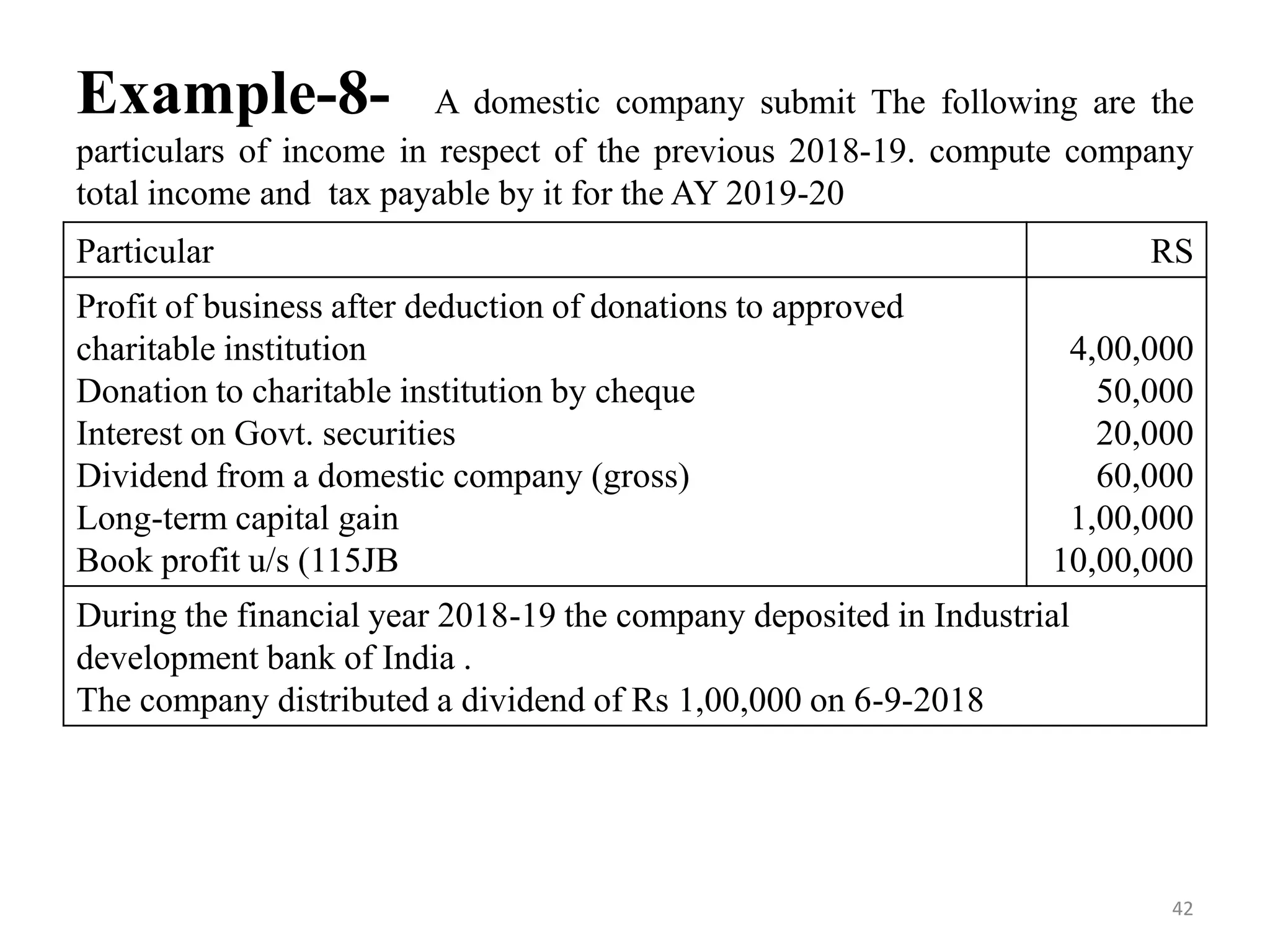

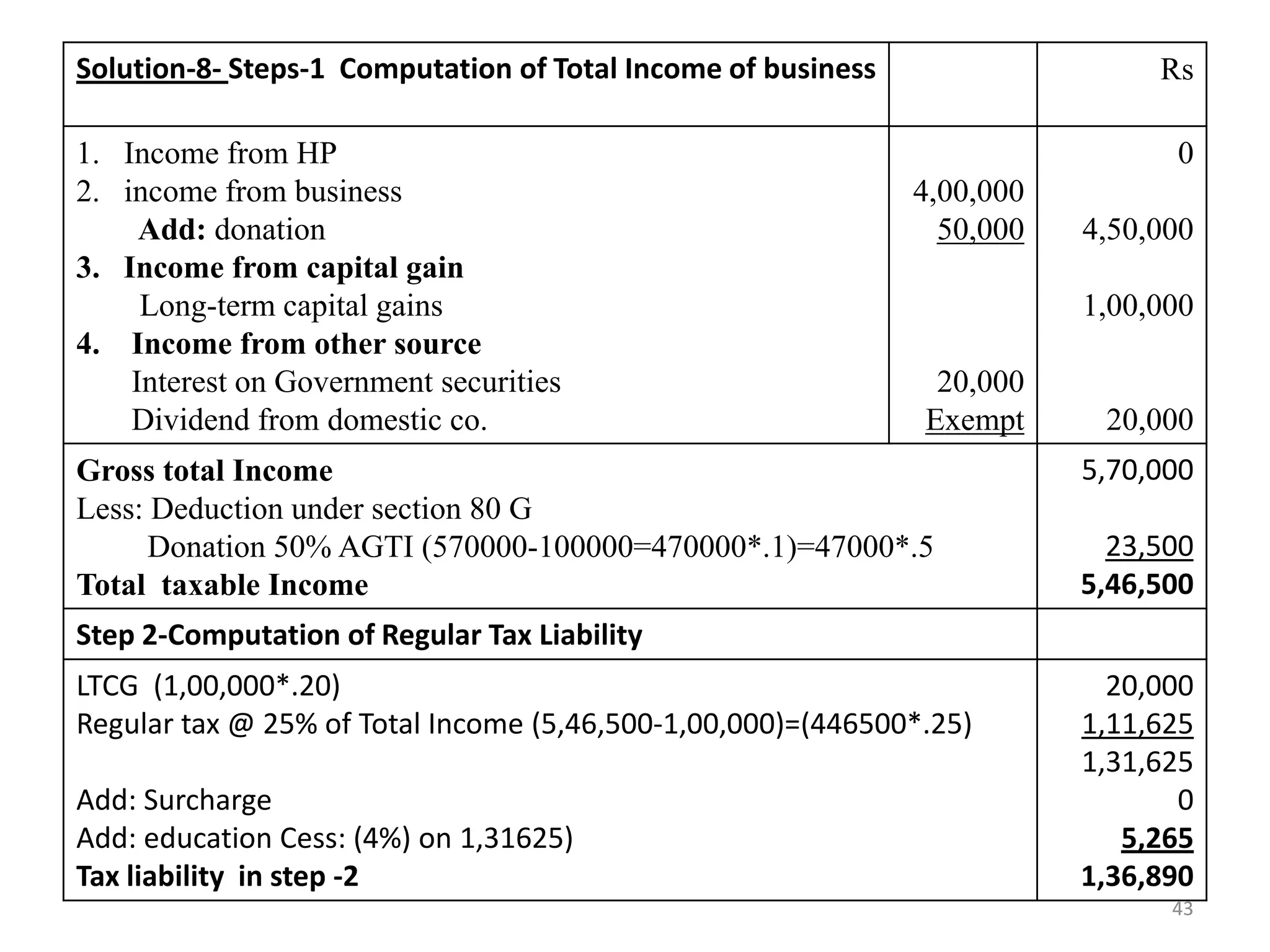

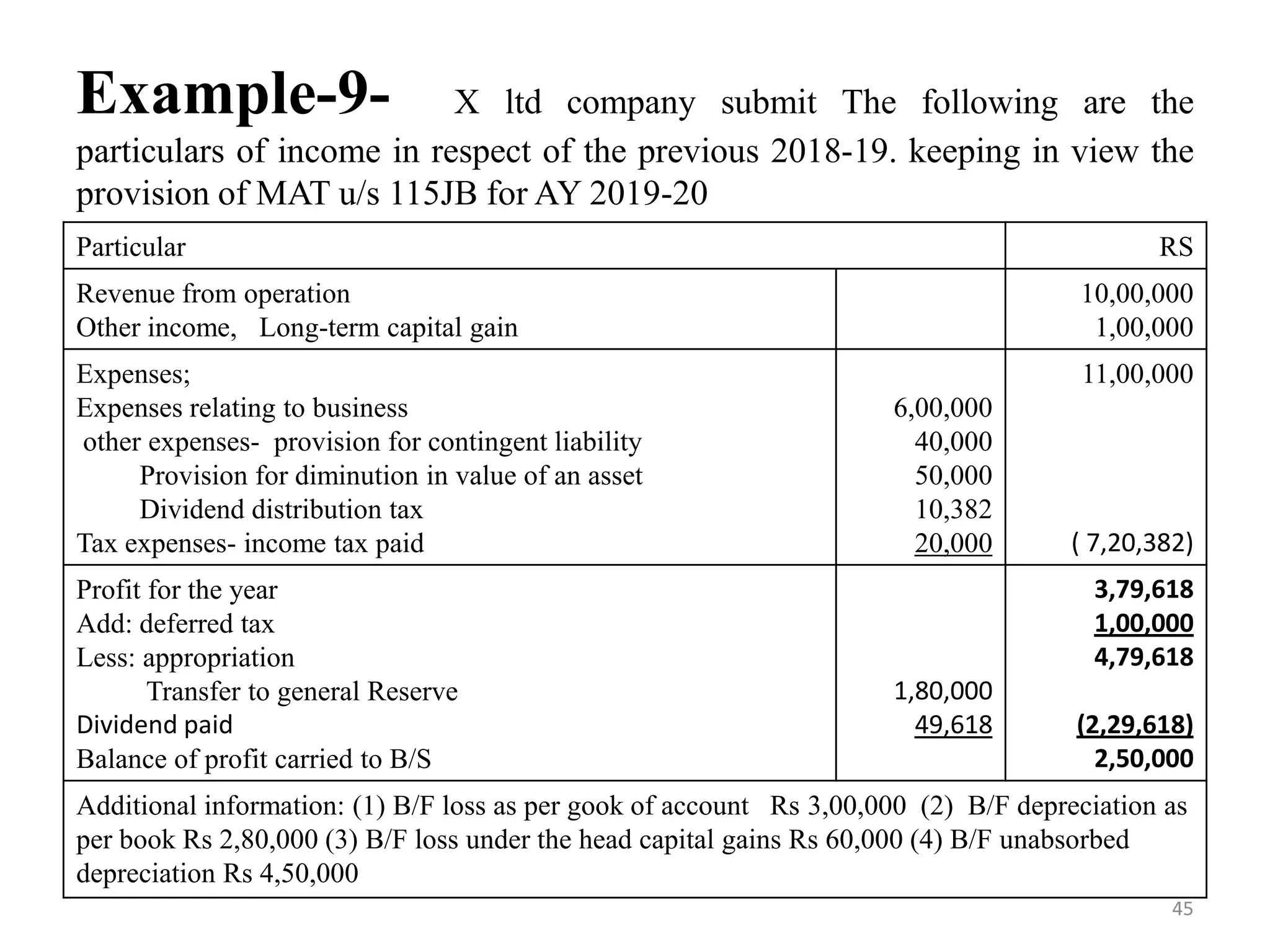

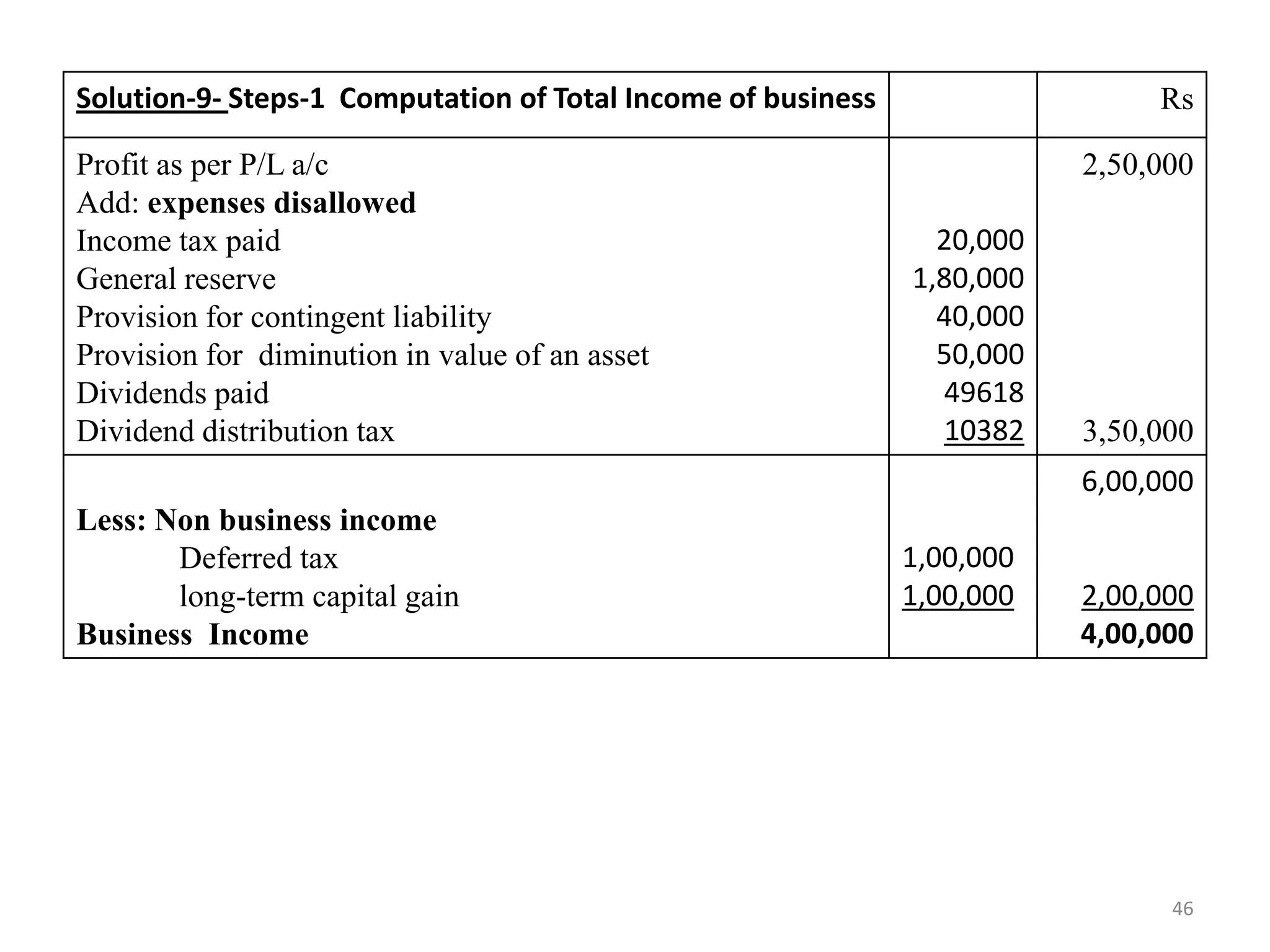

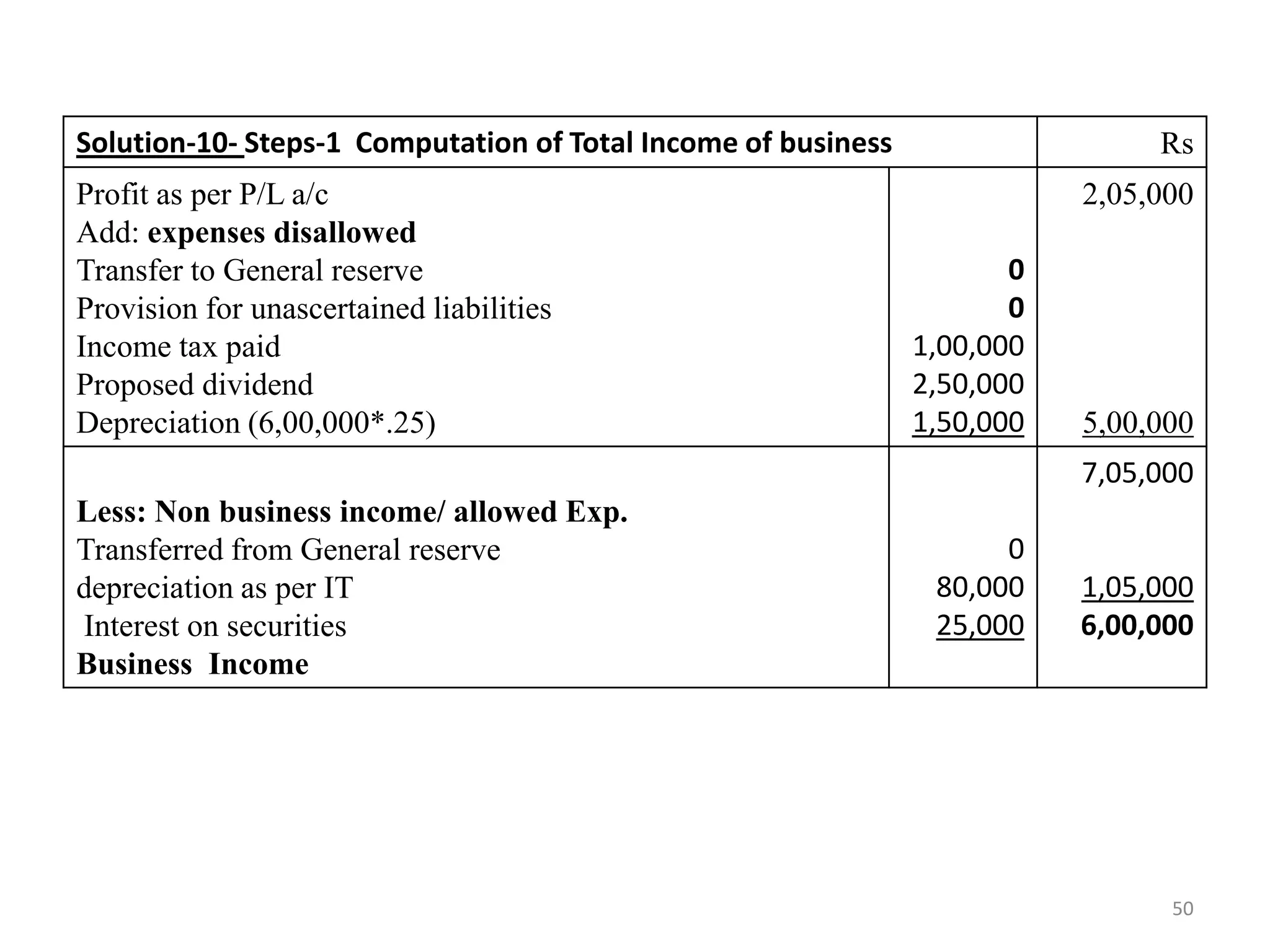

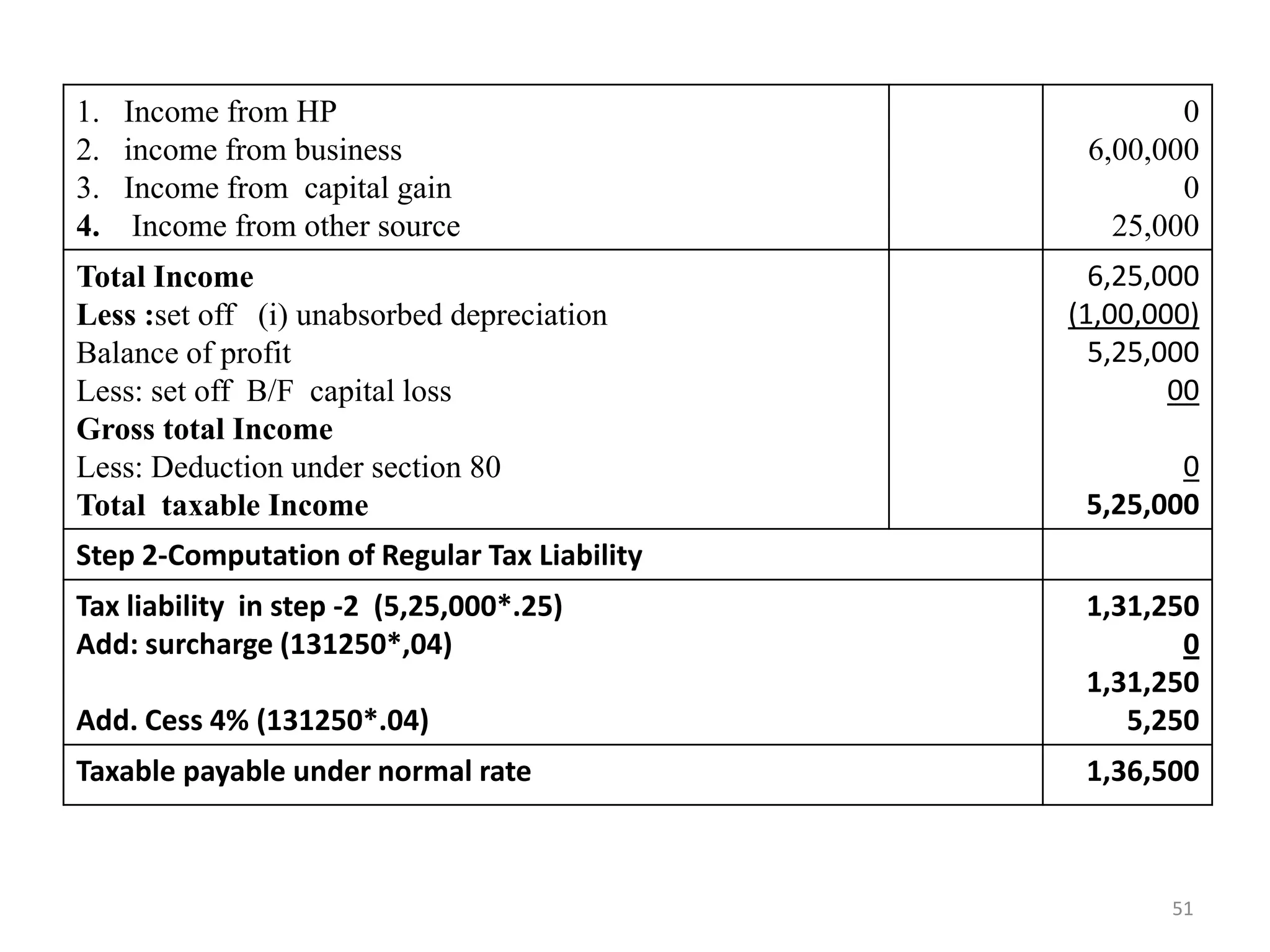

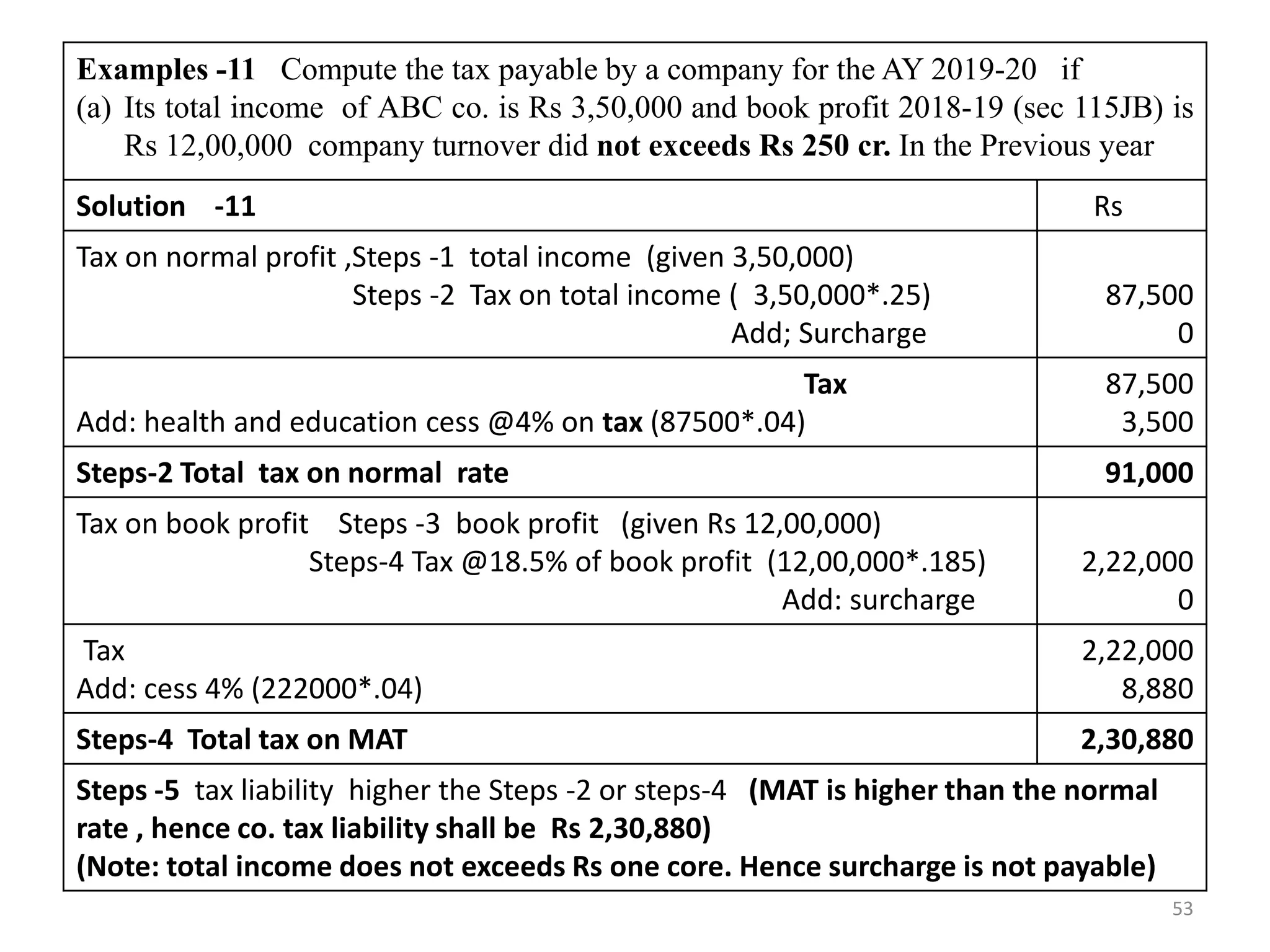

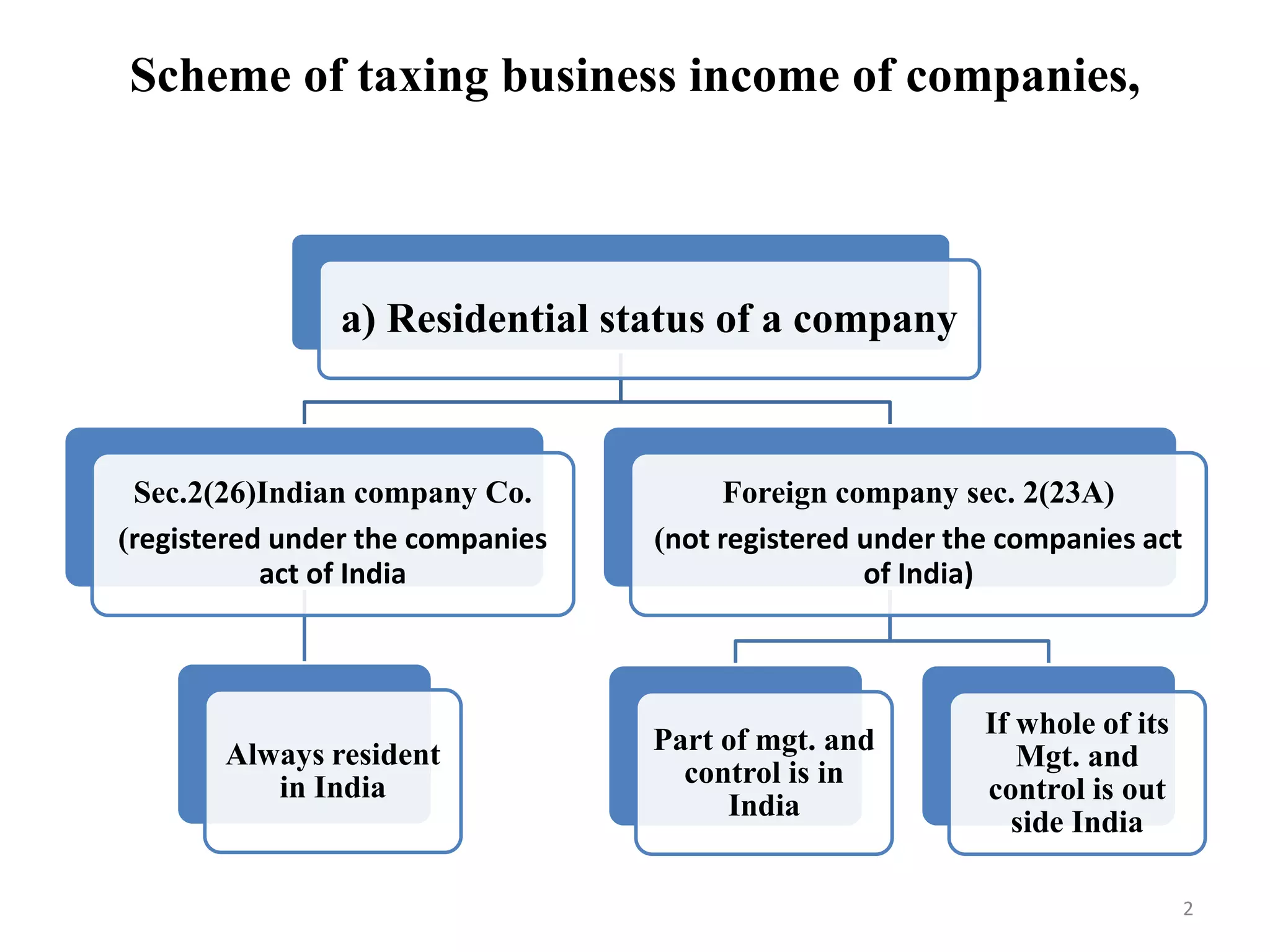

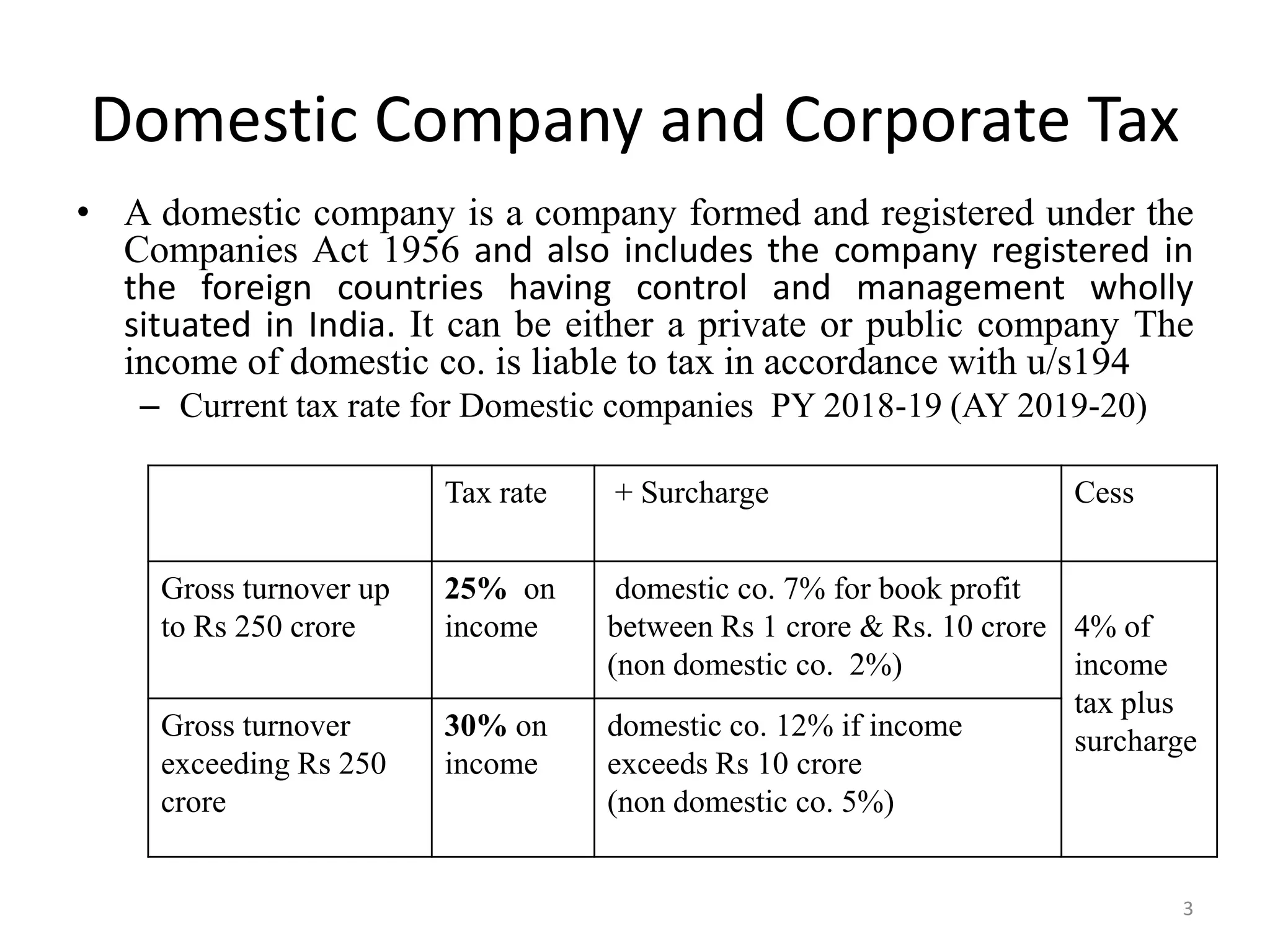

