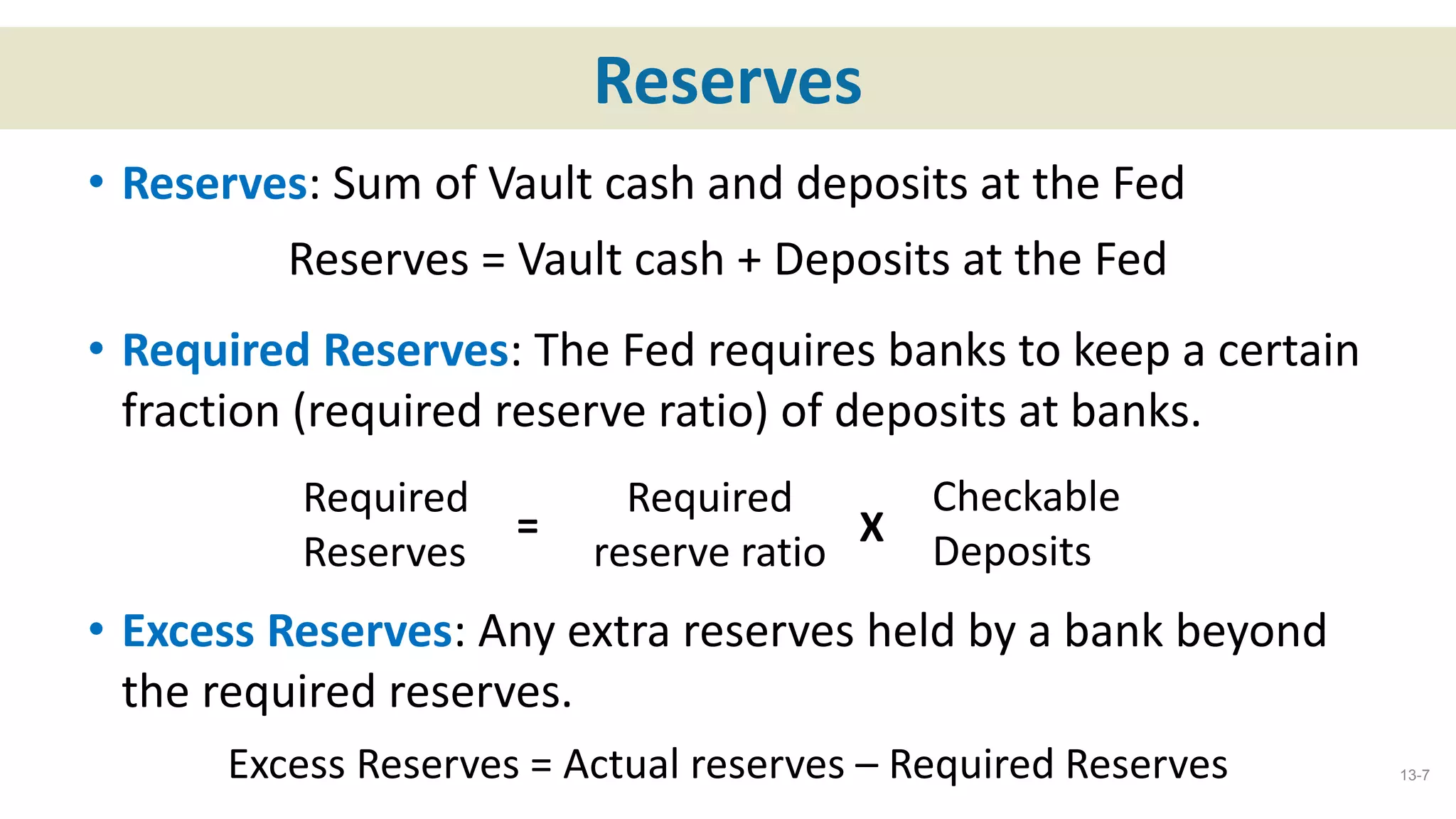

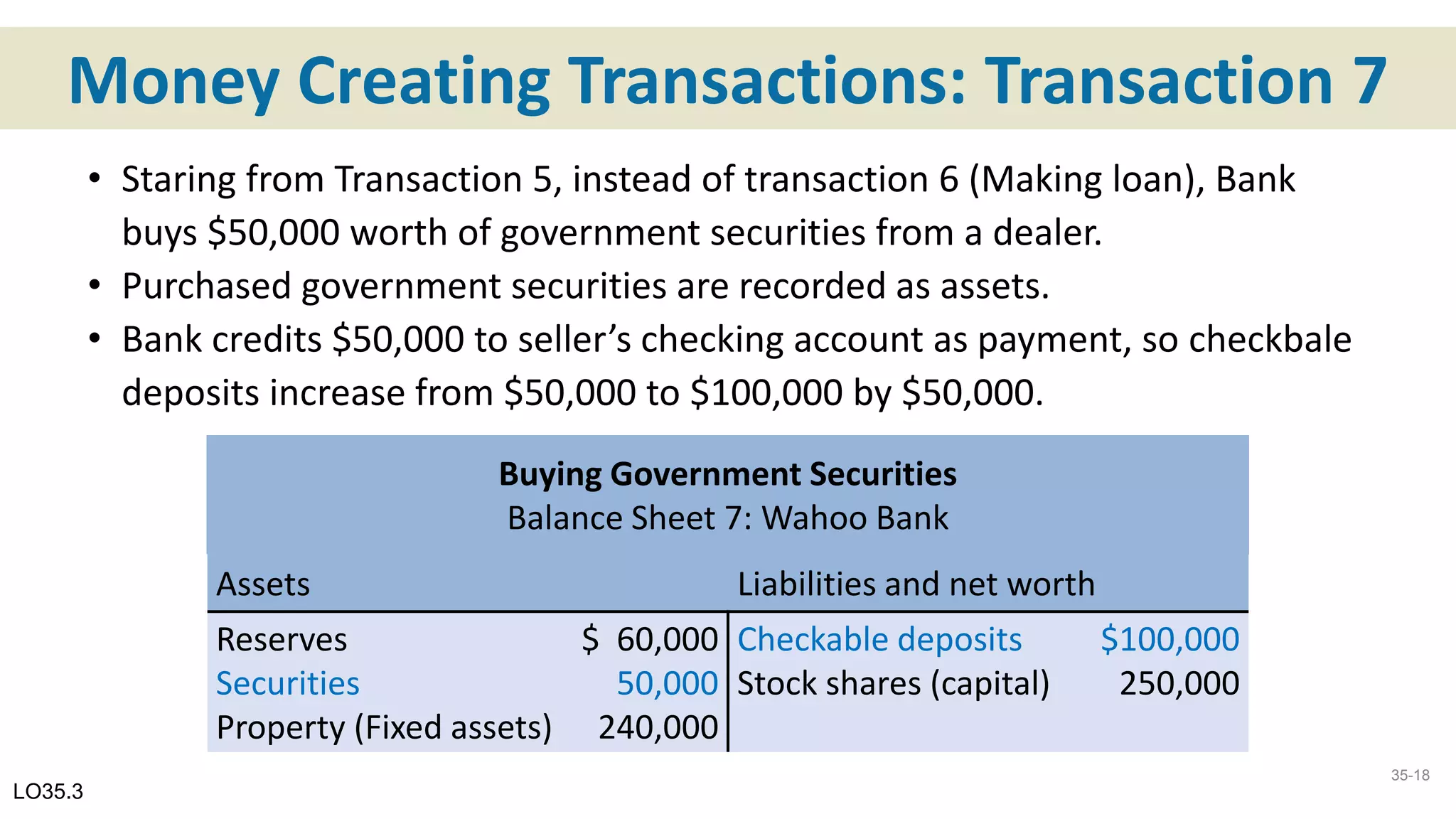

1. Banks create money through the fractional reserve banking system by accepting deposits and making loans. When a bank makes a loan, it credits the borrower's account, increasing the overall money supply.

