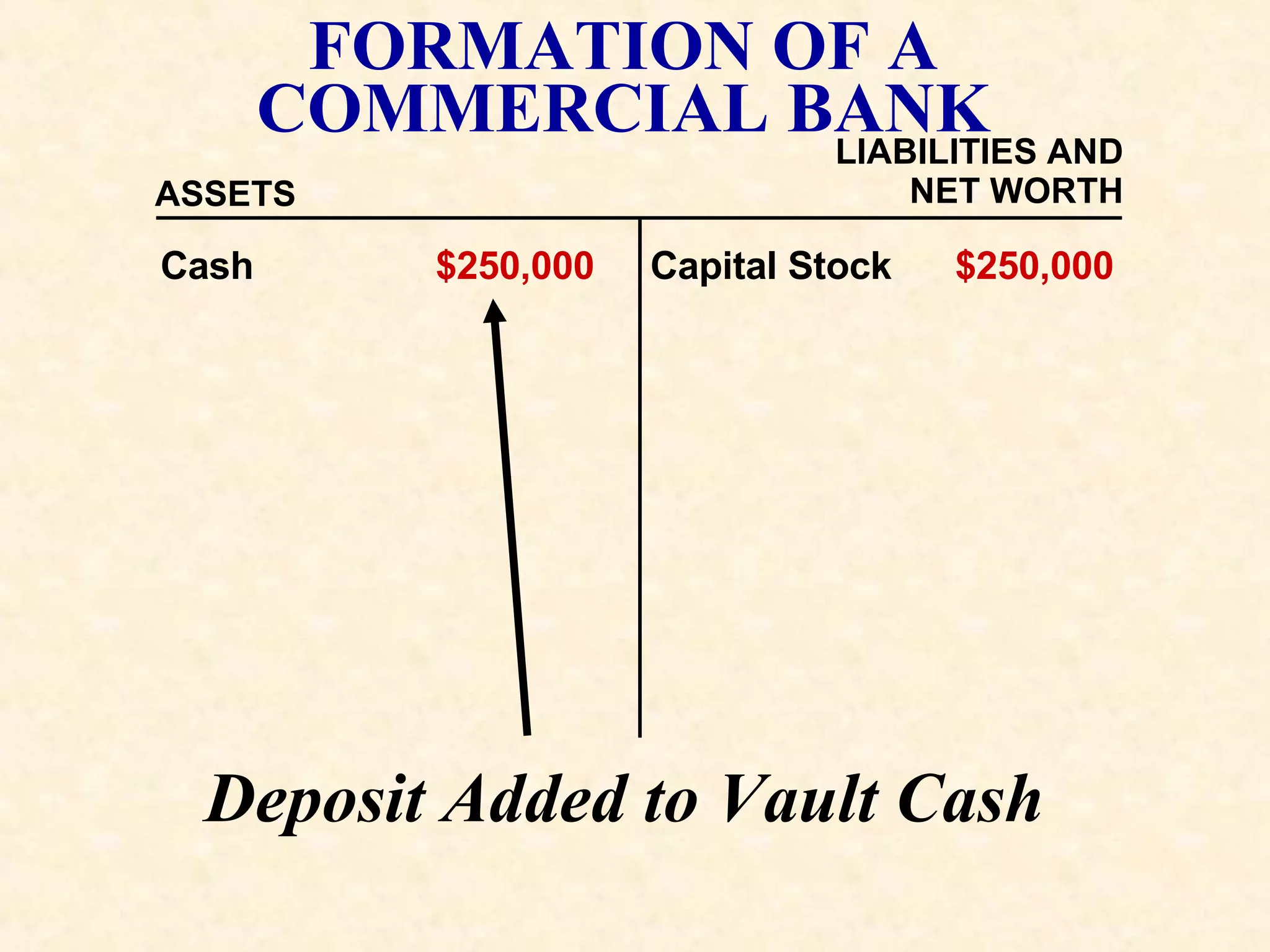

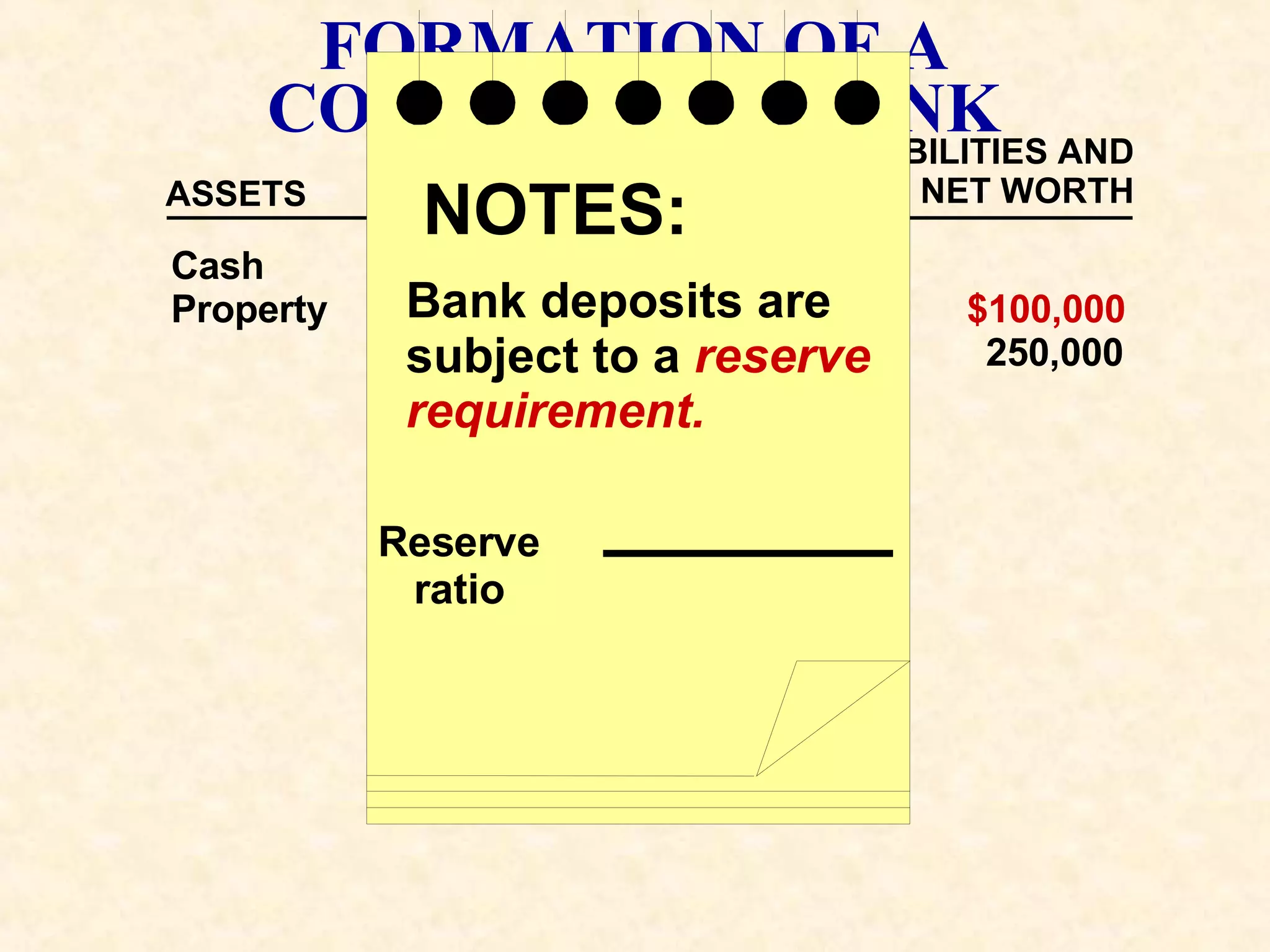

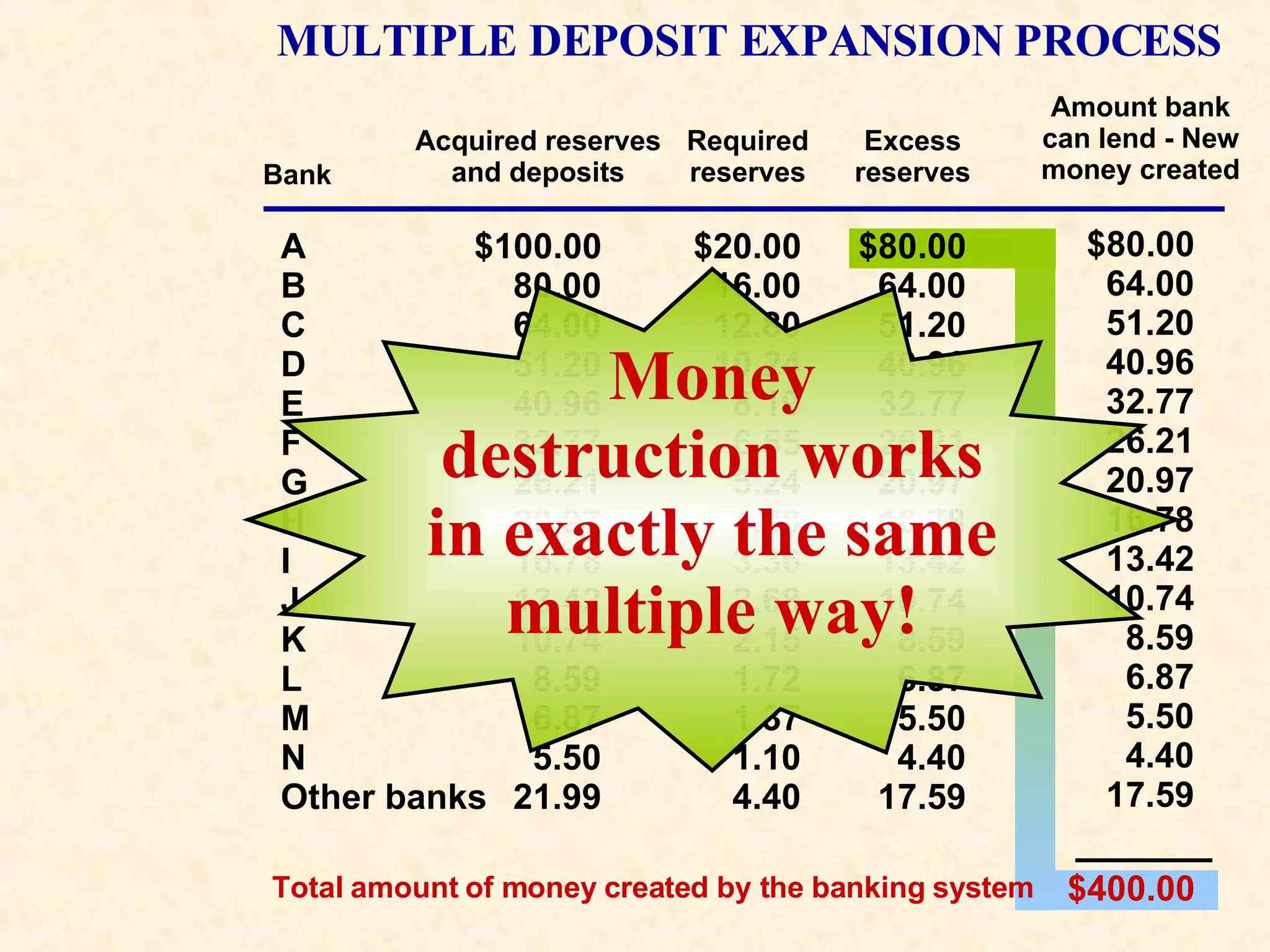

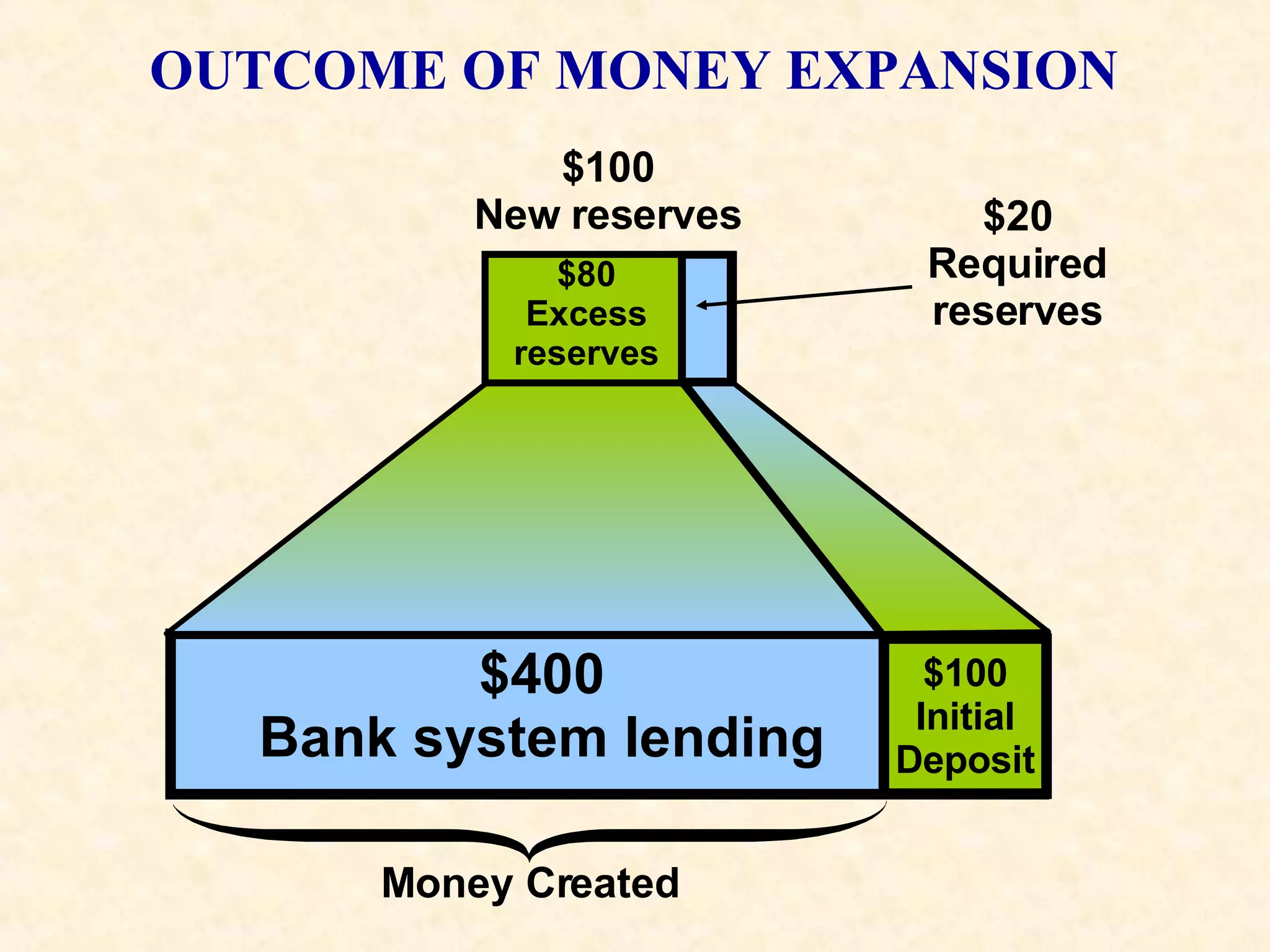

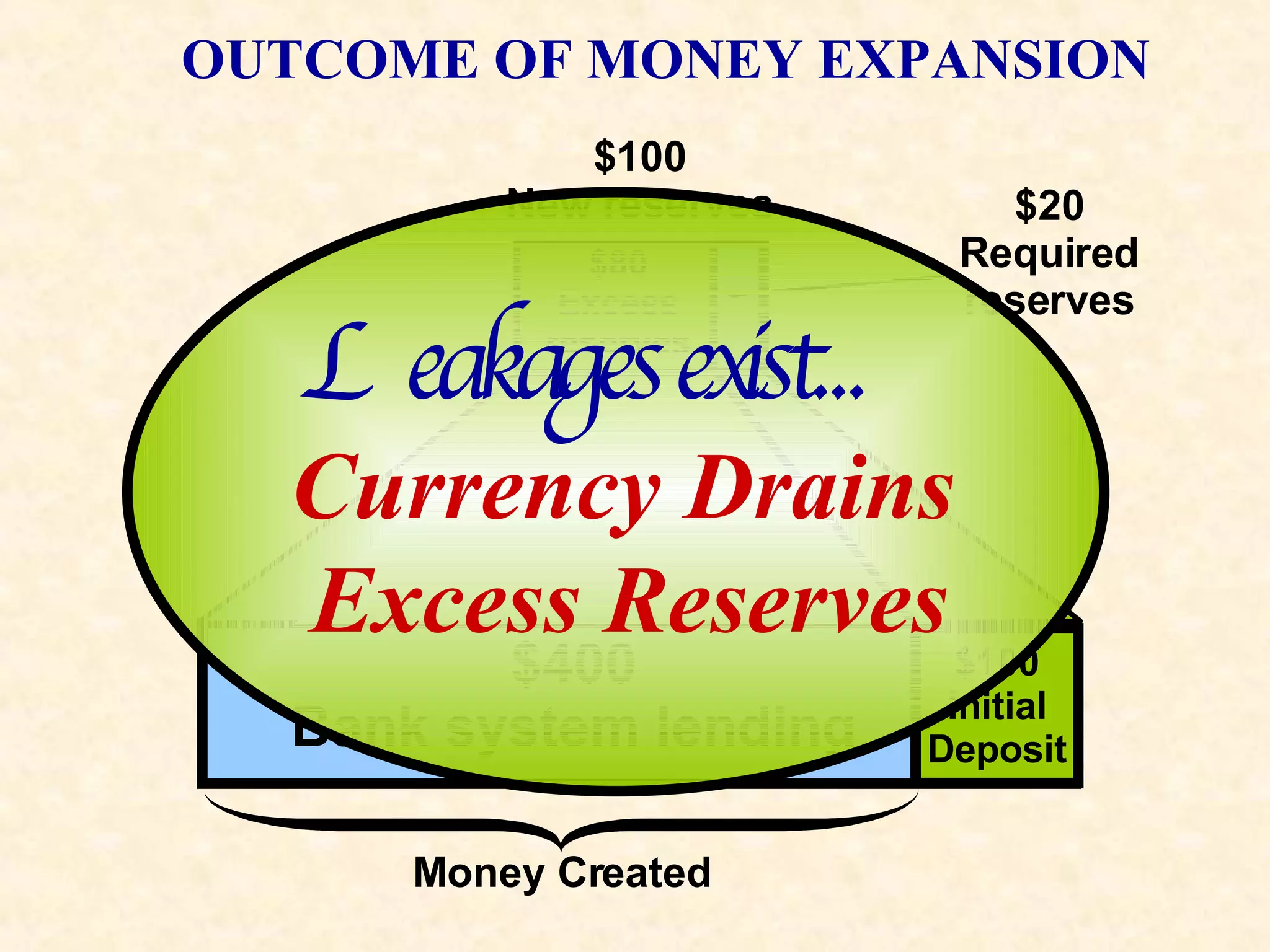

The document discusses how banks create money through fractional reserve banking. It begins by explaining how goldsmiths in the early days would lend out receipts for gold they held, even though they did not hold all the gold in reserve. This created the fractional reserve system. It then provides examples