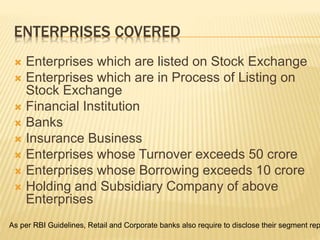

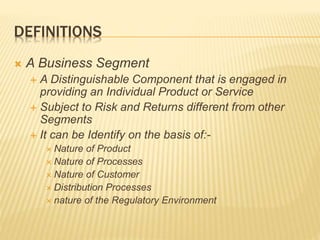

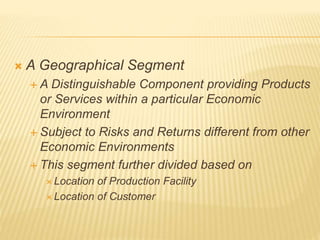

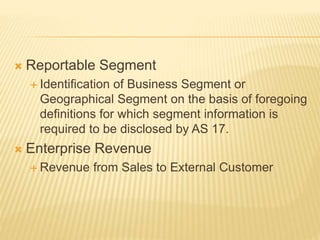

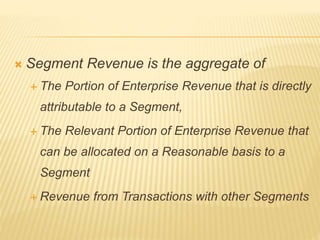

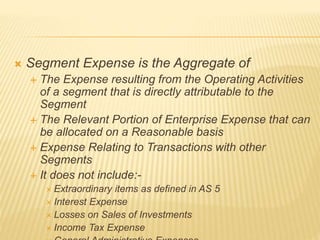

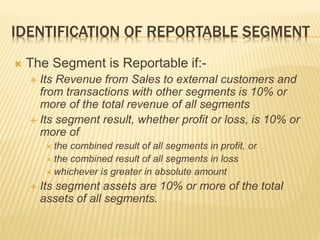

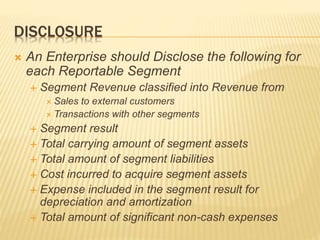

This document discusses Accounting Standard 17 on segment reporting in India. It defines key terms like business segment, geographical segment and reportable segment. It outlines the objectives of segment reporting as informing about different products, services, geographical areas to better understand performance and assess risks. It specifies the enterprises that must comply, including listed firms and large unlisted firms. It provides guidelines on identifying and reporting segments based on risk and return profiles. The primary reporting format depends on the dominant source of risks and returns, and a matrix format can also be used.