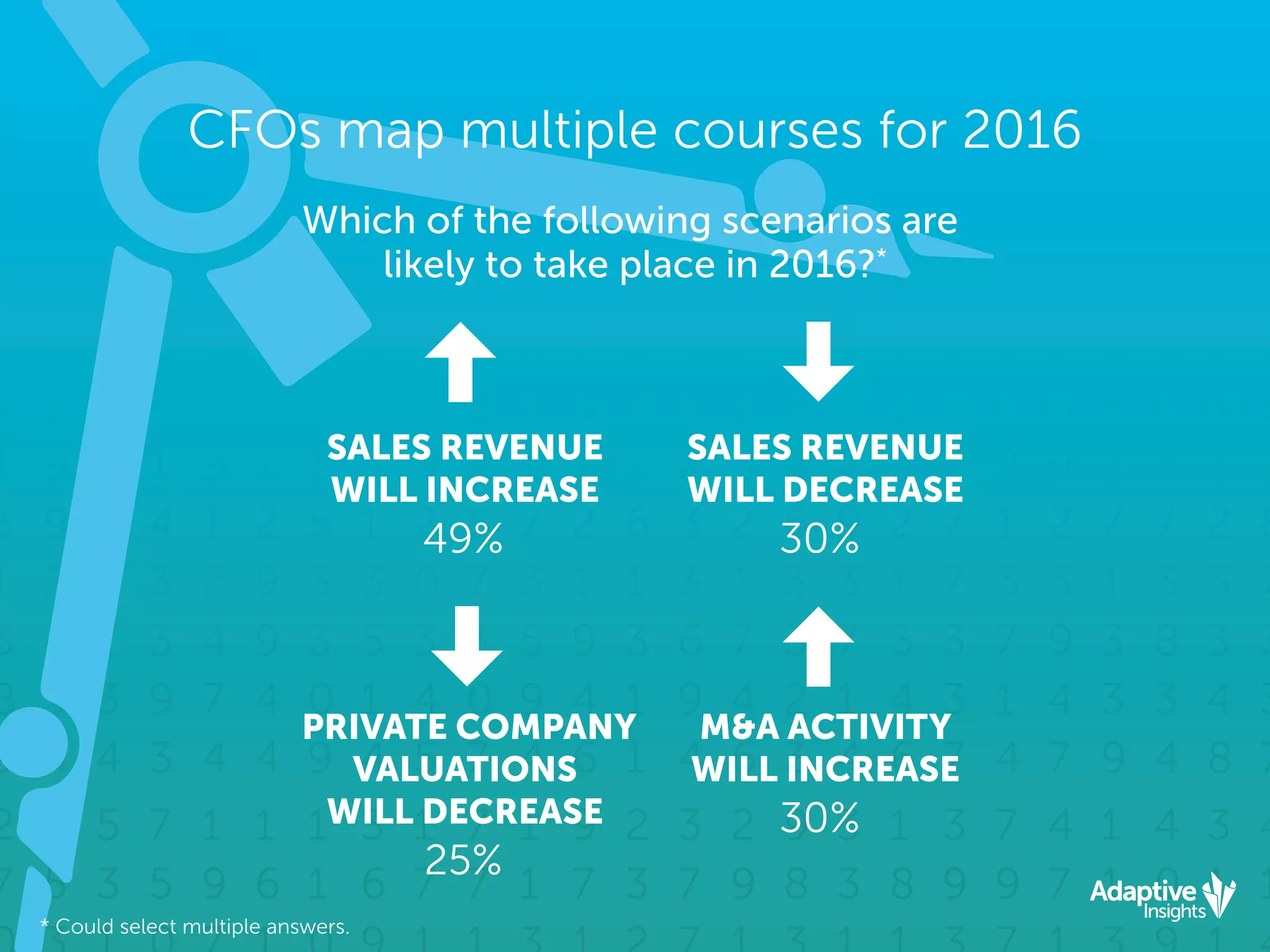

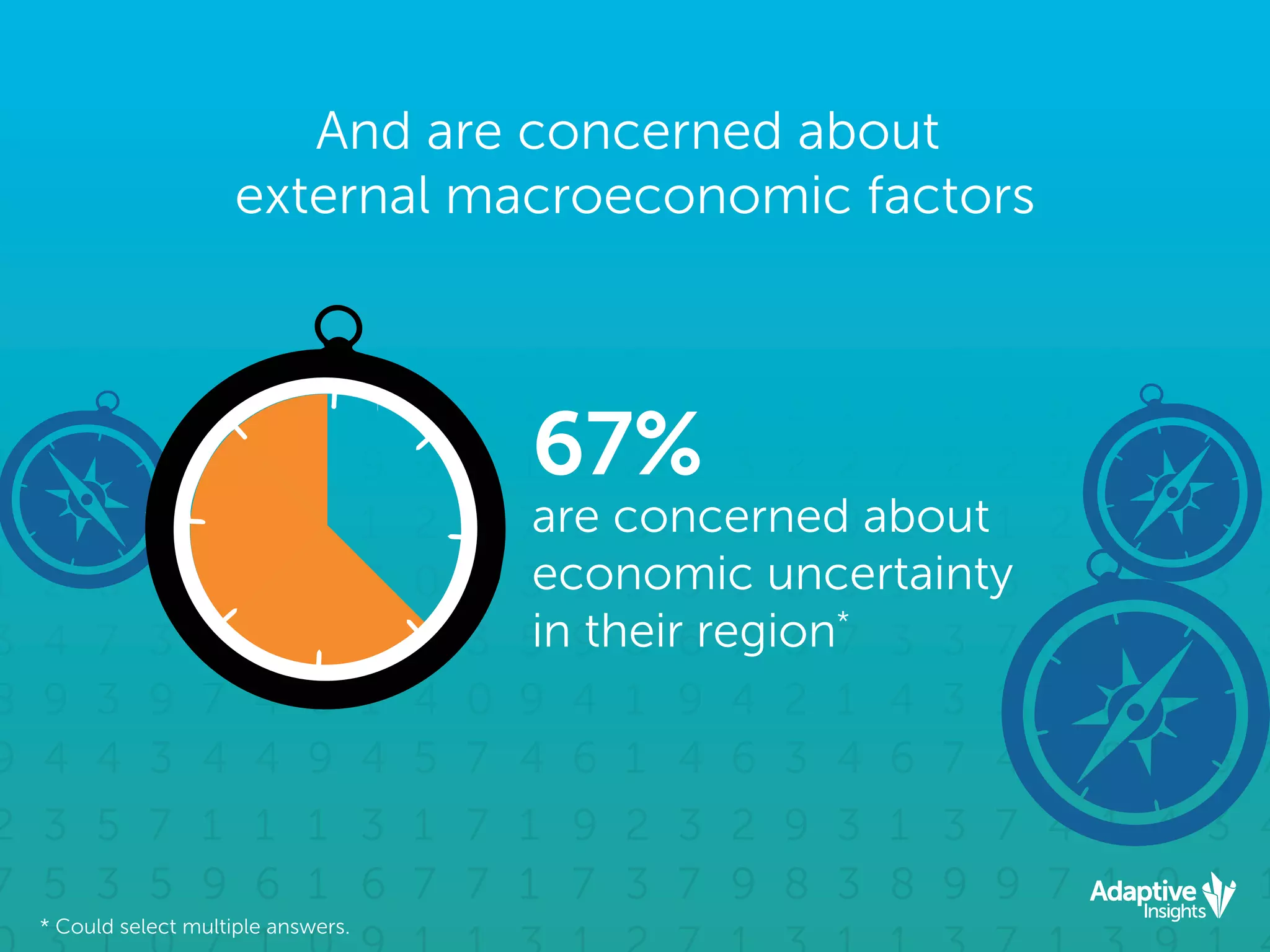

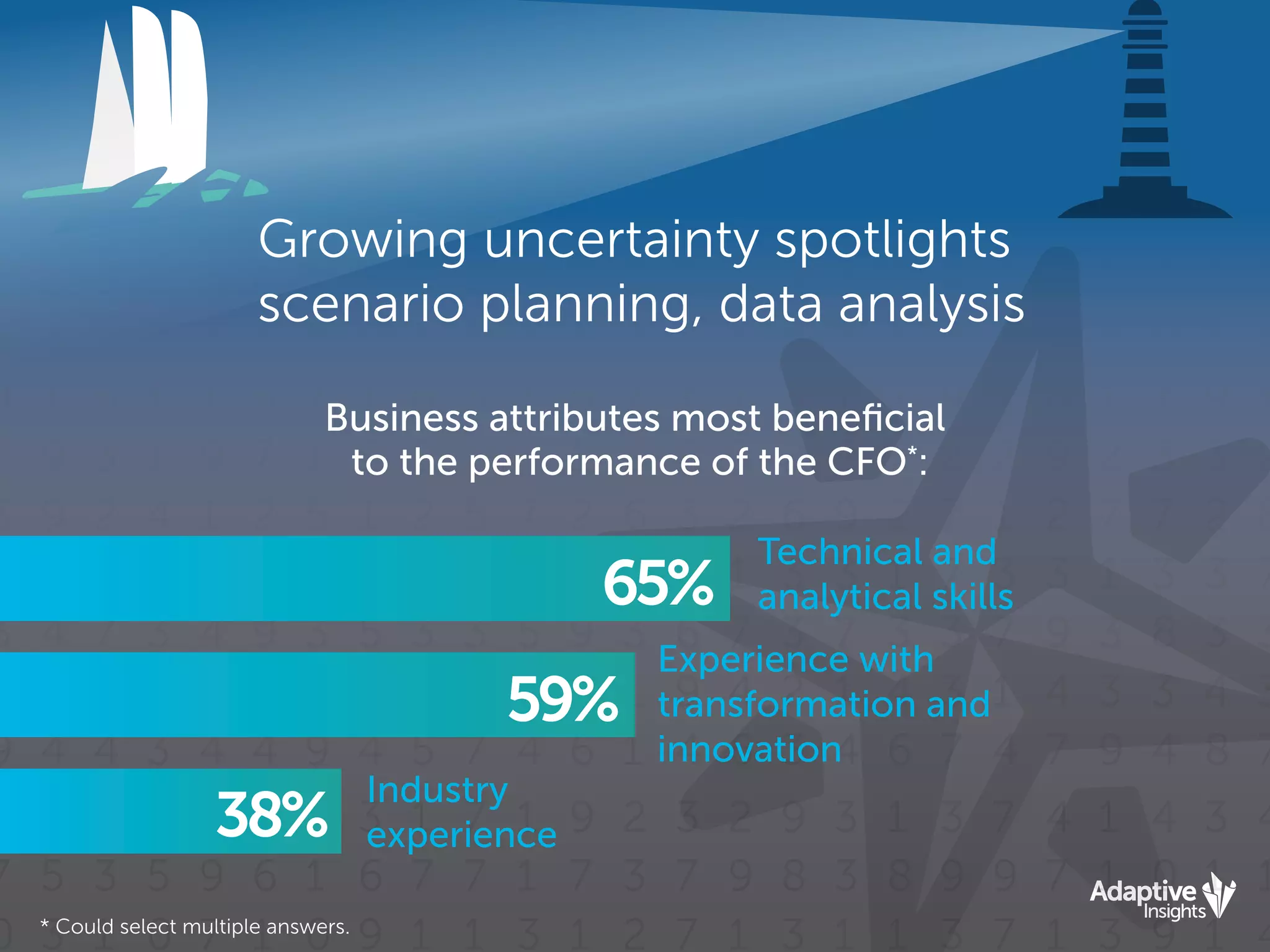