of how a commercial bank's balance sheet changes as it accepts deposits, makes loans from excess reserves, and purchases assets like government securities. The document also discusses the monetary multiplier effect, where one bank's loans become another bank's deposits, expanding the money supply. It concludes by noting that monetary policy will be covered in the next chapter.

![How Banks Create Money [ MS ] M1=Currency+DD of Public Banks [thru loans] C reate M ore DD Give me a loan so there will be more DD in the system.](https://image.slidesharecdn.com/apchapter14revised-ss-1207680103816655-8/75/AP-chapter14-how-banks-create-money-2-2048.jpg)

![“ Wow, you mean we can create money out of thin air.?” Once upon a time there was a gold-smithy who offered to store people’s gold in his vault. He issued paper receipts for the gold, and it was not long before the townsfolk used the paper to purchase eggs and beer. The smithy’s paper receipts became as “good as gold.” Our Smithy was not stupid . He said to himself. “I have 2000 ounces of gold stored in my vault, but in the last year I was never called upon to pay out more than 100 ounces in a single day. What harm could it do if I lent out say, half the gold I now have? I’ll still have more than enough to pay off any depositors that come in for a withdrawal. No one will know the difference. I could earn 30 additional ounces of gold each week. I think I’ll do it.” “ The smithy has invented the Fractional Reserve Banking System.” Advantages of Lending [One disadvantage was the possibility of “bank runs”] 1. Depositors haven’t lost money [ Goldsmiths paid them instead of other way ] 2. With the interest you earned you could give some to depositors. 3. The loans benefited the economy The Very Early Days Of Banking The fractional banking system began when someone issued claims for gold that already belonged to someone else. Greatest invention since sliced bread](https://image.slidesharecdn.com/apchapter14revised-ss-1207680103816655-8/75/AP-chapter14-how-banks-create-money-3-2048.jpg)