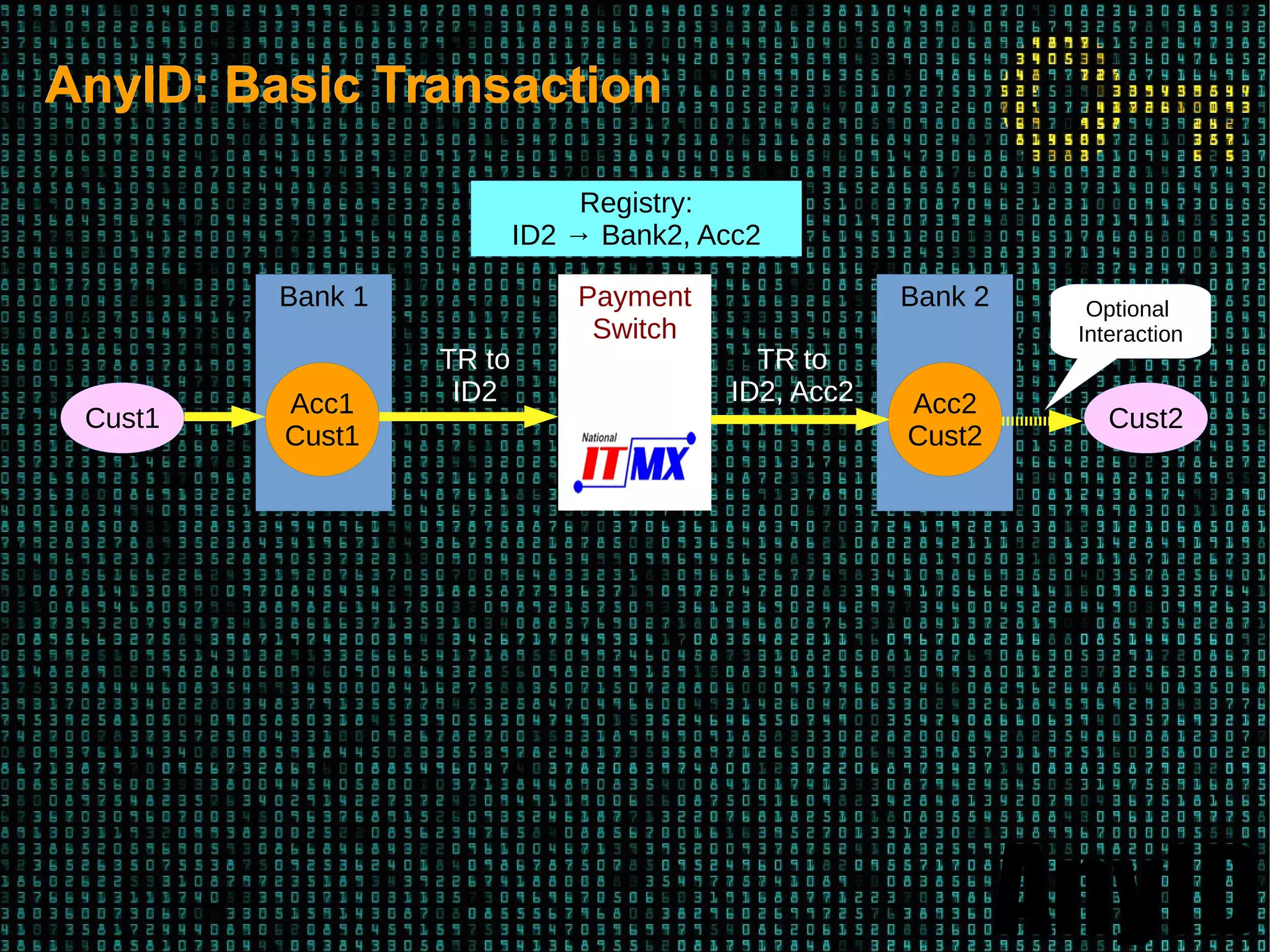

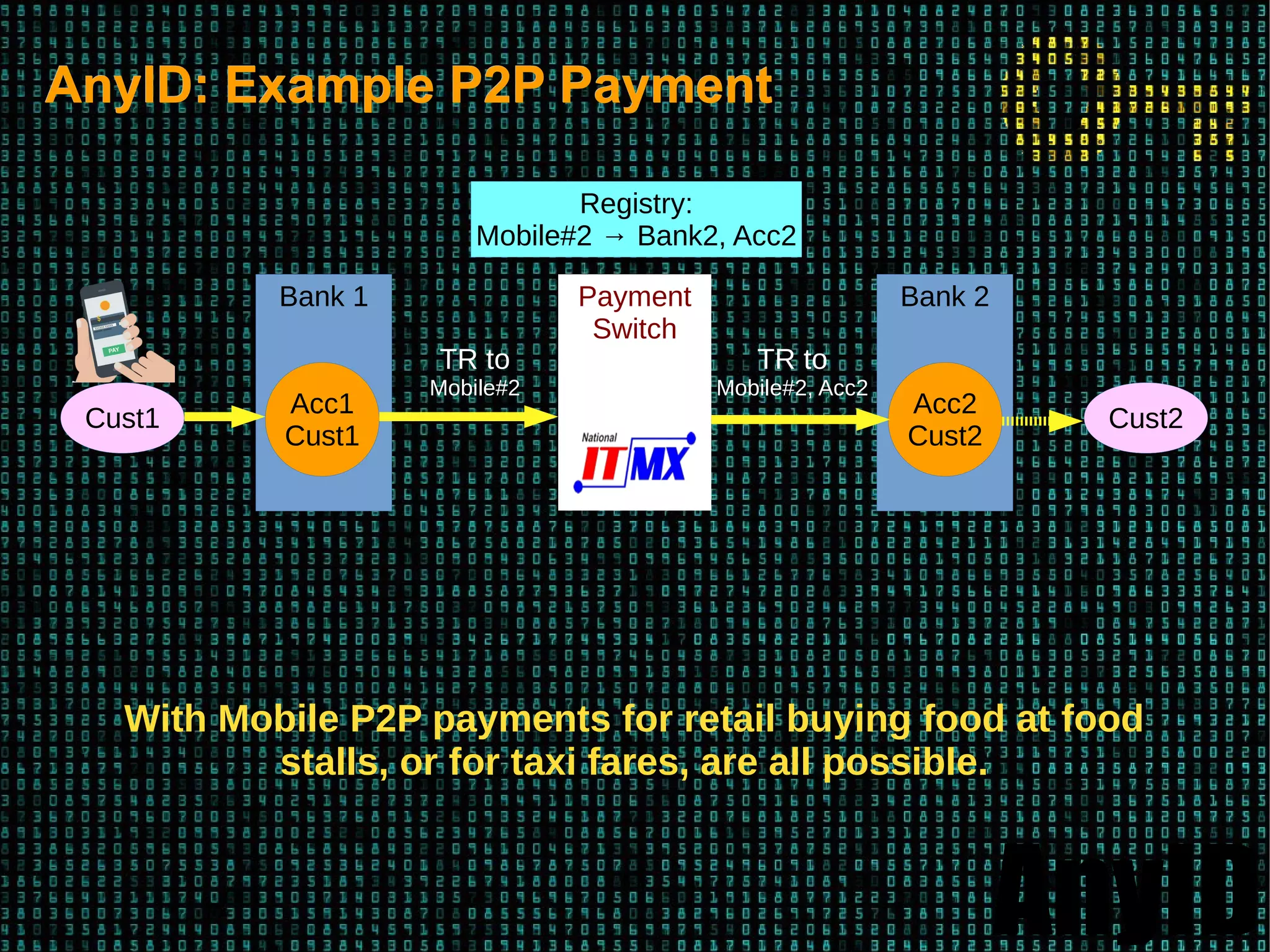

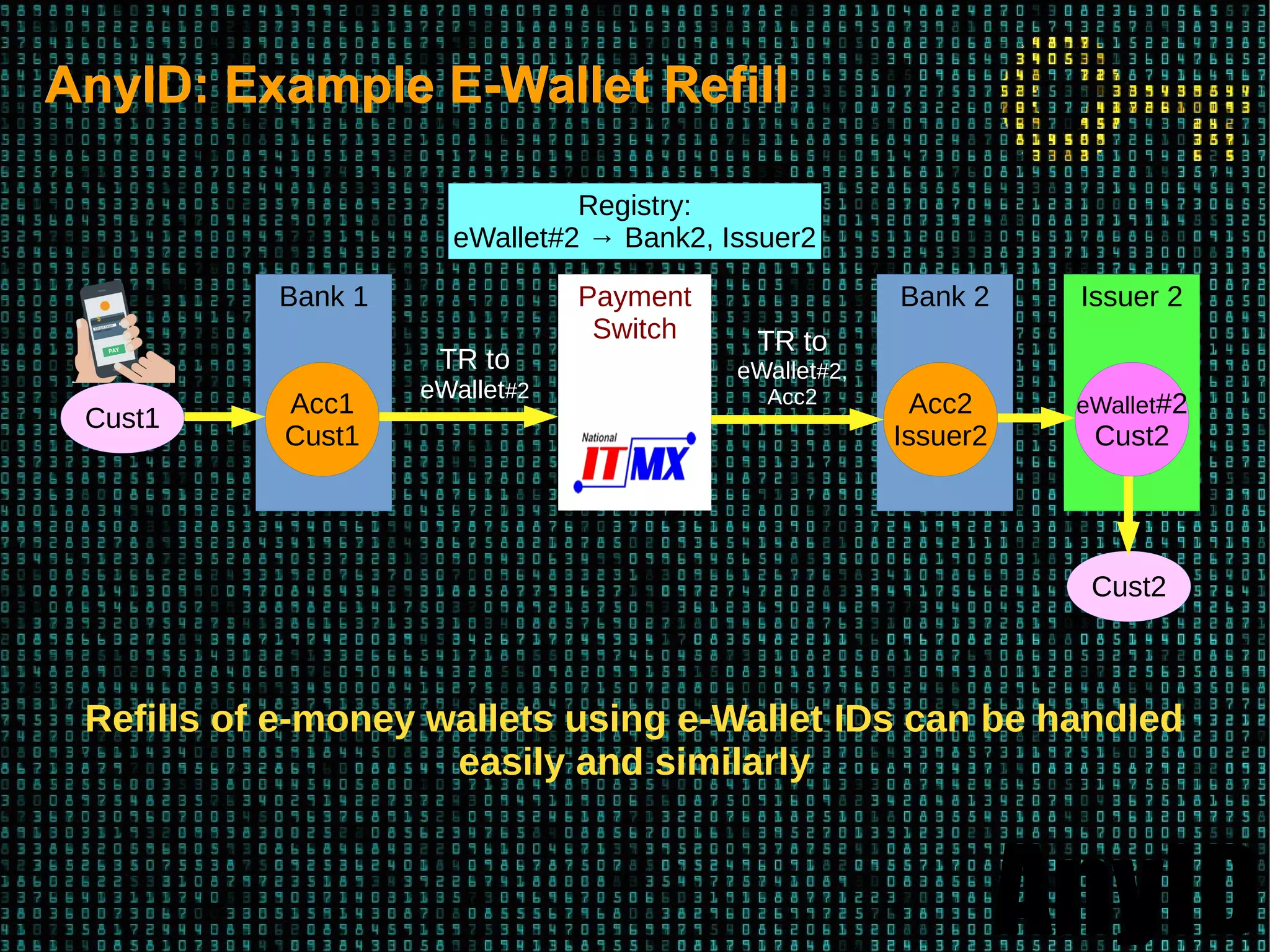

