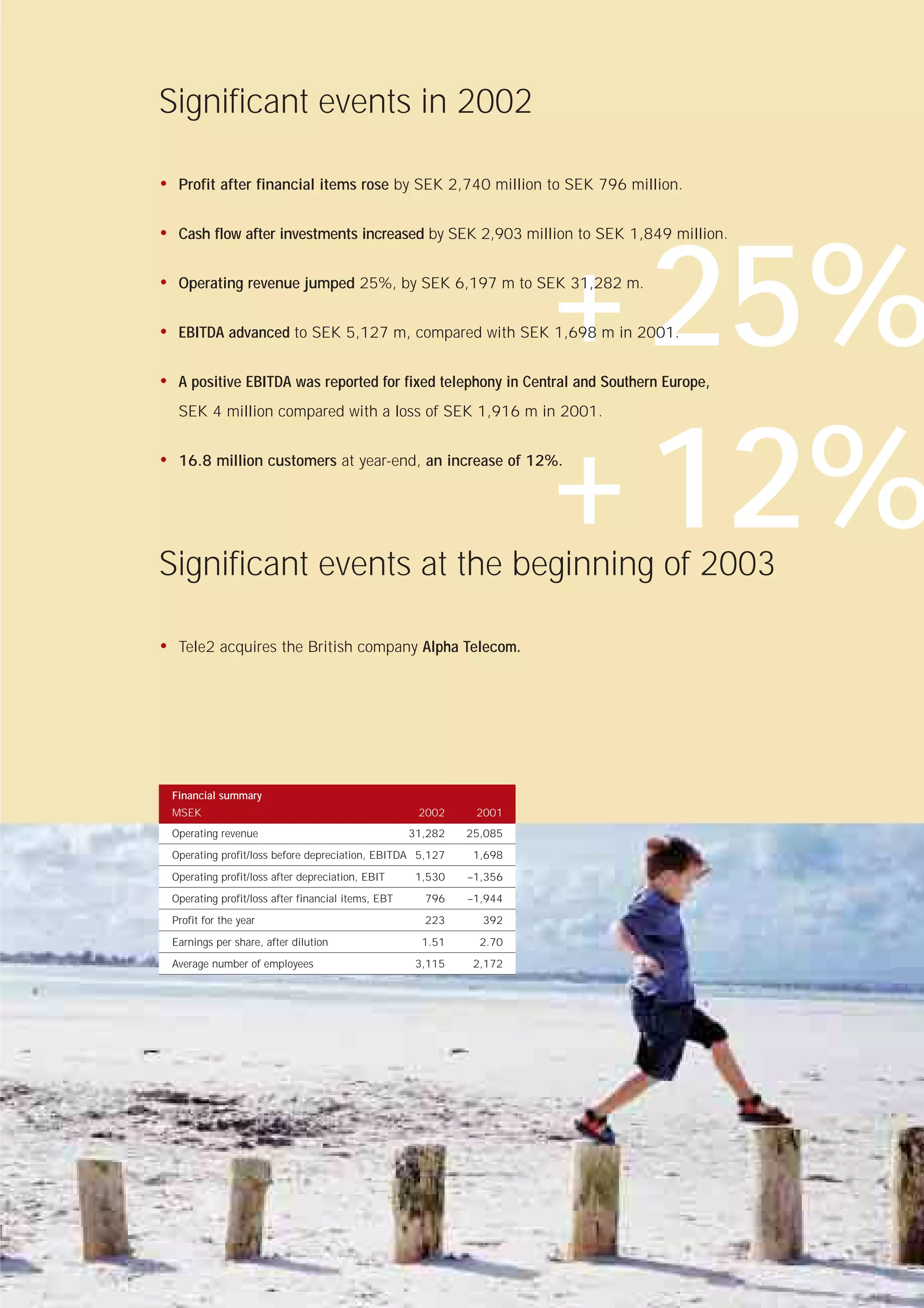