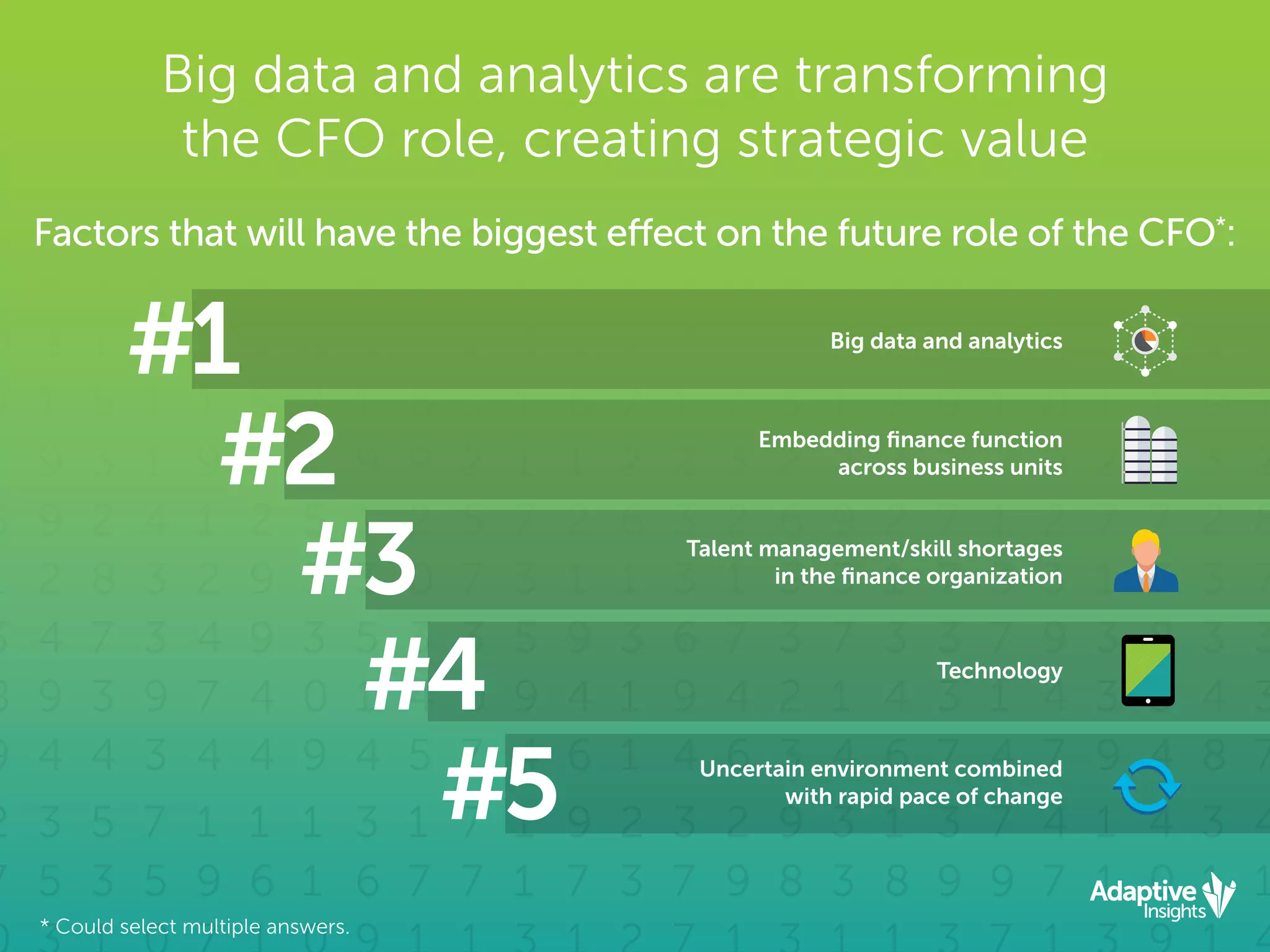

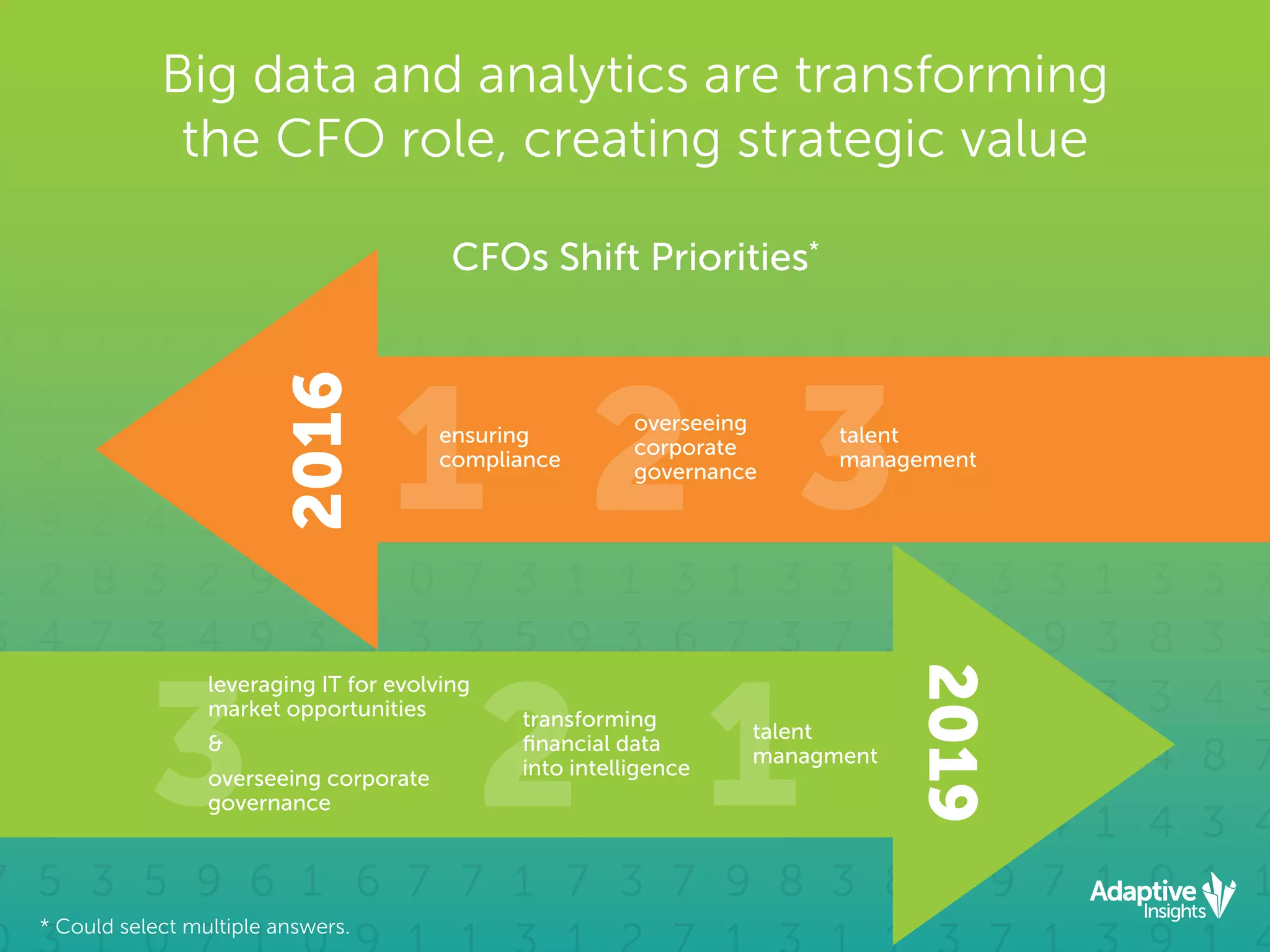