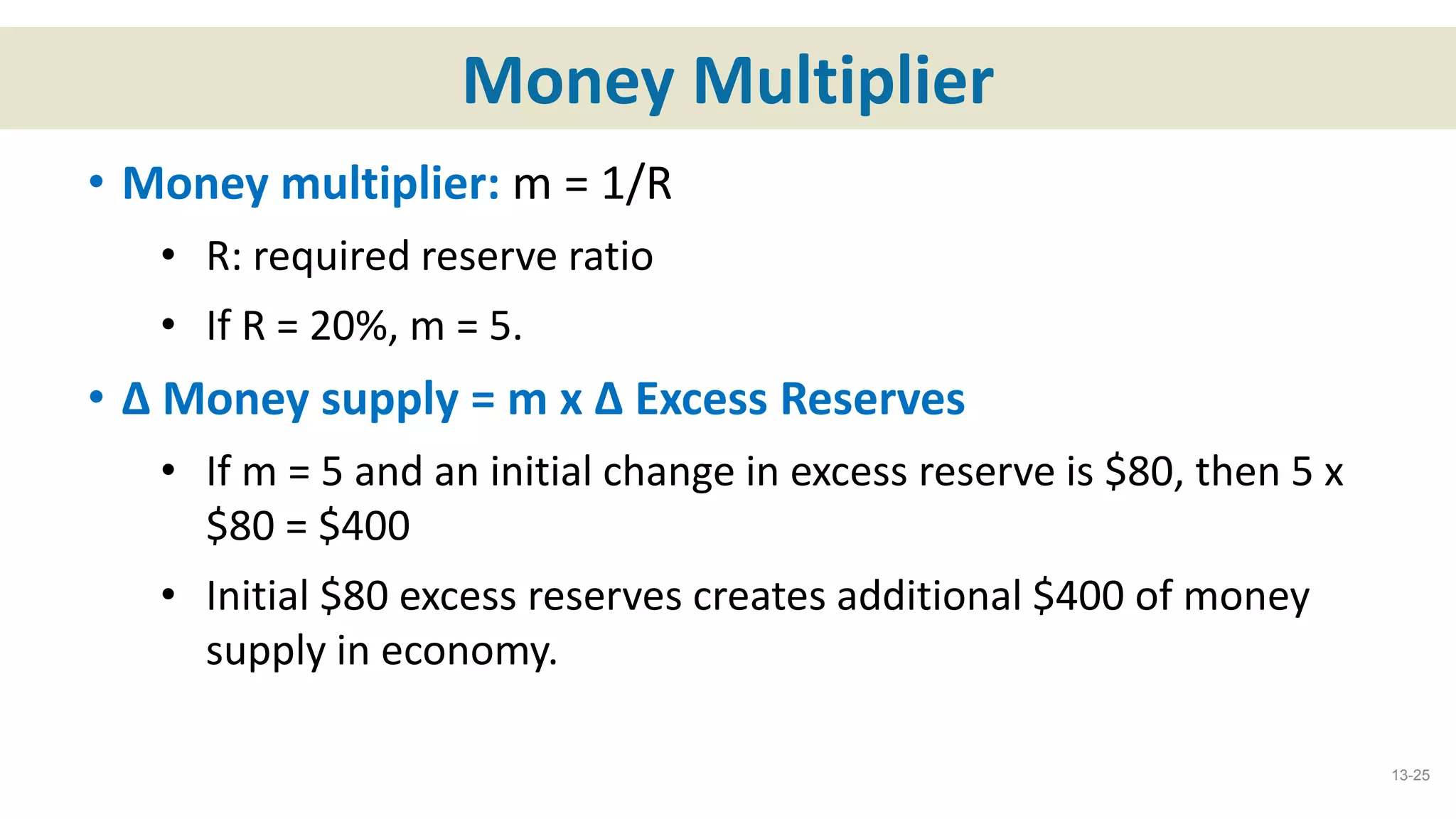

2. A single commercial bank can multiply the amount of money it creates through the process of accepting deposits and making loans. As more people deposit money and banks continue to loan out deposits, the money supply expands.

3. The money creation process occurs as banks build on one another's actions. When one bank makes a loan, those funds may be deposited in another bank, allowing the second bank to make additional loans and further increasing the money supply through the banking system.