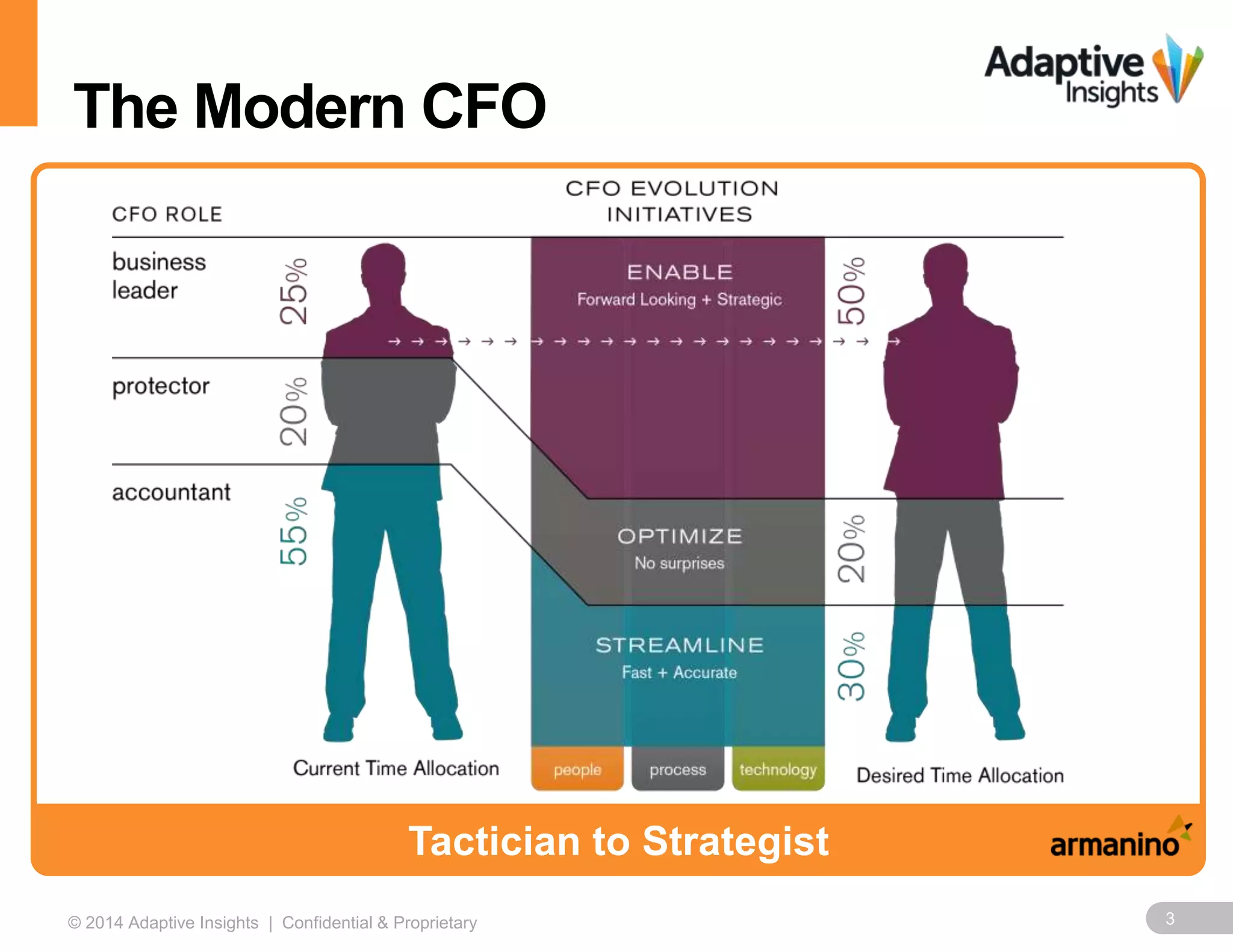

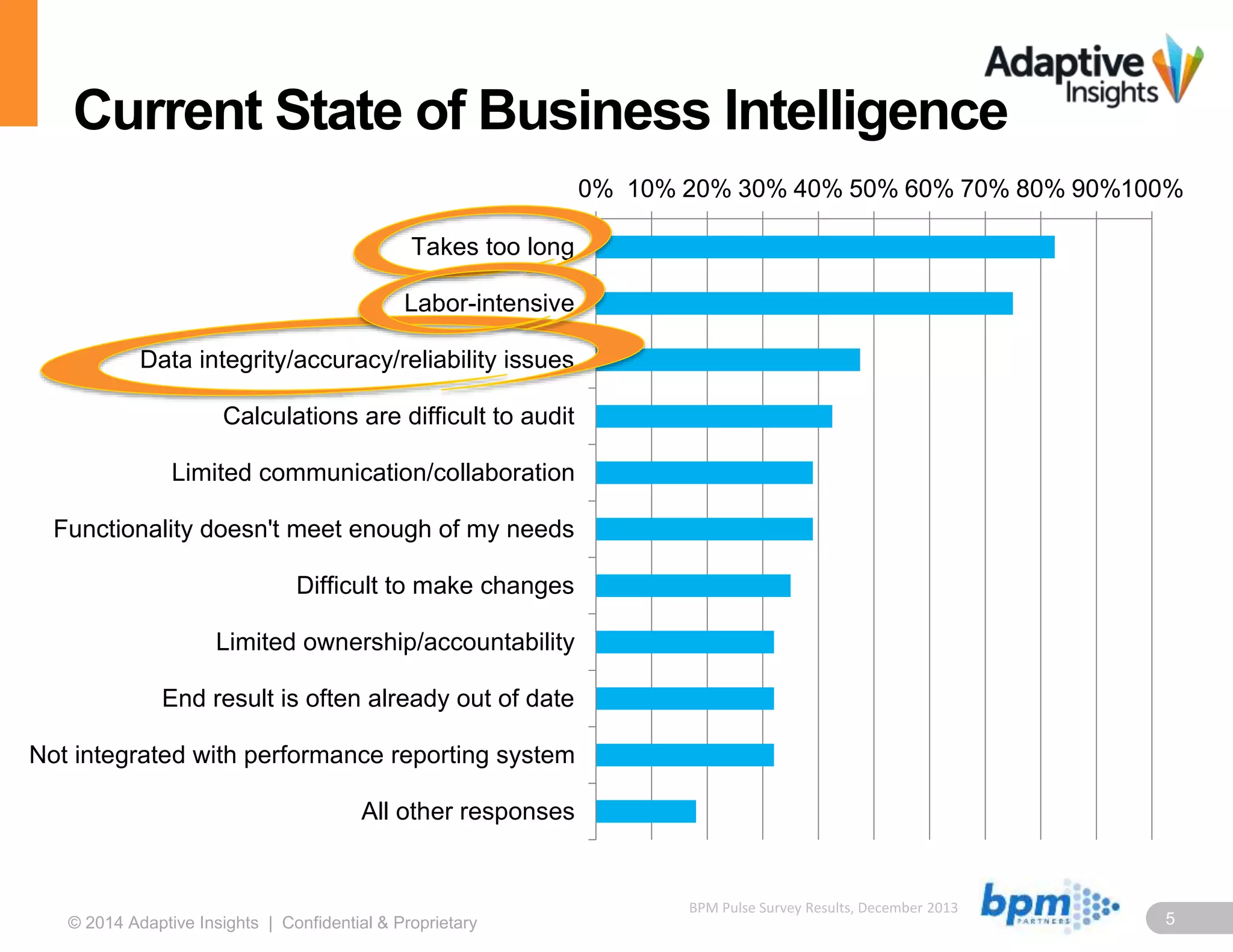

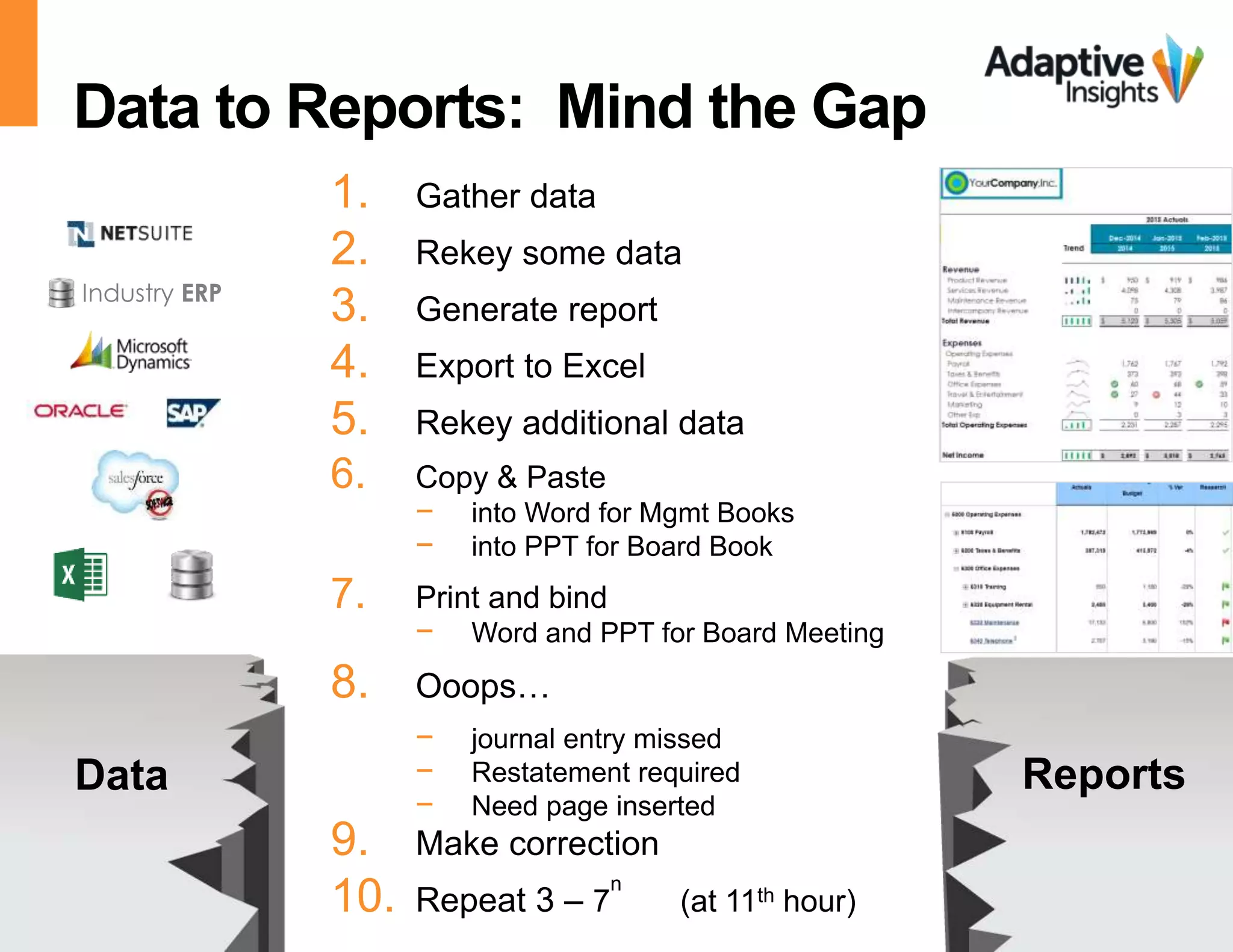

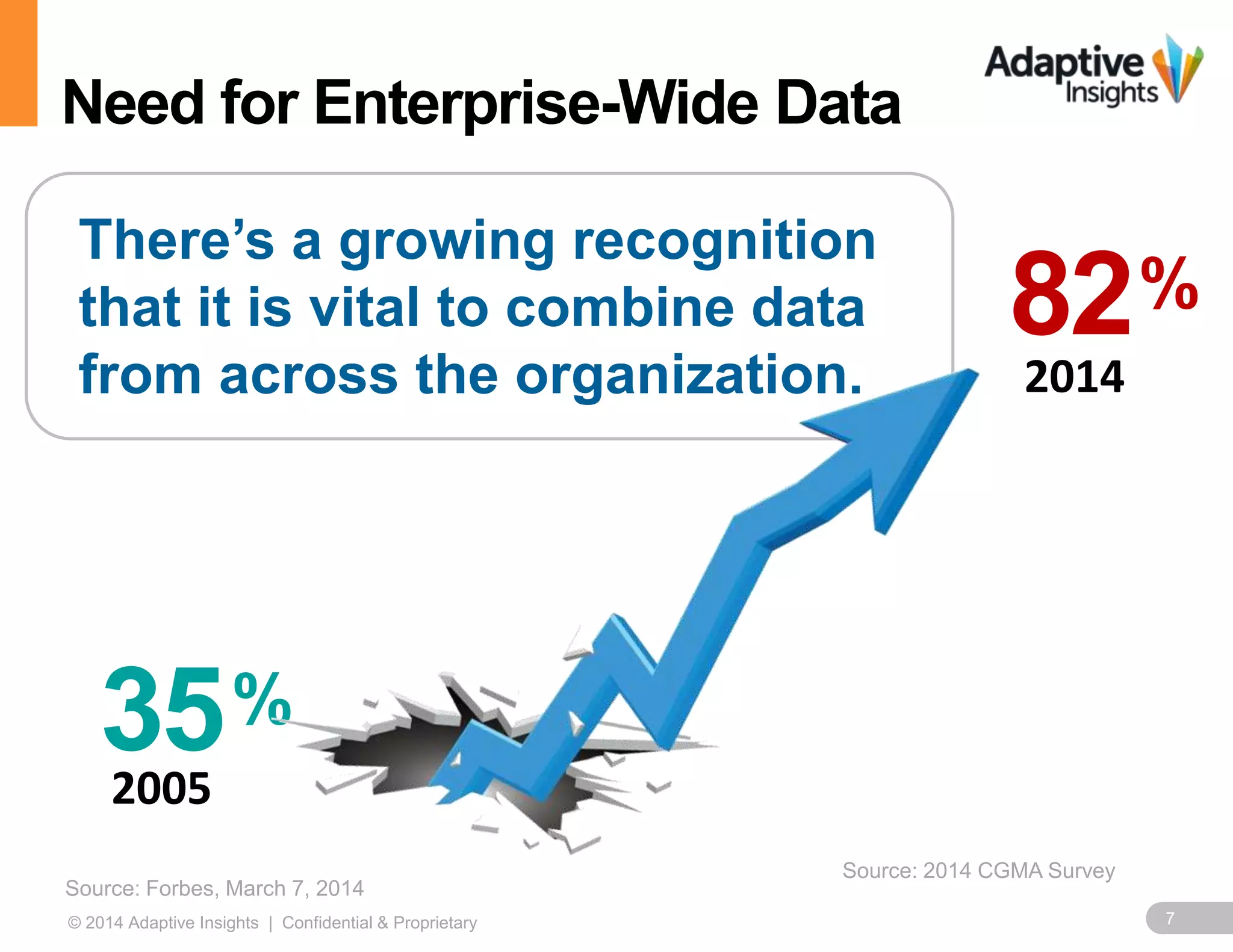

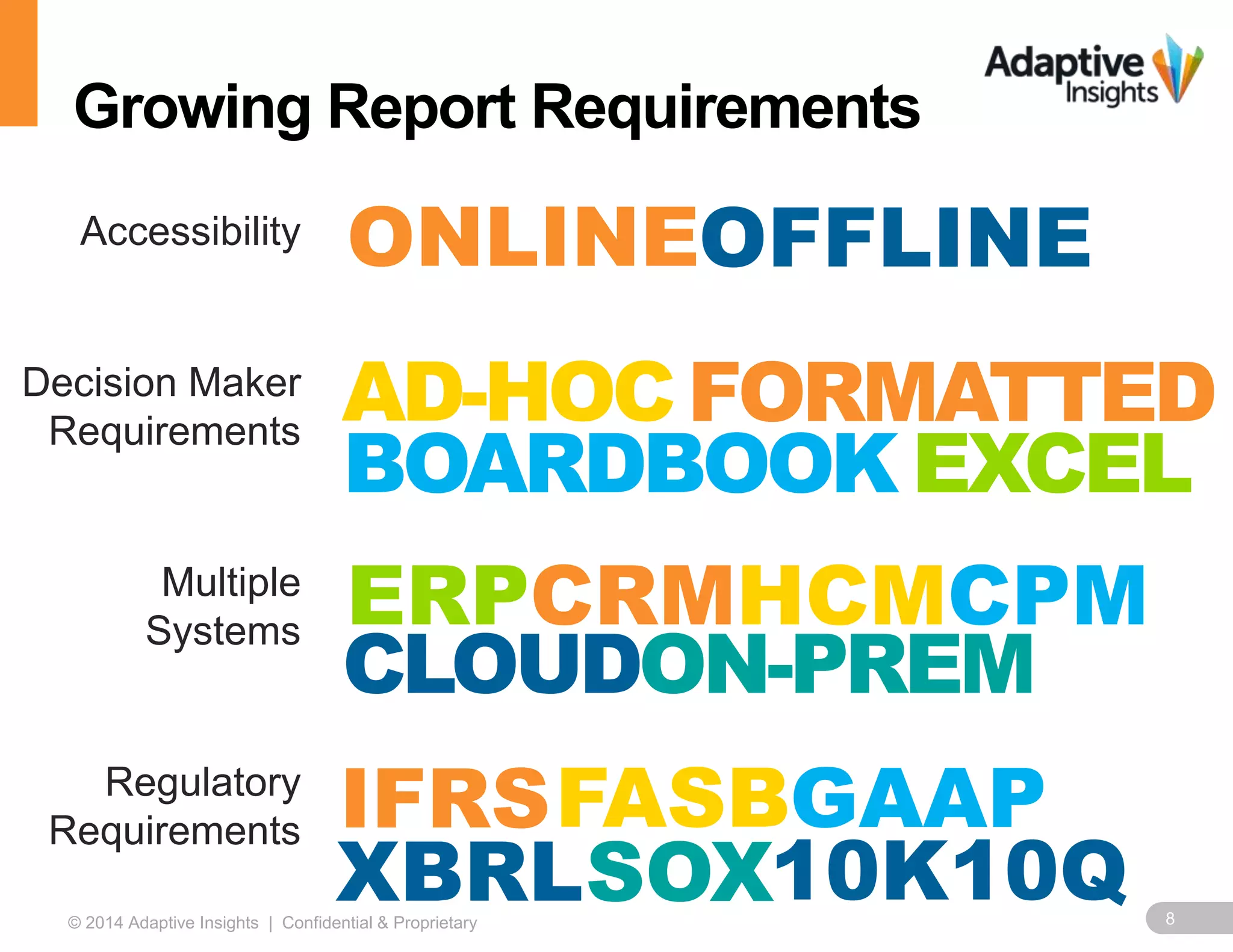