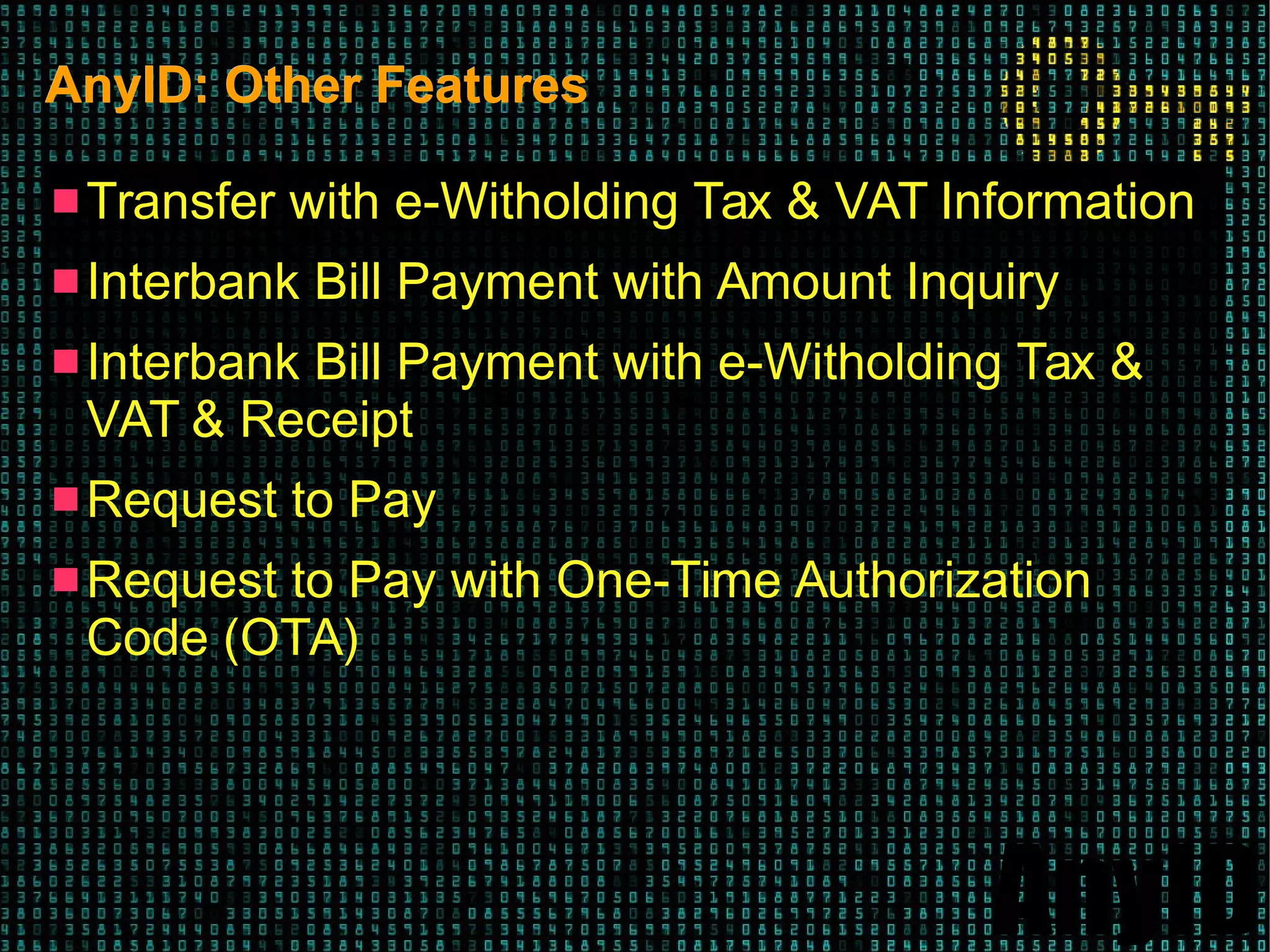

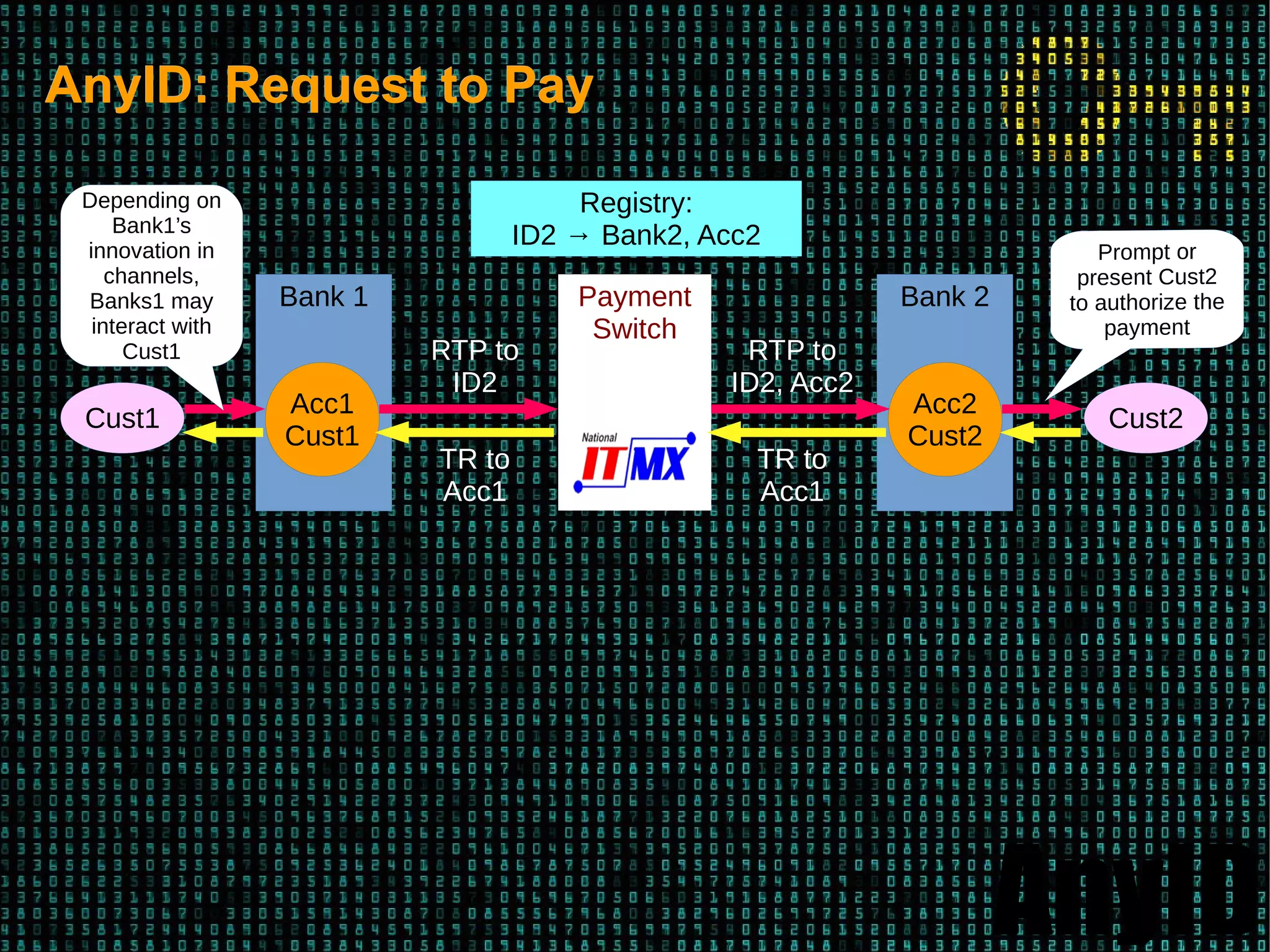

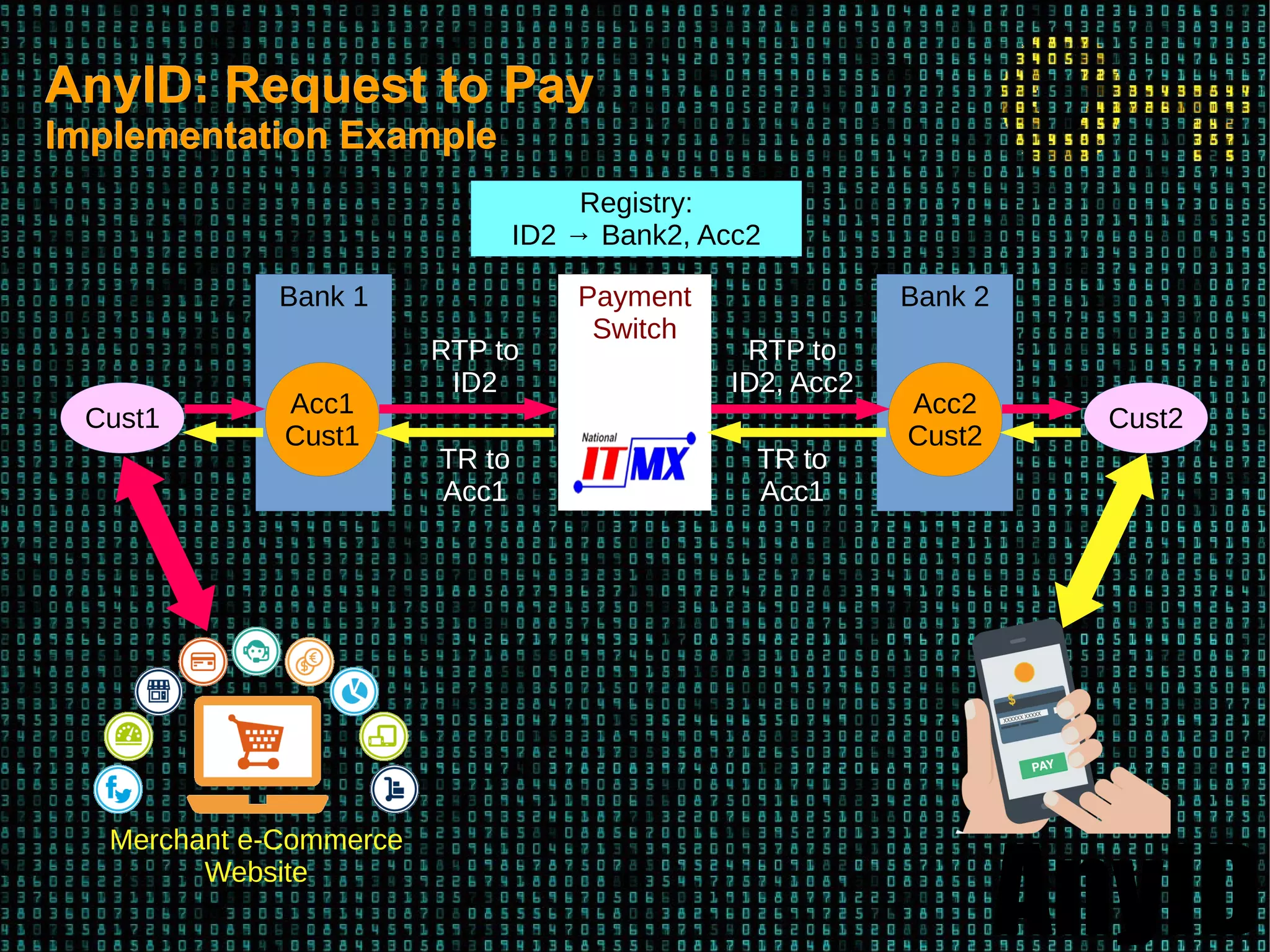

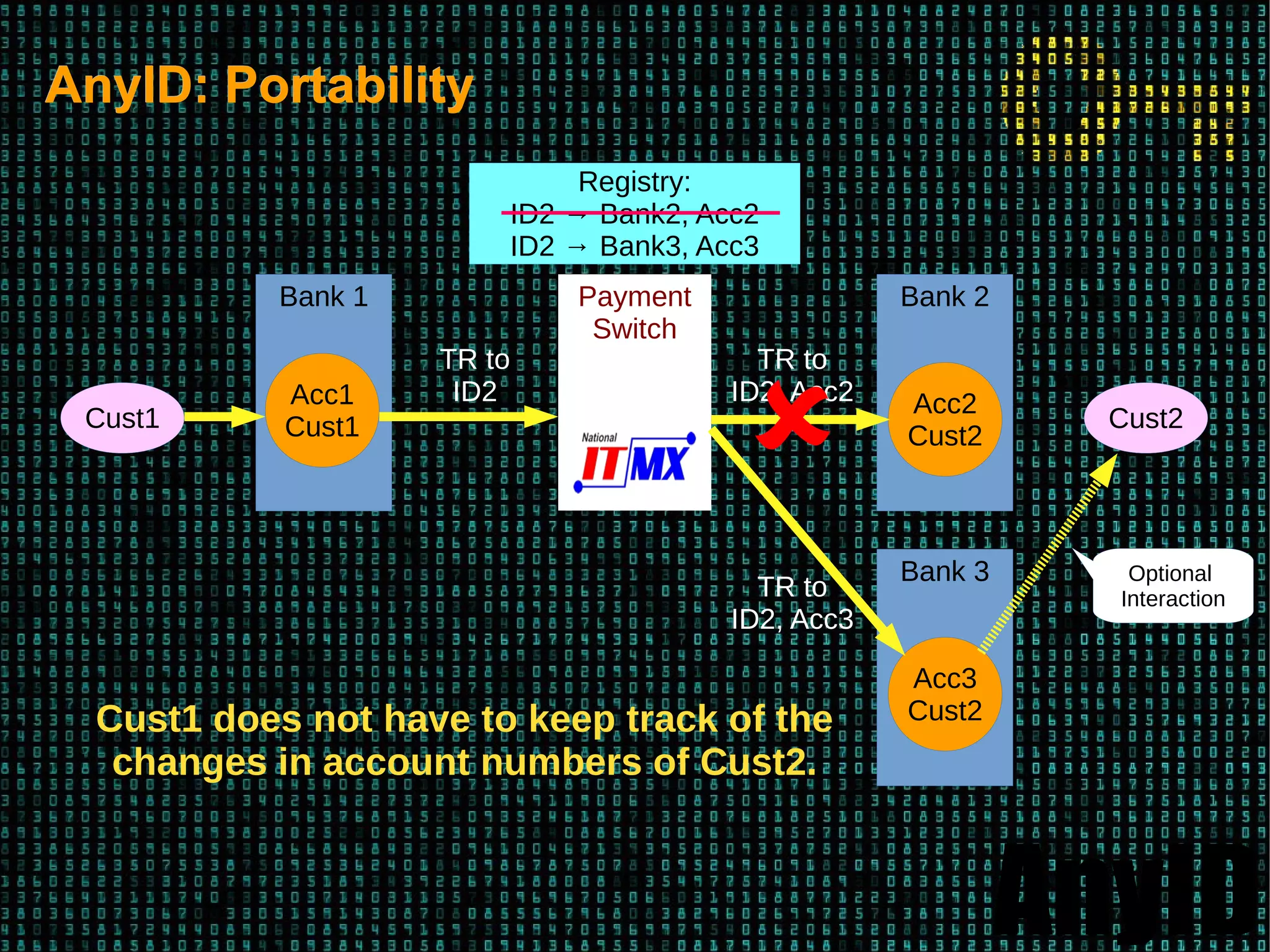

