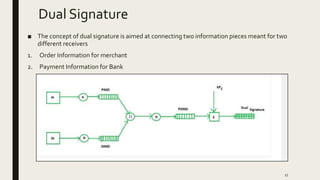

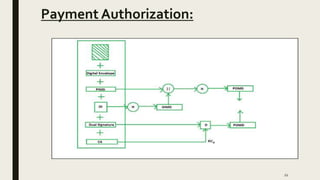

The document discusses electronic payment protocols. It describes the requirements of an e-payment protocol including anonymity, divisibility, transference, and overspending detection. It then summarizes the Kim and Lee protocol which uses certificate issuing, payment, and redemption schemes involving a user, bank, and merchant. Limitations are discussed along with a proposed protocol using a blind signature scheme involving registration, blind, transaction, and redemption schemes. Finally, it explains the Secure Electronic Transaction (SET) protocol involving participants, features, requirements, and dual signature implementation through purchase request, payment authorization, and payment capture events.

![Kim and Lee Protocol:

■ An E-Payment protocol that supports multiple merchants.

■ Protocol is divided into three schemes : (i) Certificate issuing scheme (ii) Payment Scheme (iii)

Redemption Scheme

(1) Certificate Issuing Scheme:

3

User(U) requests a

certificate to a bank B by

sending his secret

information

The bank B passes

CU[User Certificate] and

SU will be employed for

the root value in payment

scheme later

User creates his/her public

and secret key pair (PKU

,SKU) & passes PKU with IU

that contains max no: of

merchants(N) ,size of

hash (n) with his credit

info to the bank

The bank generates

special infoTU which acts

as a key factor of the root

value. Only the bank can

generate the new hash

values](https://image.slidesharecdn.com/epaymentprotocol-200517061630/85/Electronic-Payment-Protocol-3-320.jpg)