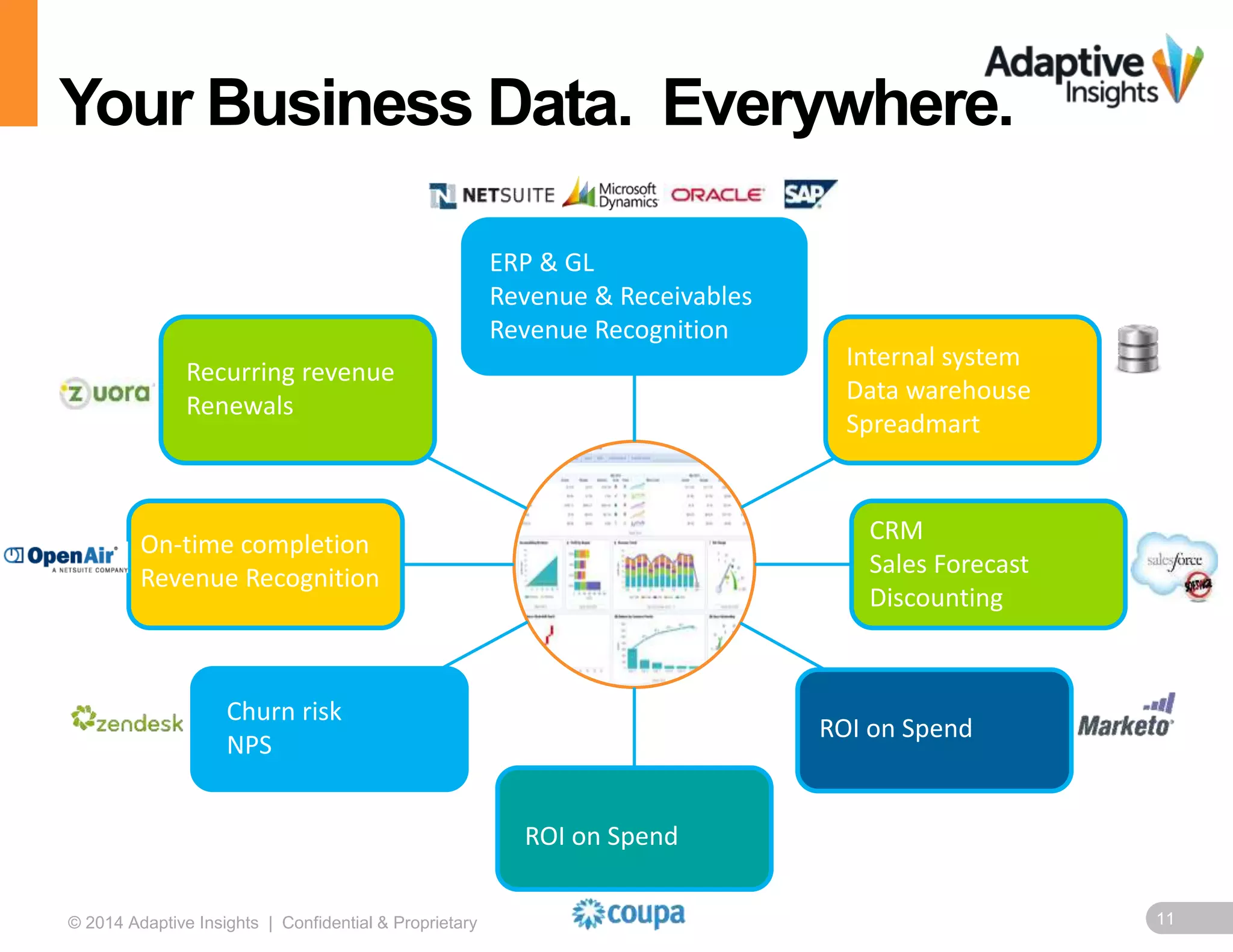

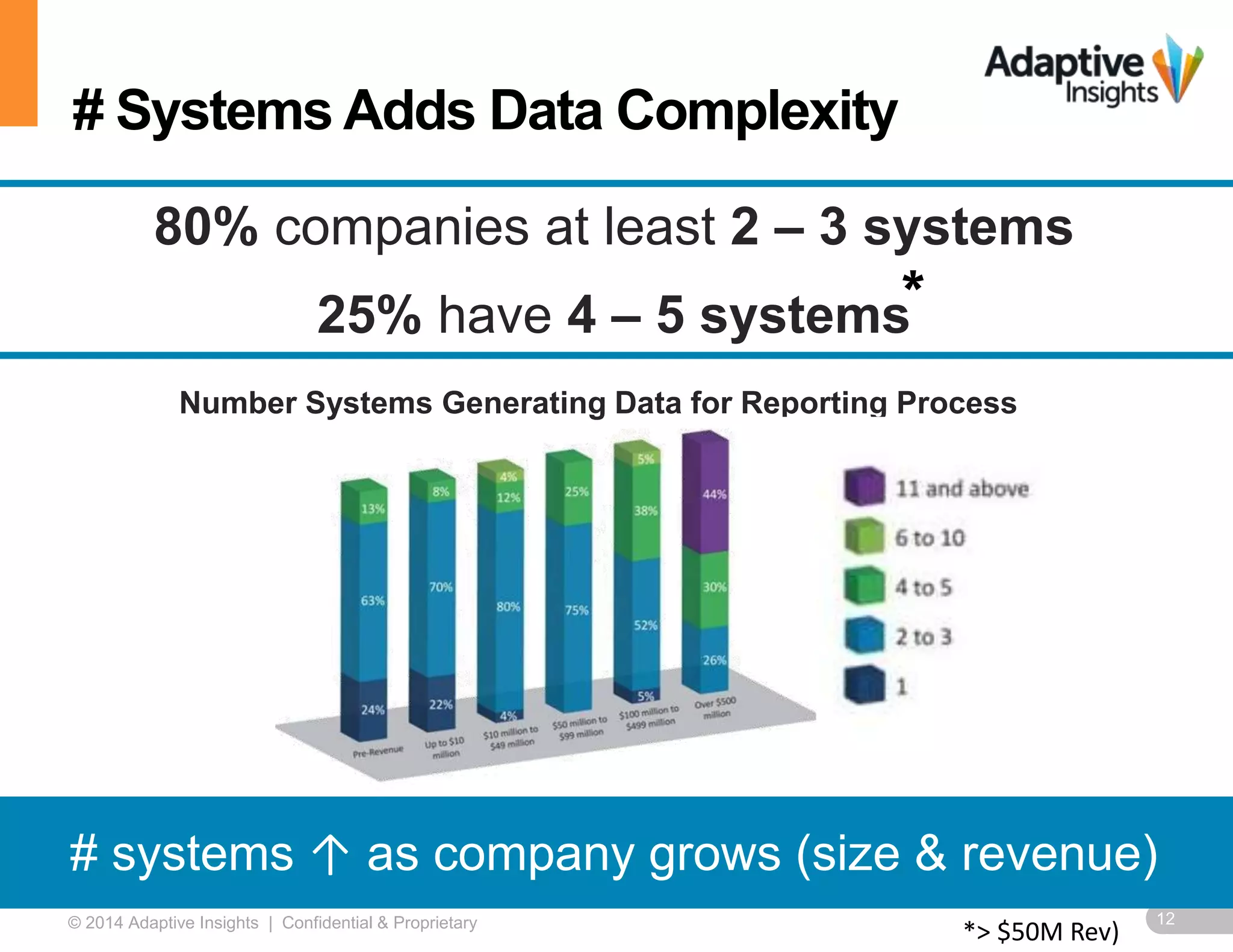

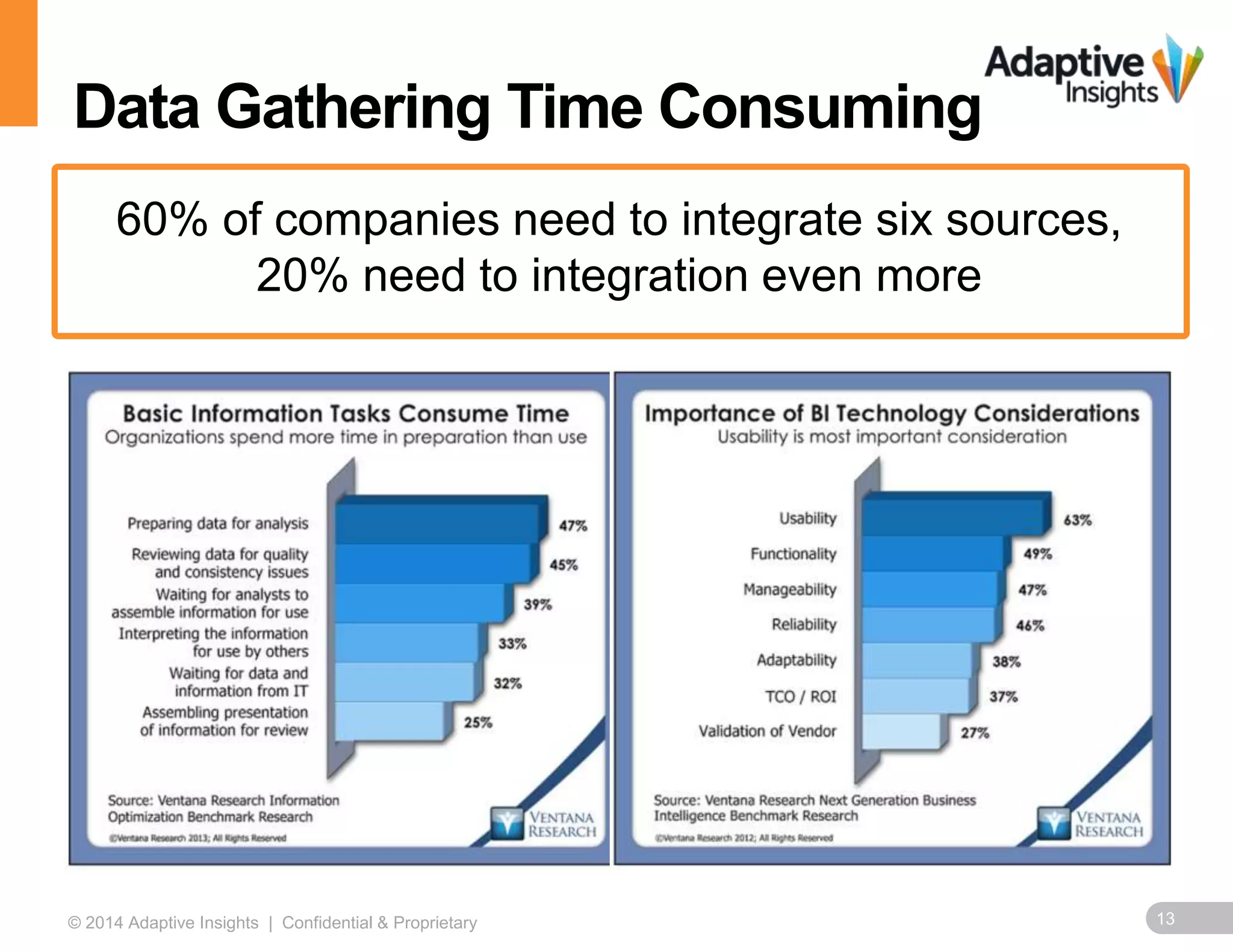

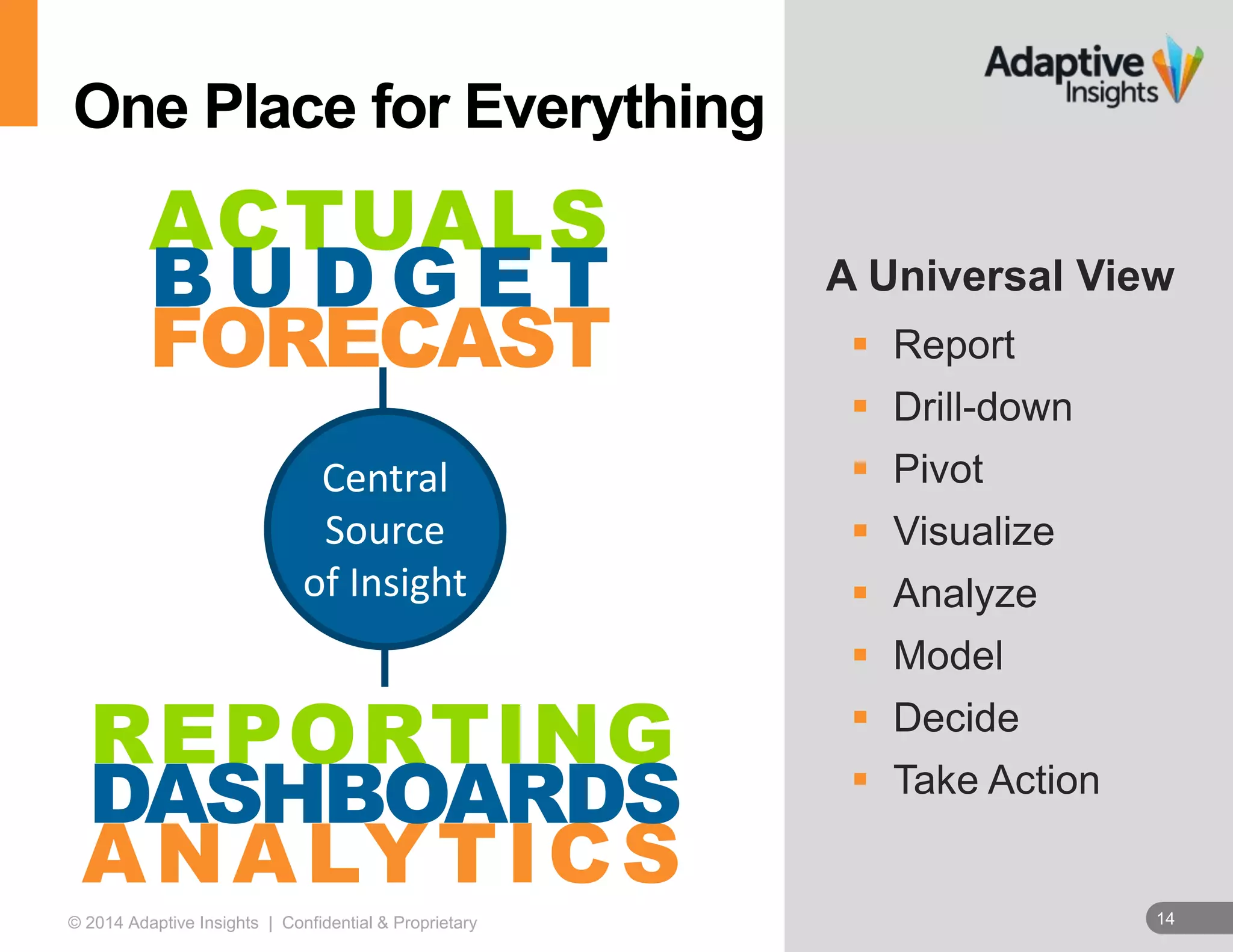

