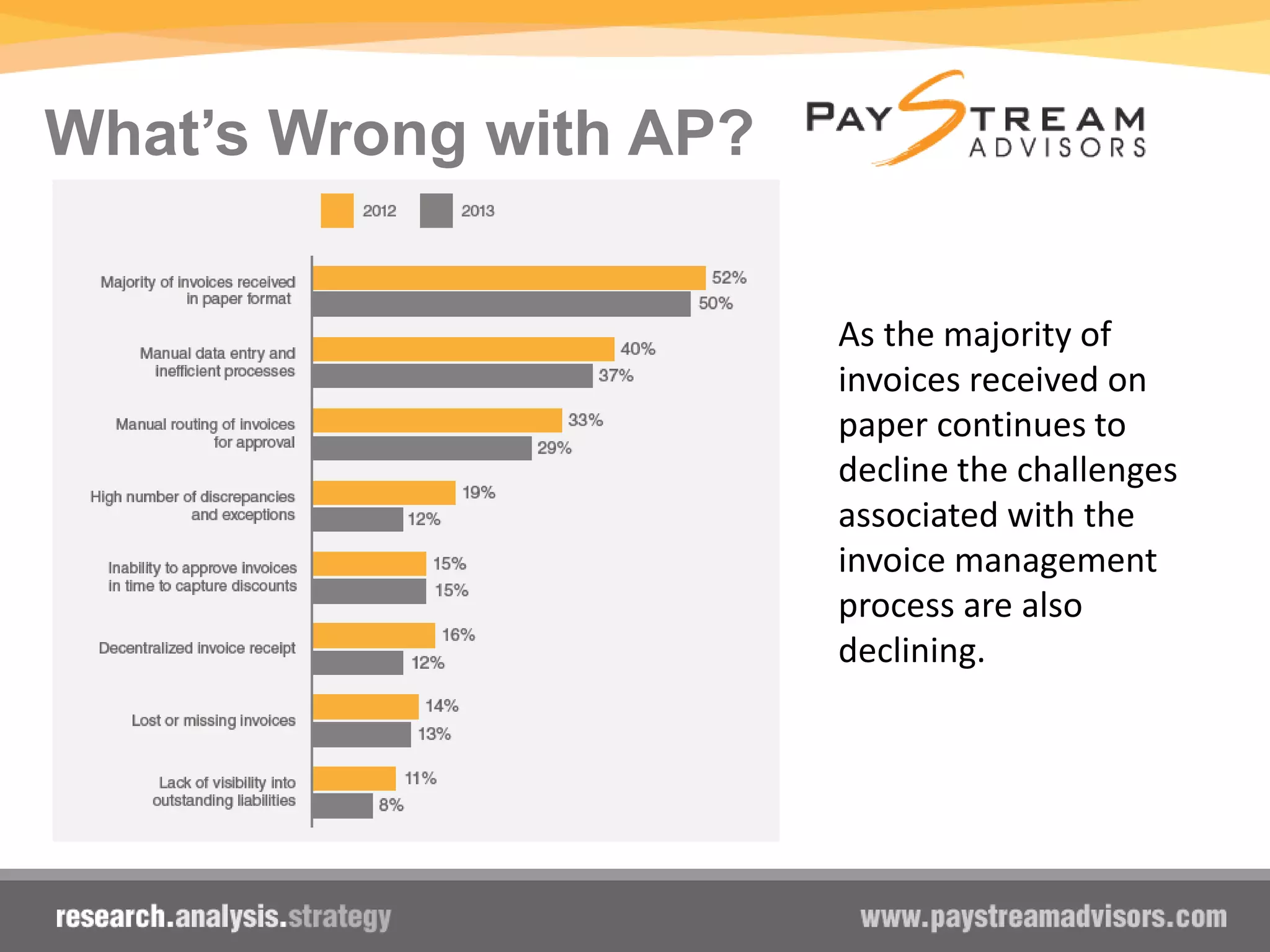

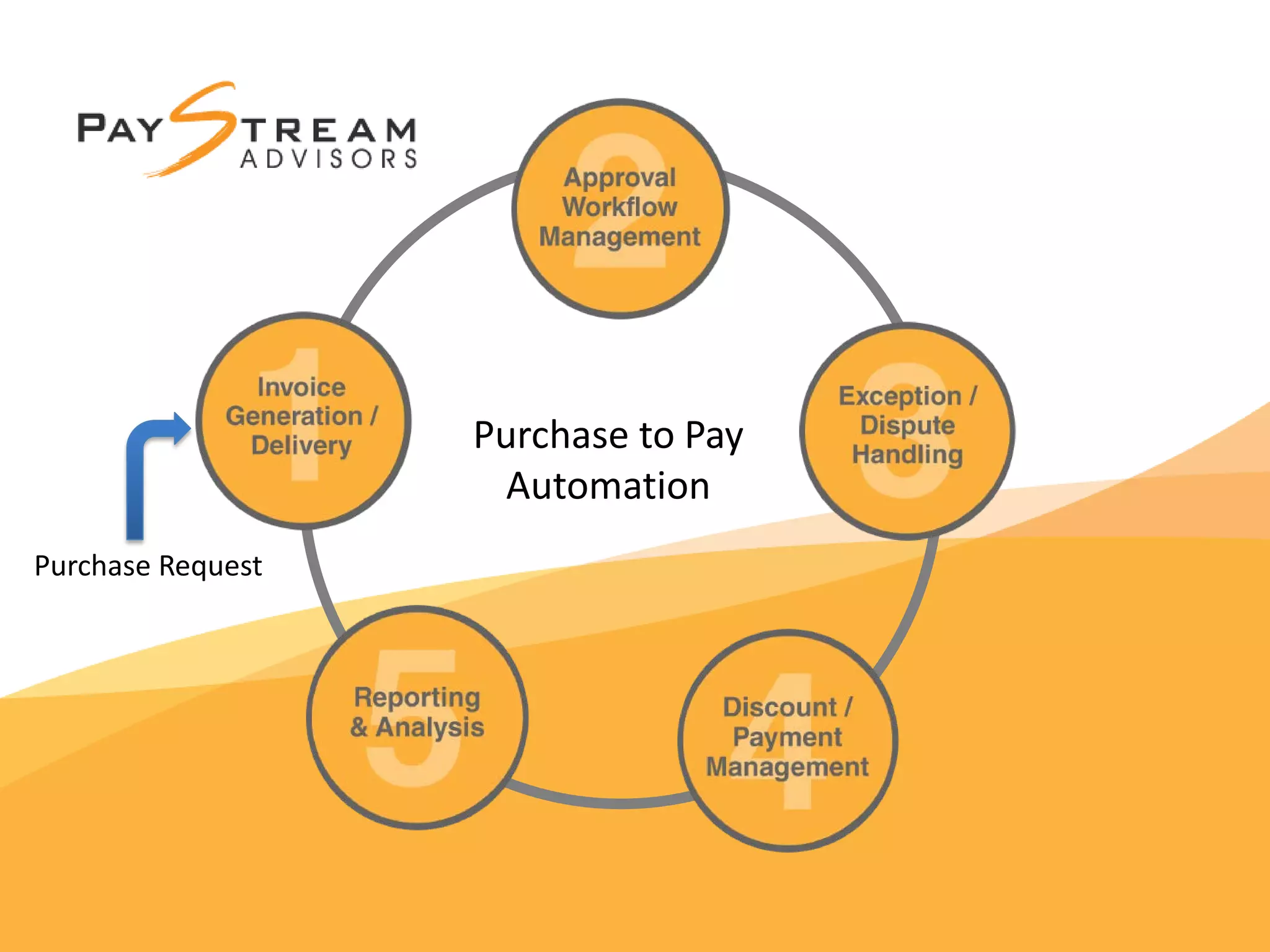

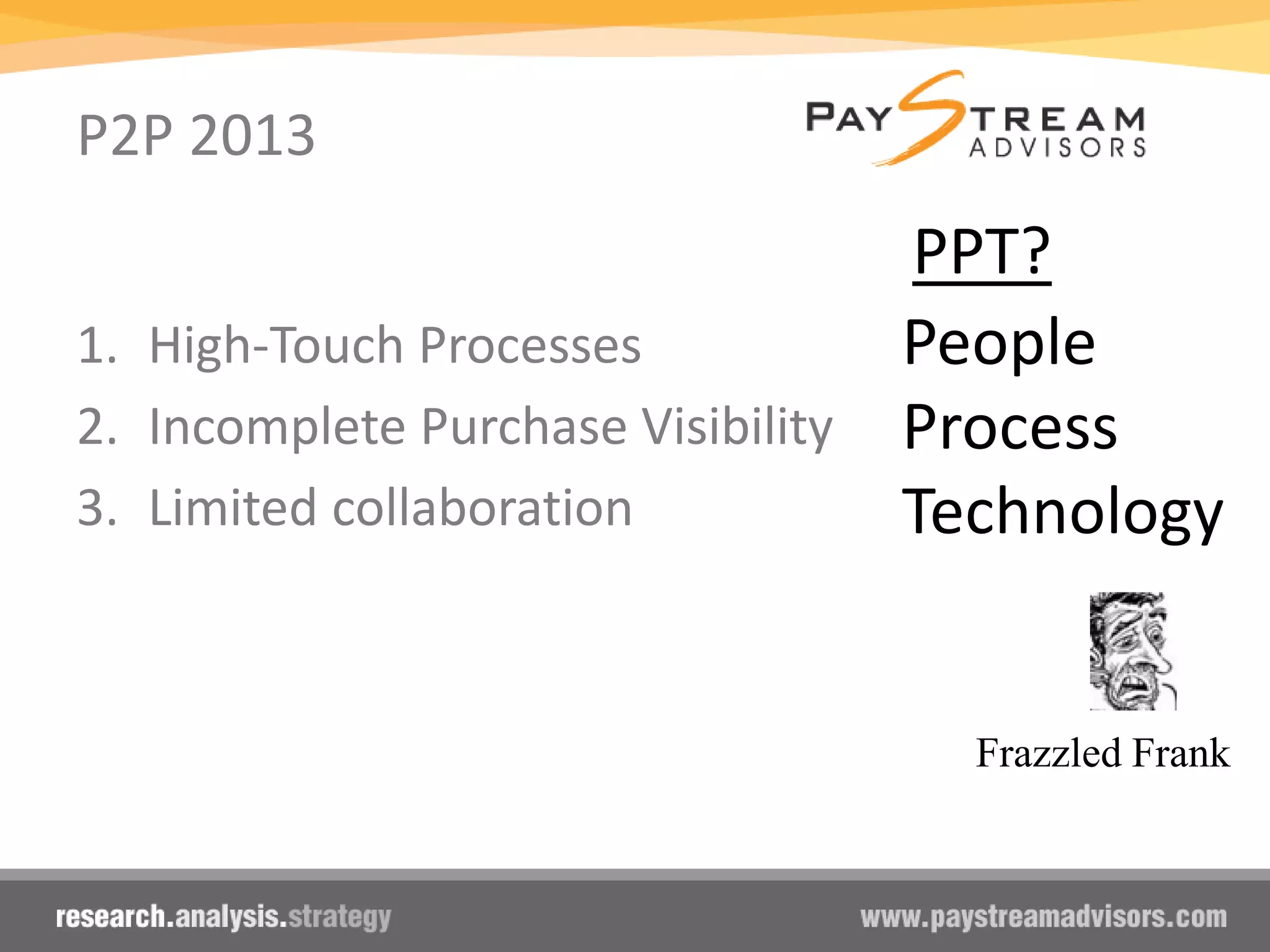

