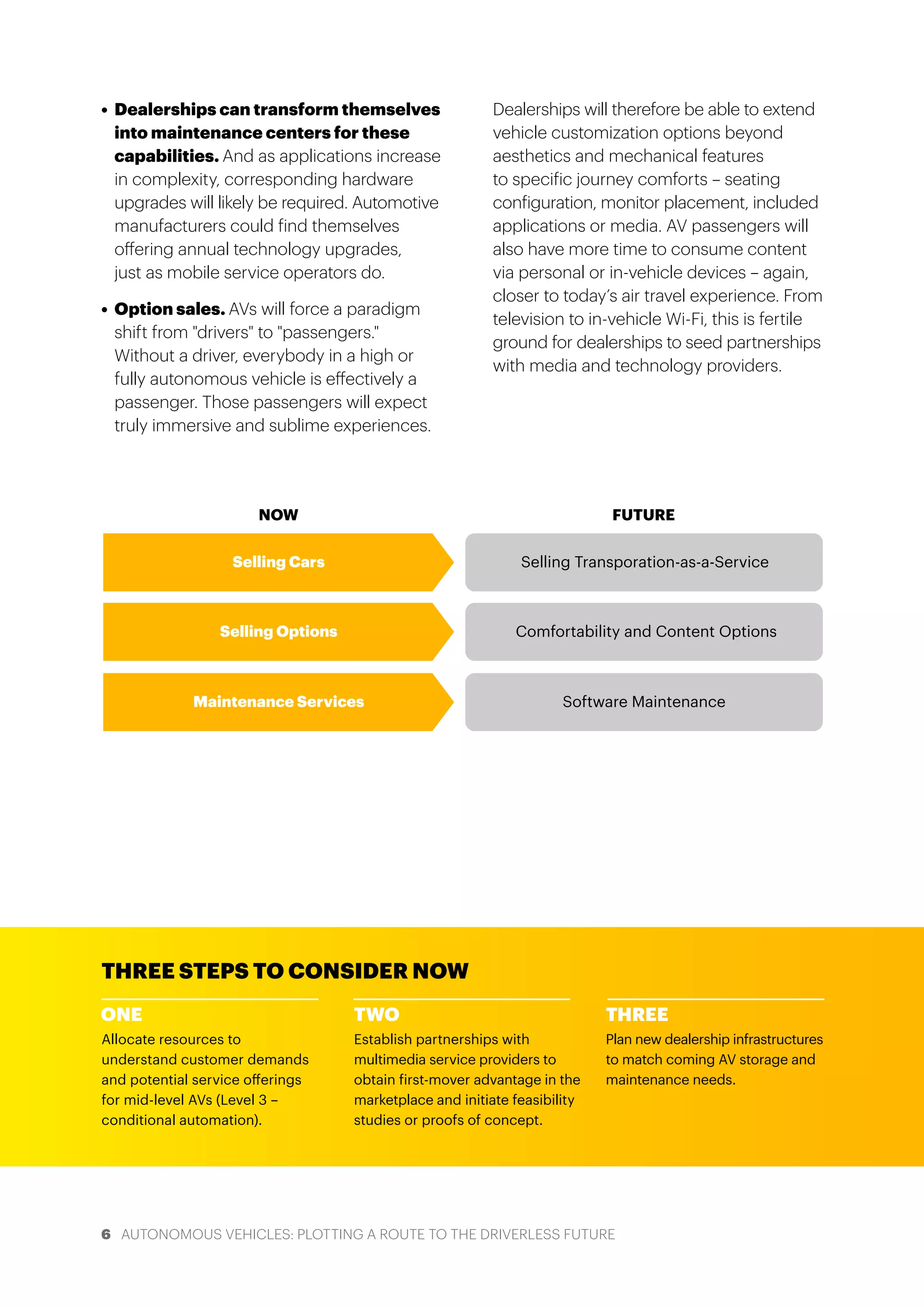

The document explores the rising adoption of autonomous vehicles (AVs) driven by technological advancements, changing consumer expectations, and shifts in mobility practices such as ridesharing. It discusses the implications of AVs across various industries, including automotive sales, logistics, and insurance, highlighting potential disruptions and new opportunities for innovation. The need for businesses to adapt and prepare for the widespread implementation of AVs is emphasized, calling for strategic planning and collaboration in the evolving landscape.