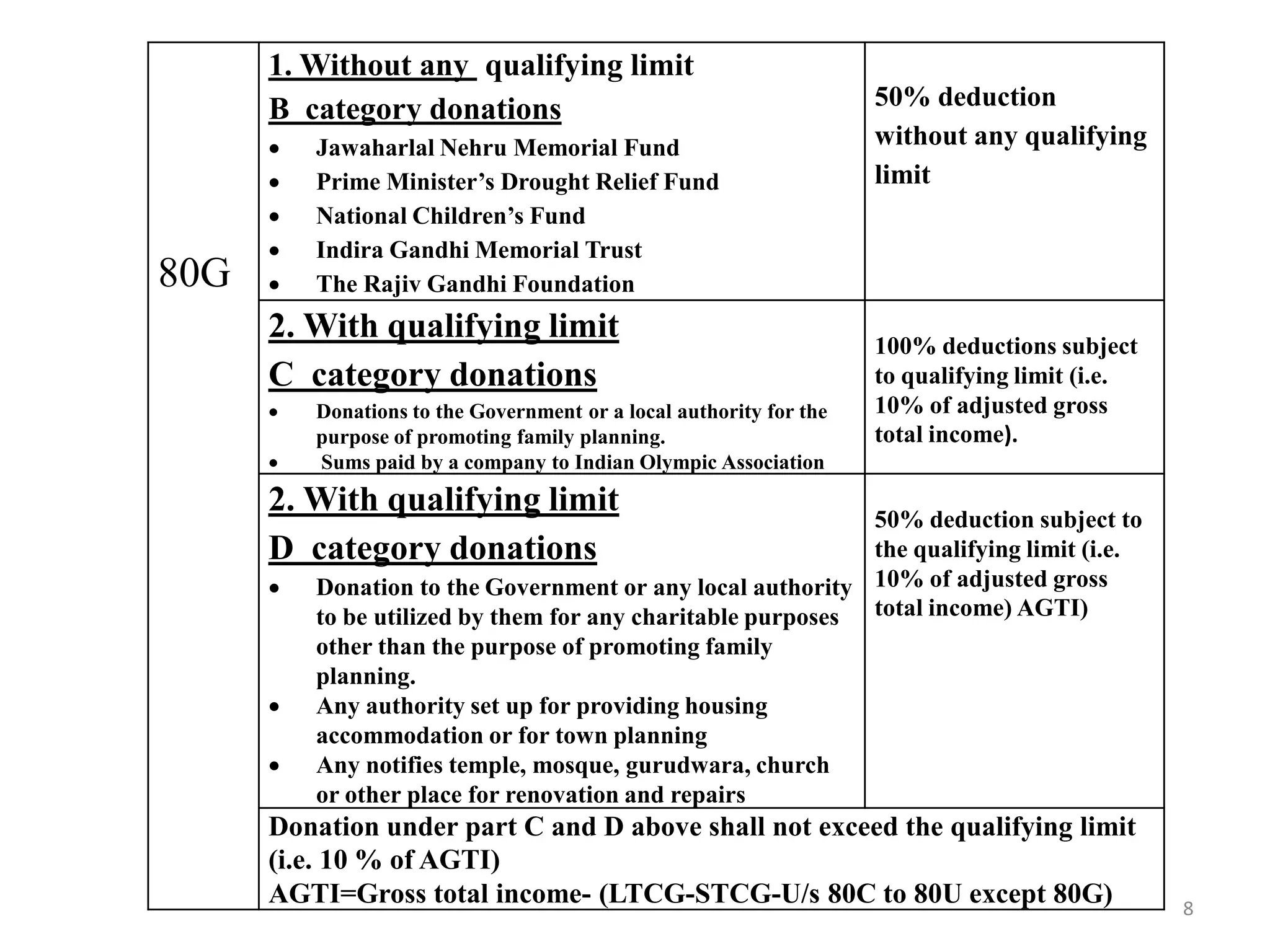

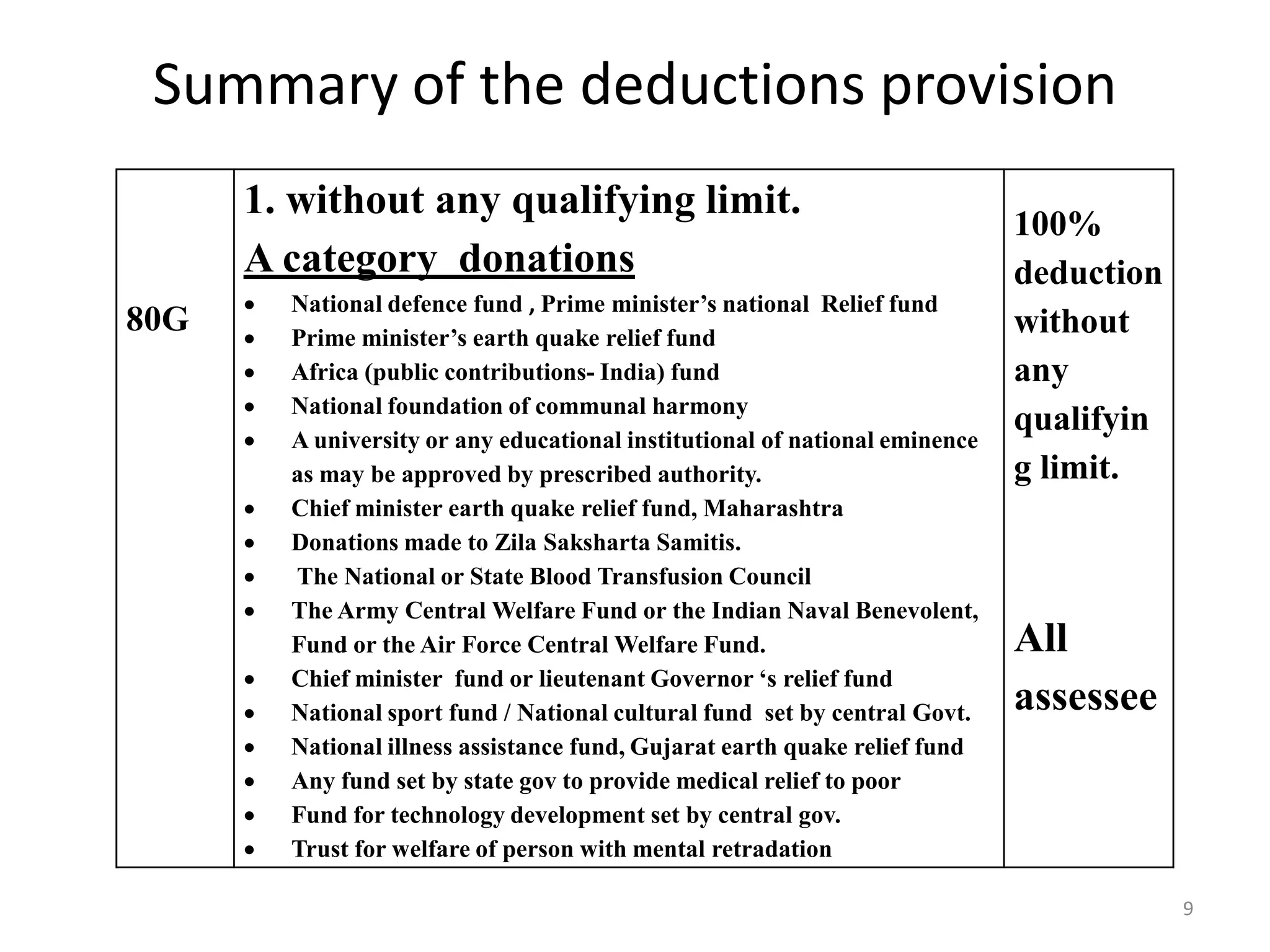

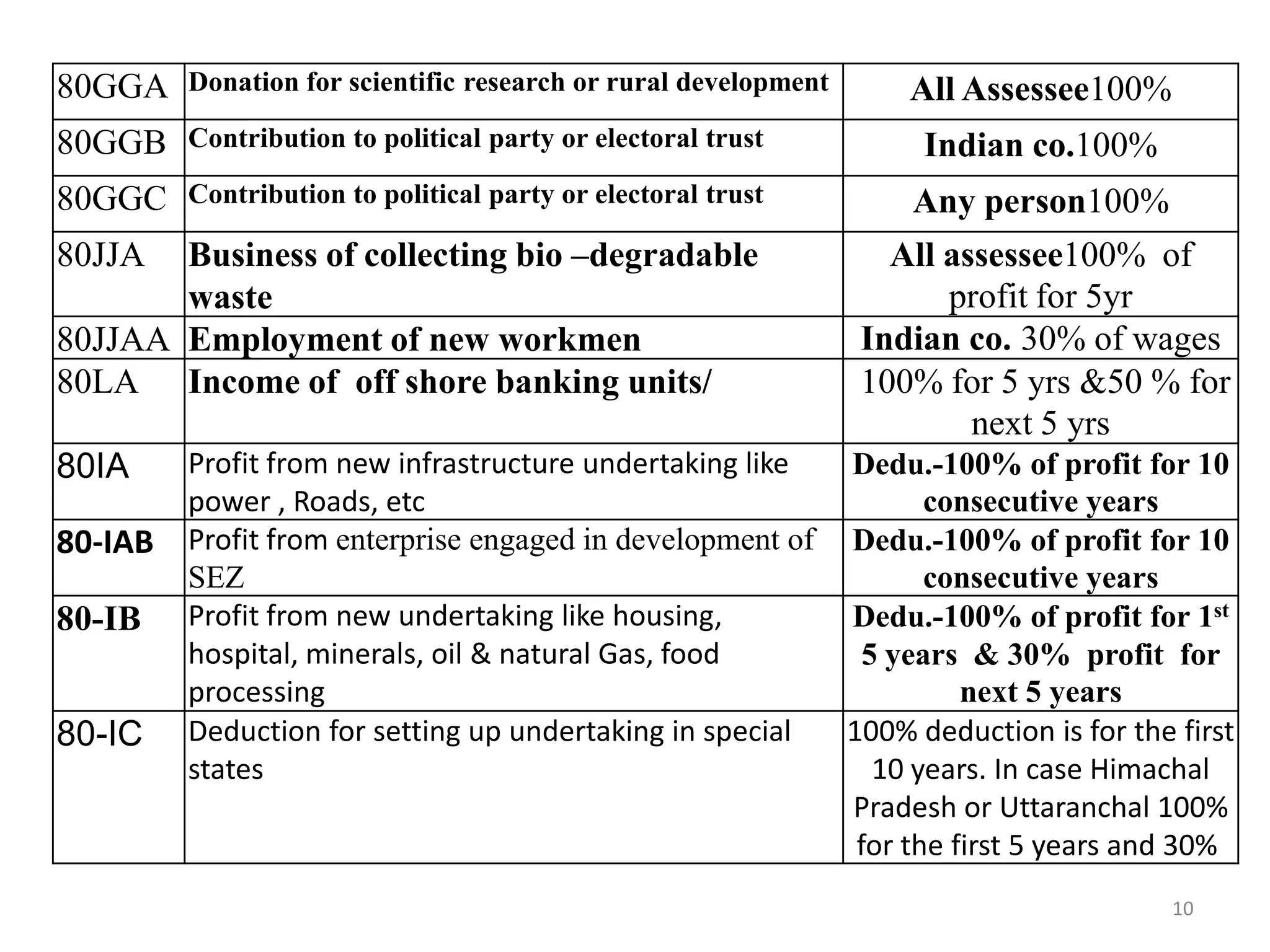

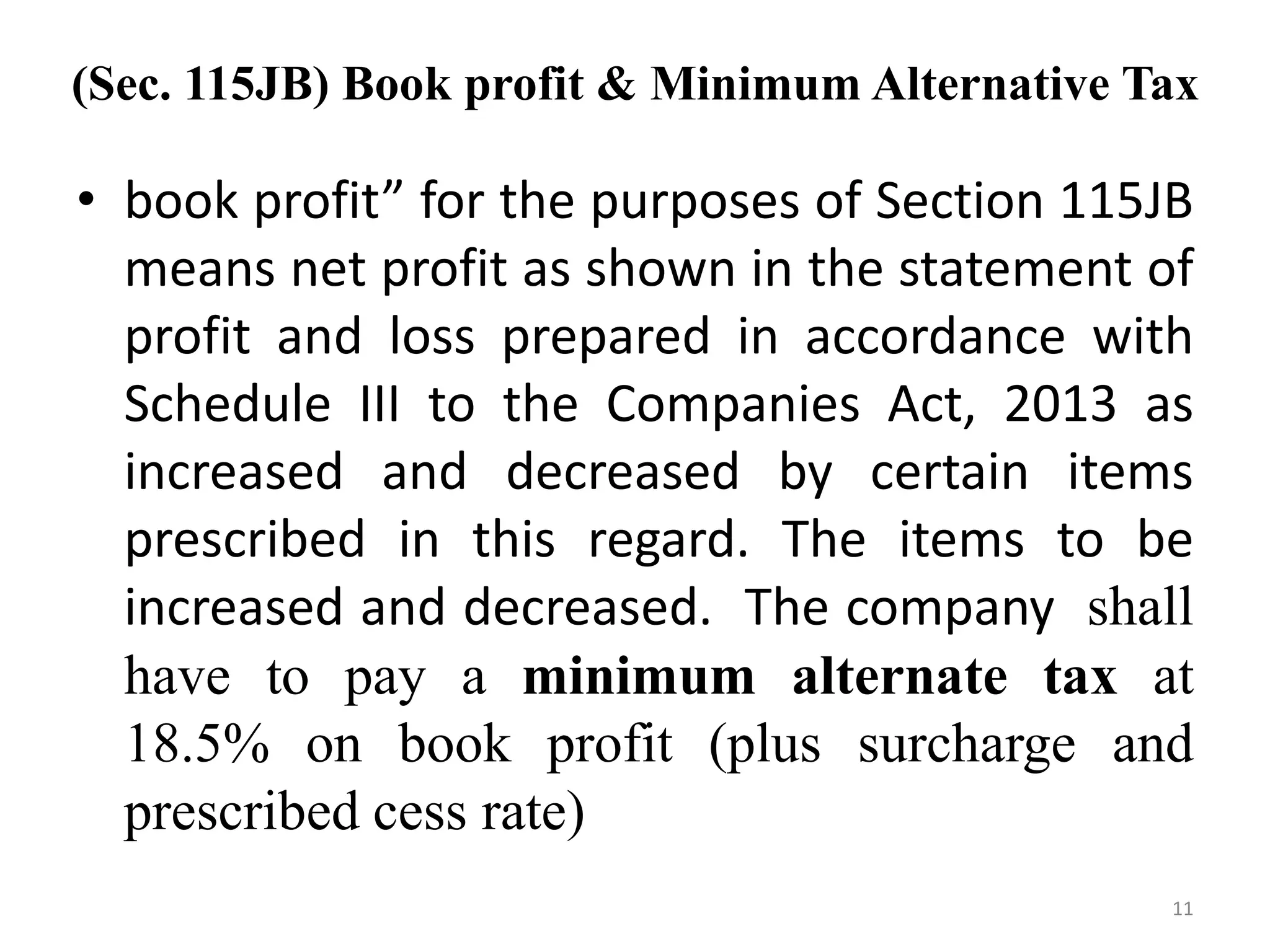

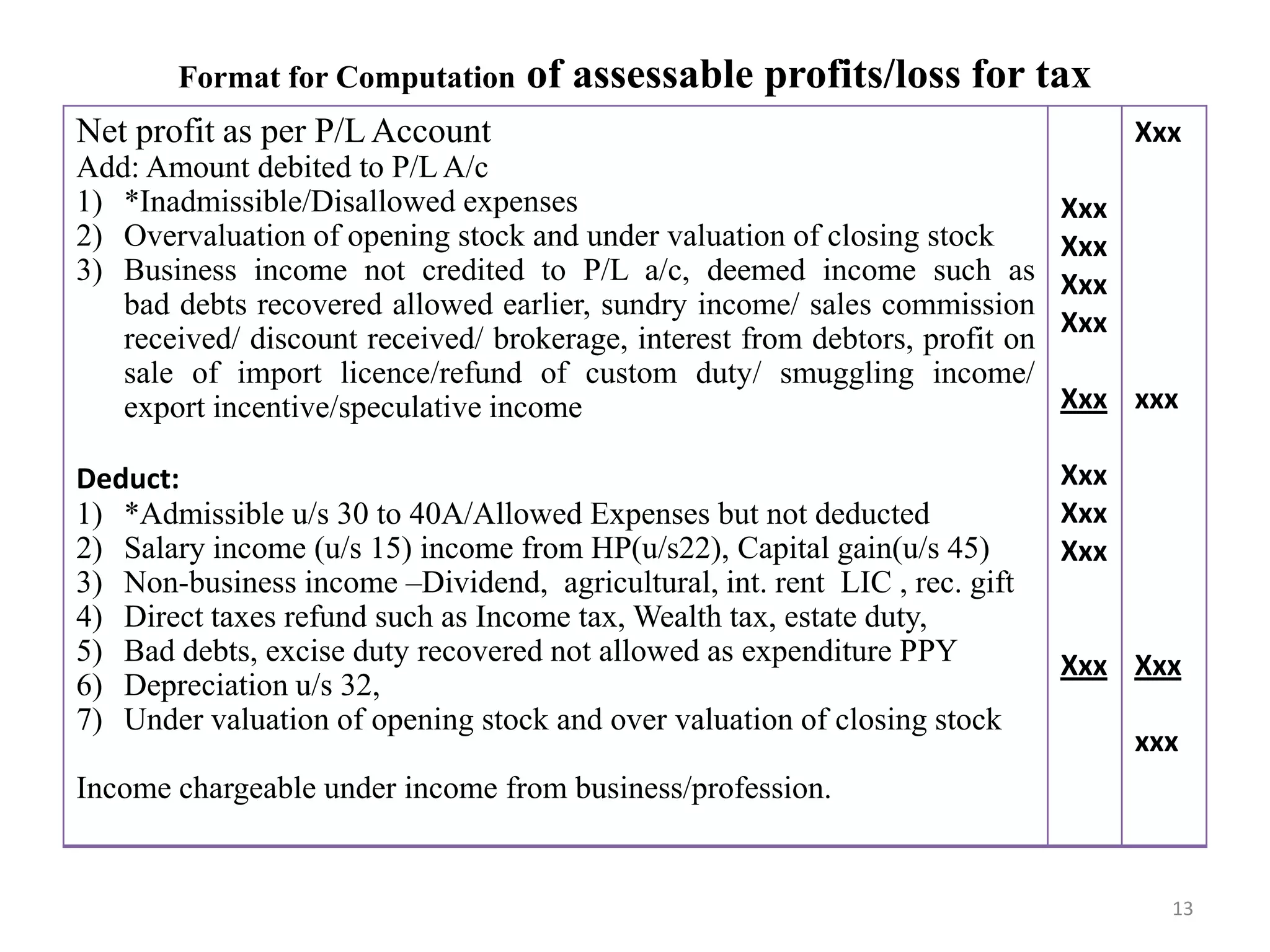

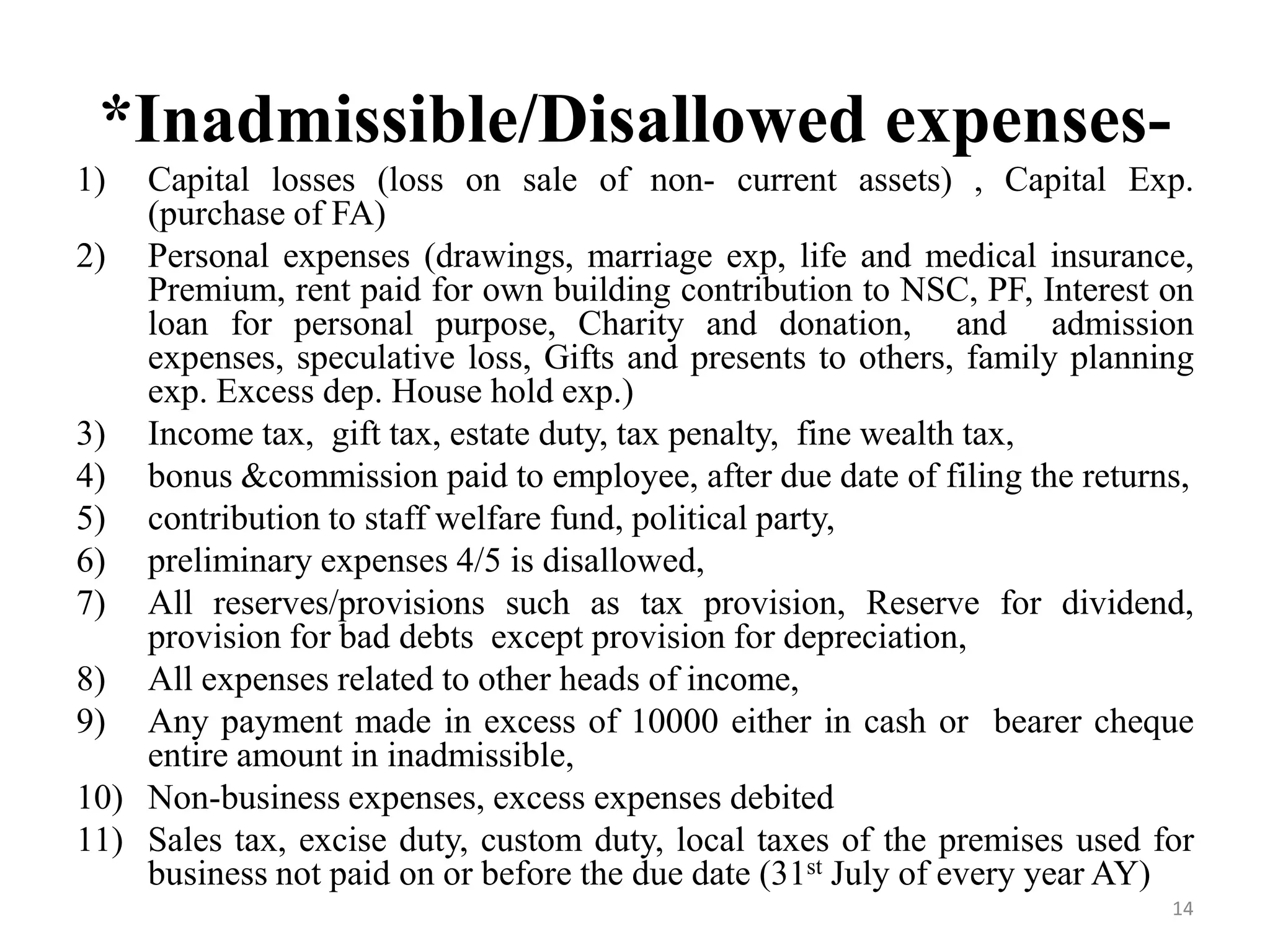

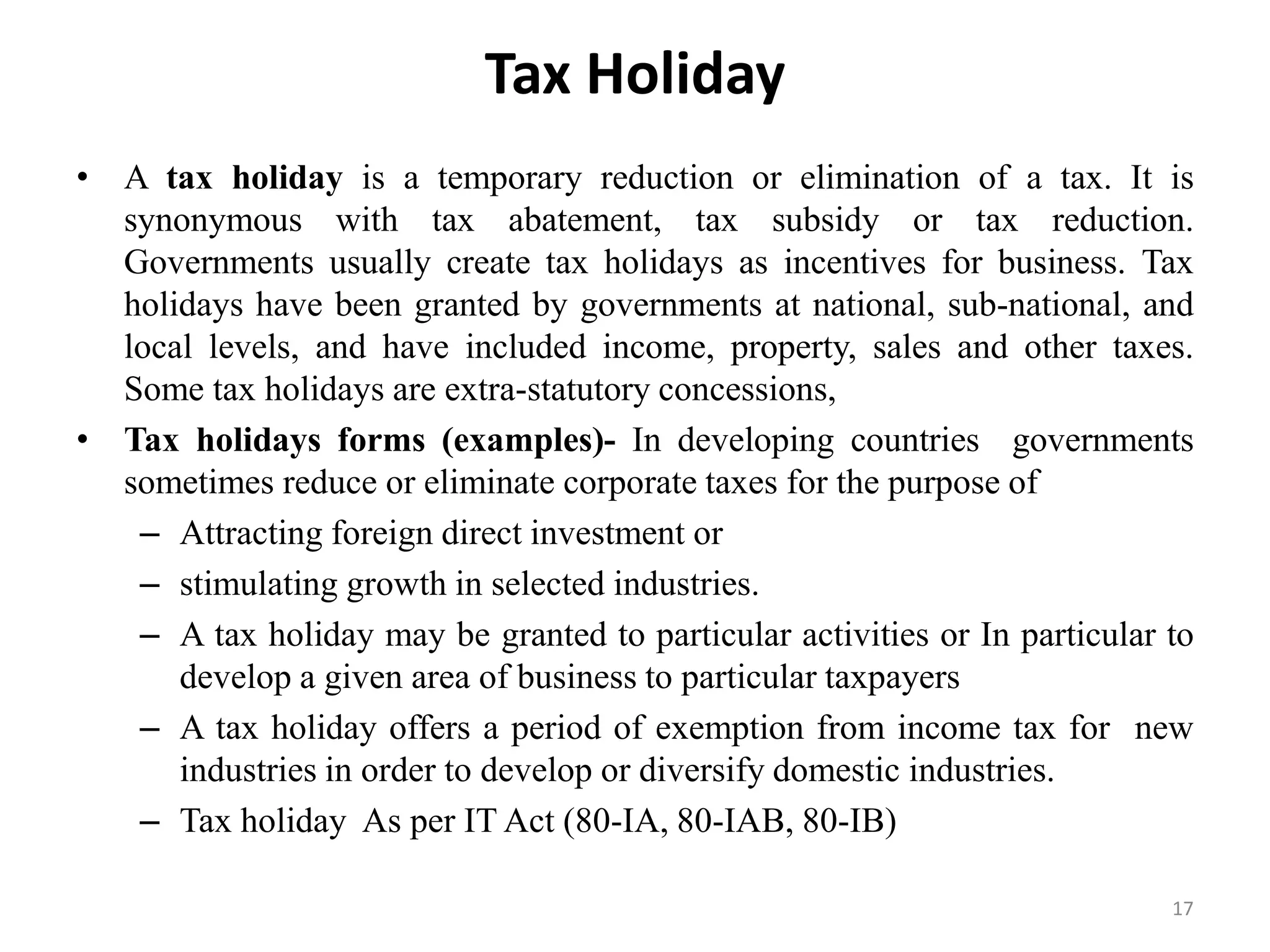

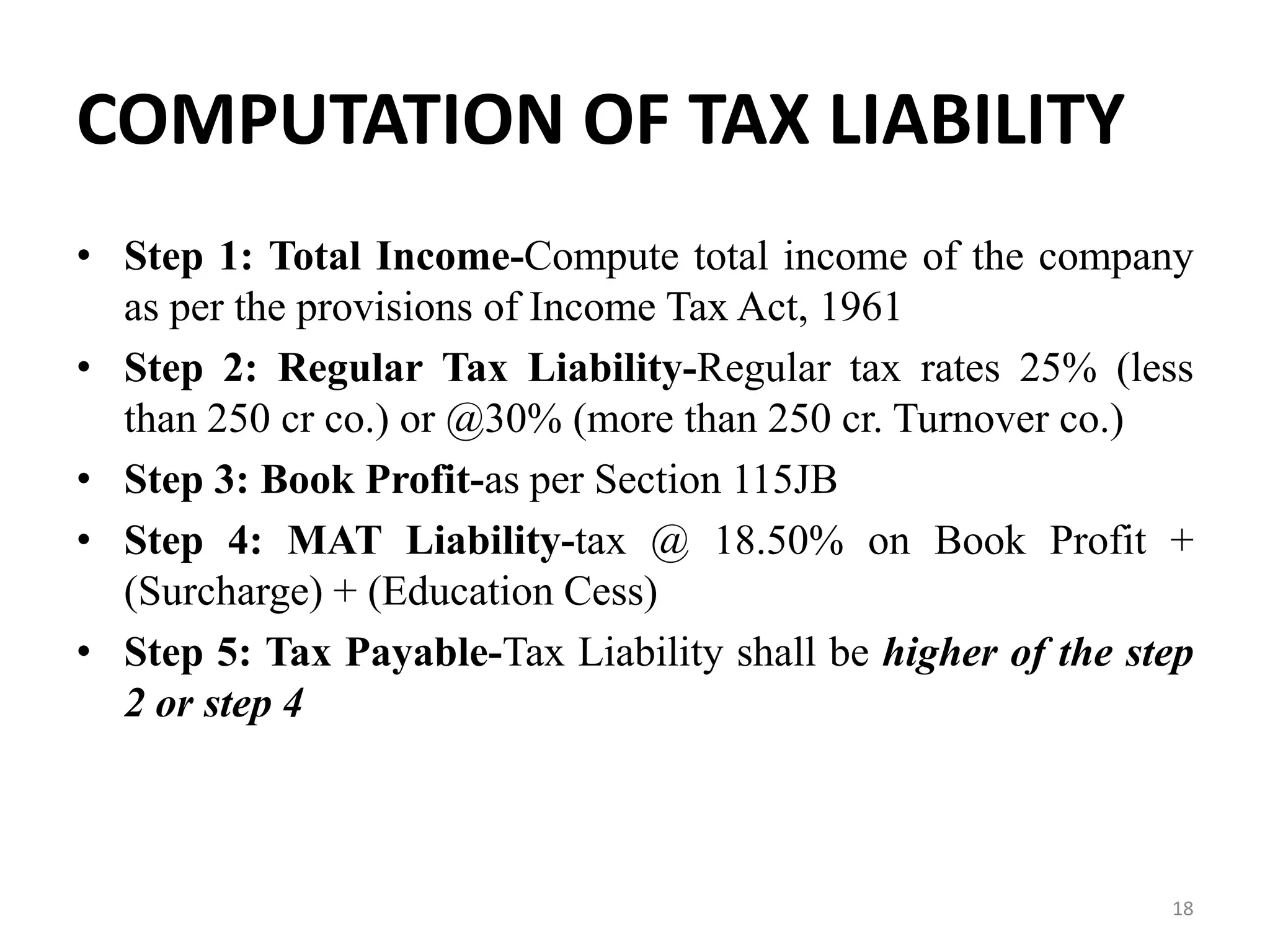

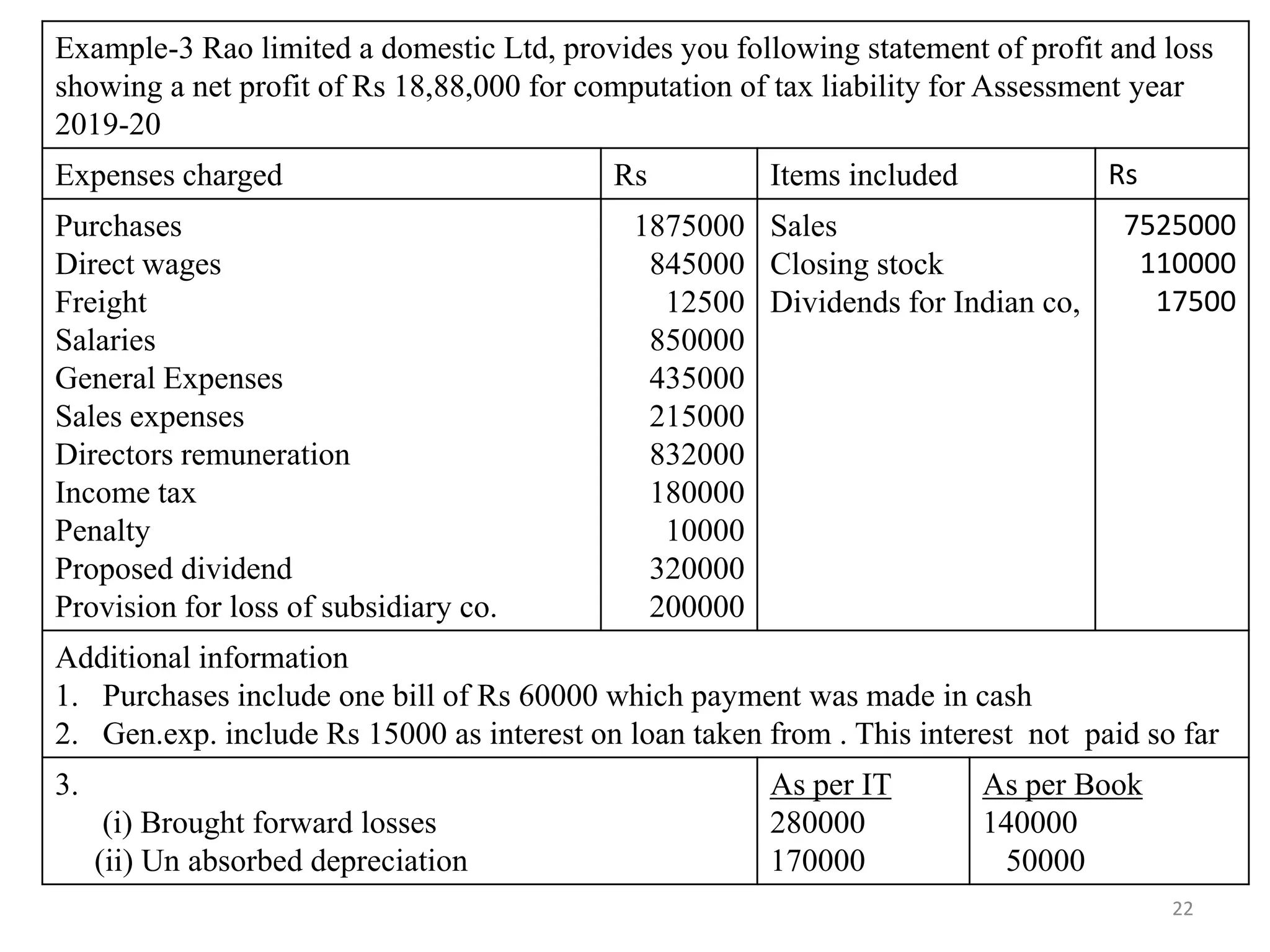

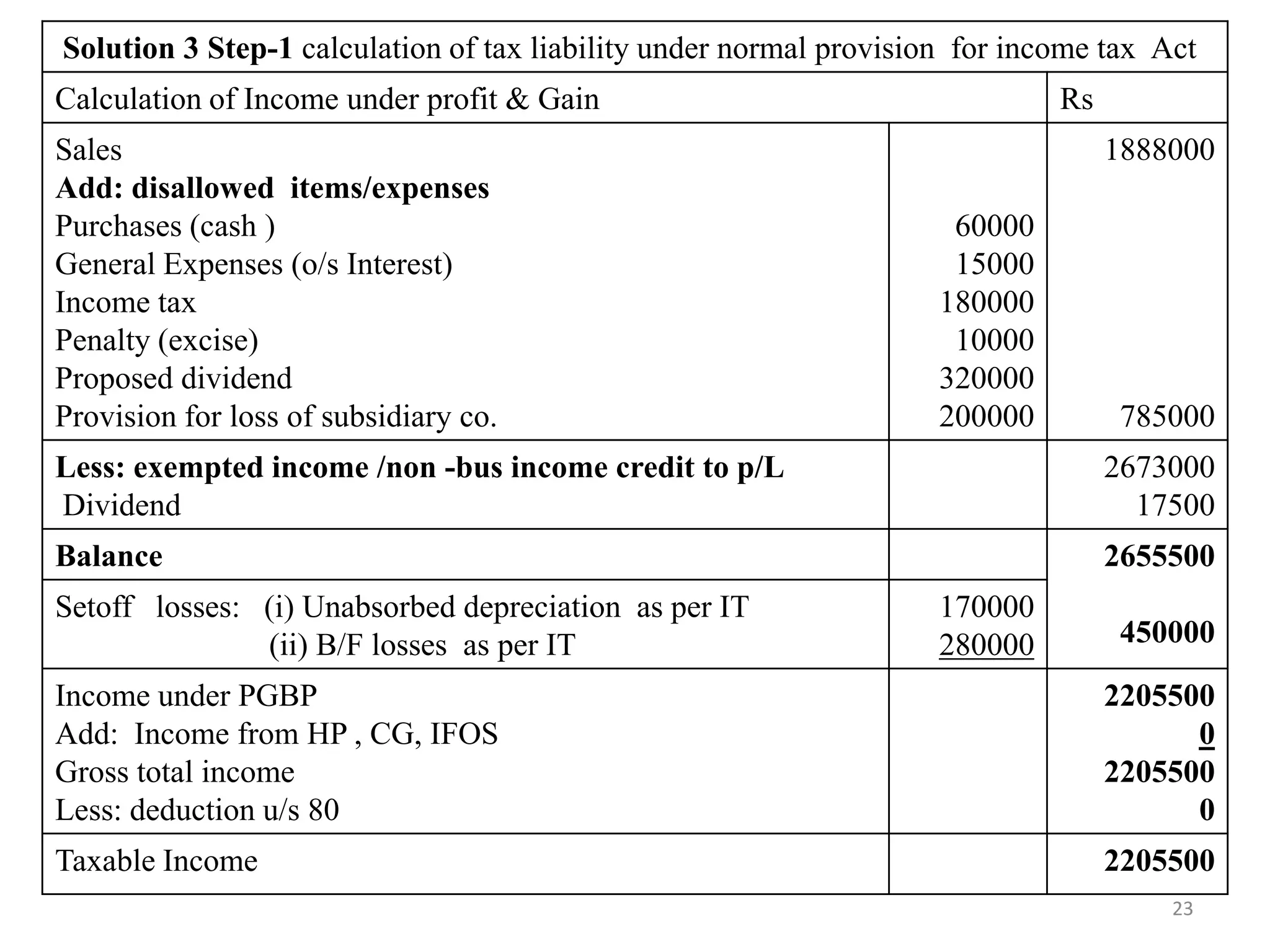

