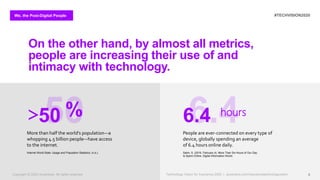

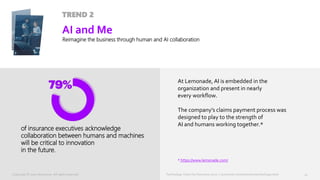

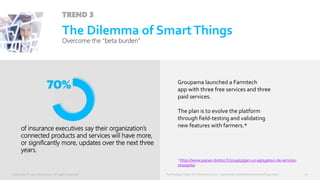

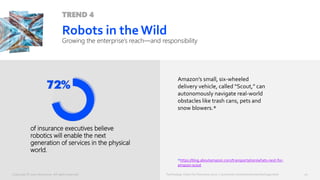

The document discusses technology trends in the insurance industry. It notes that while people are increasingly using technology, they are also rejecting aspects of technology through "tech-lash." It identifies five technology trends insurers should address: 1) Focusing on personal agency in digital experiences, 2) Using AI to enhance human capabilities rather than just automation, 3) Addressing issues from constantly updated smart devices and services, 4) Preparing for robotics to move beyond enterprises, and 5) Developing continuous innovation capabilities. The document urges insurers to transform models that are incongruous with customer expectations to survive technological changes.