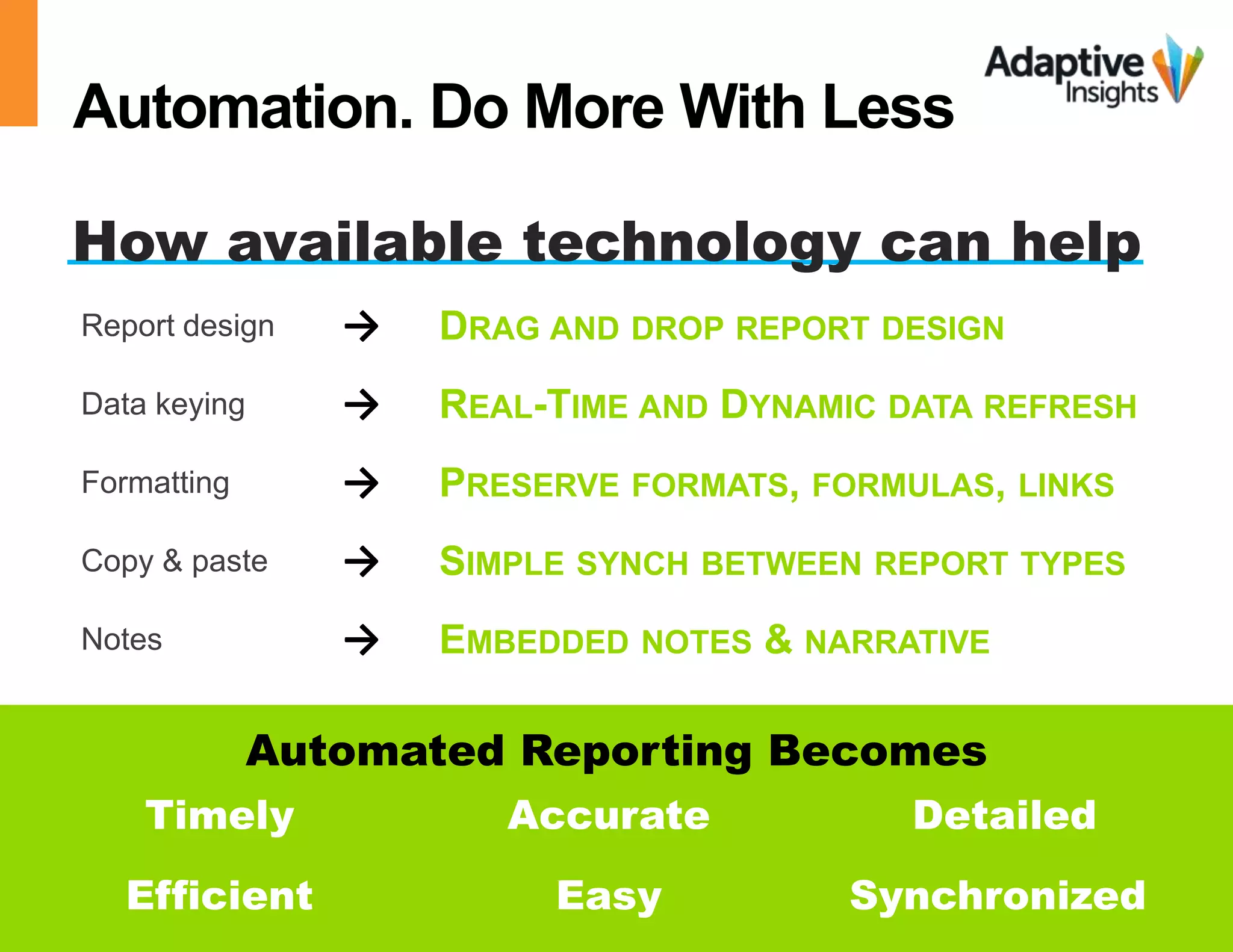

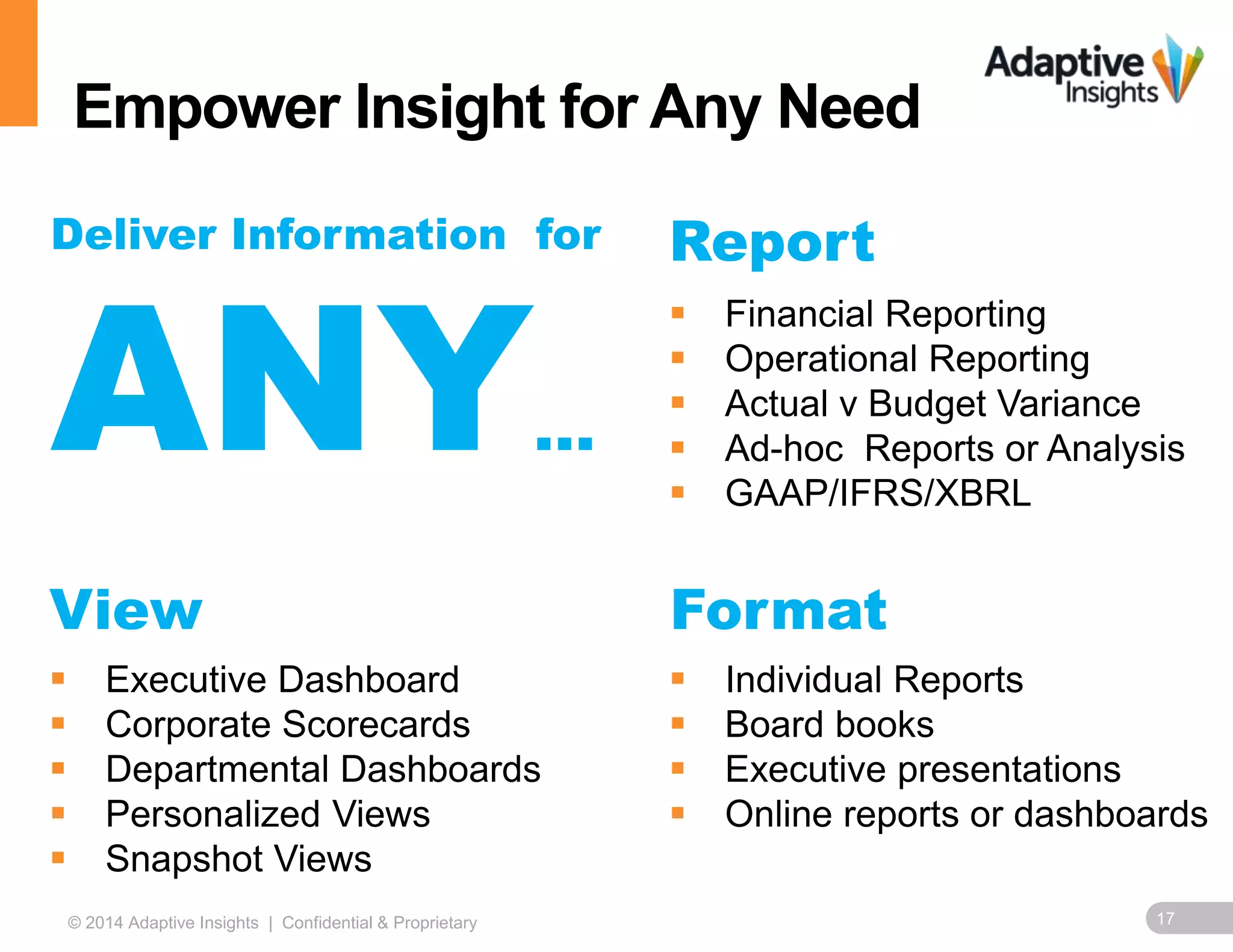

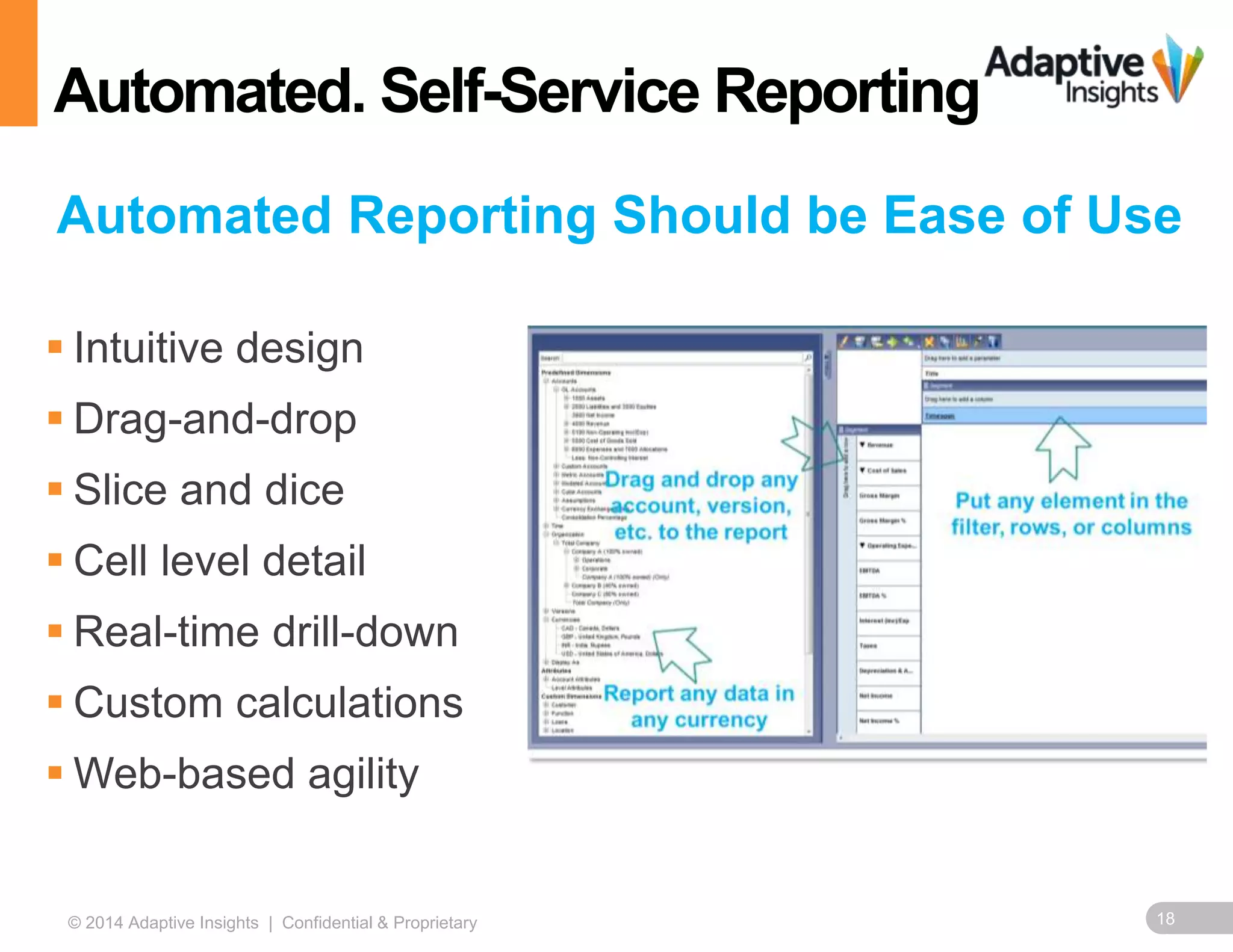

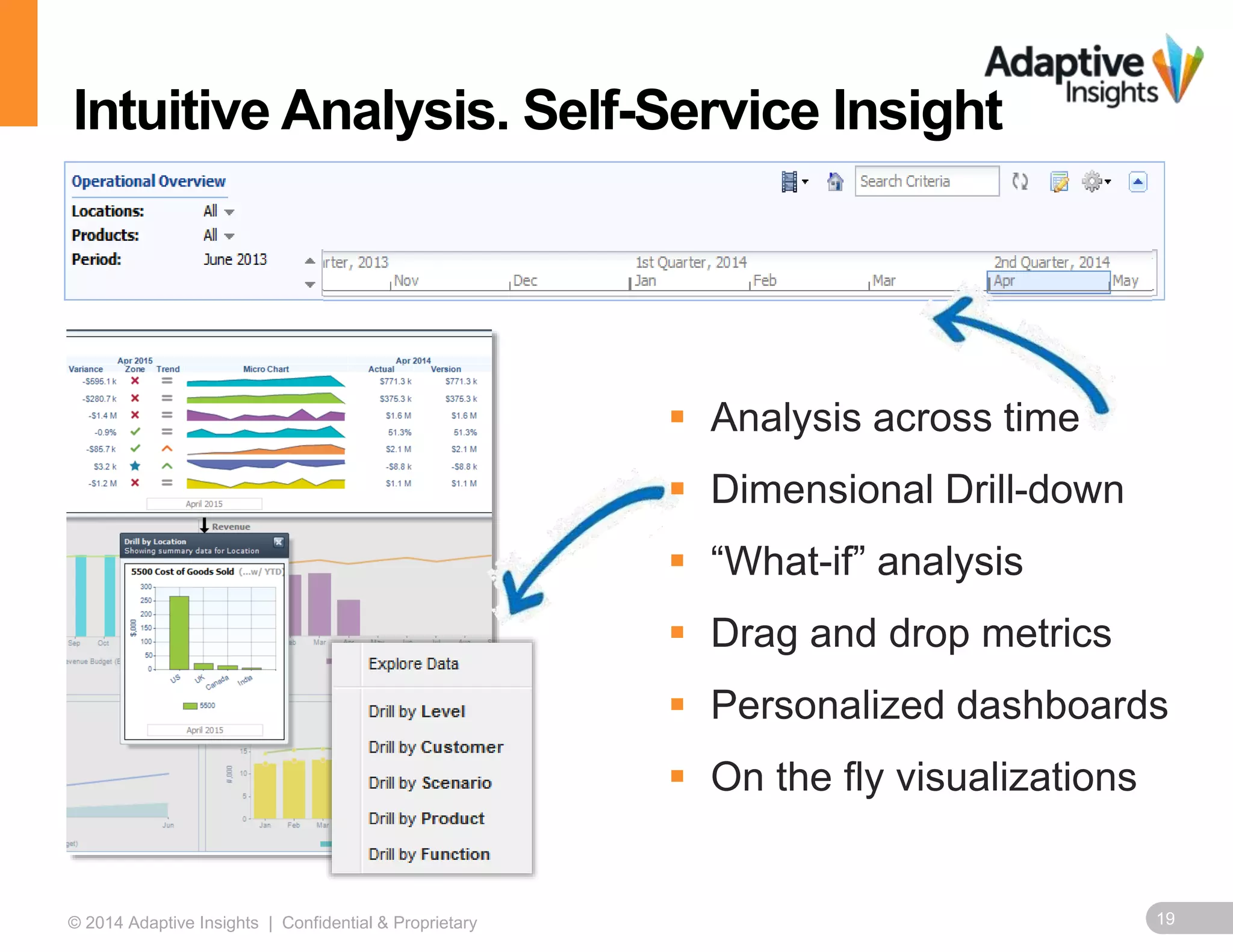

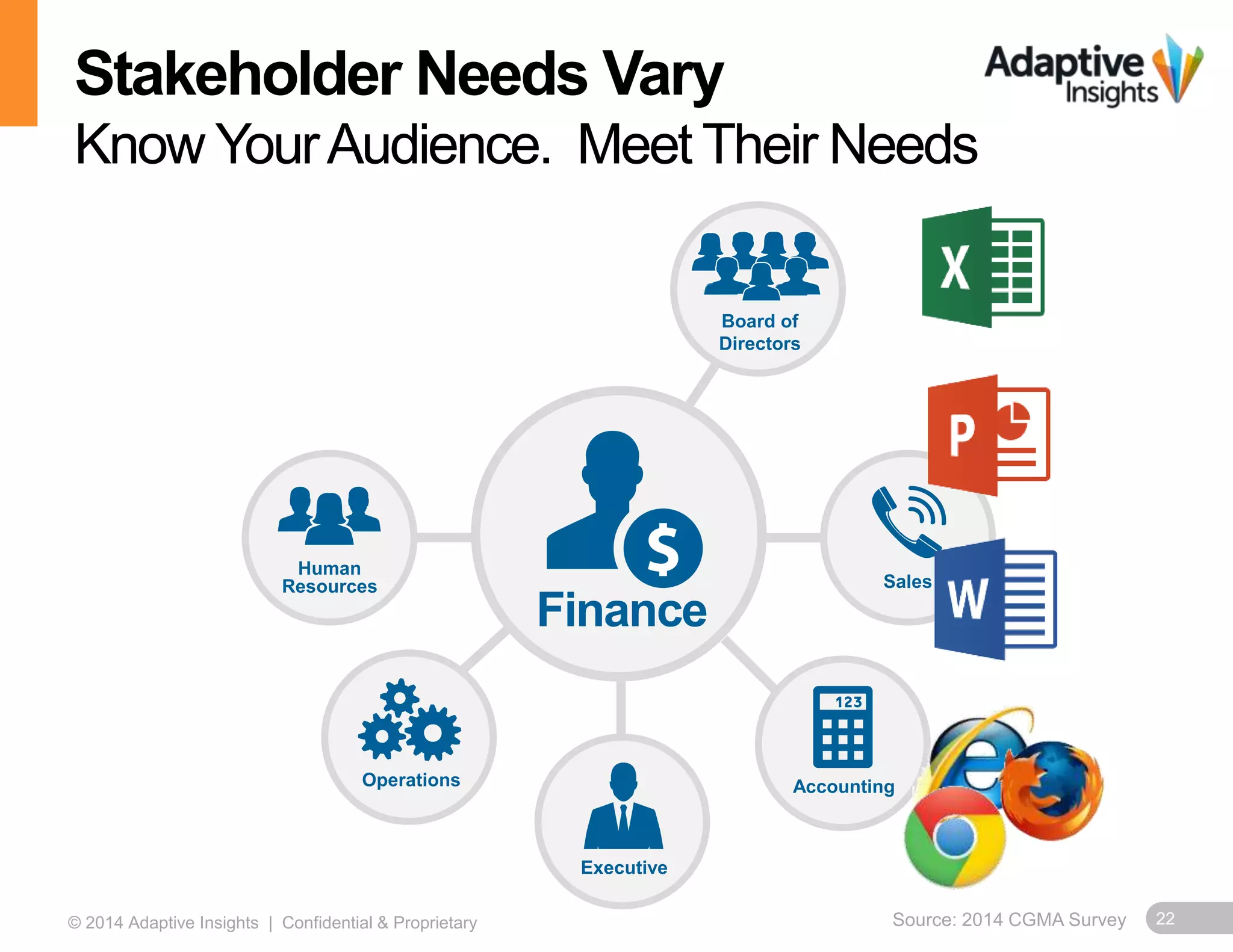