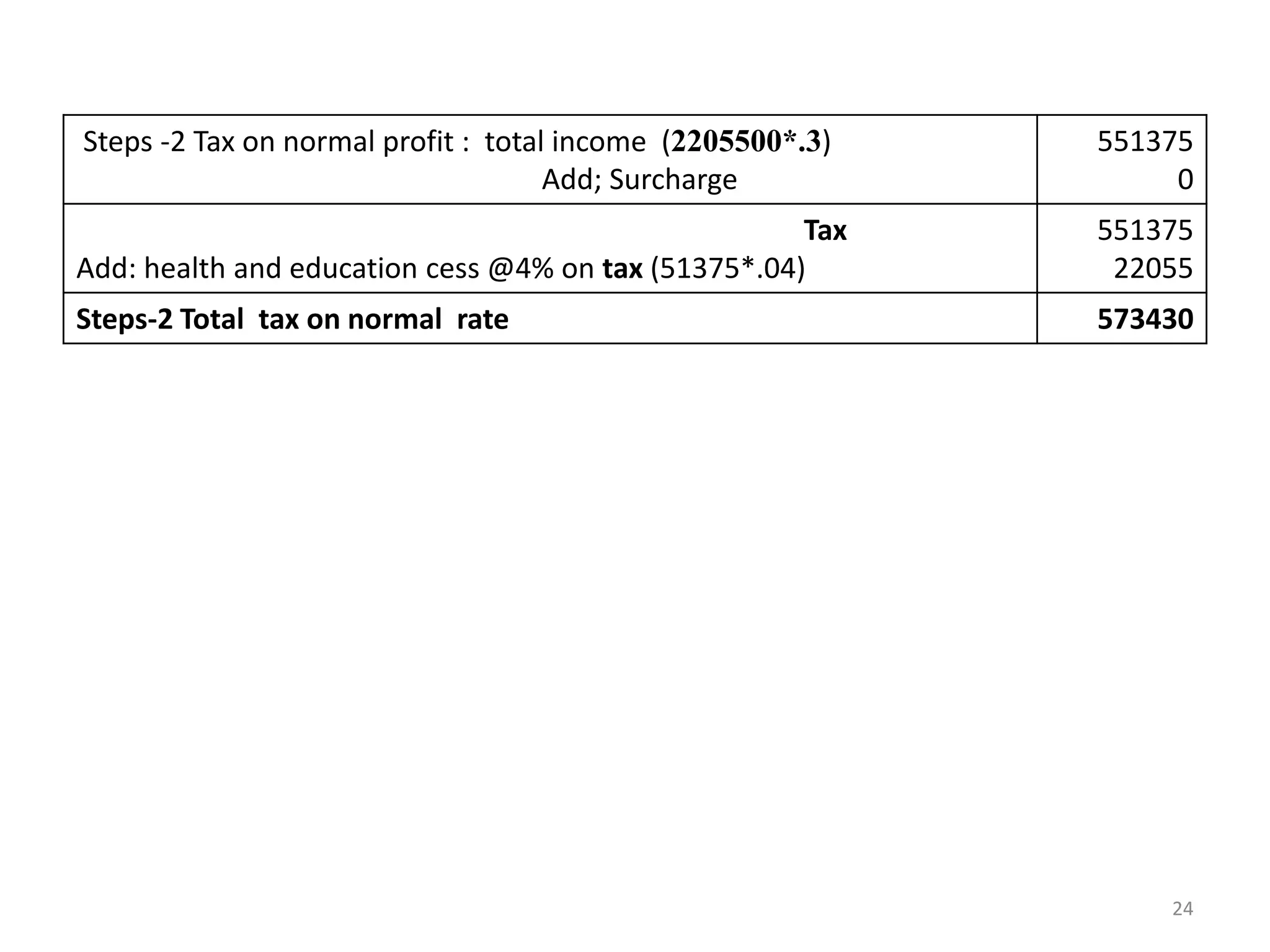

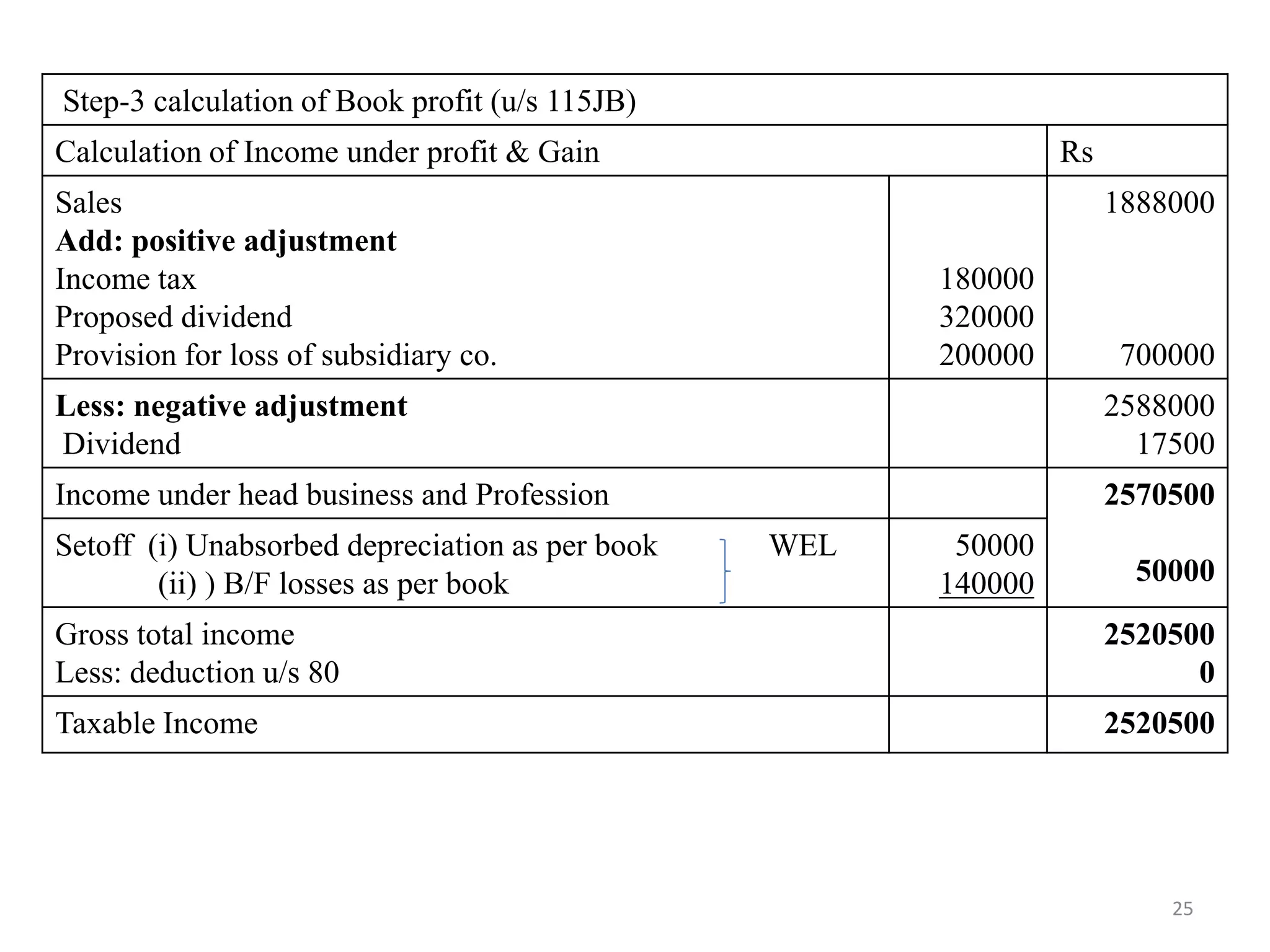

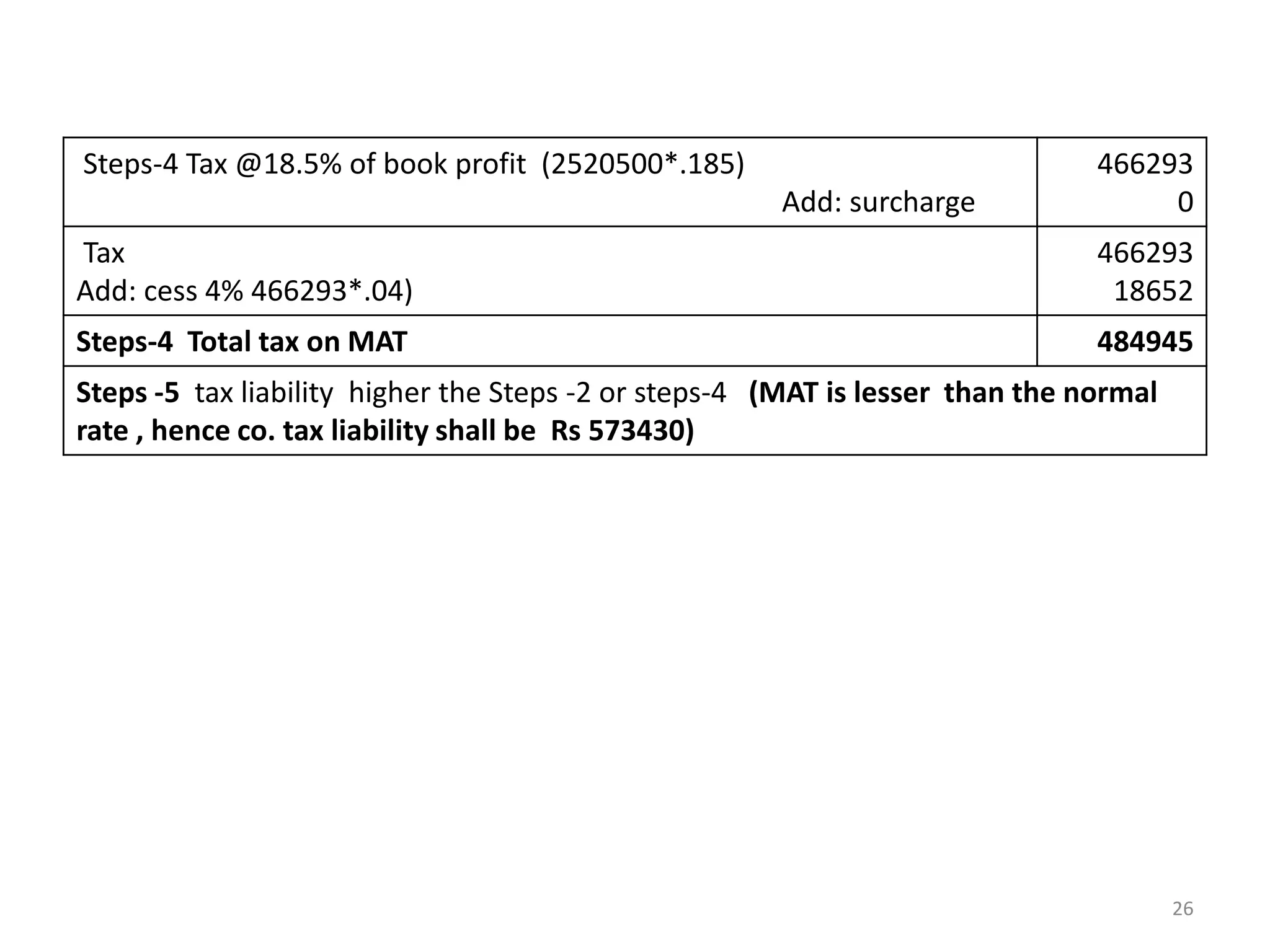

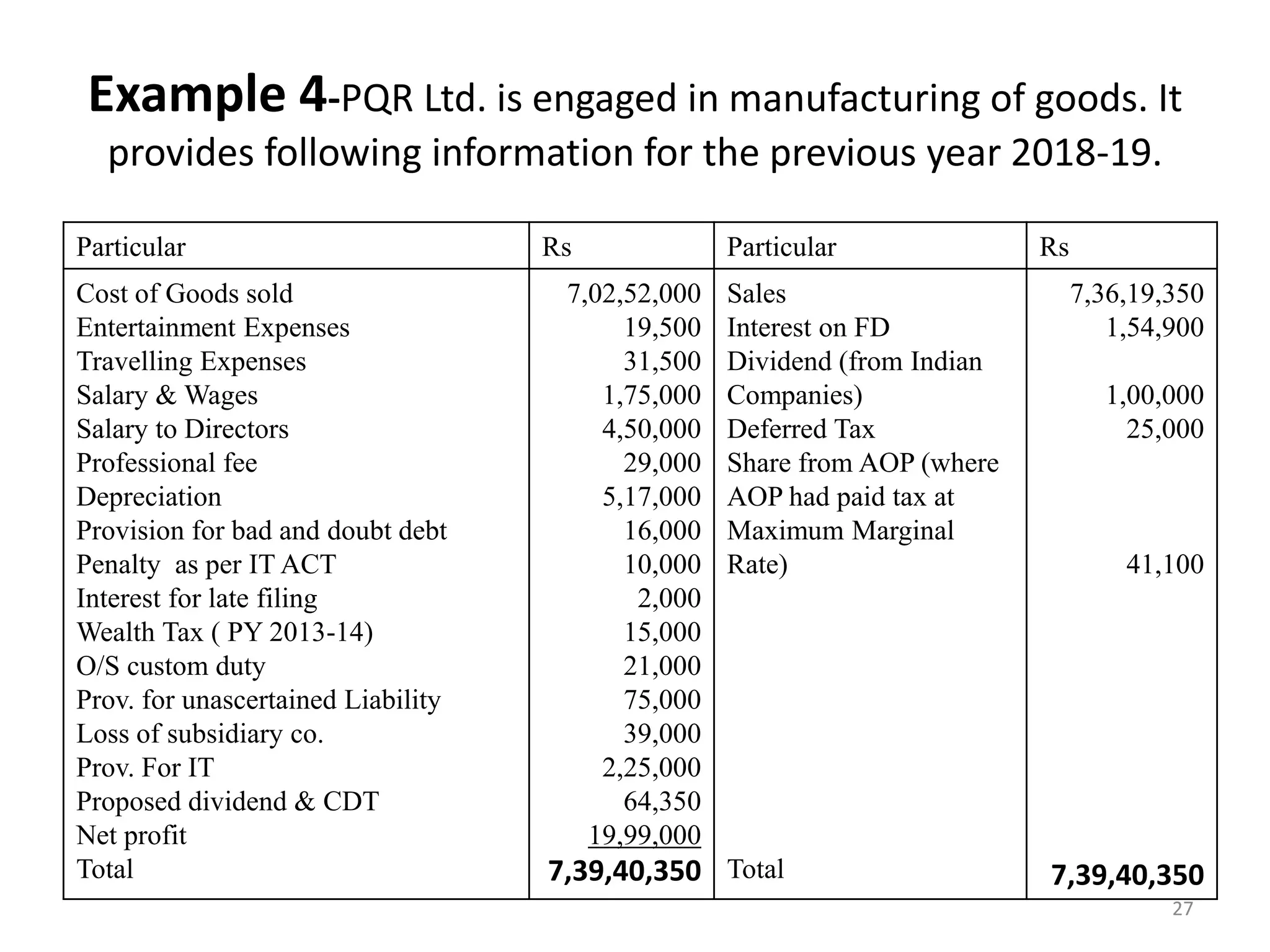

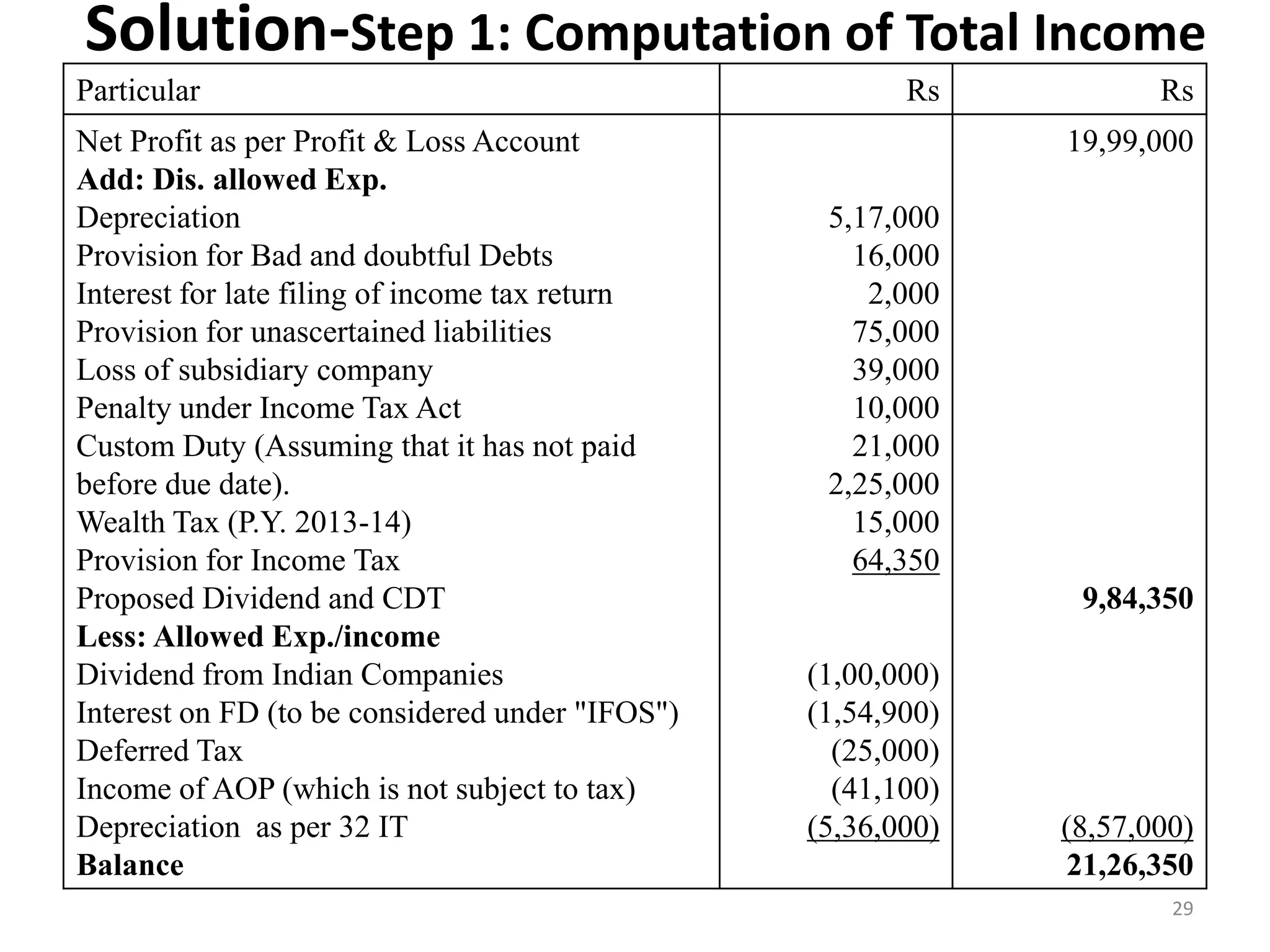

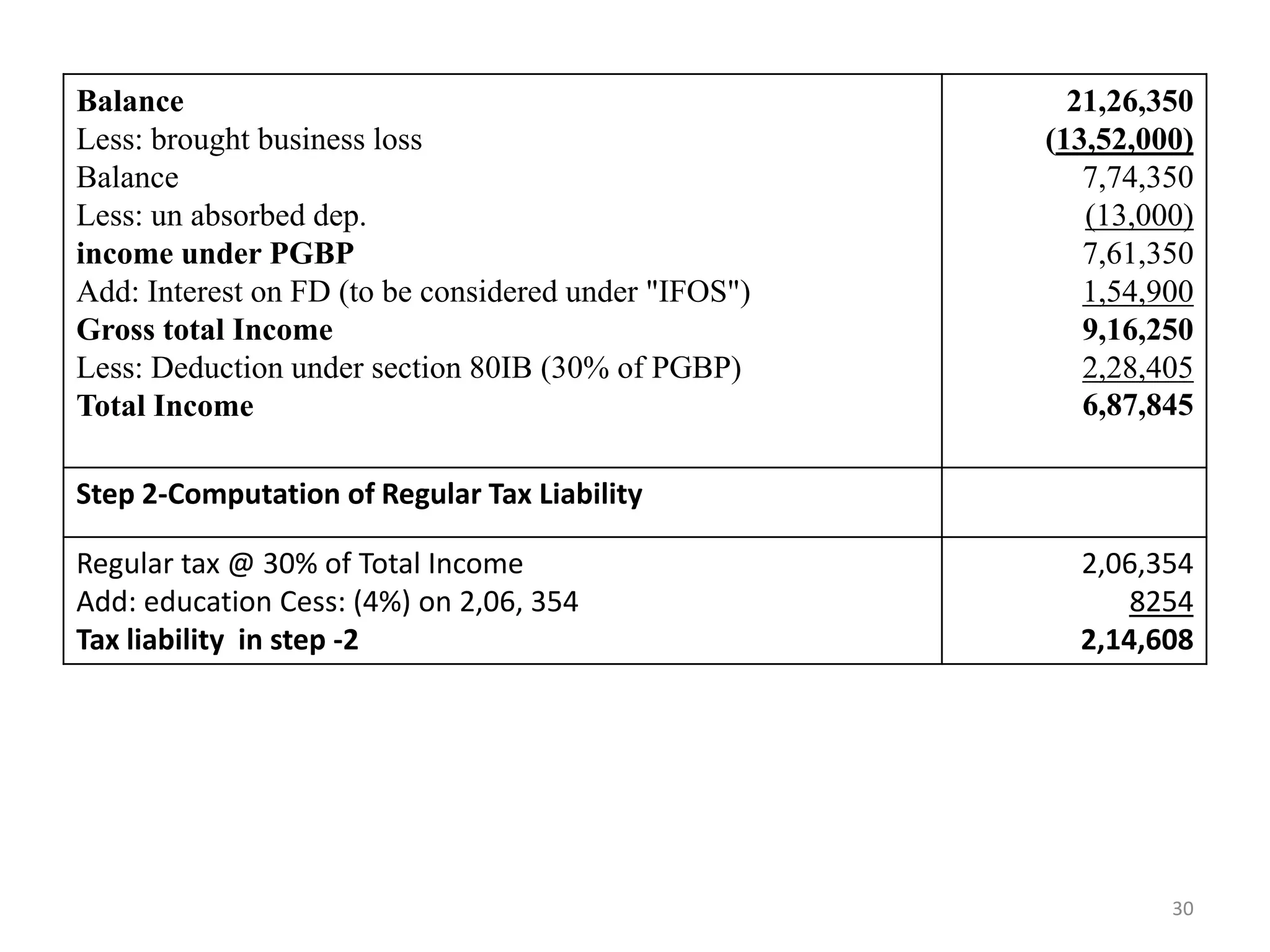

The document discusses the taxation scheme for business income of companies in India, detailing the residential status of companies, corporate tax rates for domestic and foreign companies, and the computation of gross total income. It covers provisions for set-off and carry forward of losses, deductions under section 80G, and minimum alternate tax for companies with book profits. Additionally, the document includes steps for computing tax liability and examples illustrating the calculation of payable tax.

