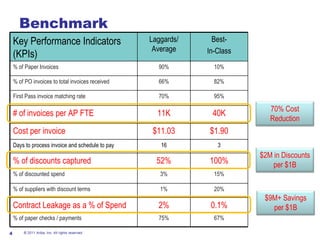

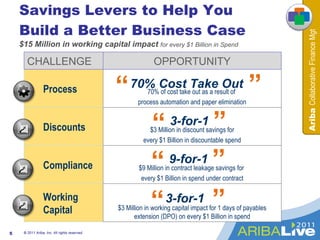

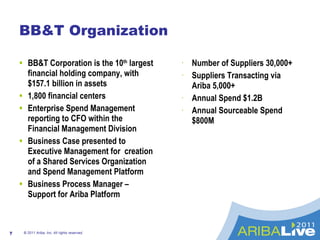

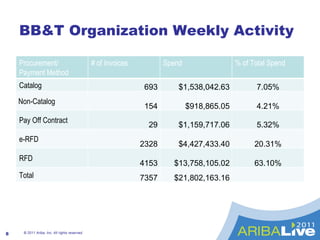

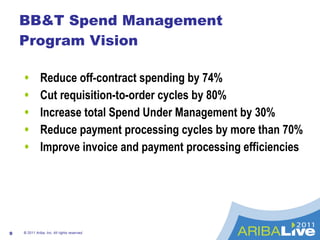

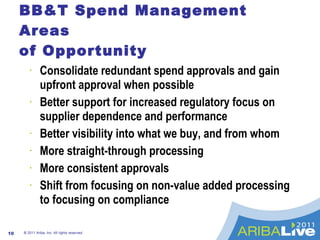

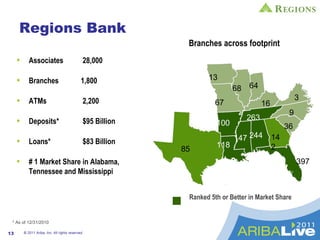

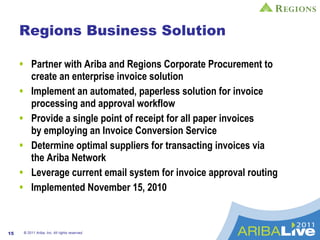

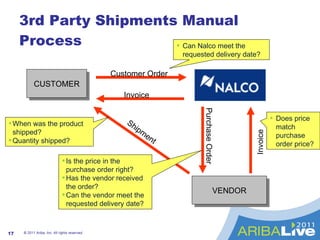

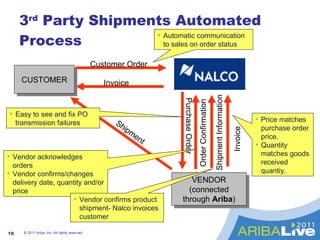

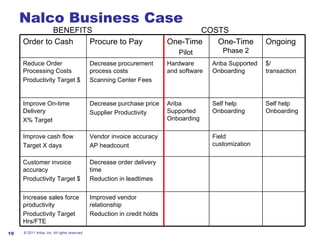

The document discusses the business case for payables automation presented by Ariba. It provides key performance indicators showing the benefits organizations can achieve through automation. Case studies from BB&T, Regions Bank, and Nalco are presented, outlining challenges they faced and how partnering with Ariba helped address them through increased efficiencies, cost savings, and improved visibility. The presentation concludes with next steps around continued supplier onboarding and connectivity.