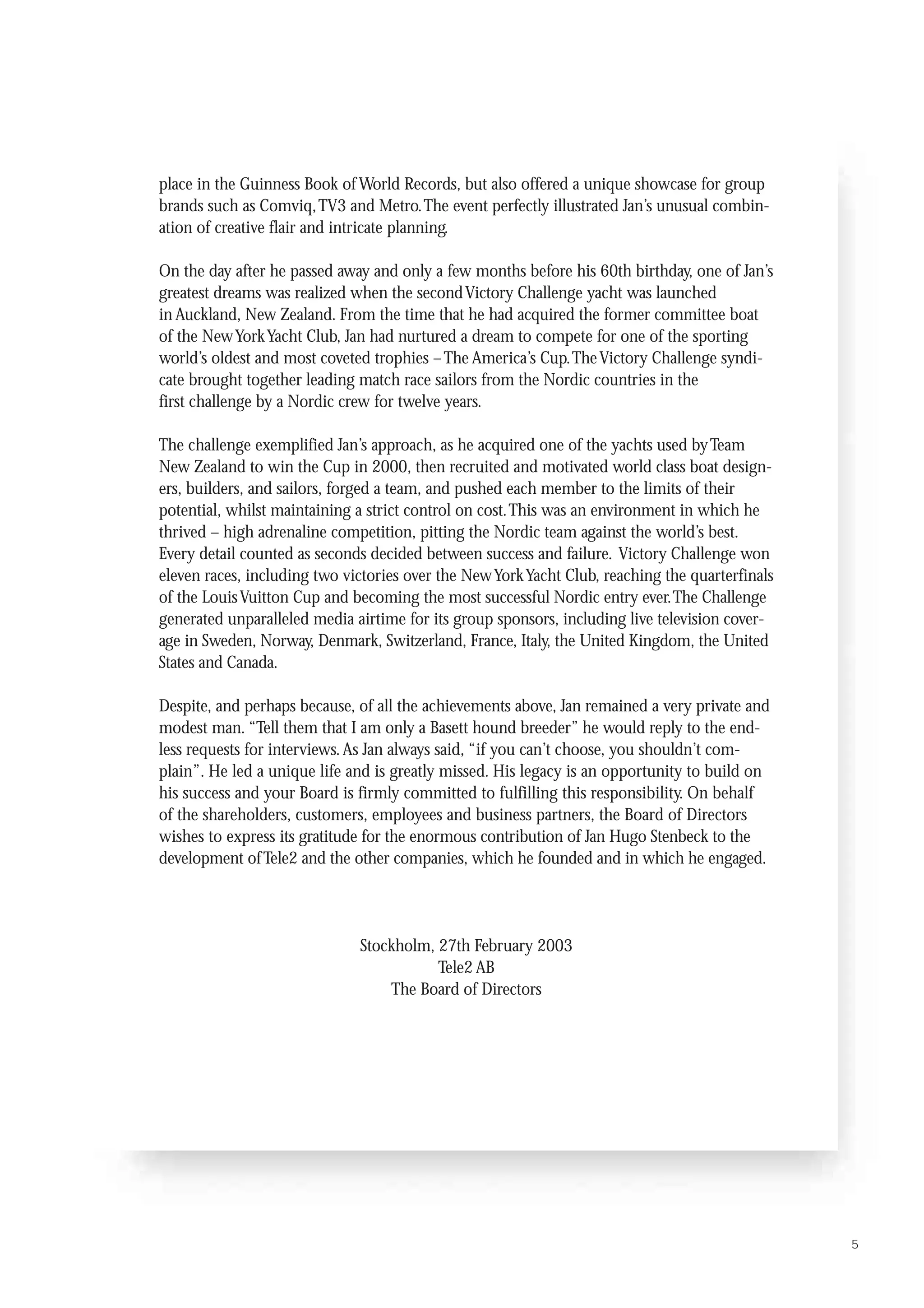