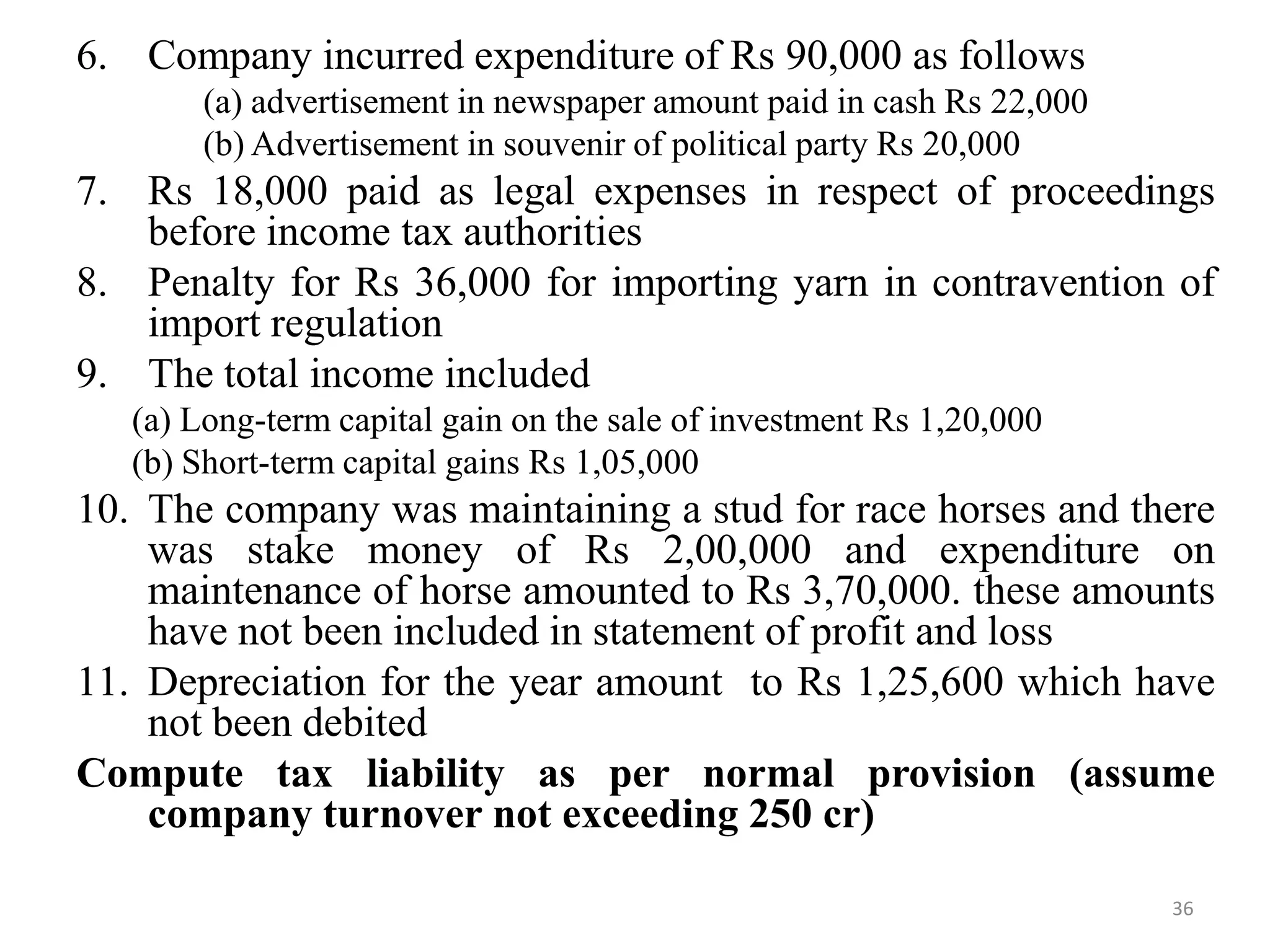

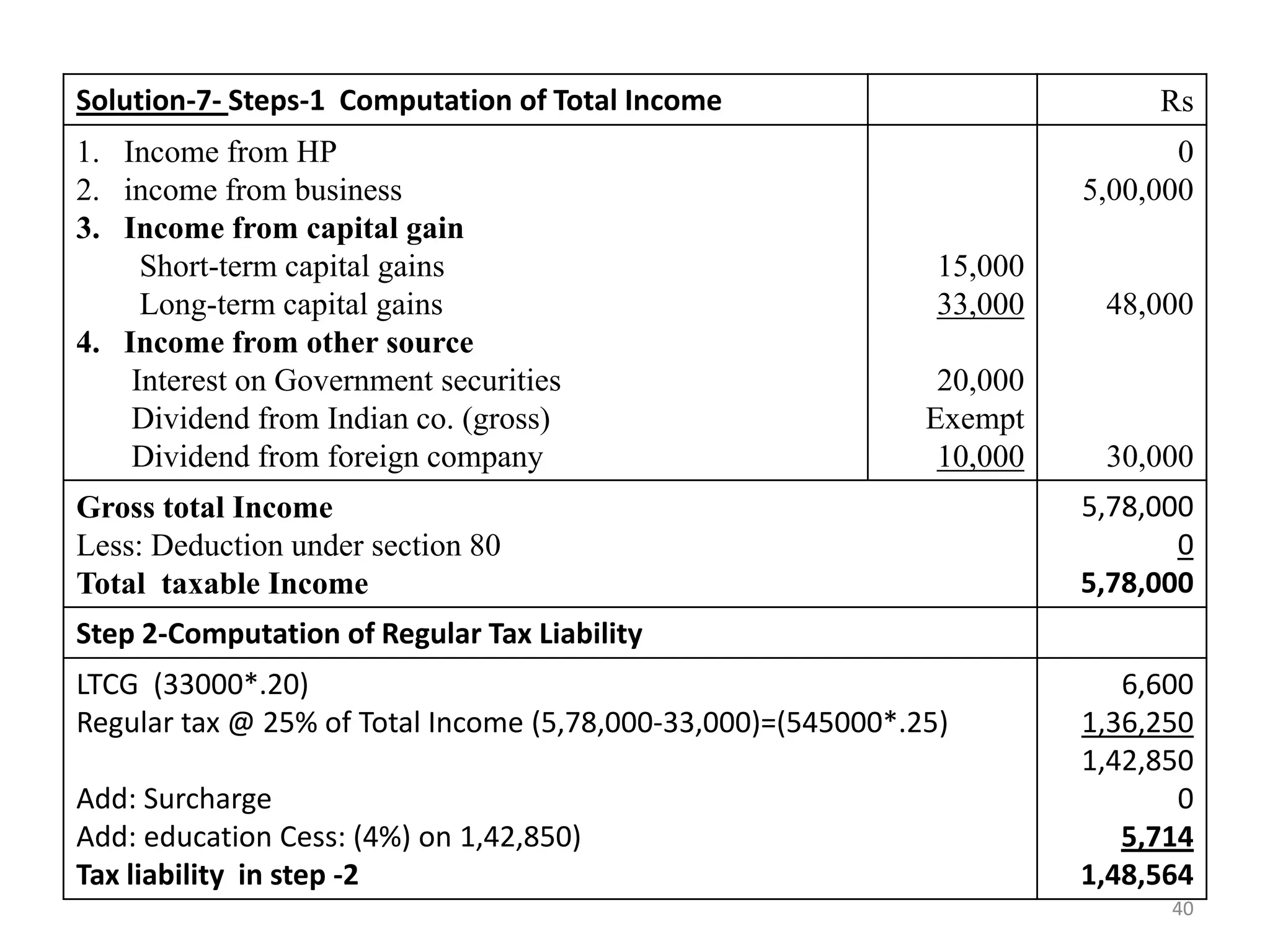

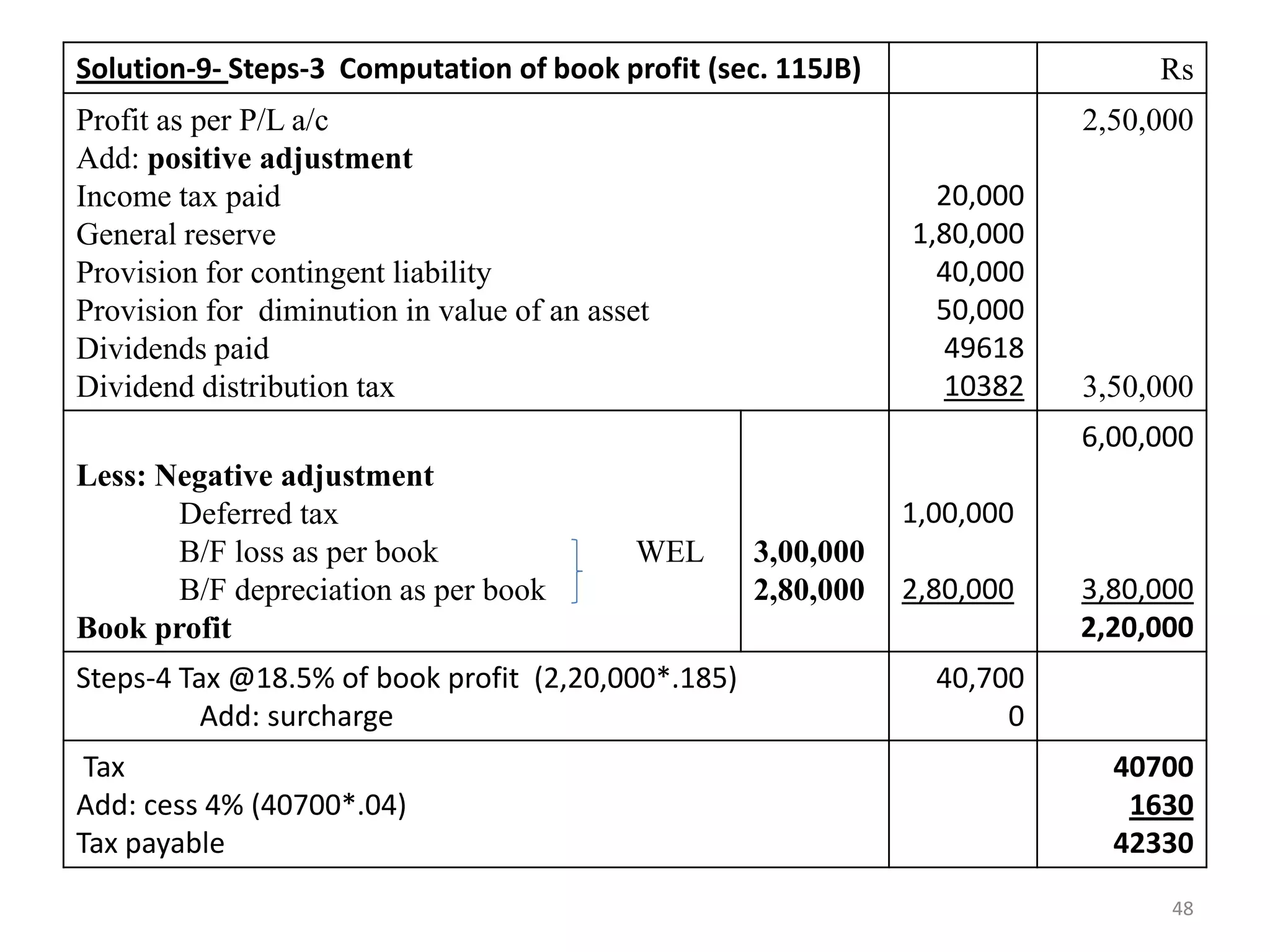

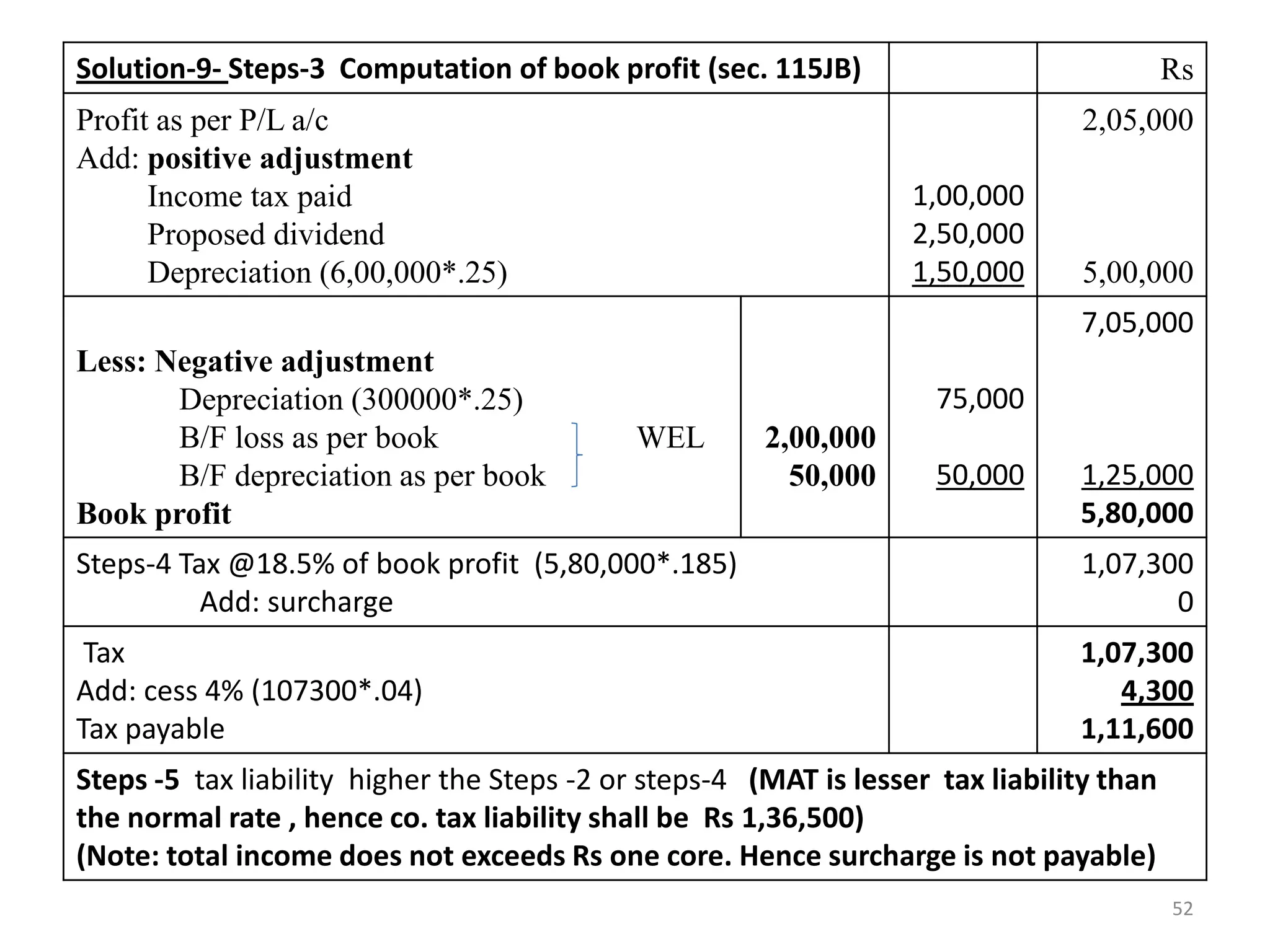

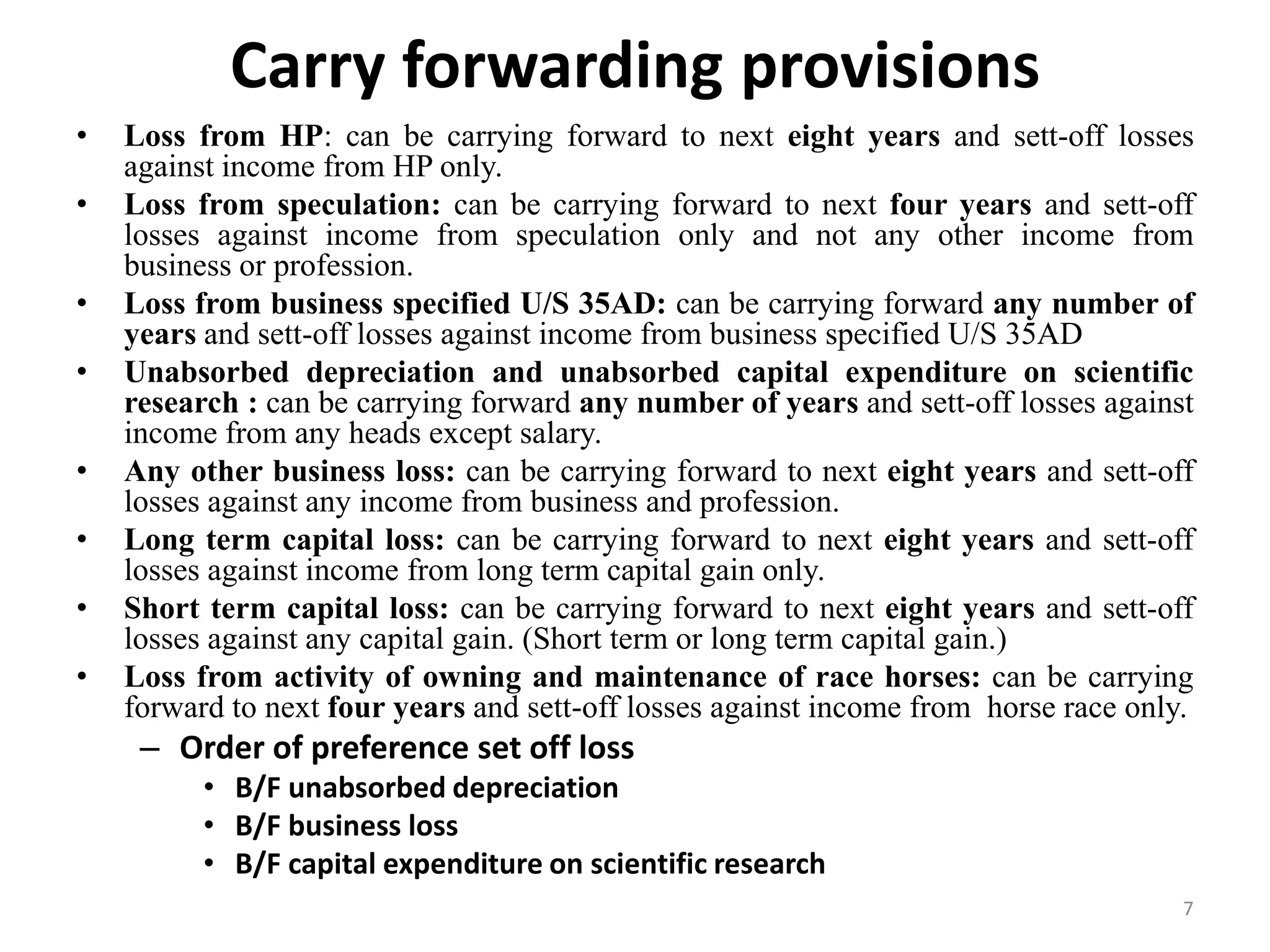

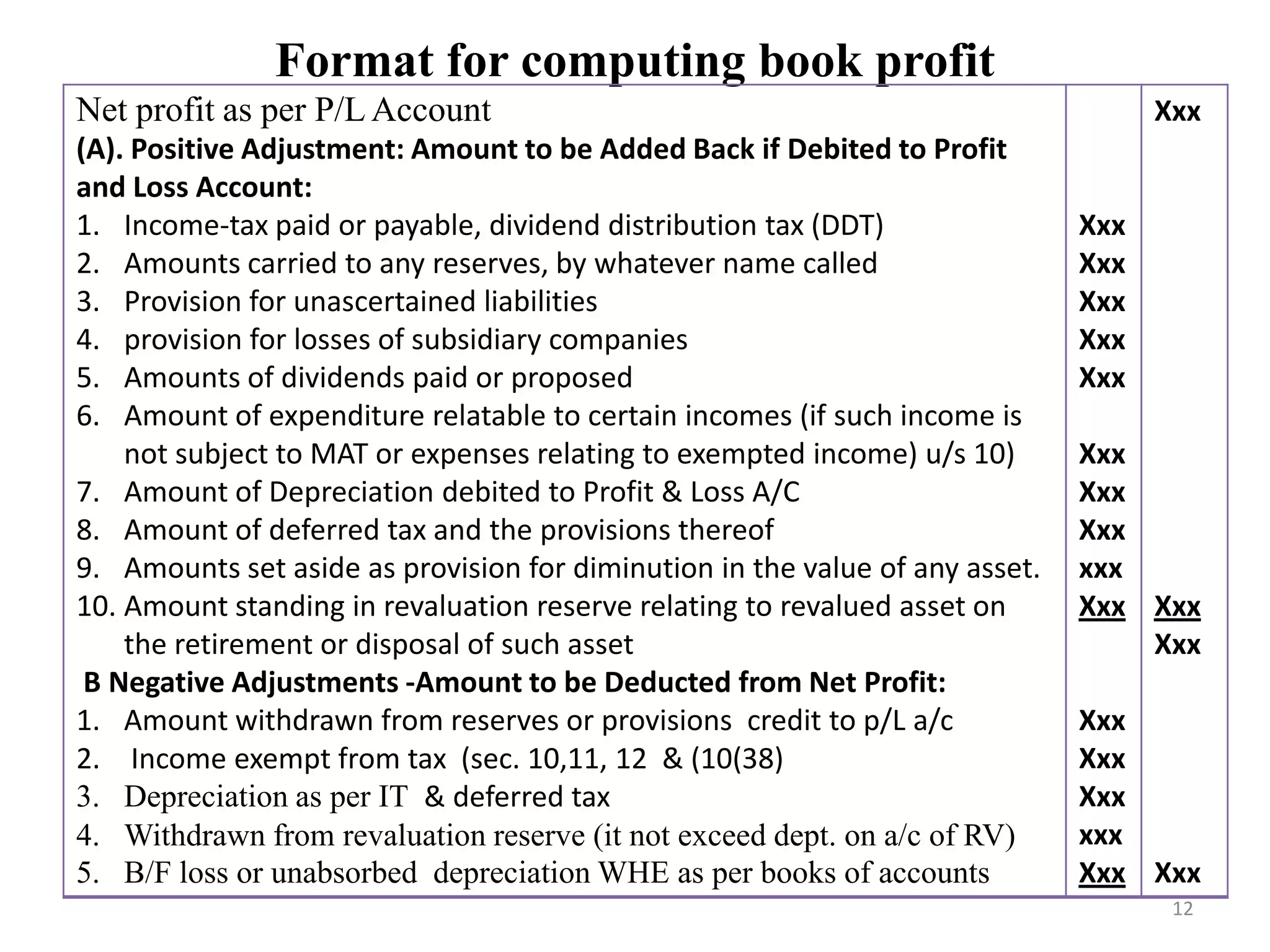

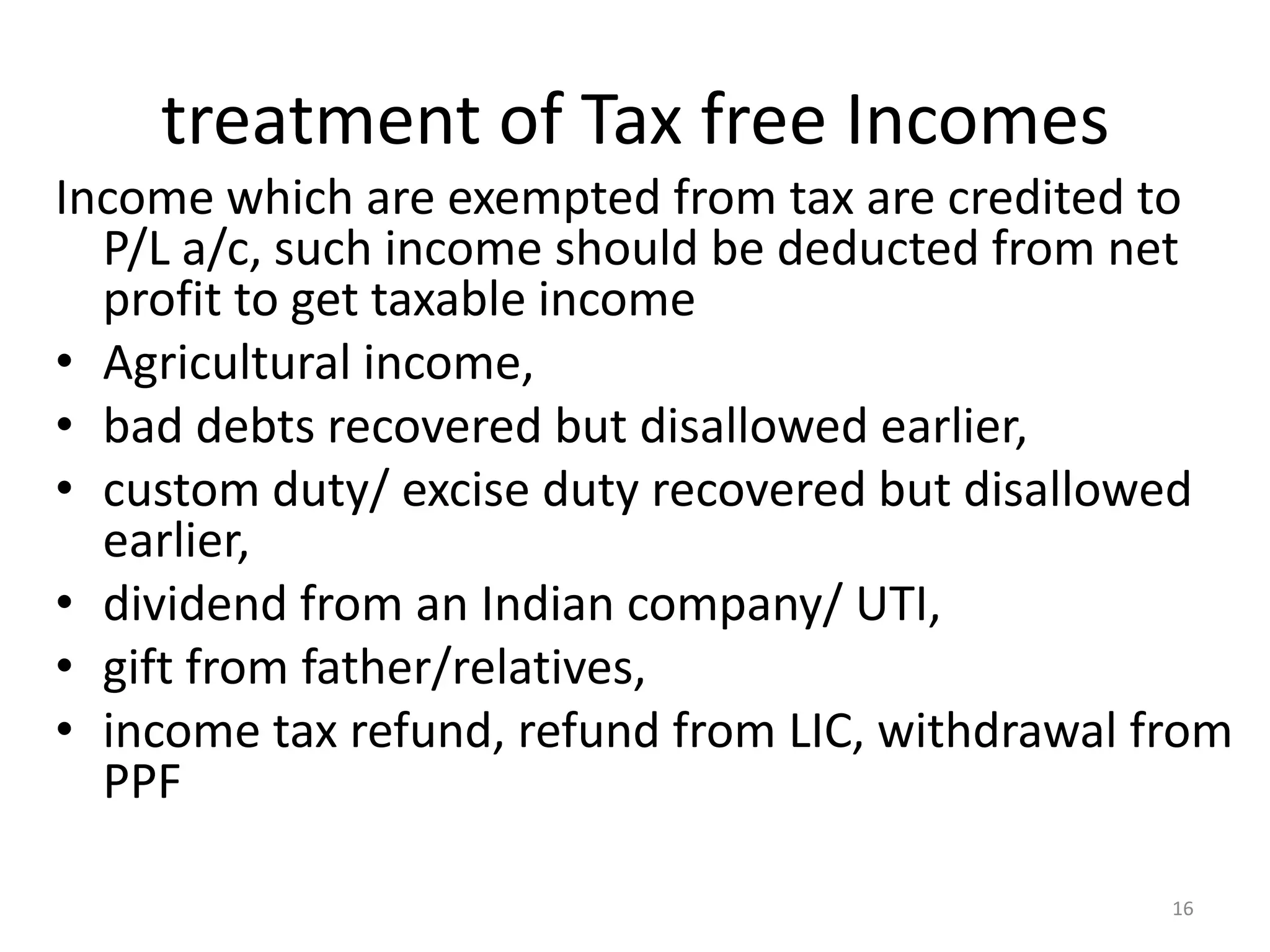

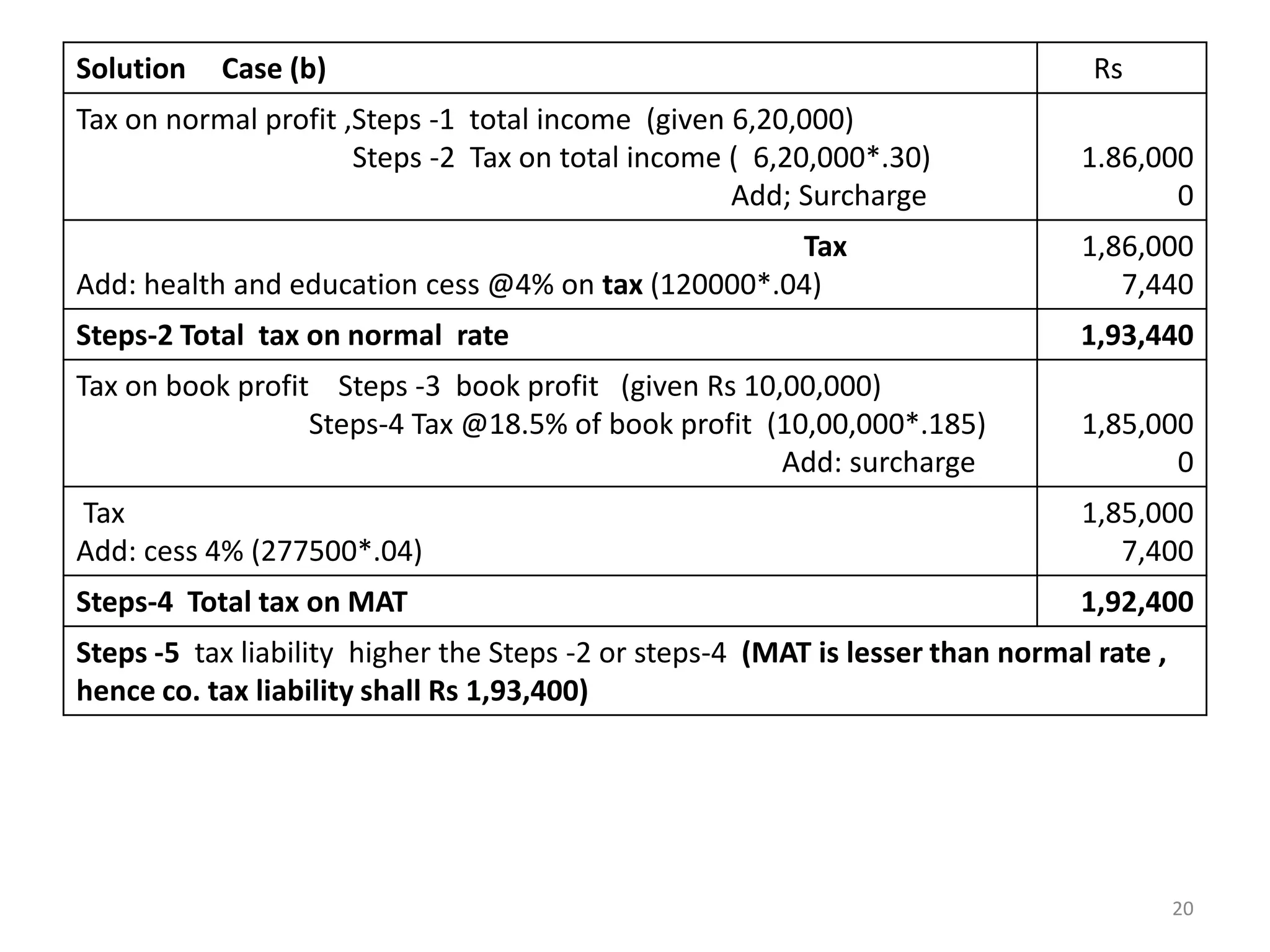

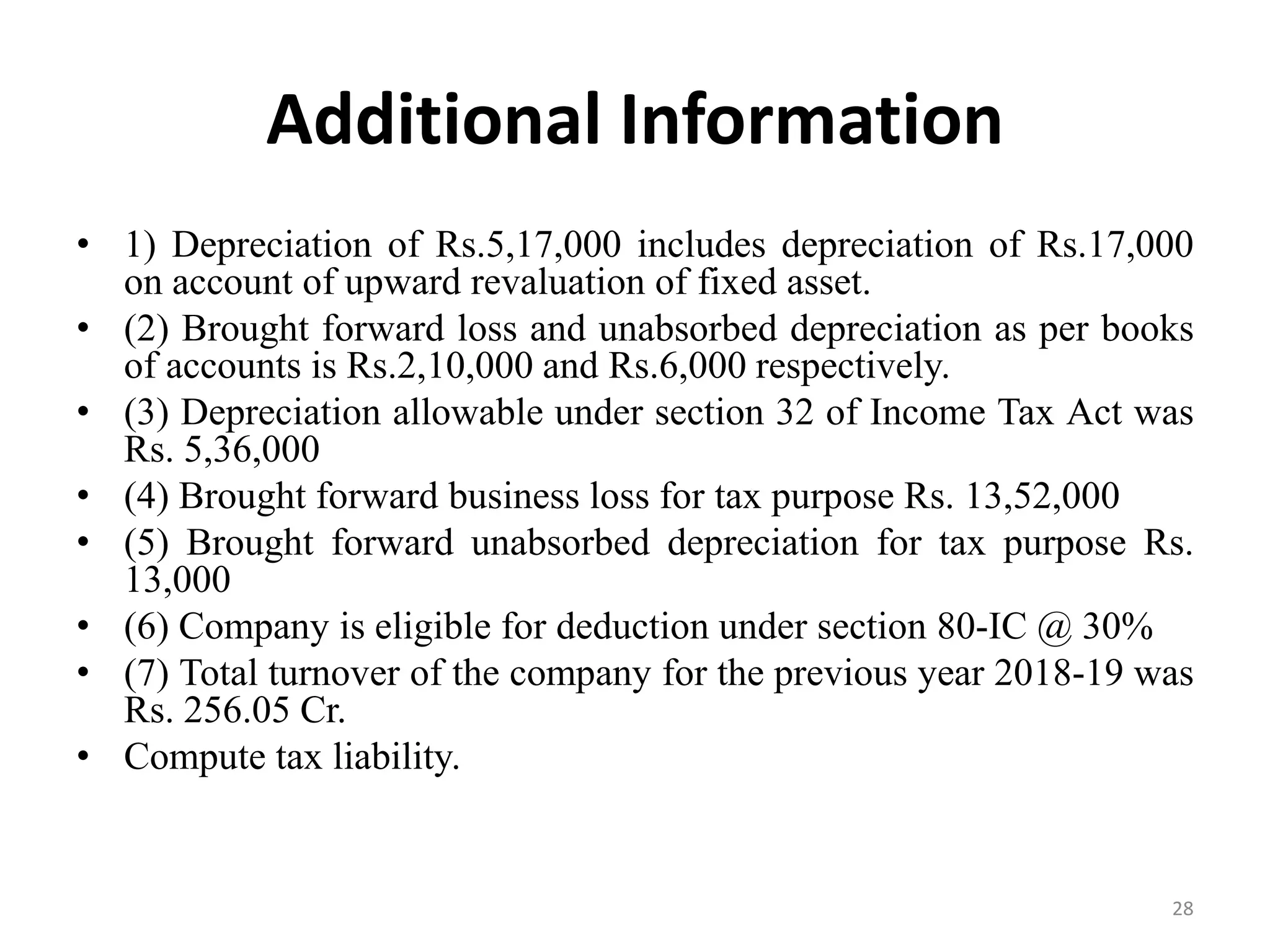

![Solution-Step 3: Computation of Book Profit

Particular Rs Rs

Net Profit as per Profit & Loss Account

Add: Positive Adjustments/statutory additions

Depreciation

Provision for Bad and doubtful Debts

Interest for late filing of income tax return

Provision for unascertained liabilities

Loss of subsidiary company

Provision for Income Tax

Proposed Dividend and CDT

Less: Negative Adjustments/ Statutory deductions

Dividend from Indian Companies (exempt)