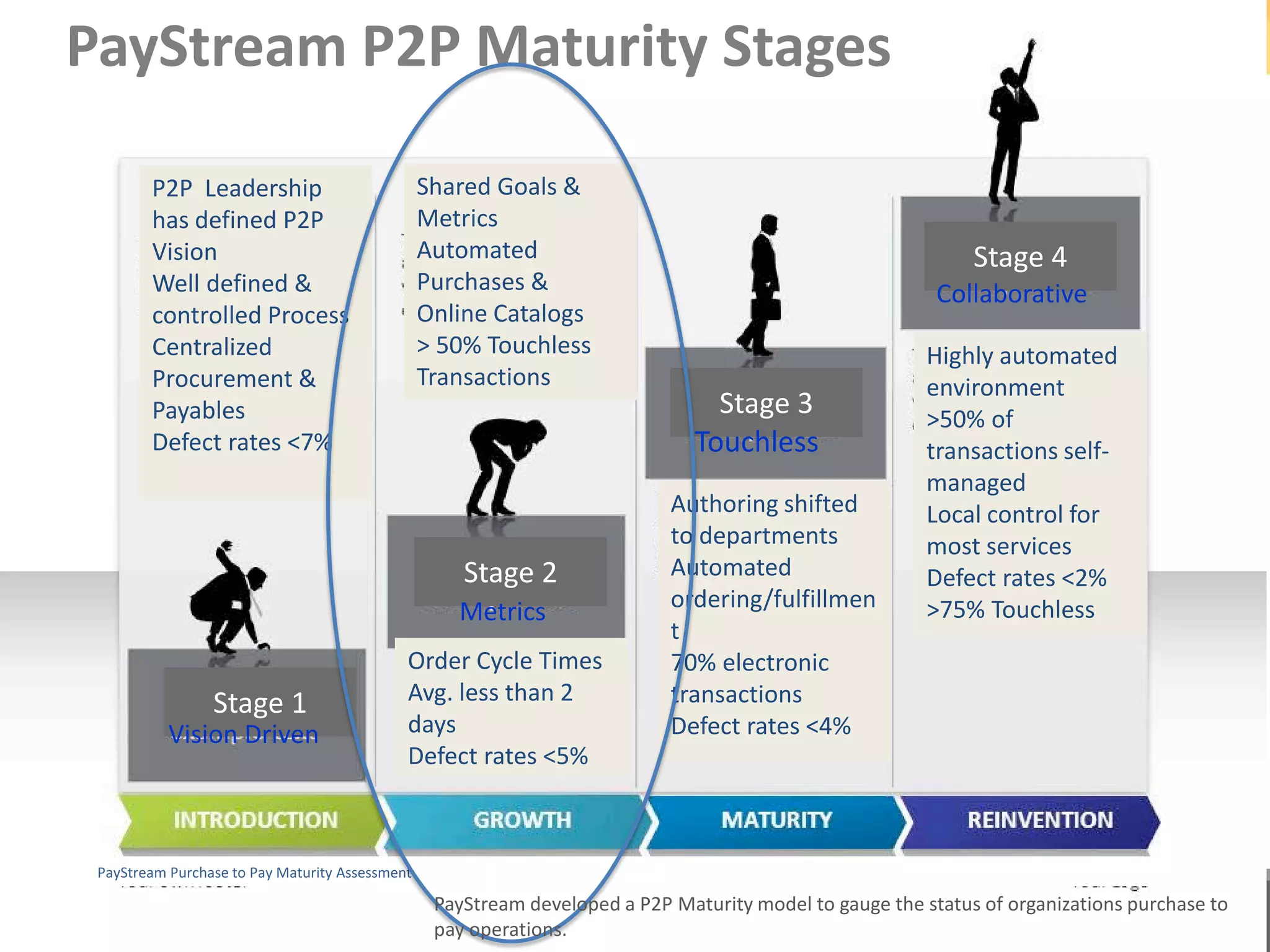

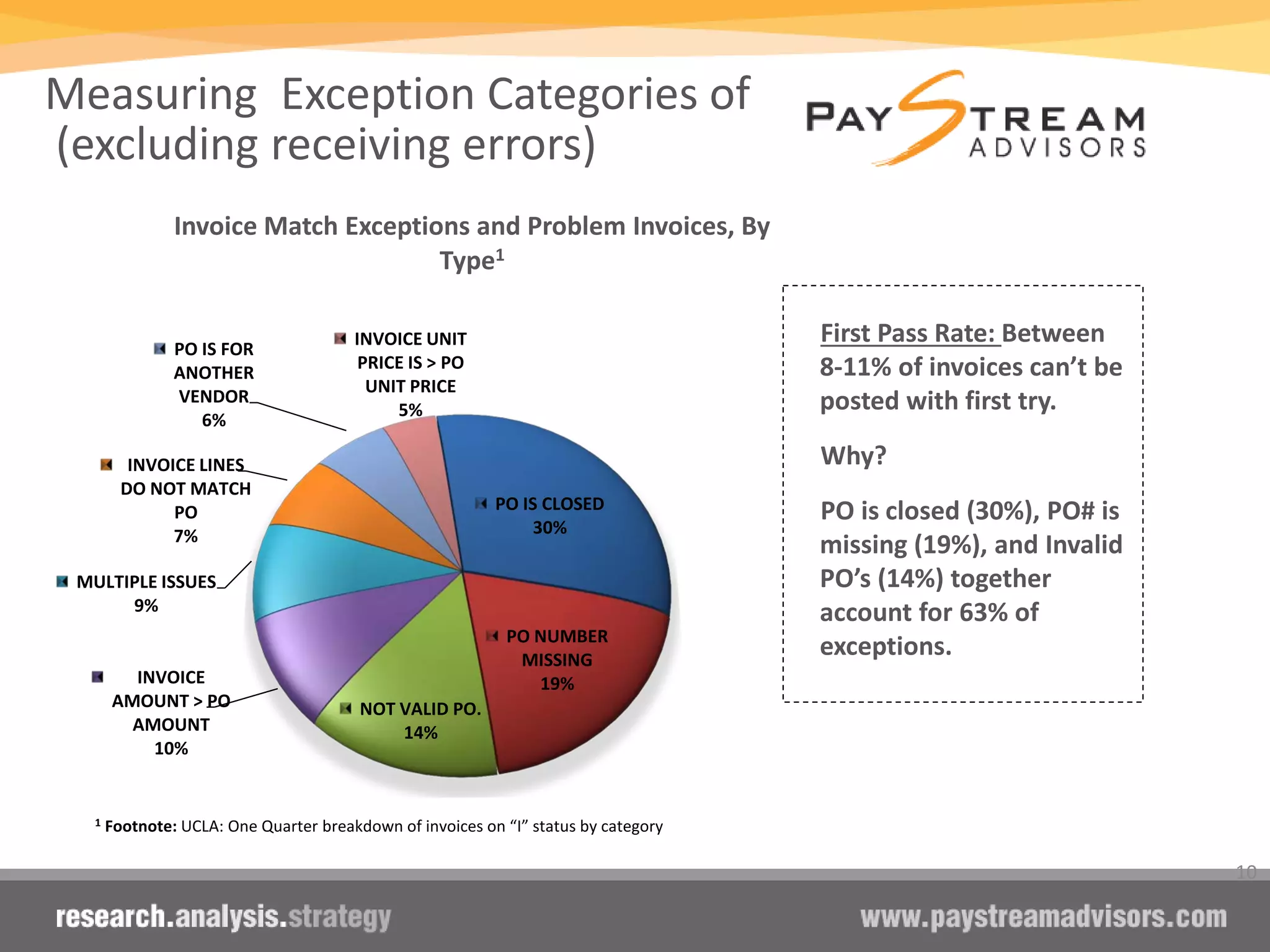

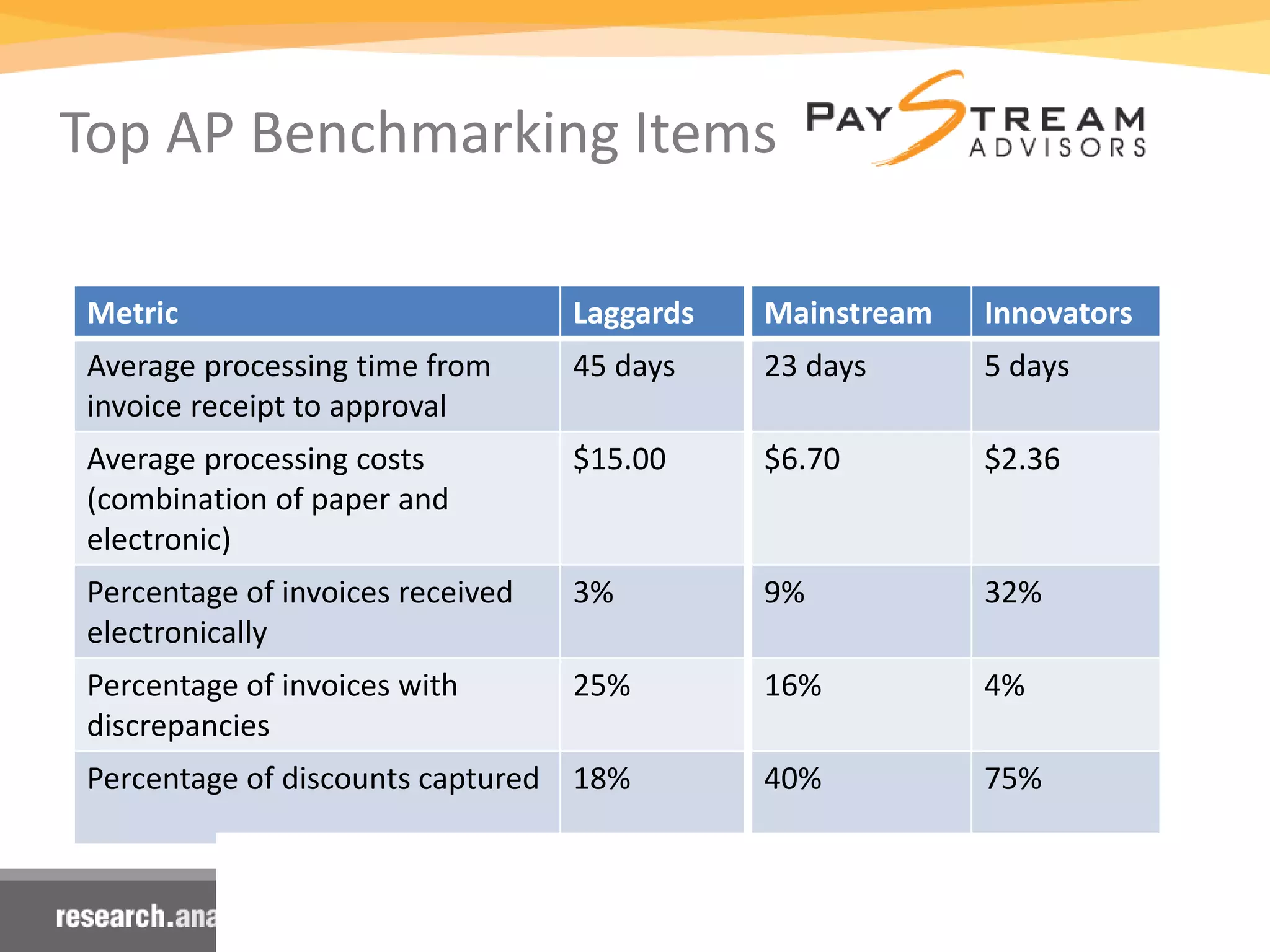

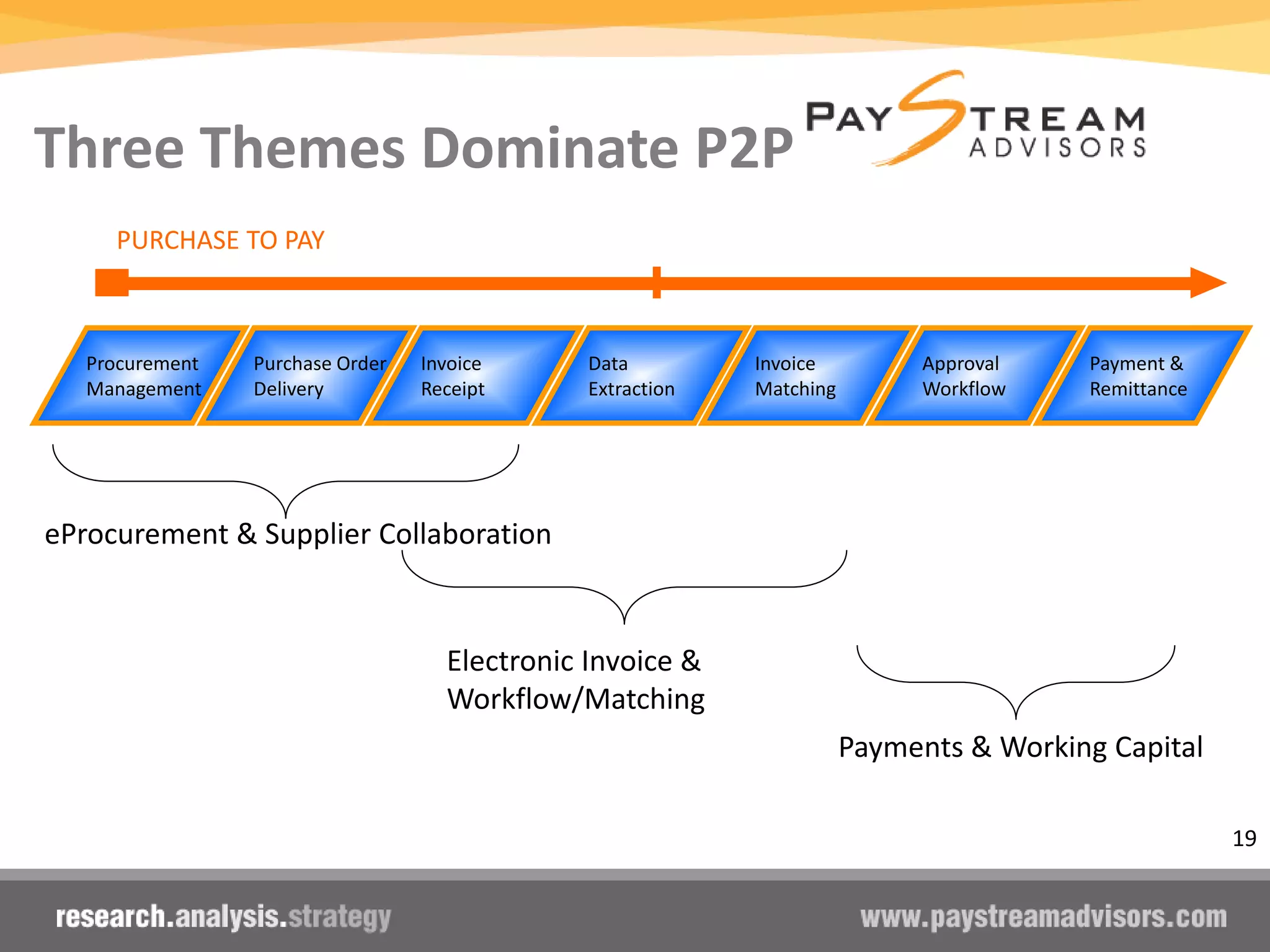