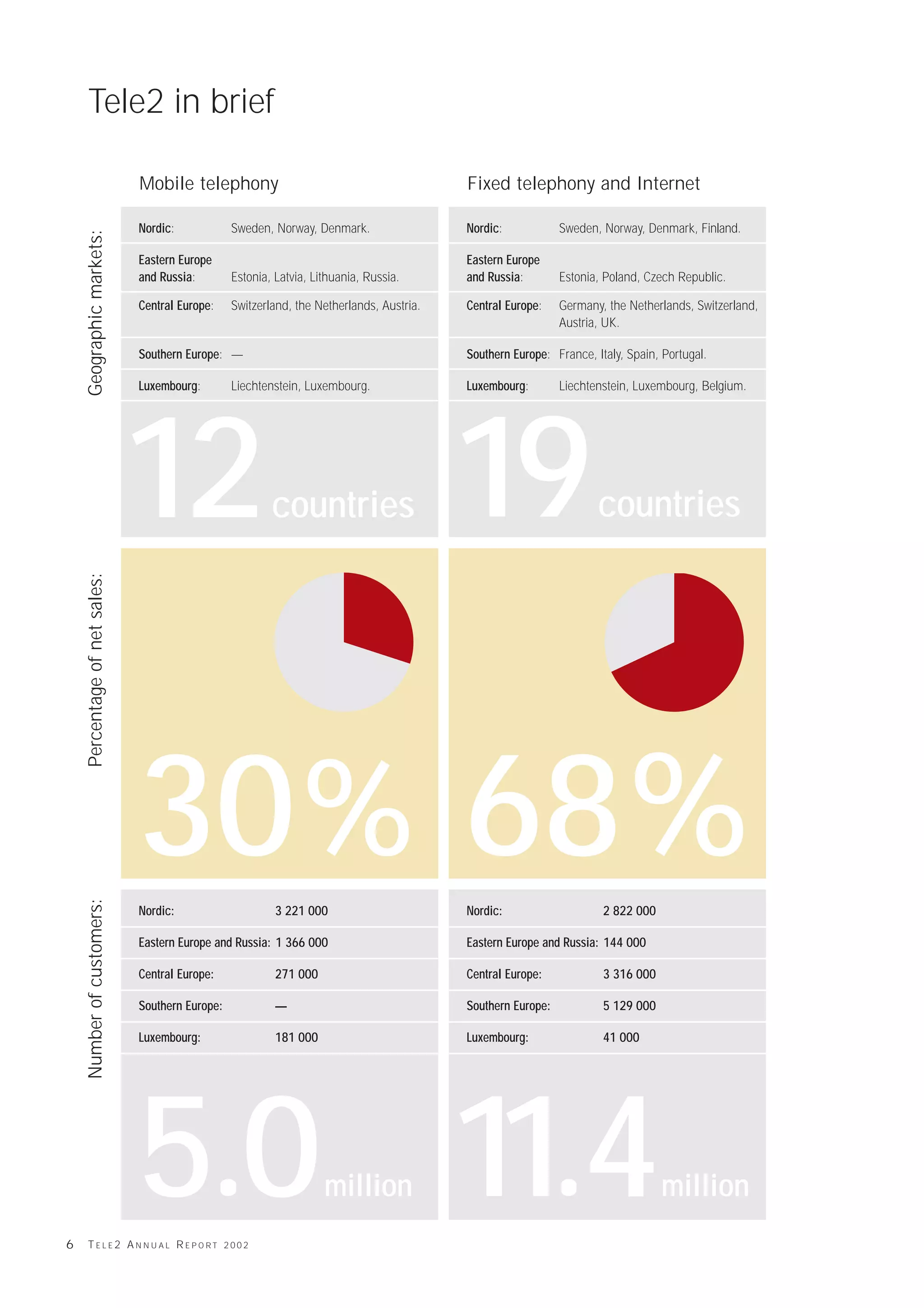