Deferred Tax

Income of AOP (which is not subject to tax)

Depreciation (excl.dep. on a/c of revaluation)

Brought forward loss or unabsorbed dep. whichever is

lower [as per books of accounts]

Book Profit

5,17,000

16,000

2,000

75,000

39,000

2,25,000

64,350

(1,00,000)

(25,000)

(41,100)

(5,00,000)

(6,000)

19,99,000

9,38,350

(6,72,100)

22,65,250

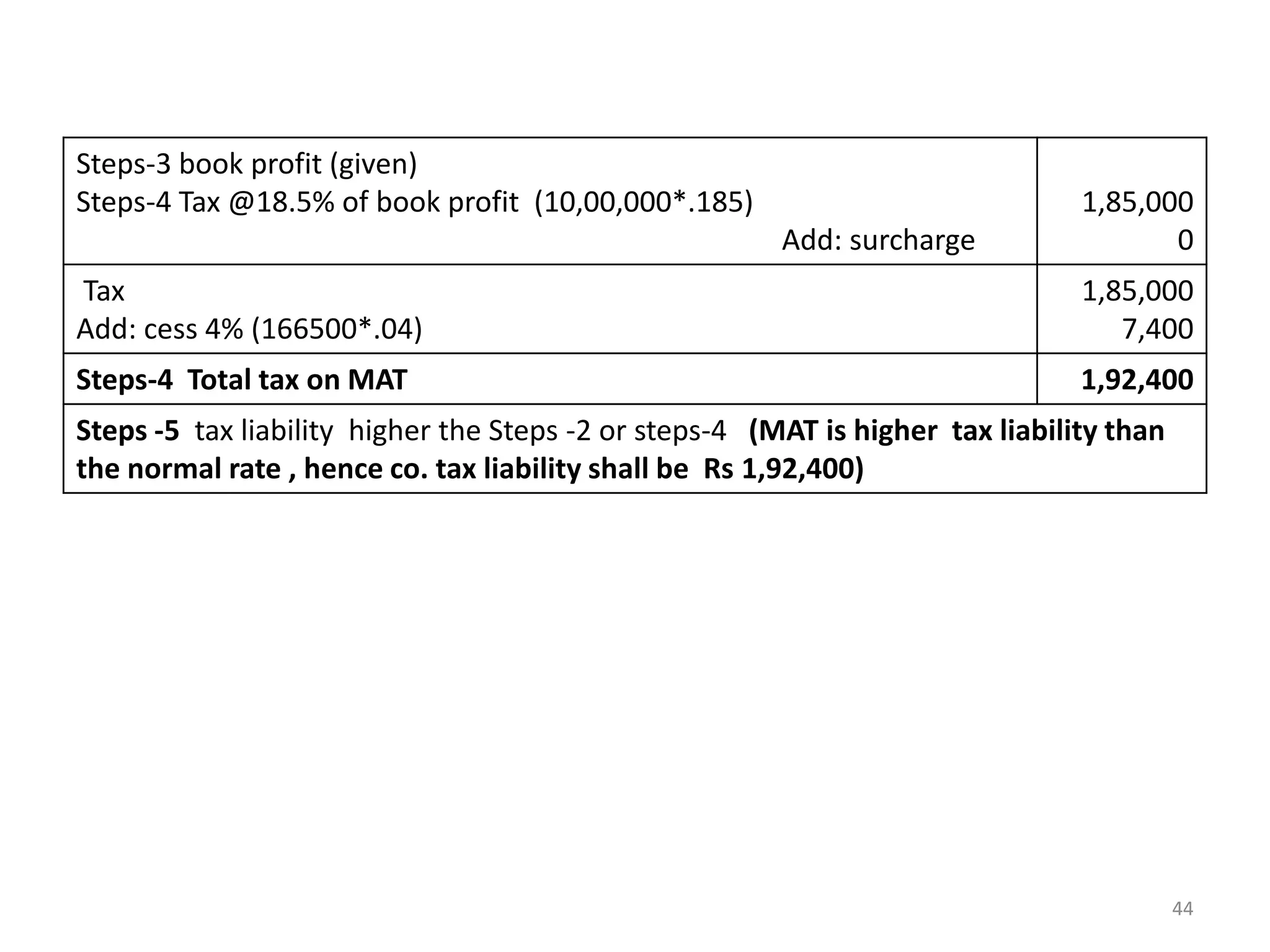

Step 4-MAT Liability= MAT @18.5% of Book Profit Rs. 22,65,250

Educ.Cess 4% on 4,19,071

Mat liability

4,19,071

16,763

4,35,834](https://image.slidesharecdn.com/aoc-221210134720-130c5d50/75/aoc-pdf-31-2048.jpg)