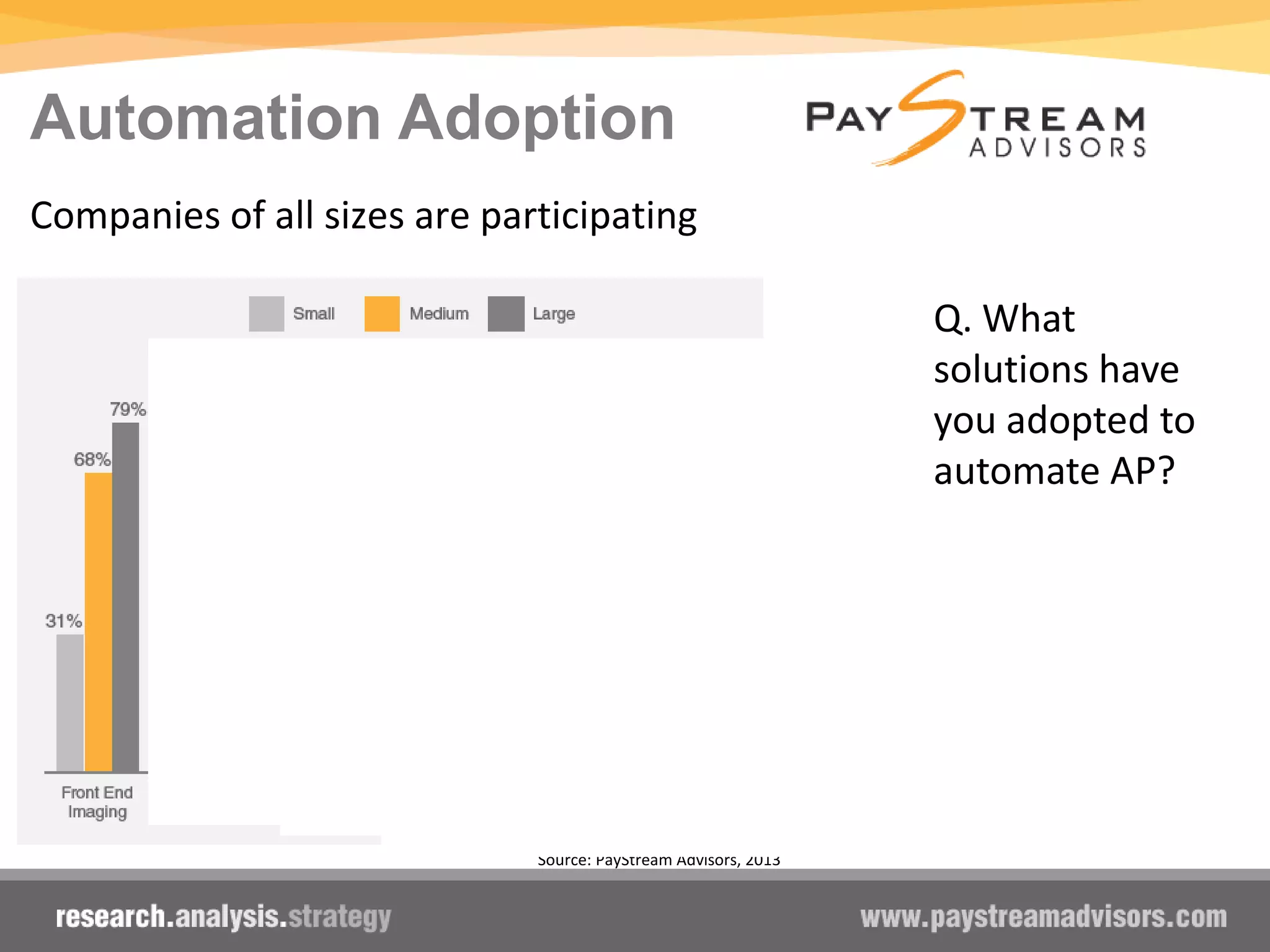

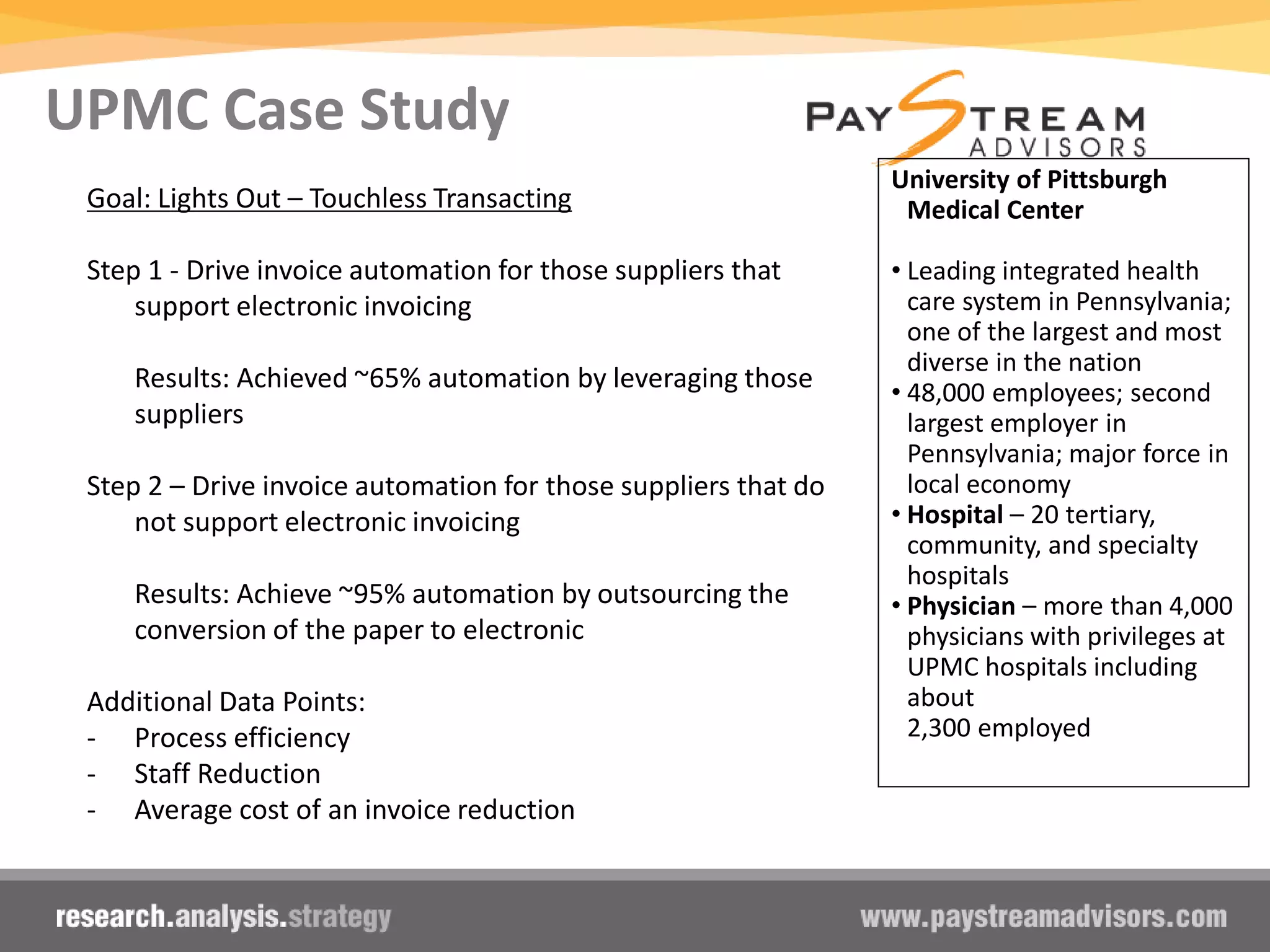

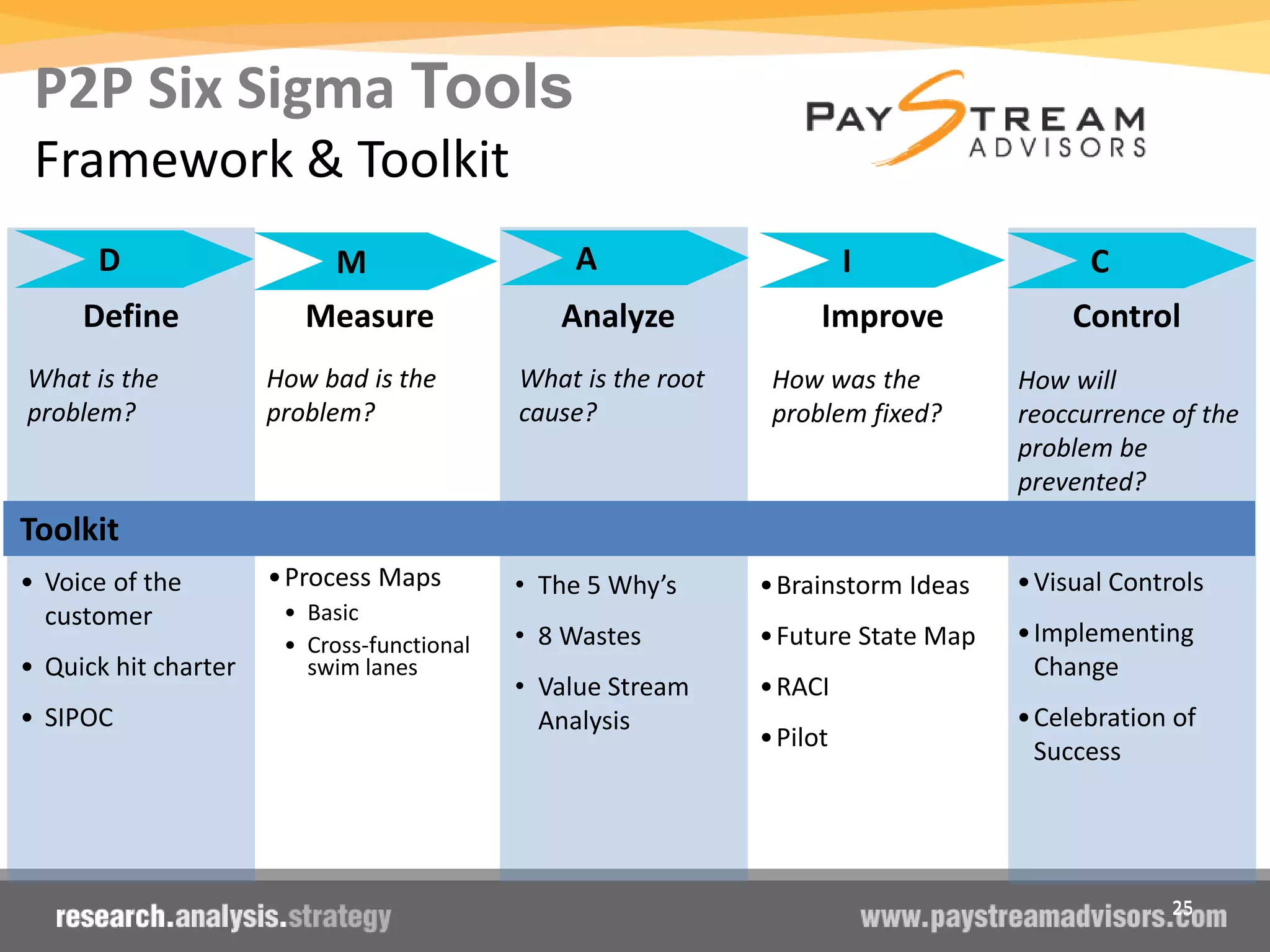

