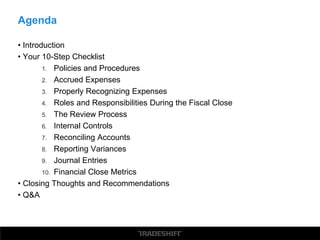

The document provides a detailed 10-step checklist for accounts payable fiscal year-end close, emphasizing the importance of policies, procedures, and communication. It covers crucial aspects such as accruing expenses, recognizing expenses, roles during the close, internal controls, reconciliations, and reporting variances. The checklist aims to improve coordination and accountability in the financial close process and is supported by experts Chris Doxey and Christopher Jablonski.