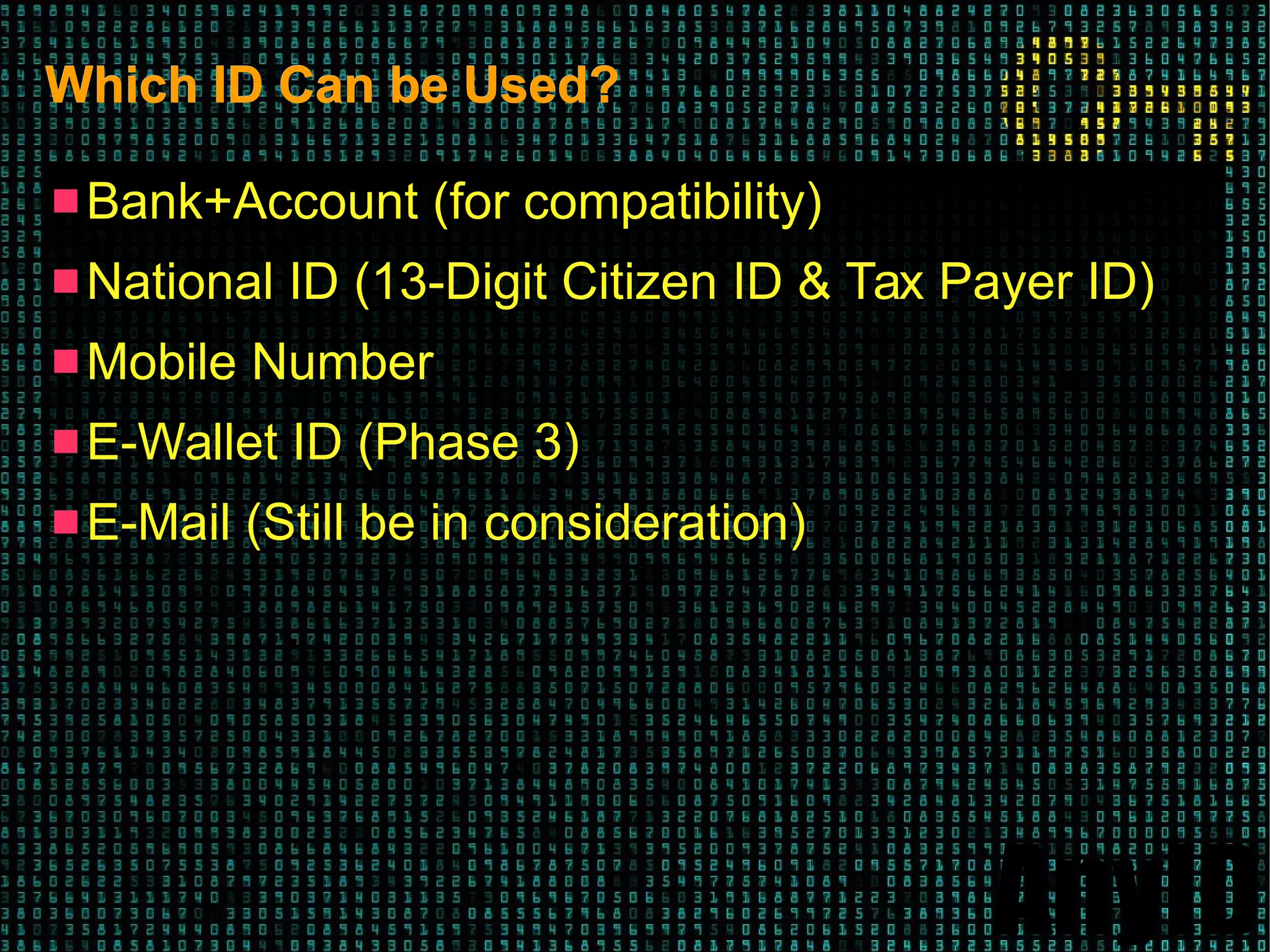

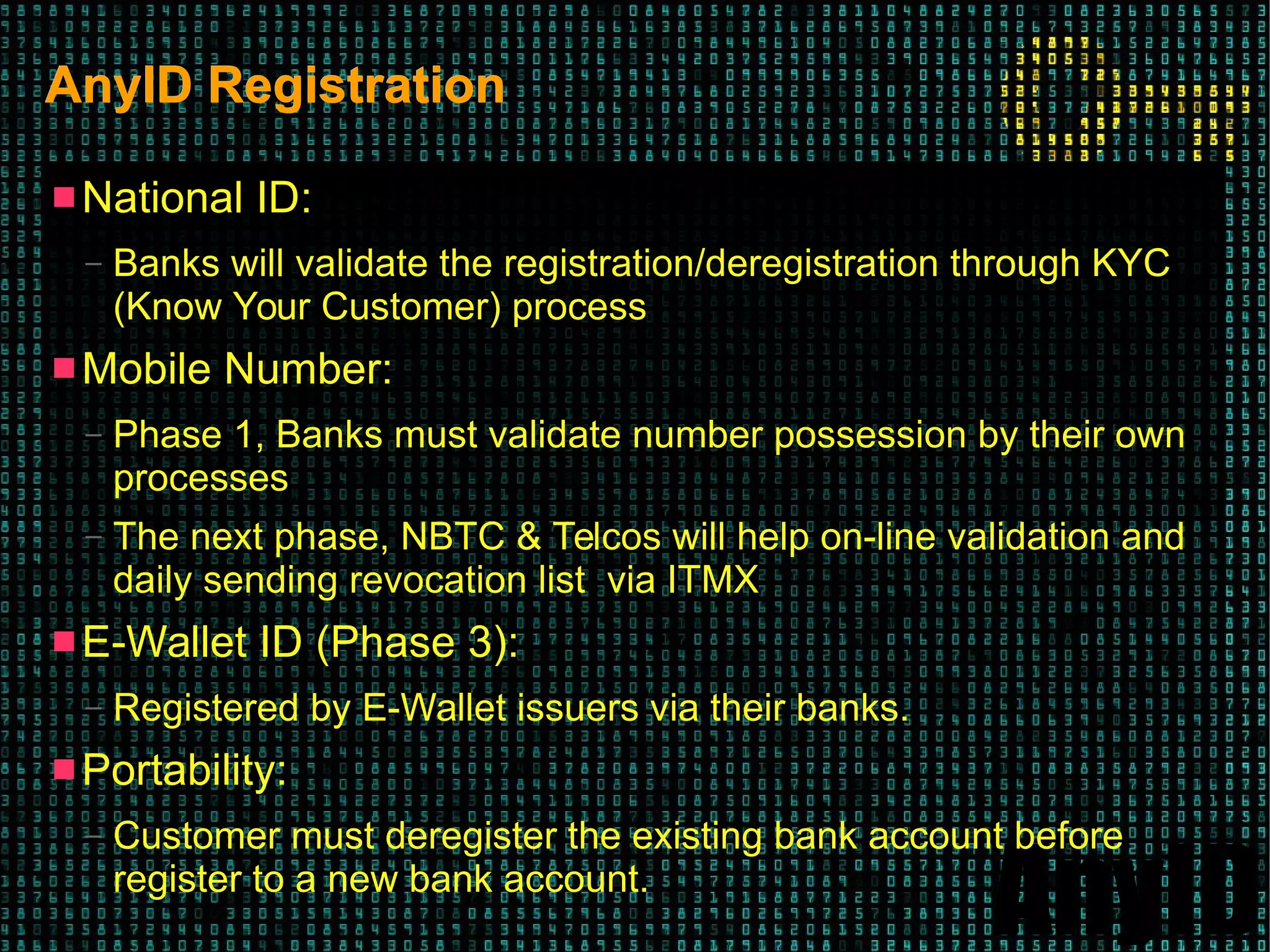

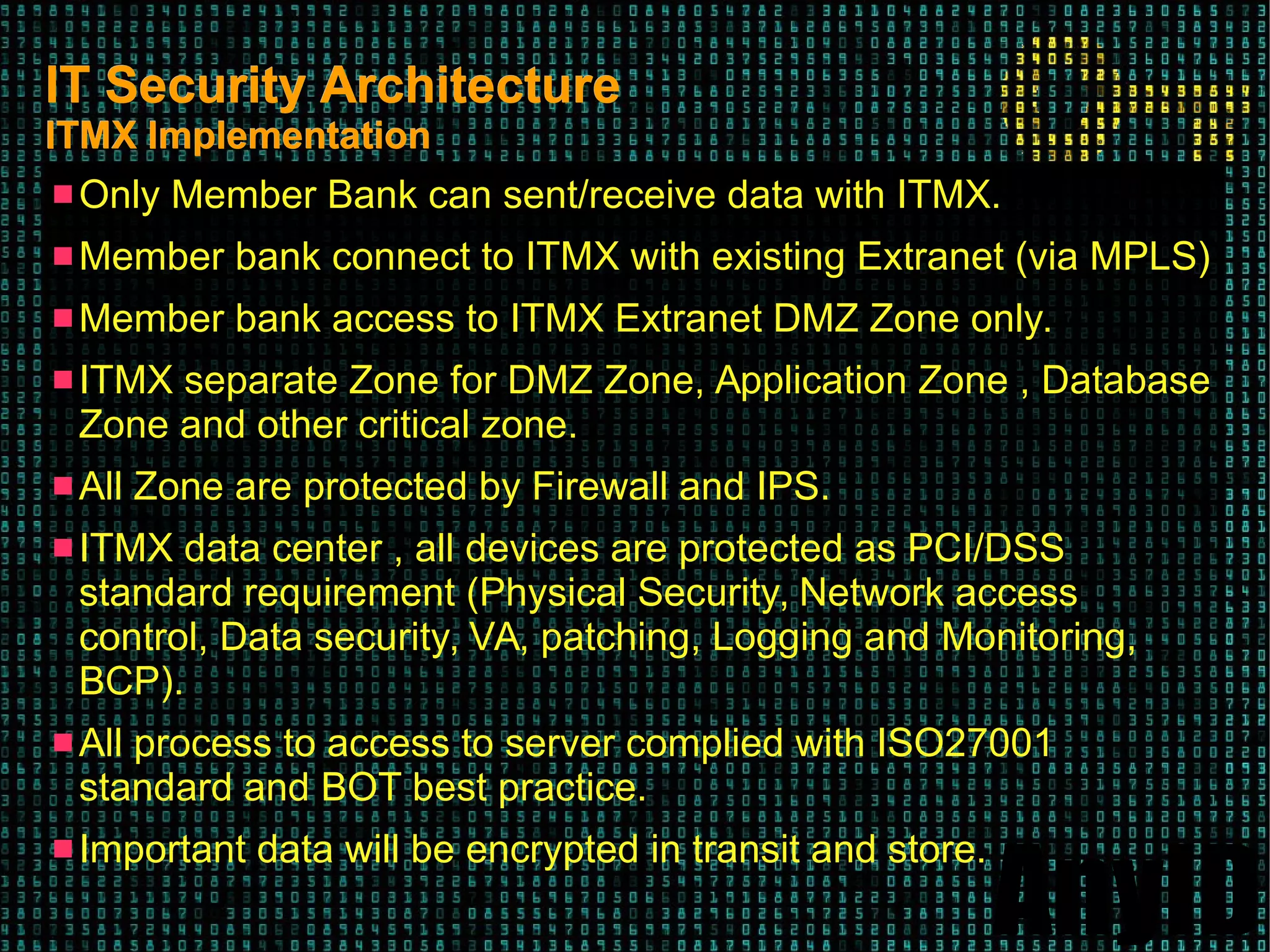