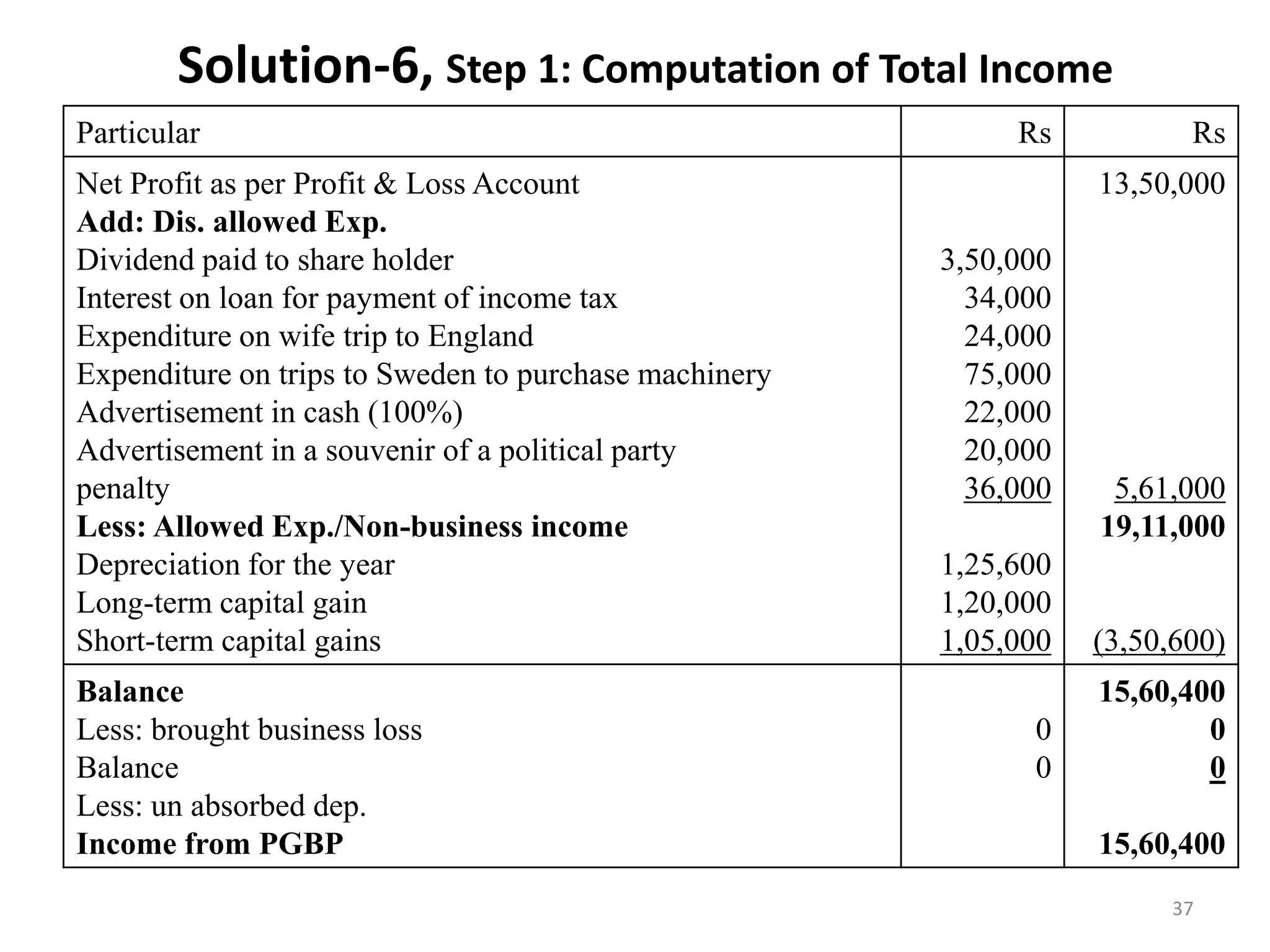

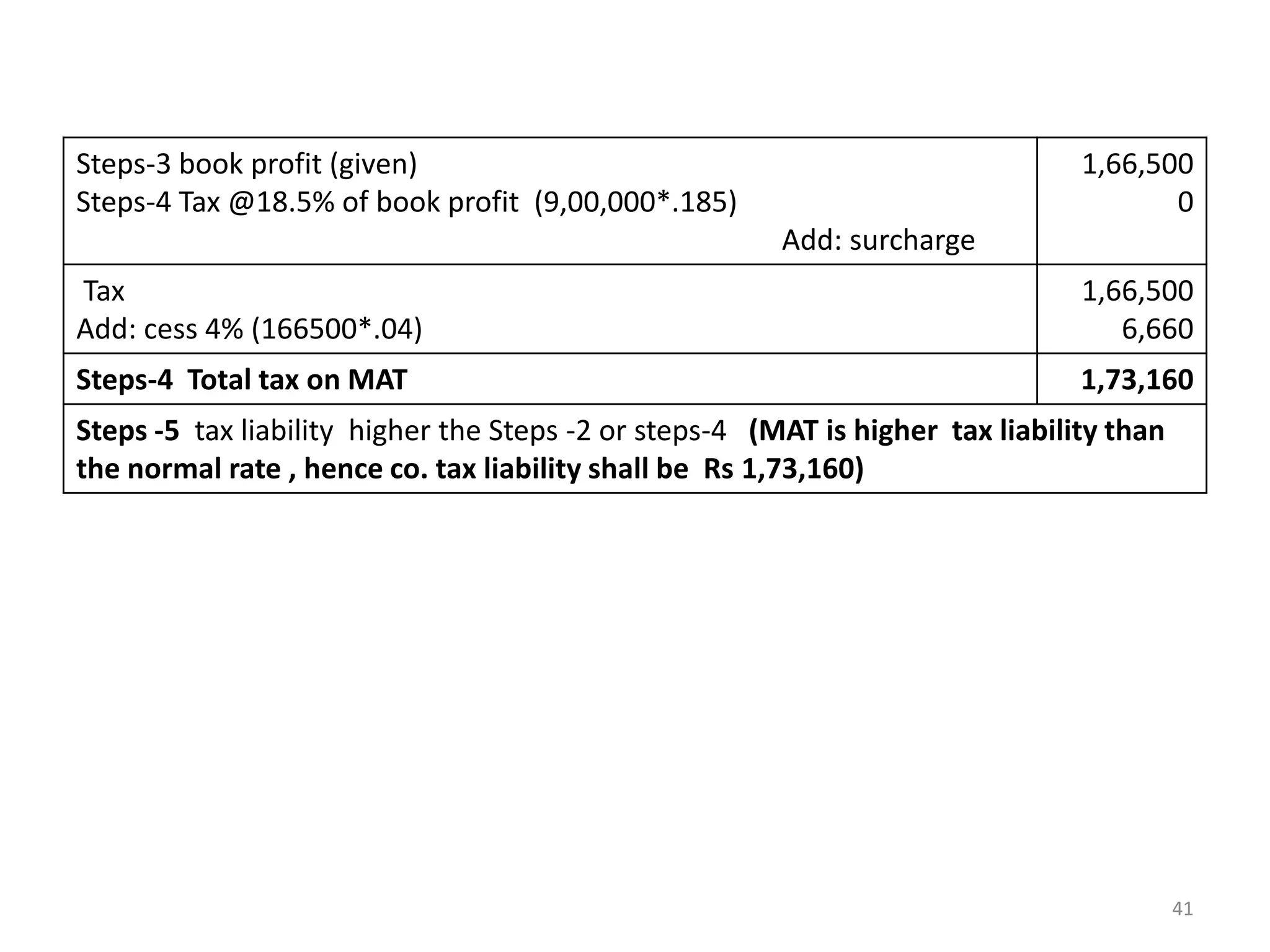

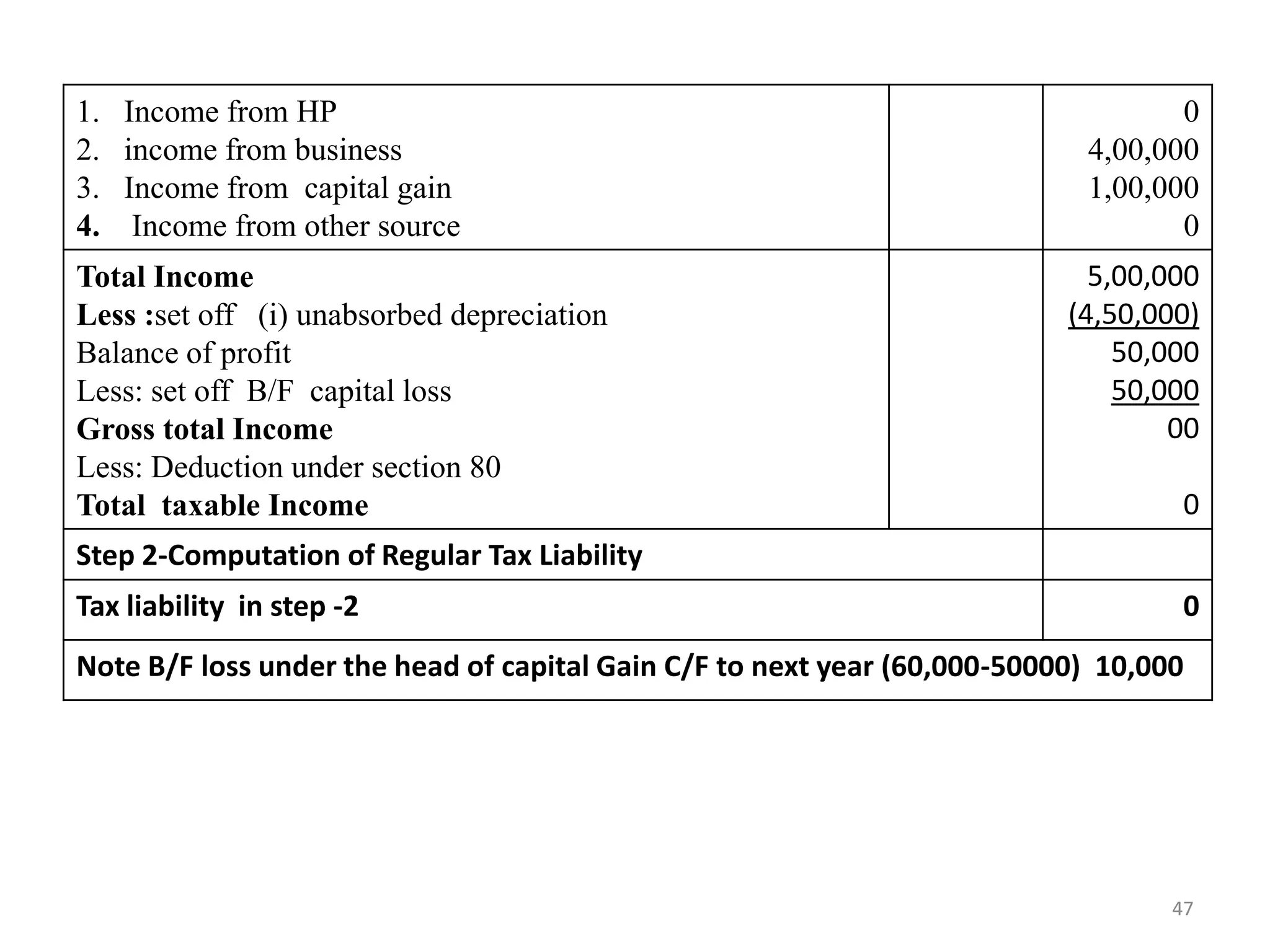

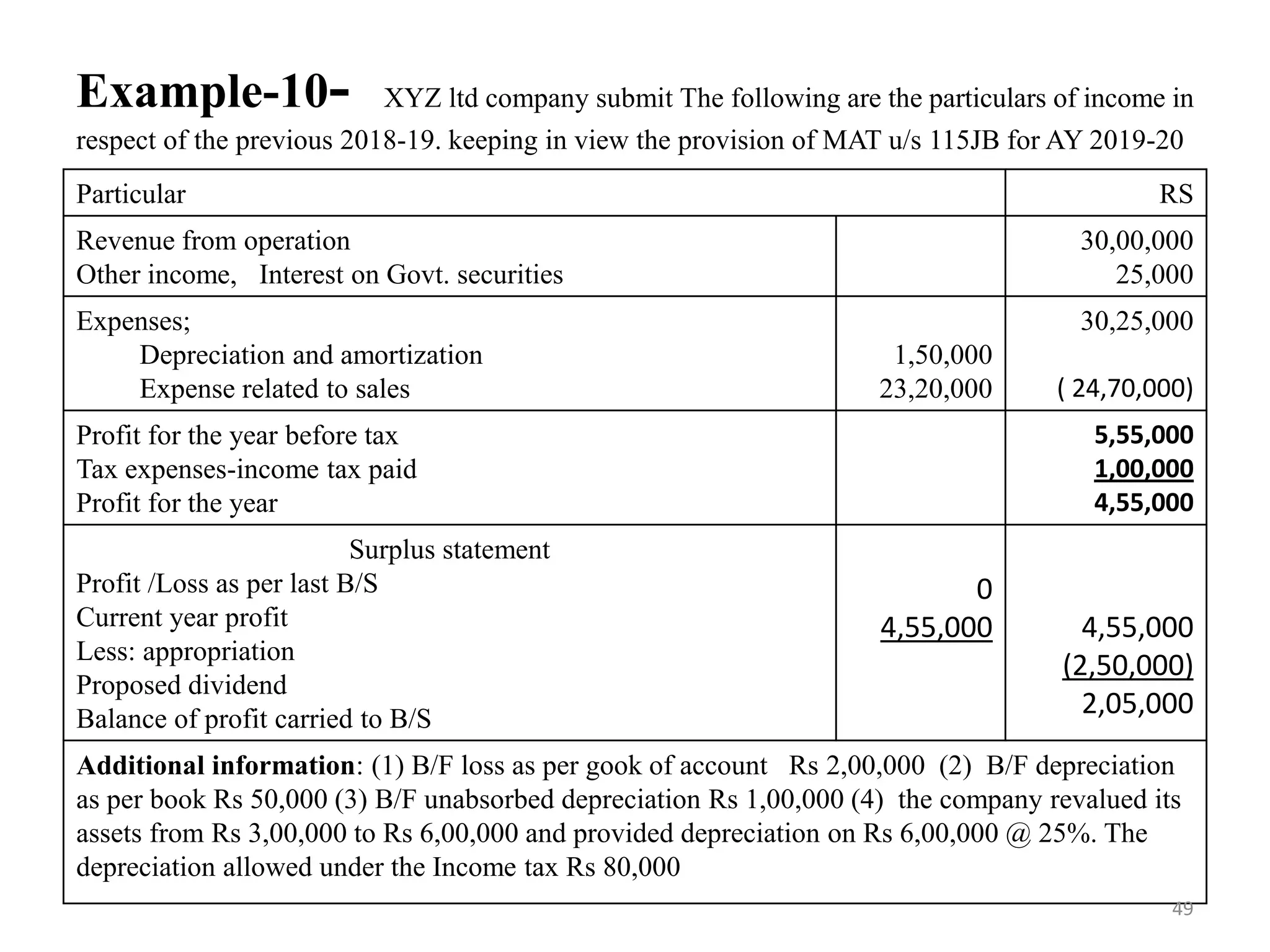

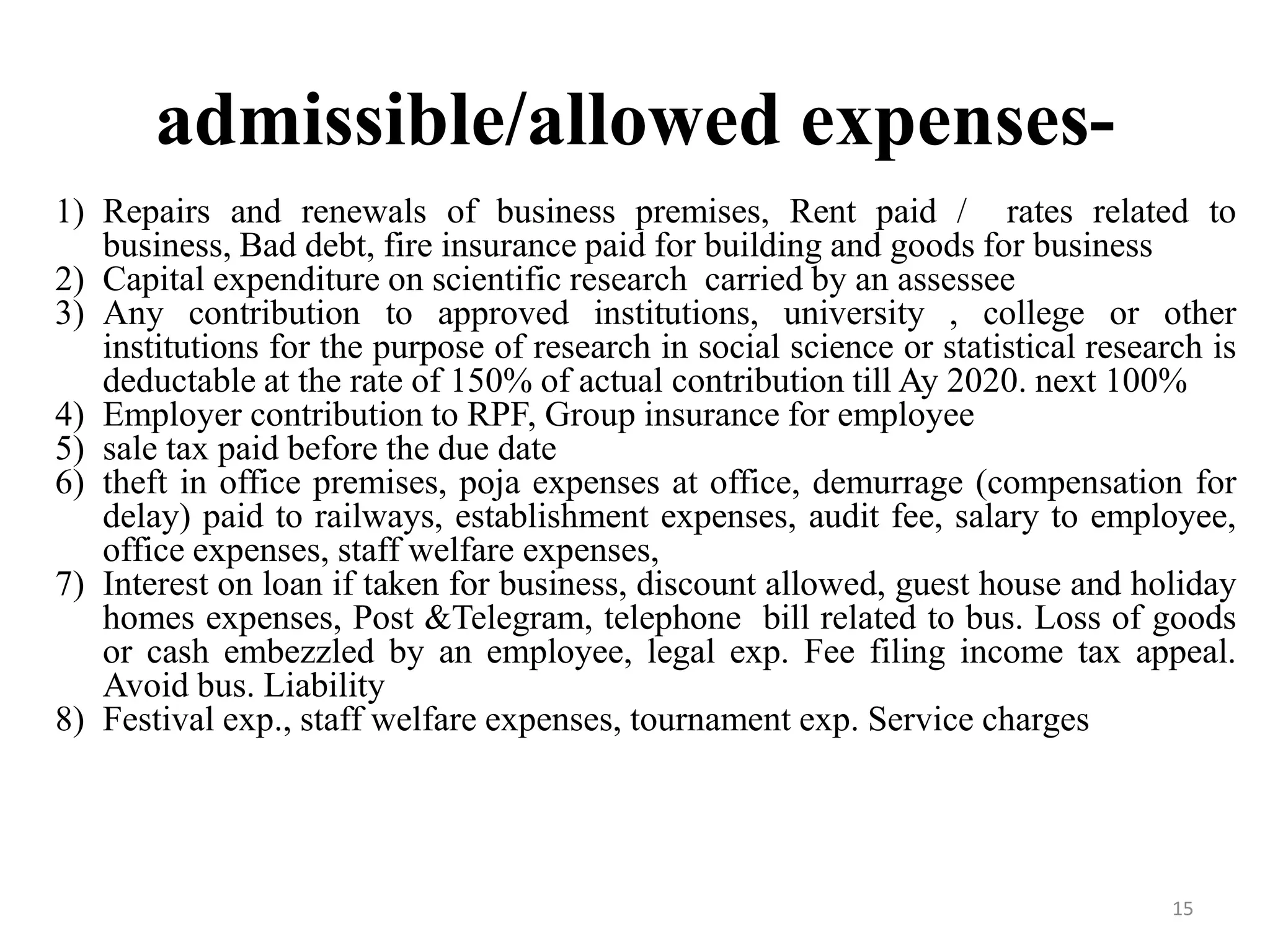

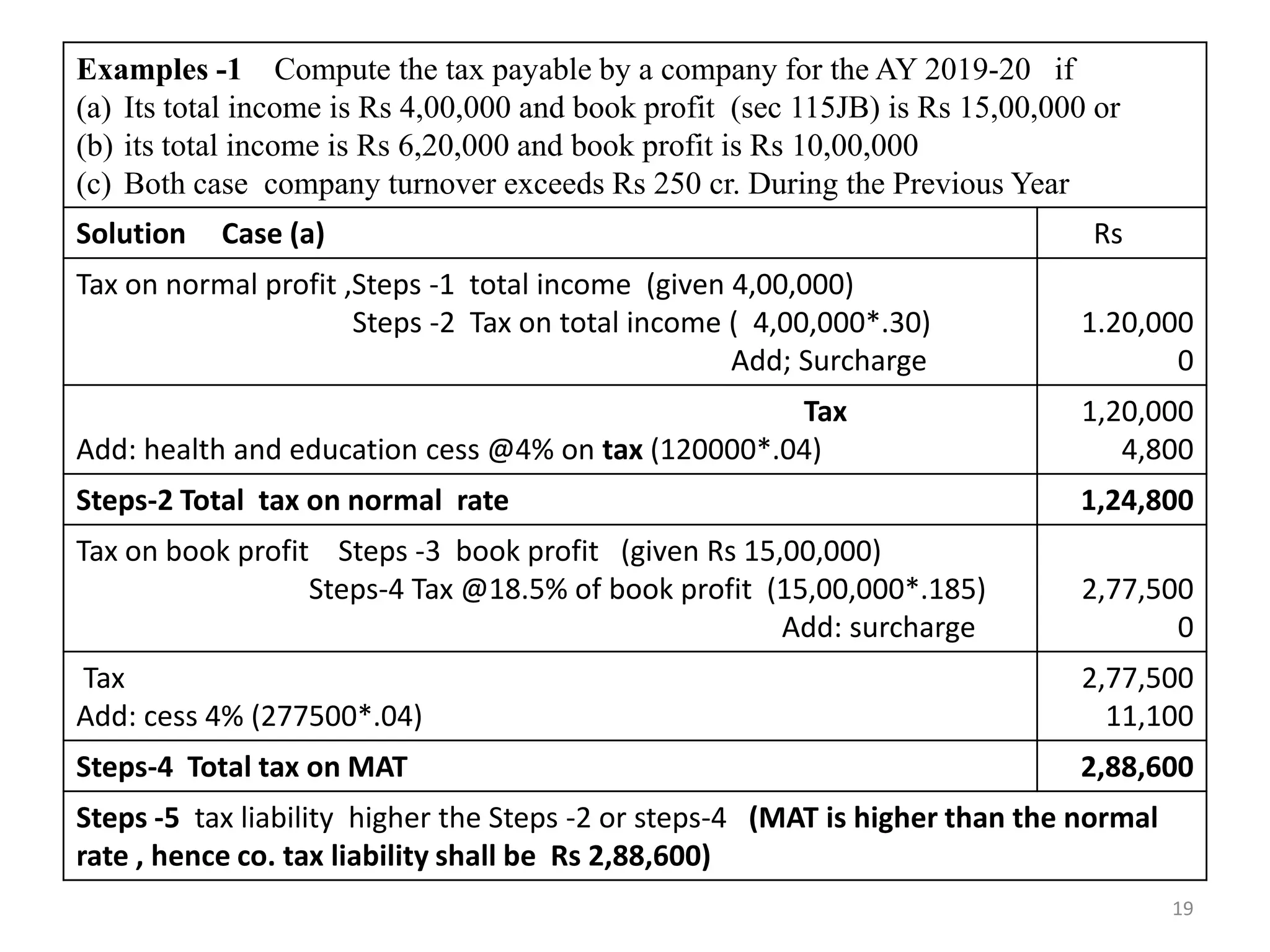

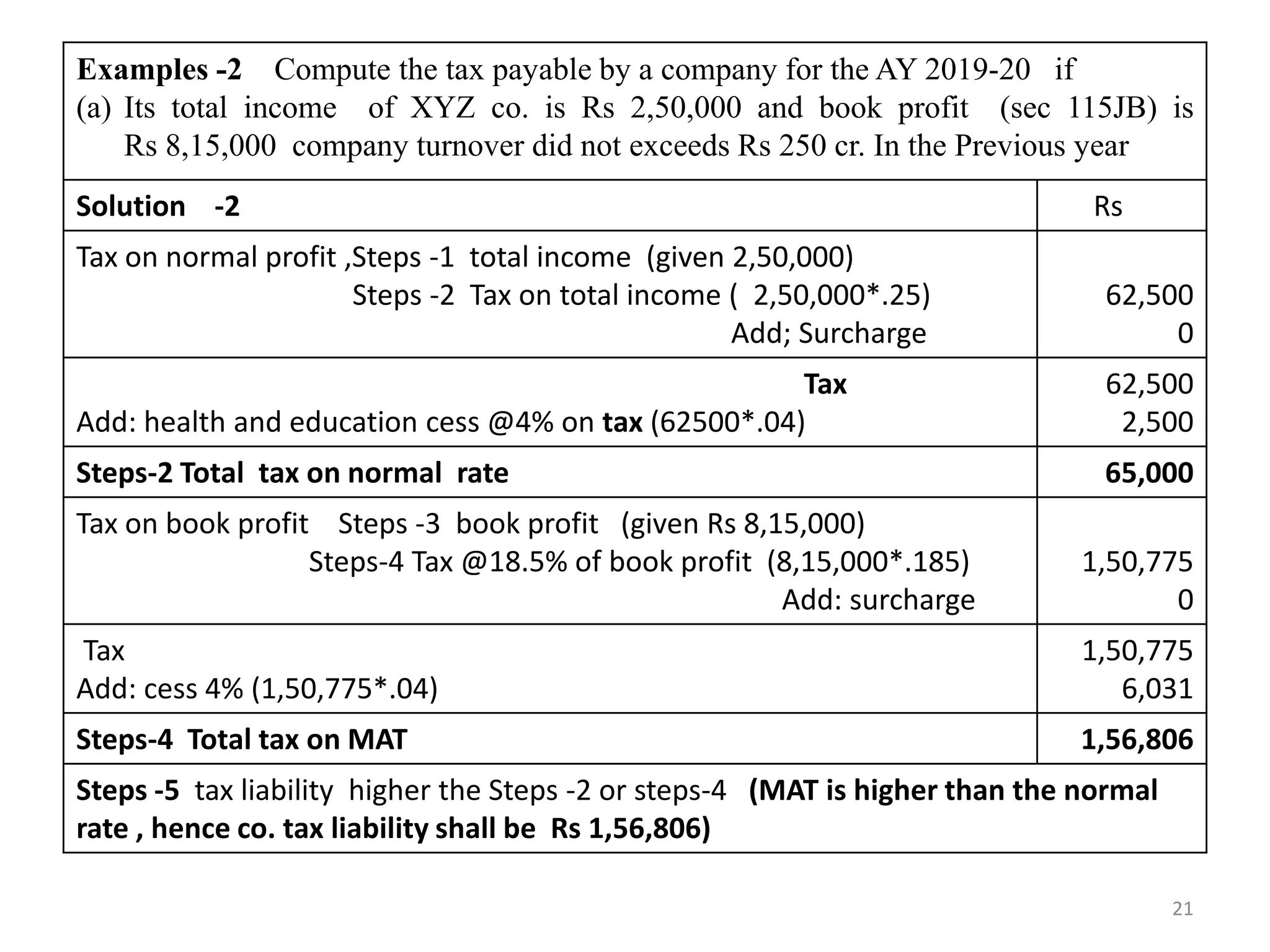

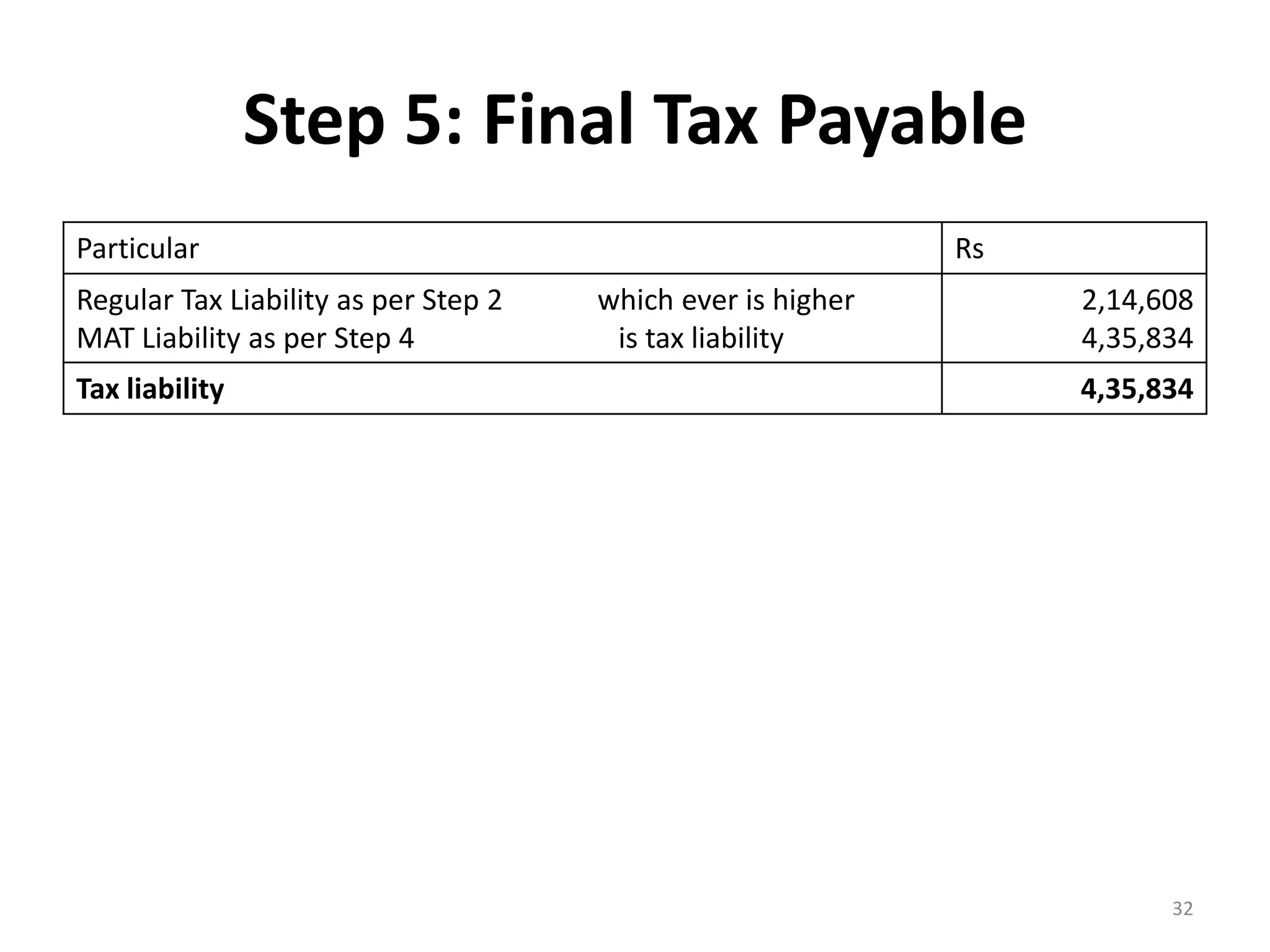

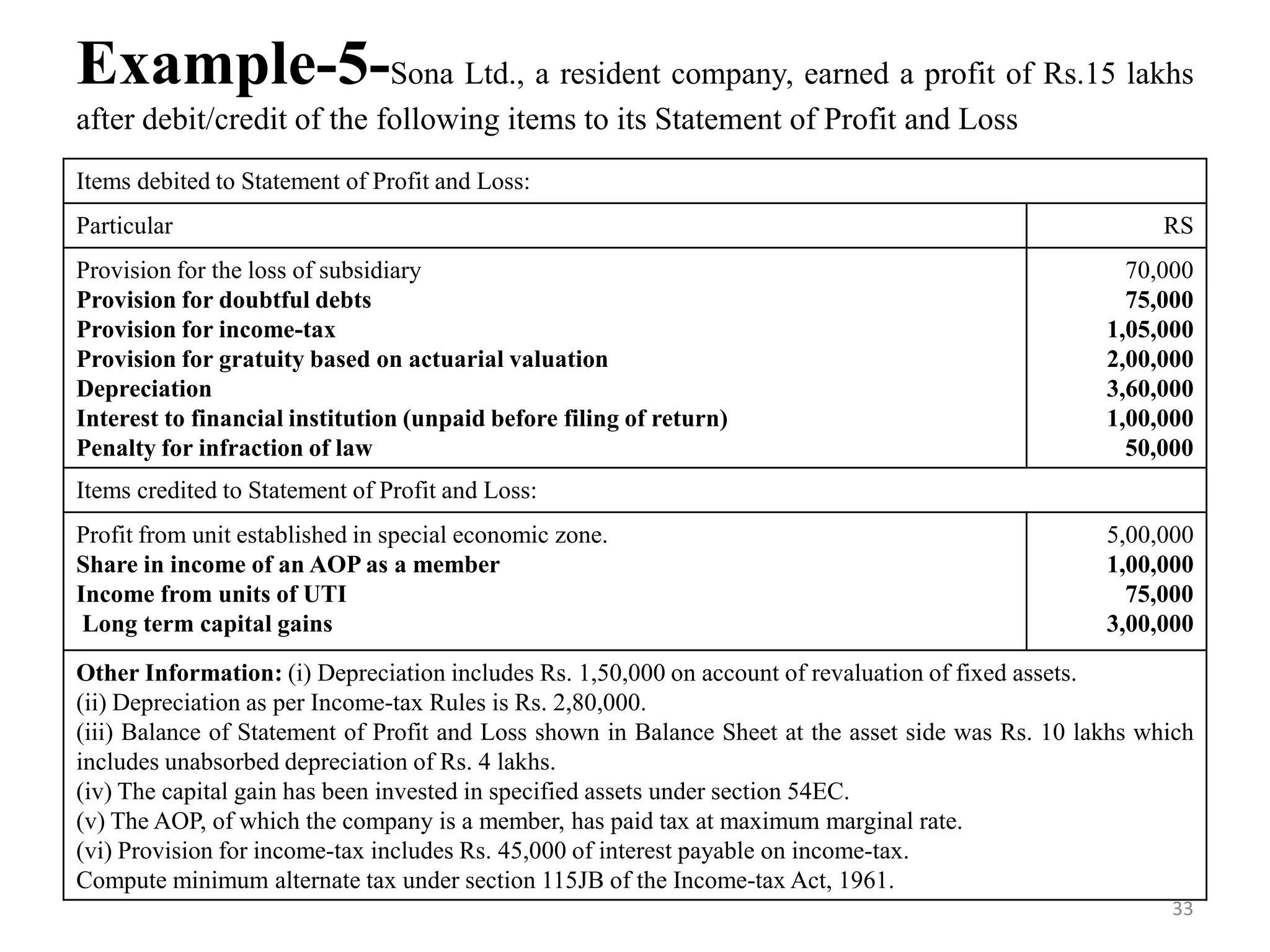

![Solution -5 Computation of Book Profit

Particulars RS

Net Profit as per profit and loss account

Positive Adjustments/statutory additions

Provision for the loss of subsidiary

Provision for doubtful debts,

Provision for income-tax

Depreciation

Negative Adjustments/statutory deductions

Share in income of an AOP as a member

Income from units in UTI [Income from units in UTI shall be reduced while

computing the book profits, since the same is exempt under section 10(35)]

Depreciation other than dep. on revaluation of assets(Rs.3,60,000–Rs.1,50,000)

Unabsorbed dep. or b/f business loss, whichever is less, as per the books of

account.[Here, unabsorbed dep. is Rs.4,00,000 while b/f business loss Rs 6,00,000

15,00,00

70,000

75,000

1,05,000

3,60,000

(1,00,000)

(75,000)

(2,10,000)

(4,00,000)

Book Profit 13,25,000

MAT @18.5% of Book Profit (Rs. 13,25,000)

Add: education Cess: (4%)

2,45,125

9,805

MAT Liability

2,54,930

34](https://image.slidesharecdn.com/aoc-221210134720-130c5d50/75/aoc-pdf-34-2048.jpg)