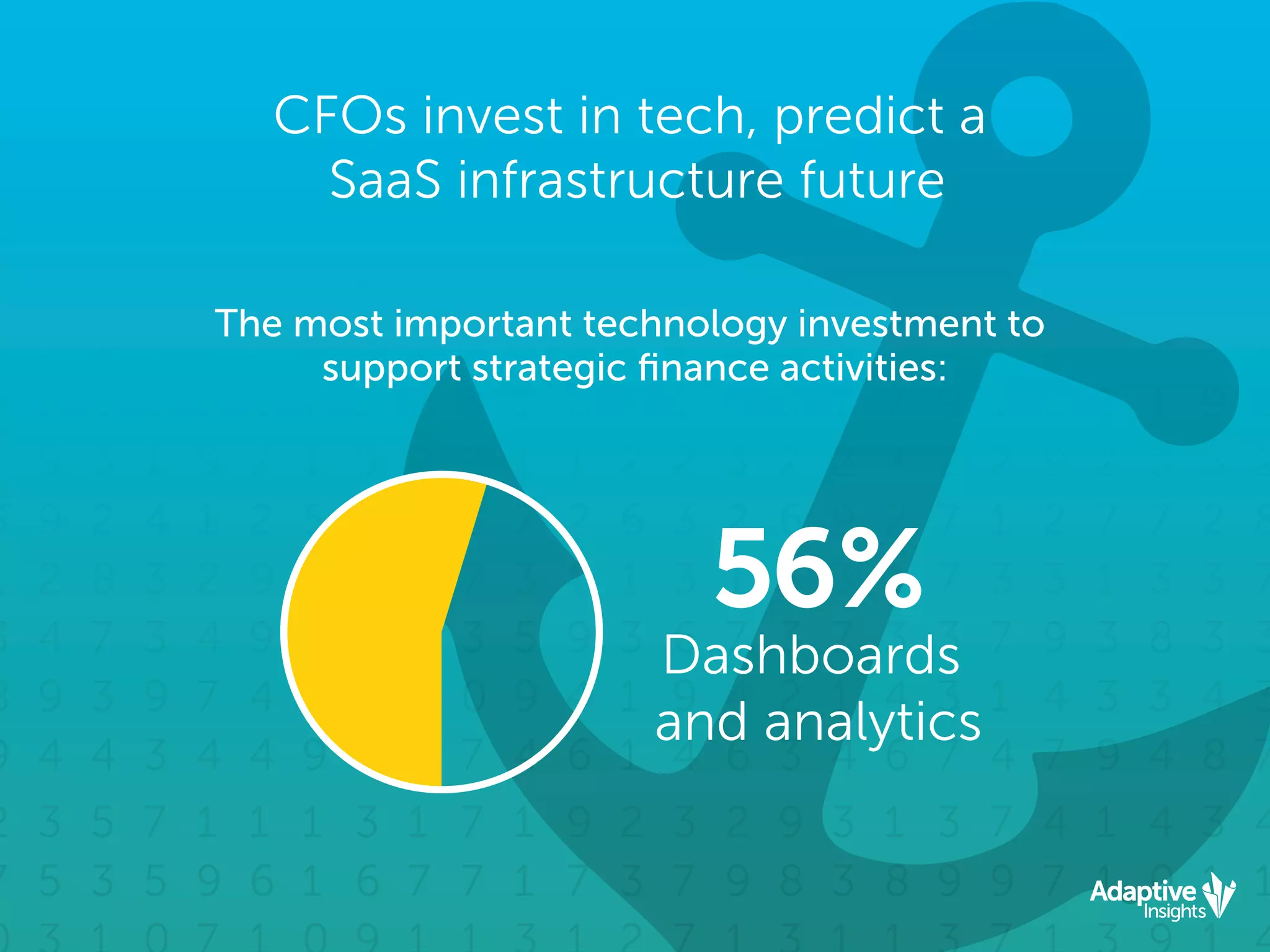

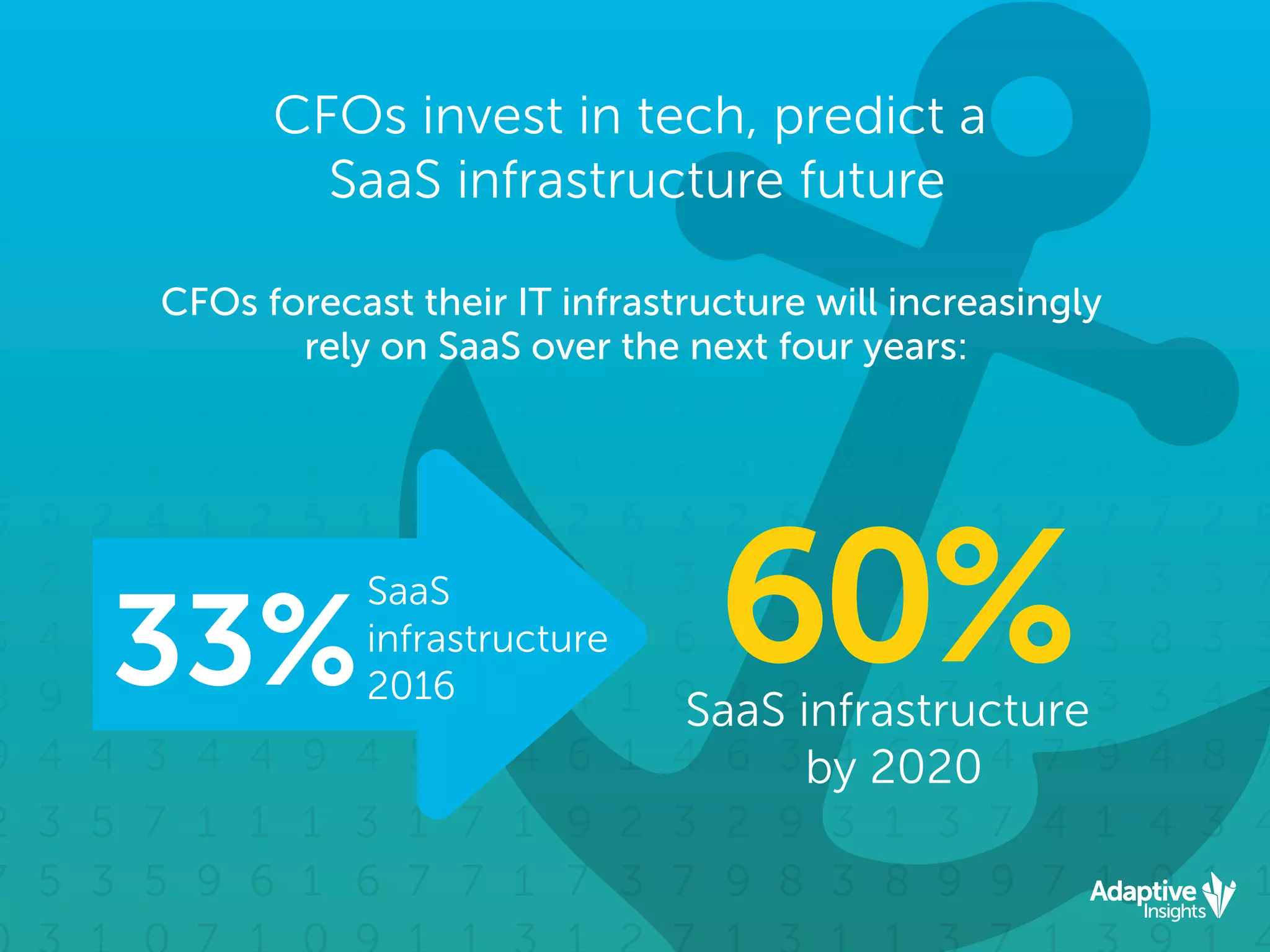

The document discusses the findings from the Q1 2016 Adaptive Insights CFO Indicator survey, which polled 377 global CFOs regarding their financial forecasting amid economic uncertainty. CFOs express confidence in their forecasting abilities due to data analytics, though they are concerned about external economic factors. Key themes include the importance of scenario planning, the transformative role of big data, and evolving technology infrastructure, notably the shift towards SaaS solutions.