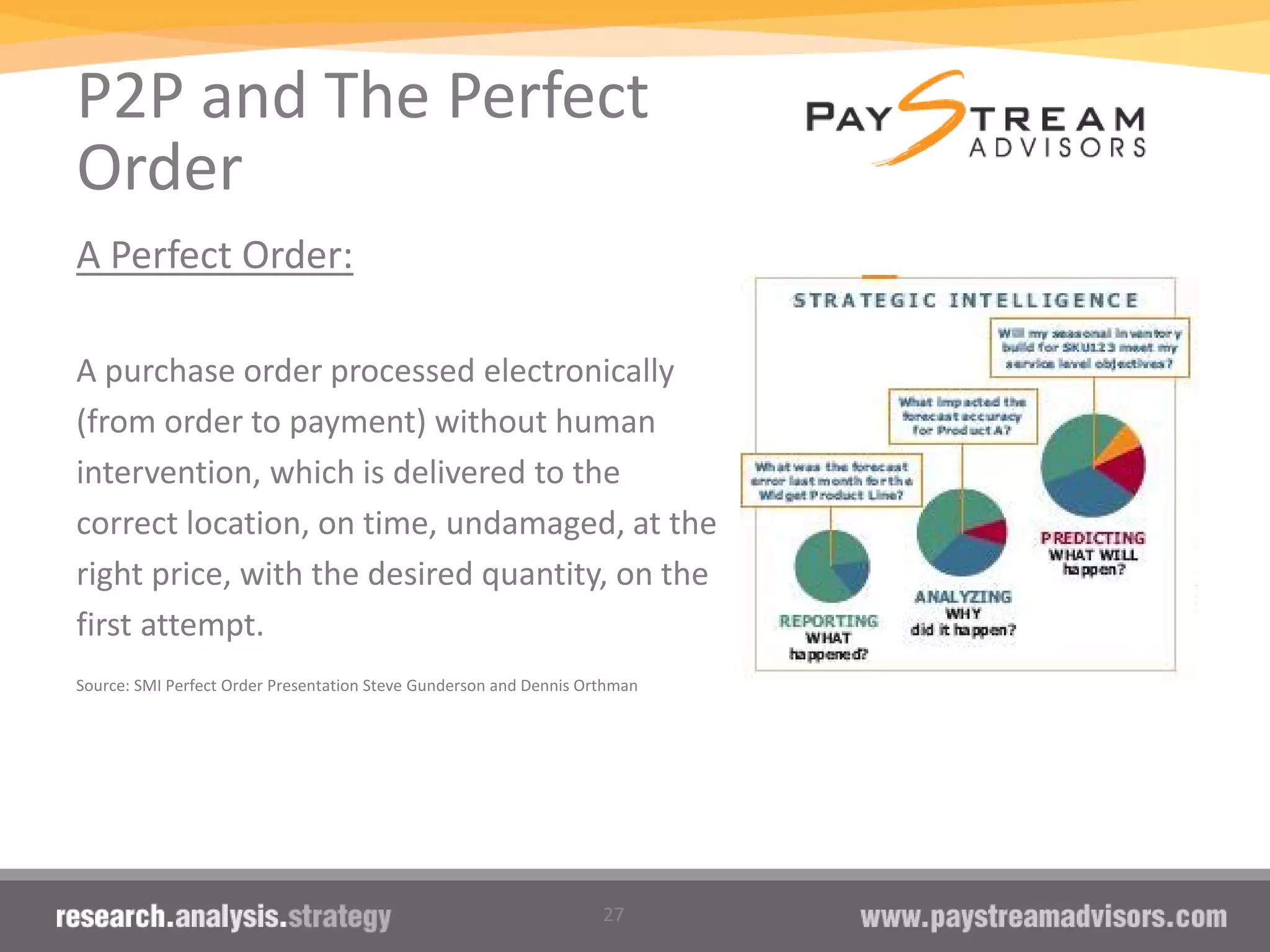

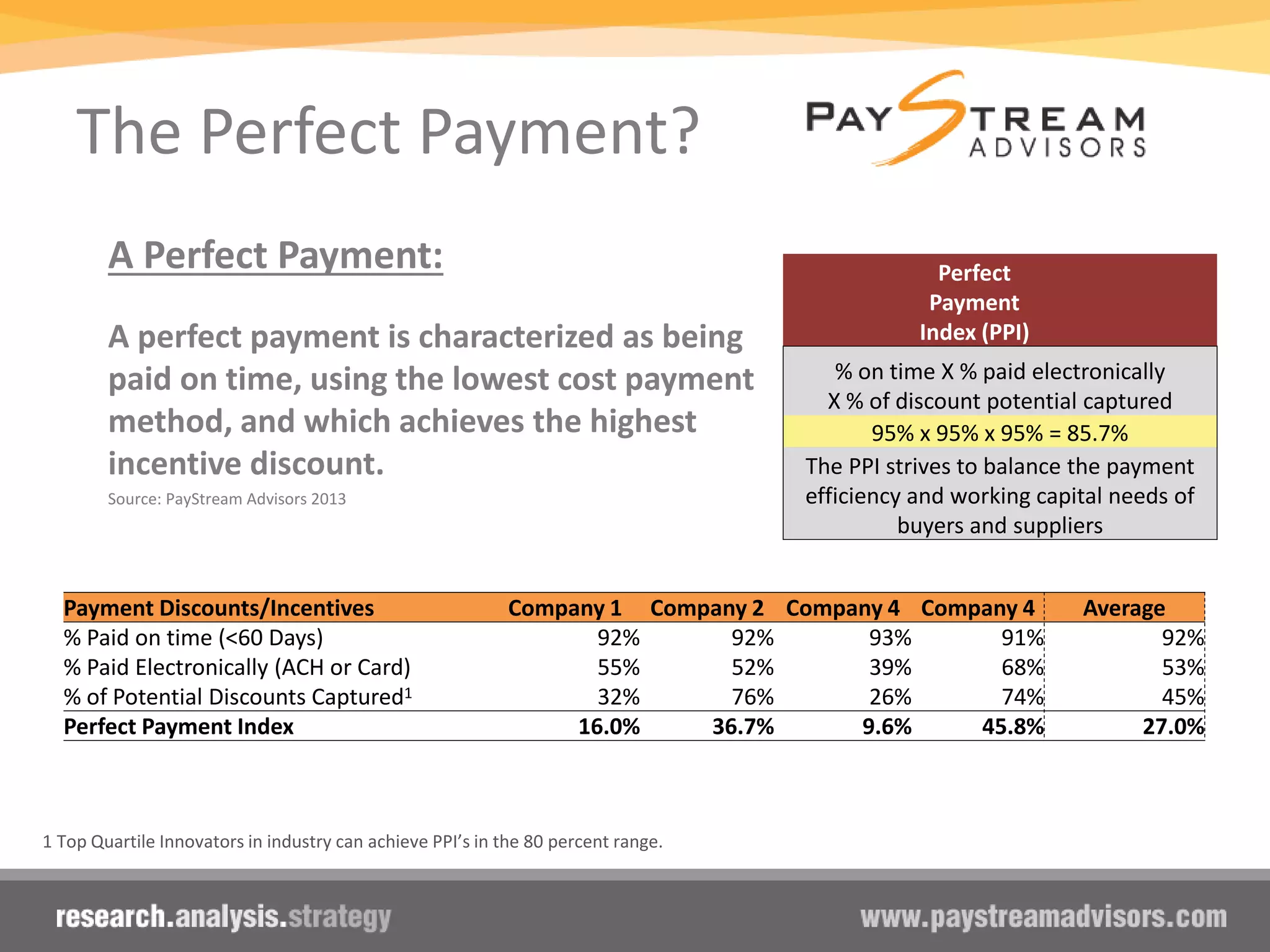

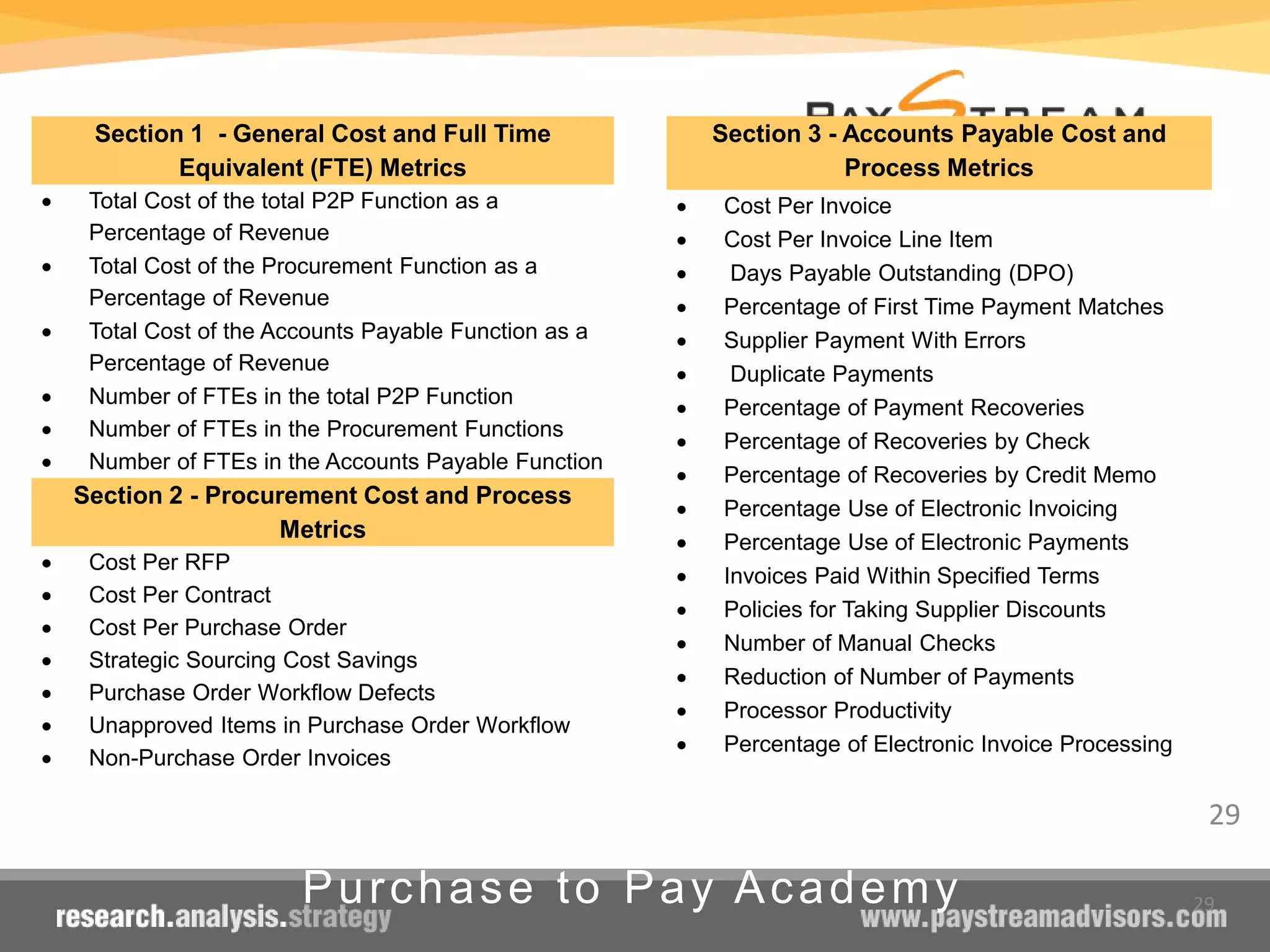

This document summarizes a presentation on trends in procure-to-pay processes. It discusses how procure-to-pay is moving towards more perfect, touchless transactions with high levels of automation and collaboration between stakeholders. The presentation outlines a maturity model for purchase-to-pay operations and provides examples of innovative organizations that have achieved high rates of electronic ordering, invoice processing, and payments. It emphasizes the importance of people, process redesign, and technology working together to transform procure-to-pay functions.