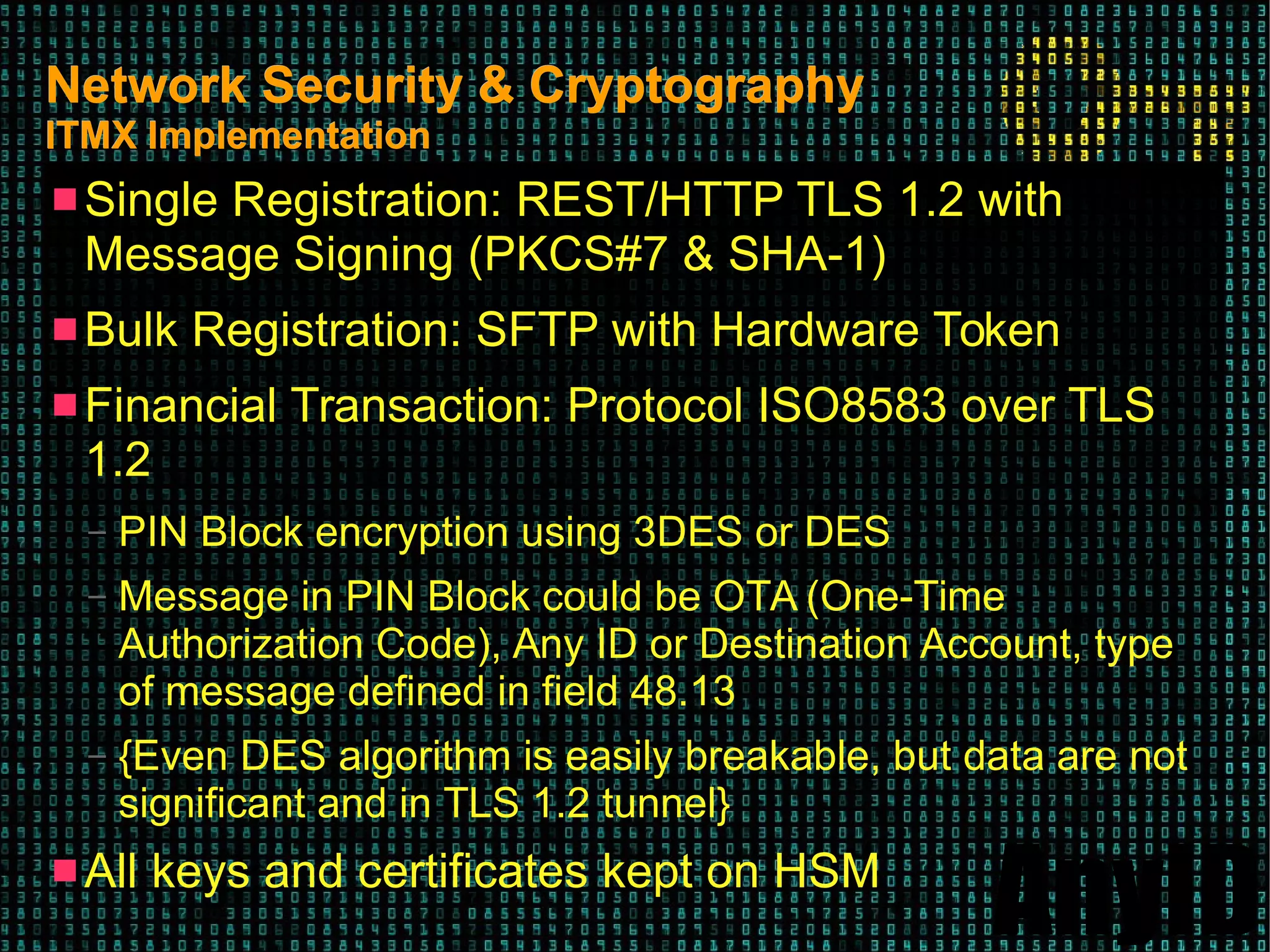

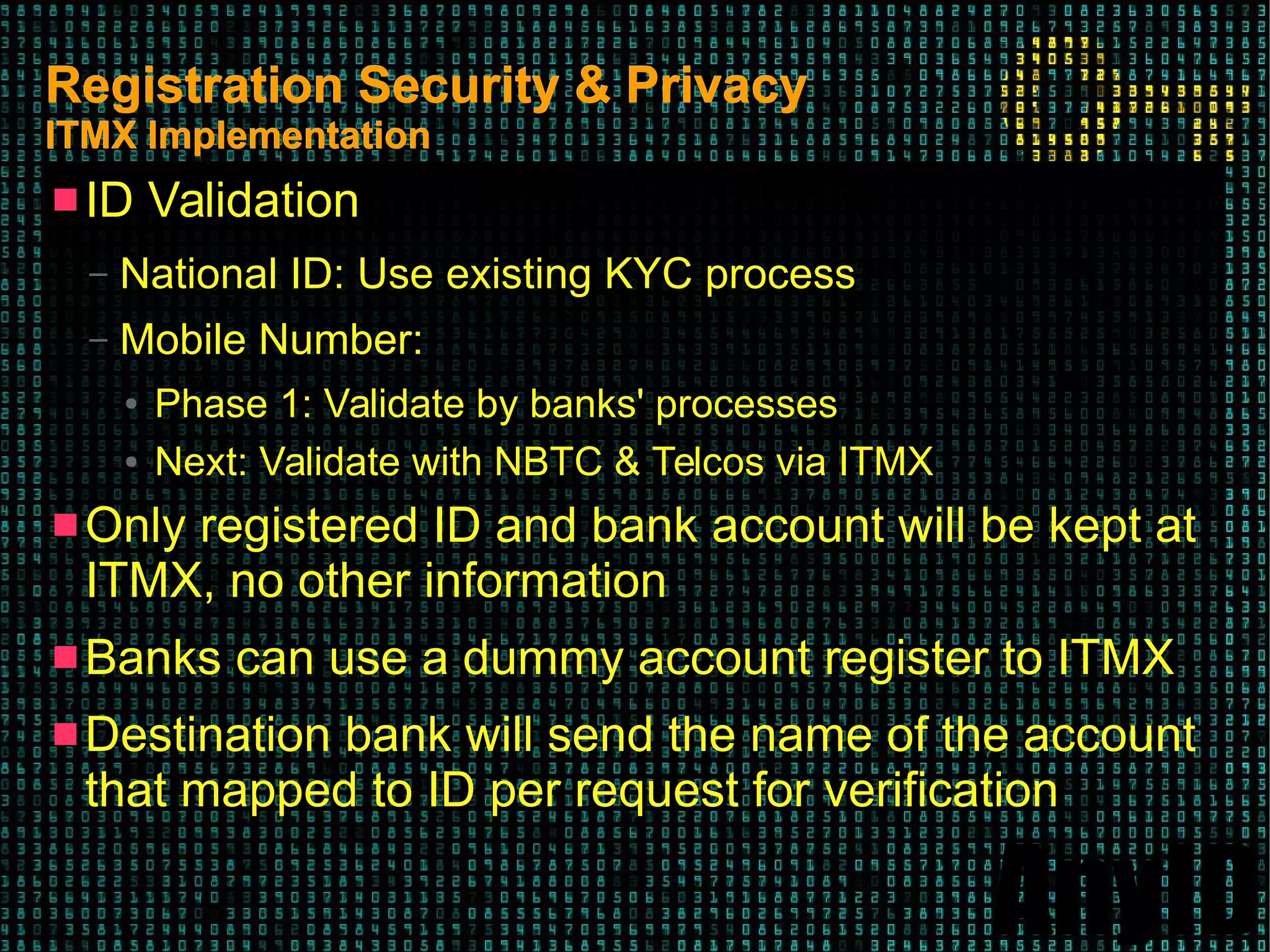

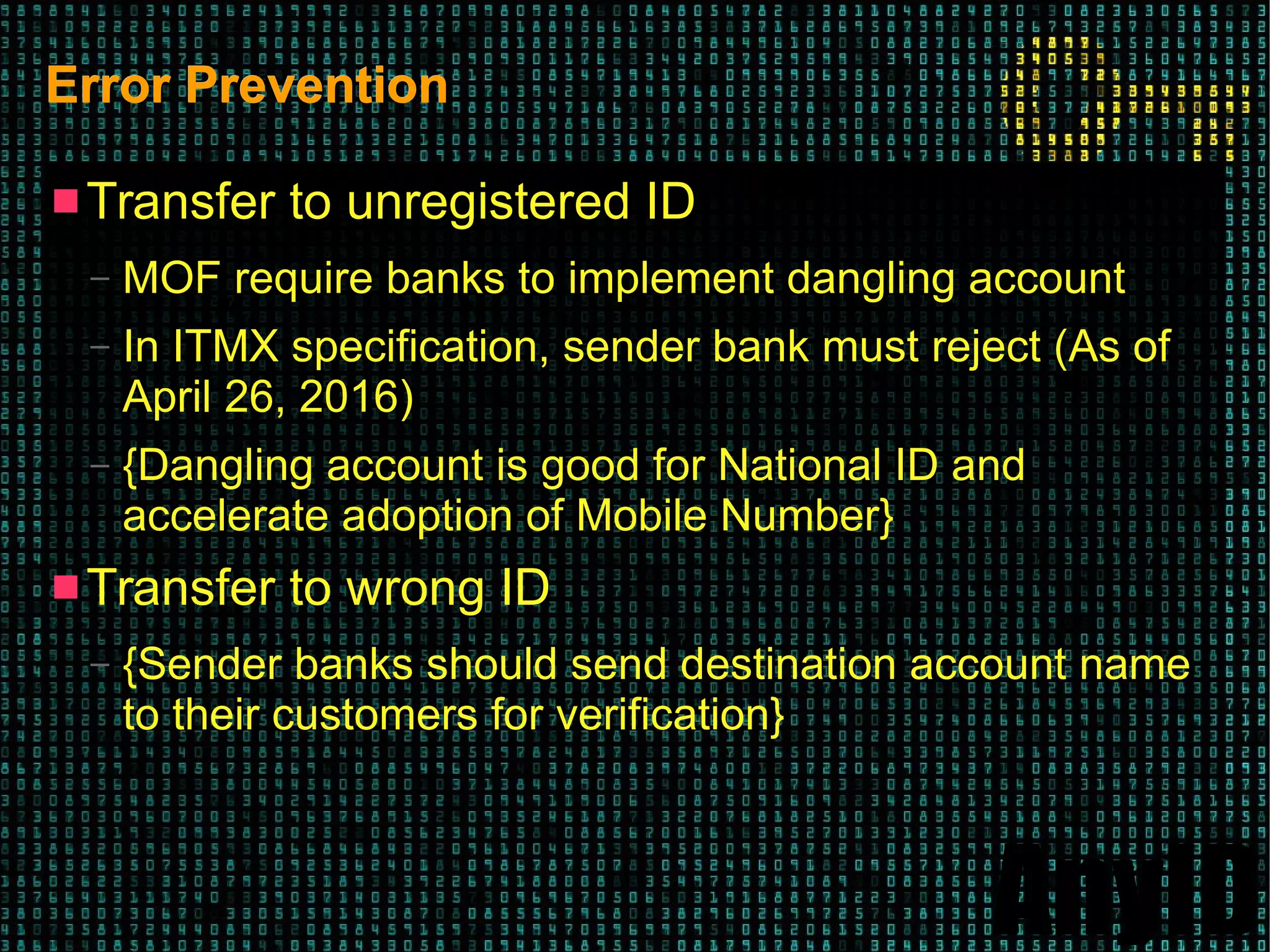

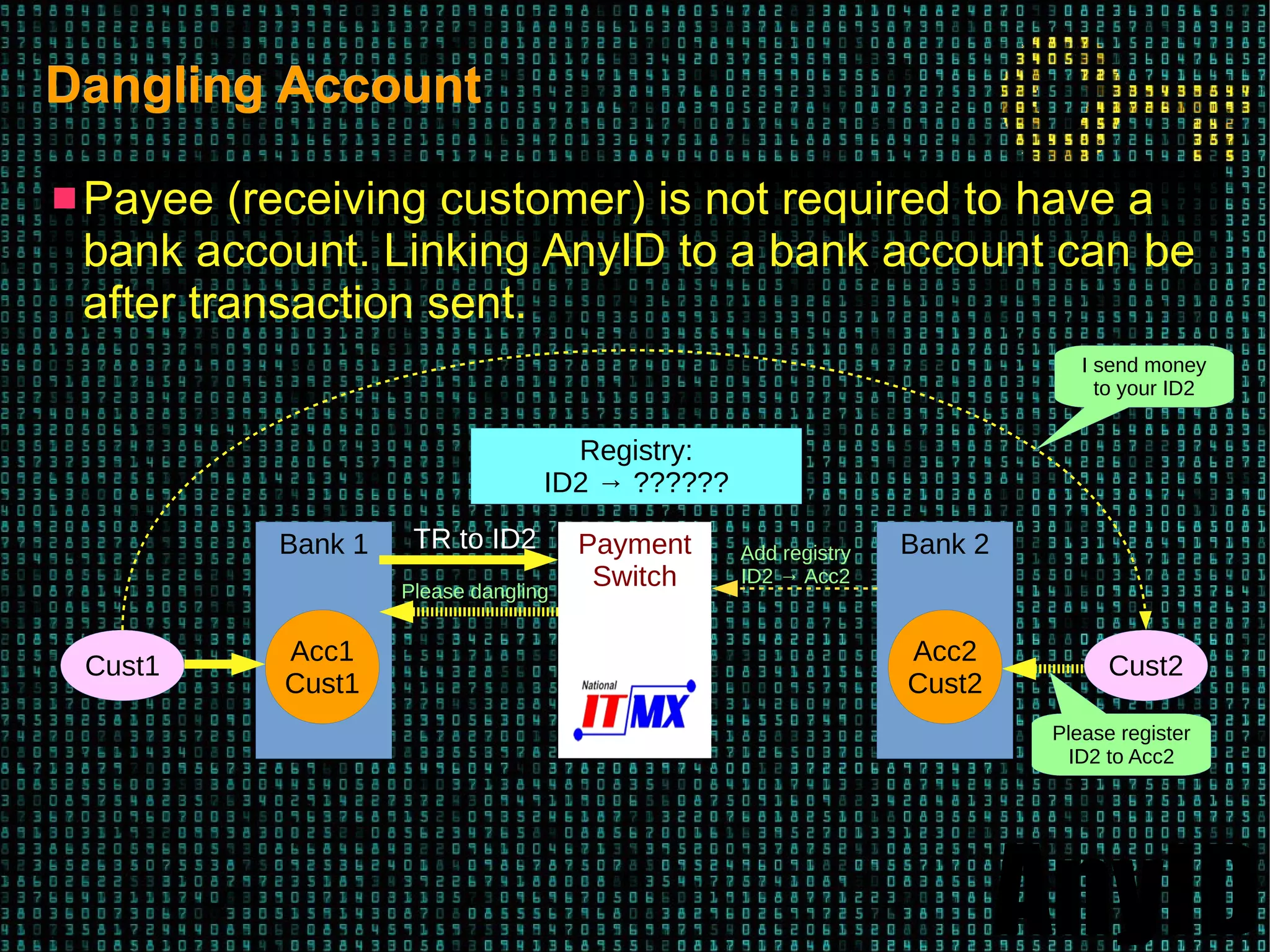