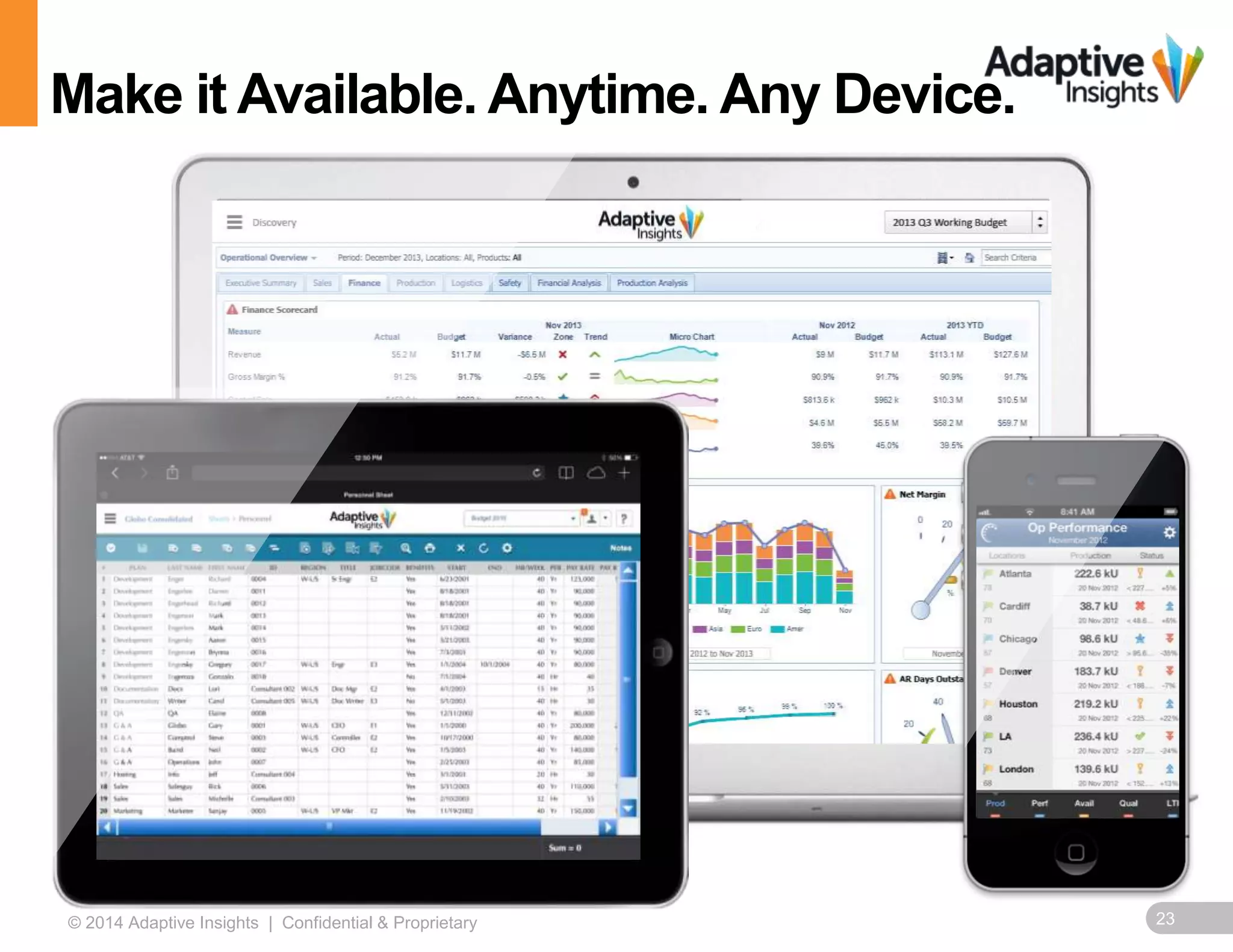

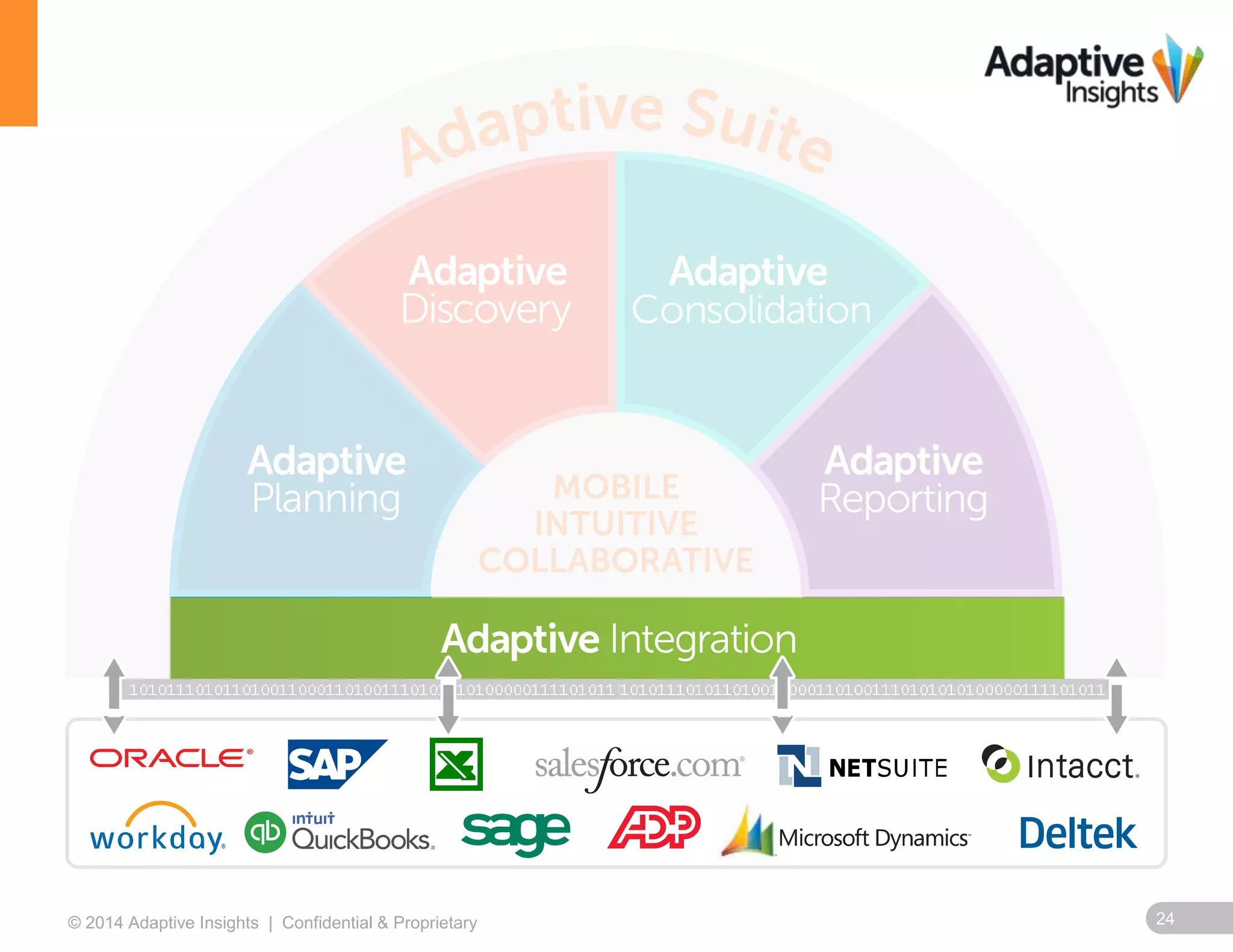

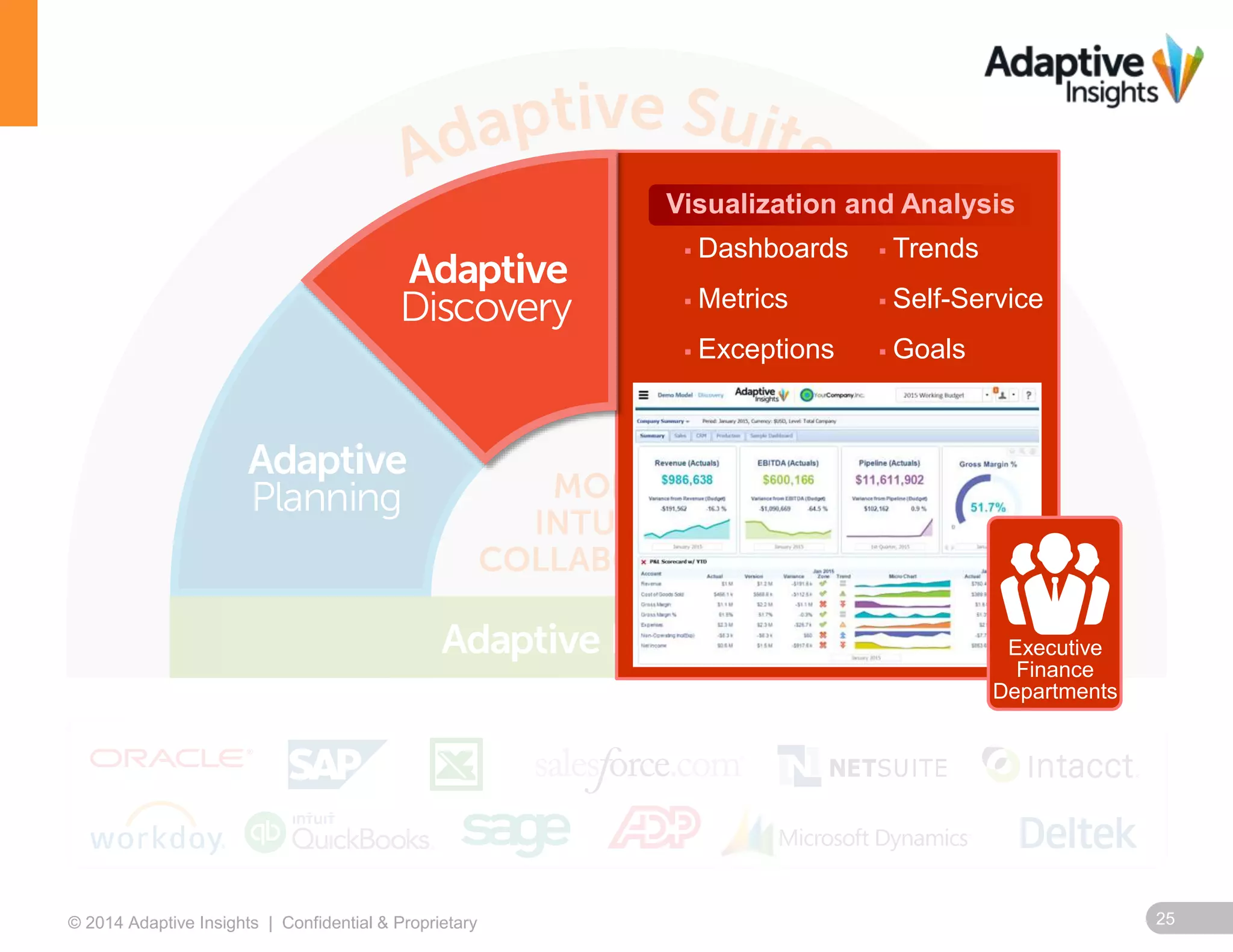

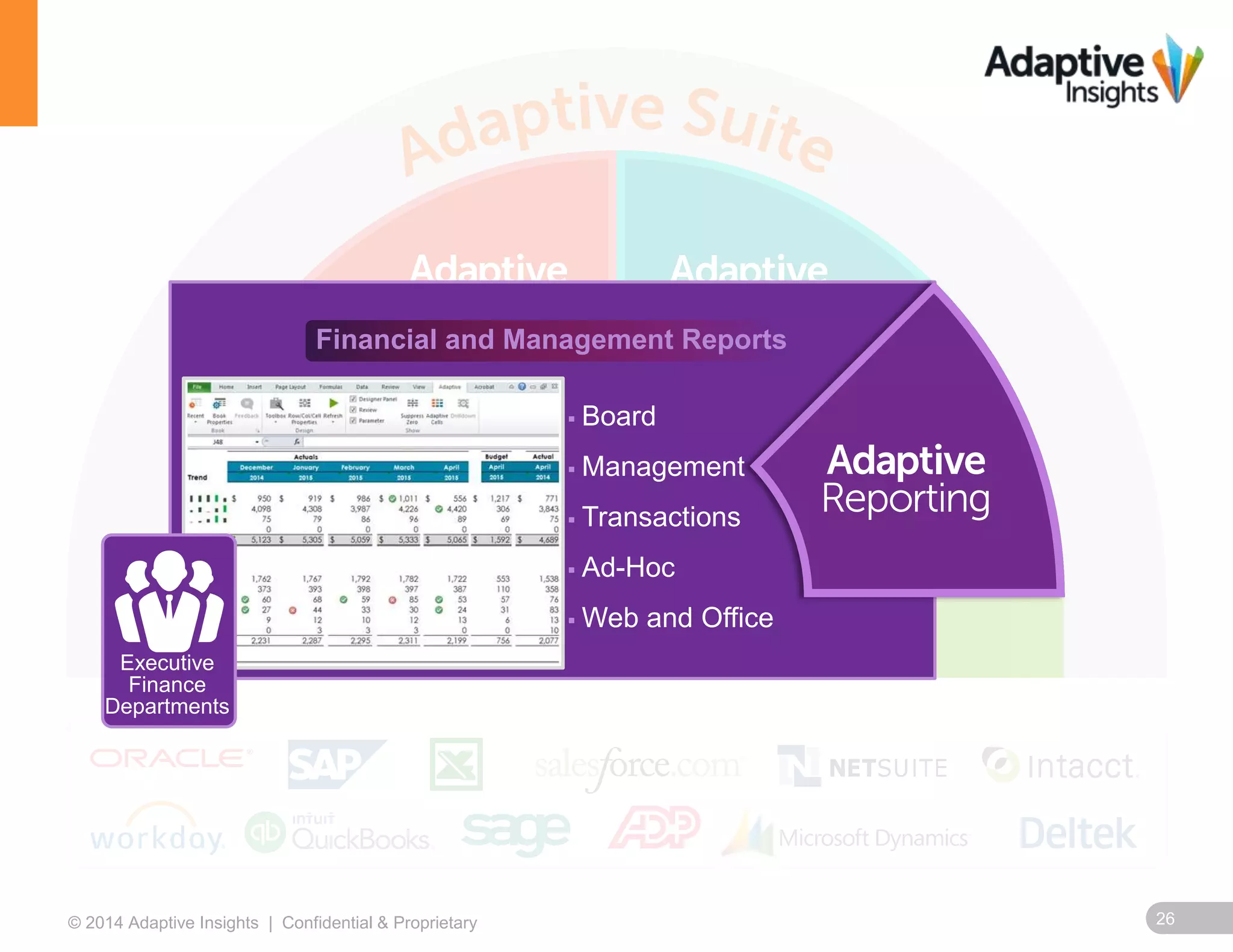

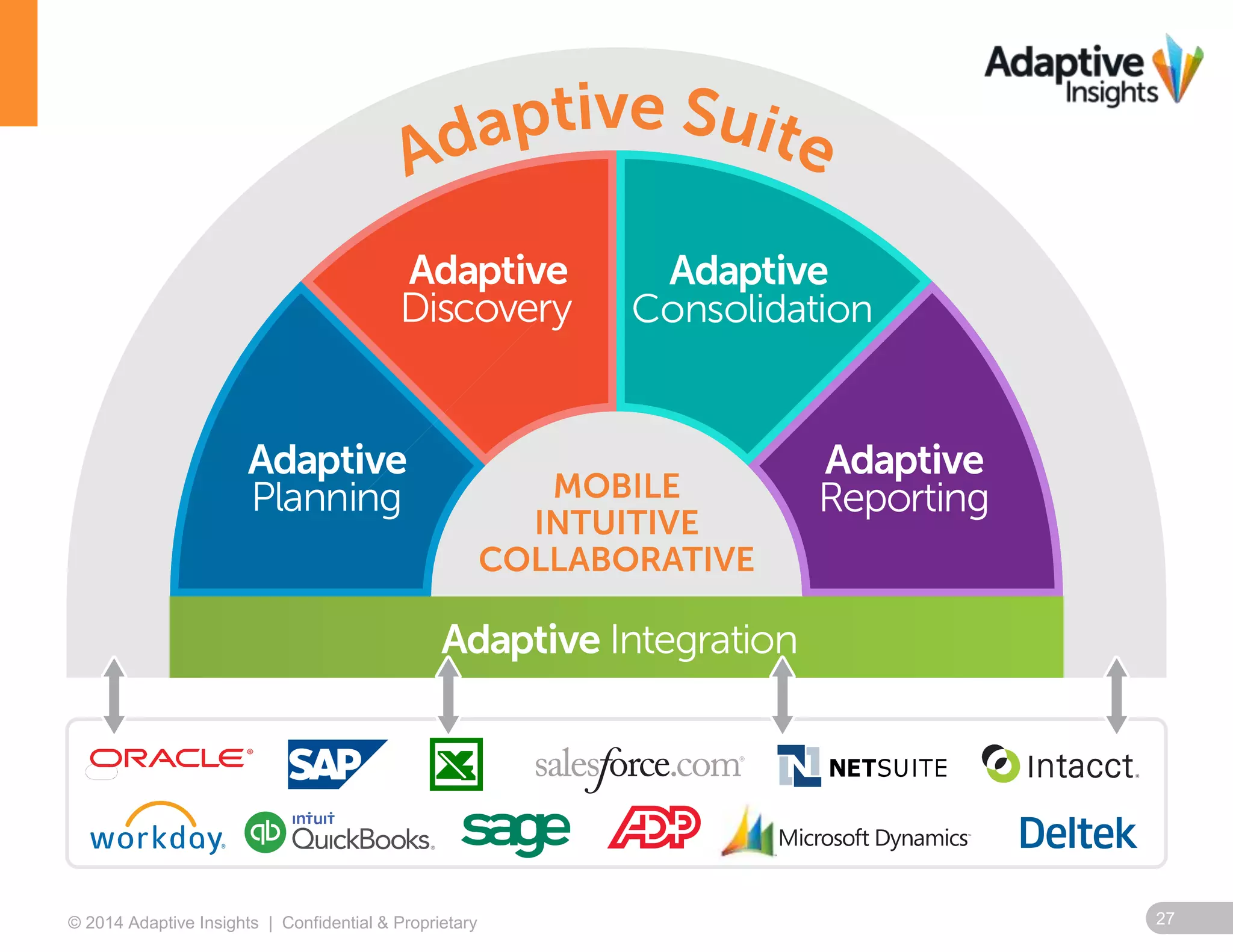

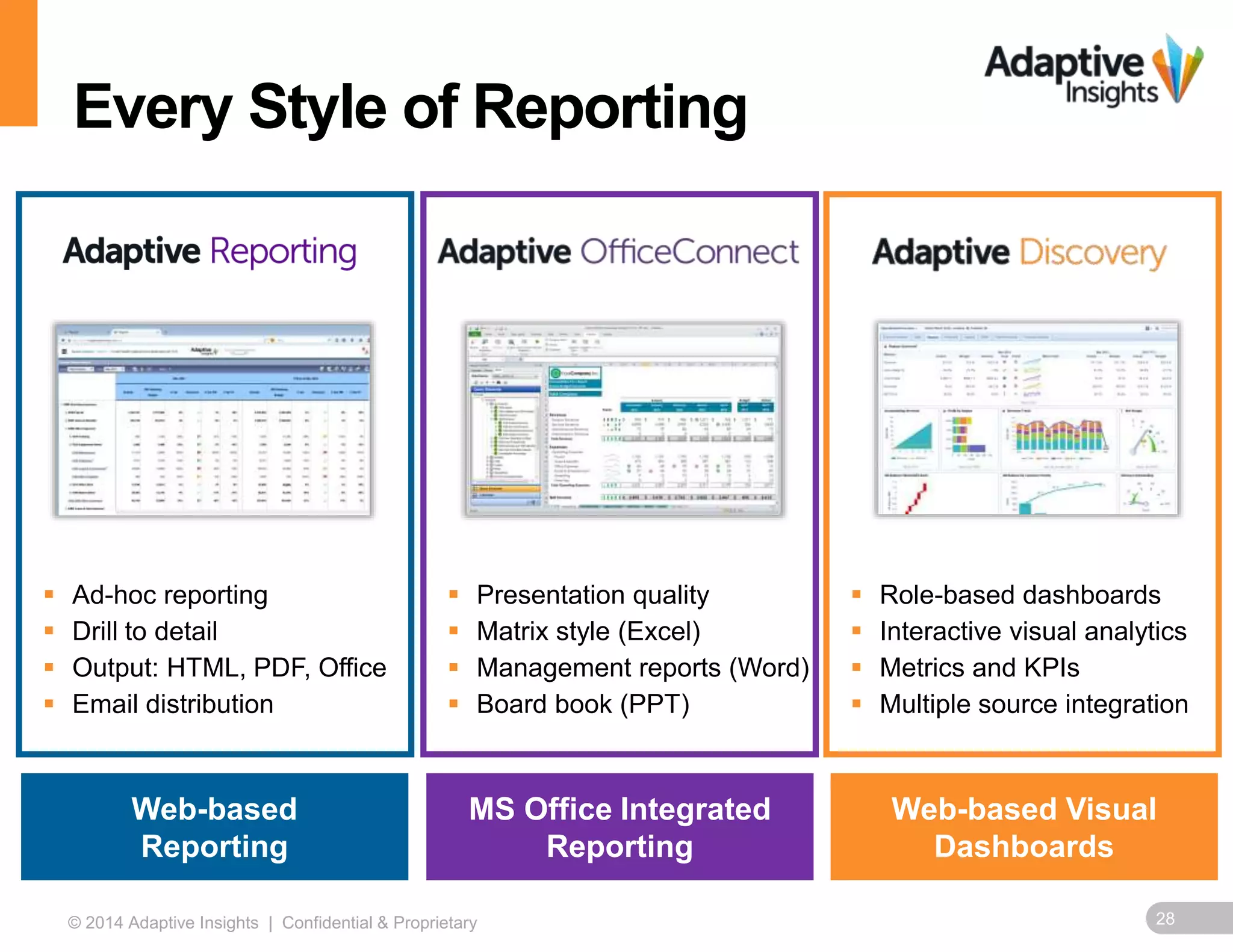

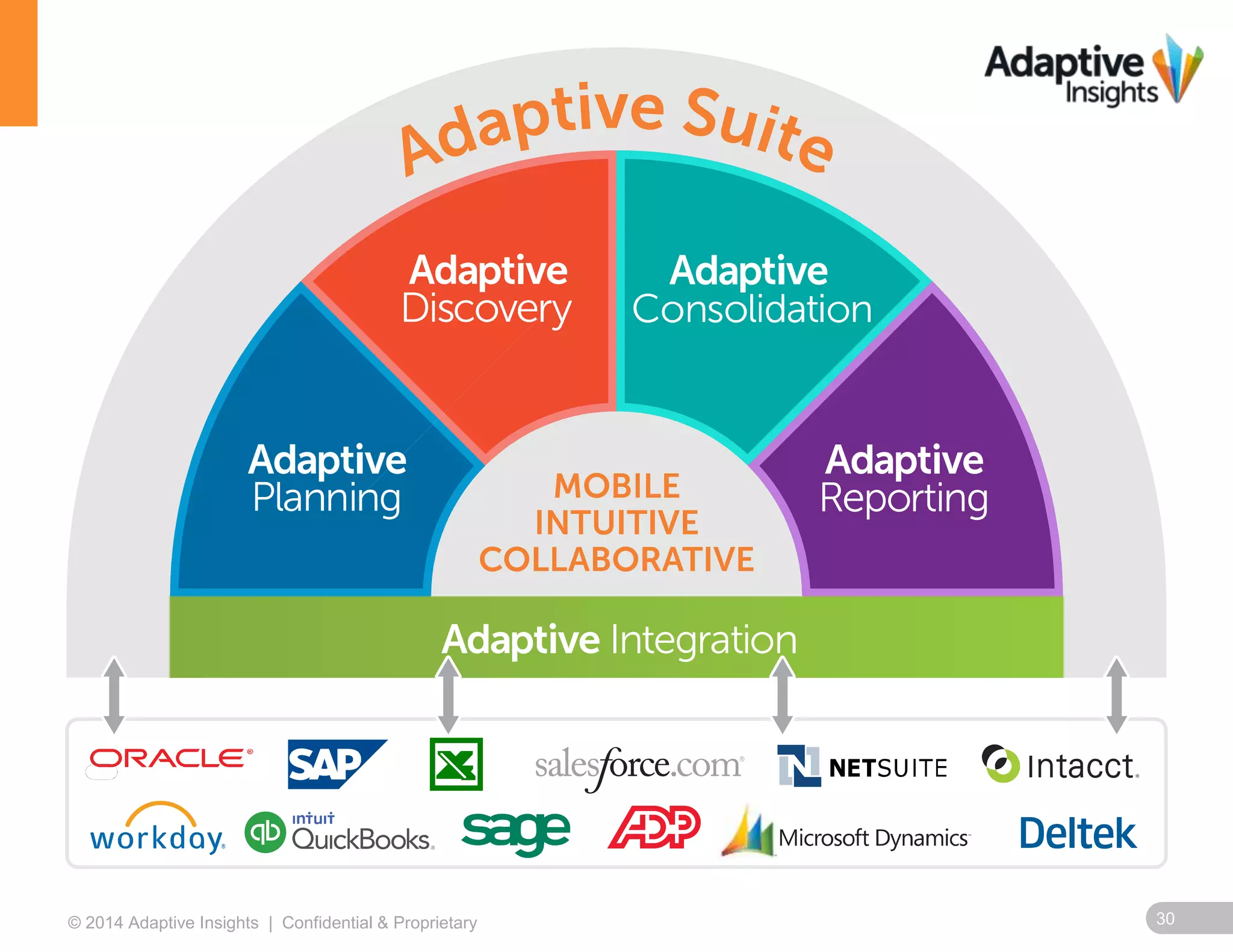

The document discusses the need for businesses to elevate their reporting and dashboards. It notes that current business intelligence takes too long, is labor intensive, and has issues like outdated data. The modern CFO needs better analysis and decision making support. The document then outlines three keys to better insights: making data easy to access across different systems; making reporting easy to use through drag and drop tools; and making information easy for different audiences to consume through mobile and online access. It provides examples of how Adaptive Insights solutions address these needs through features like centralized data access, self-service reporting, and role-based dashboards.