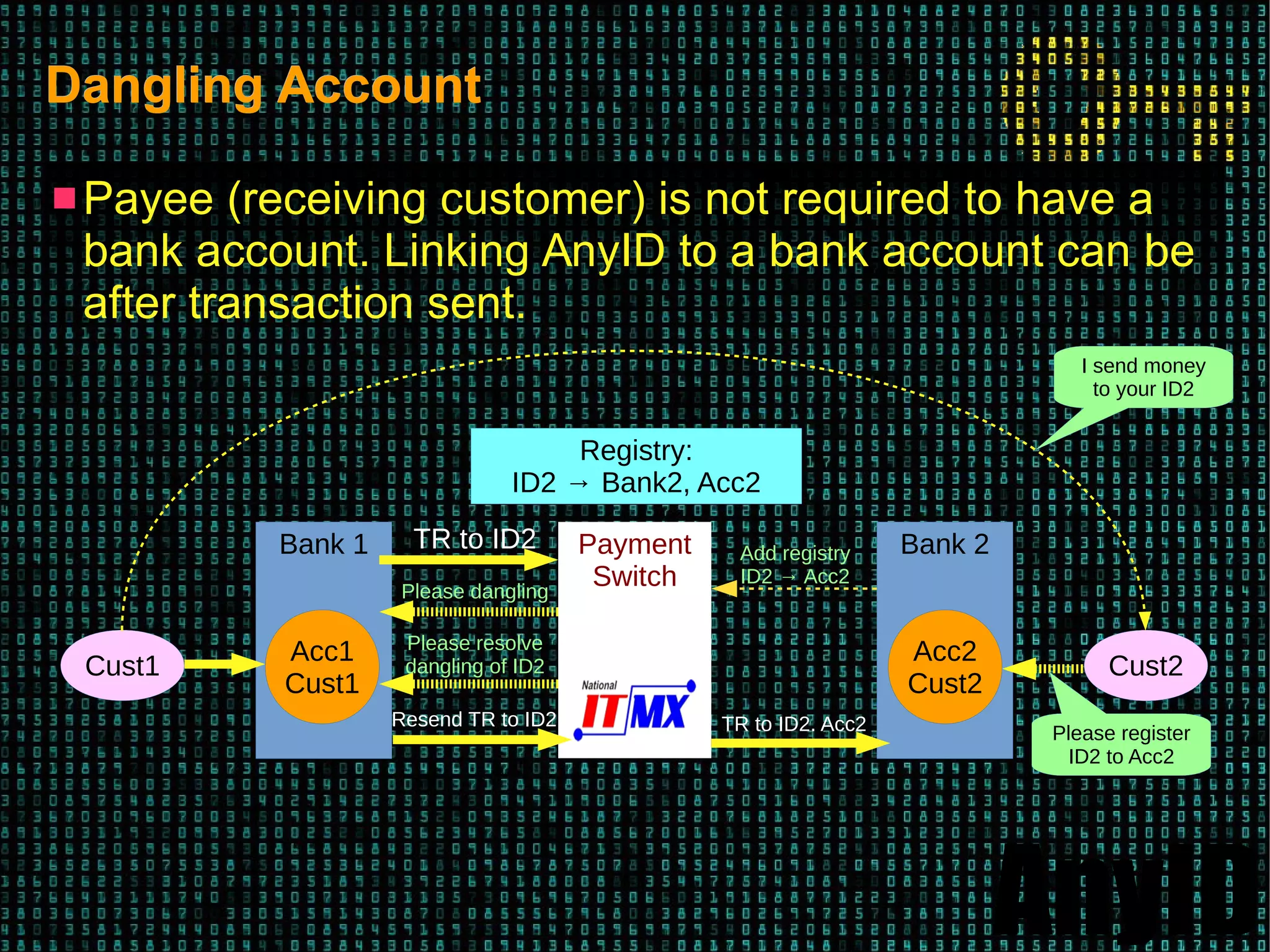

The document outlines the National E-Payment Initiative in Thailand, detailing five strategic projects aimed at improving electronic payment infrastructure, including card acceptance and public education on electronic transactions. It discusses various features such as peer-to-peer payments, e-wallet refills, and security measures in transaction systems, emphasizing usability alongside security. The initiative focuses on the implementation of sophisticated architecture for data protection and fraud prevention within the banking sector.