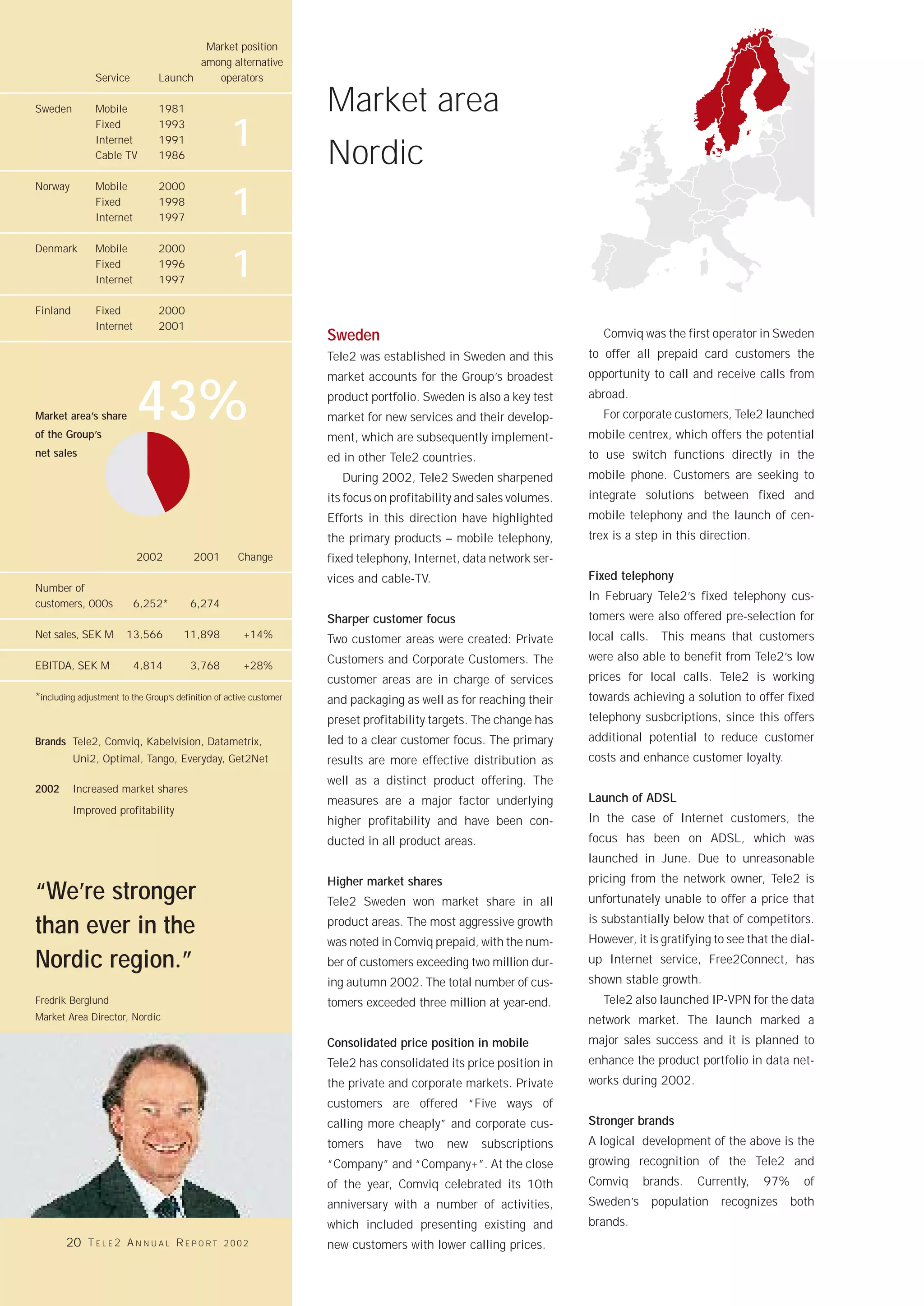

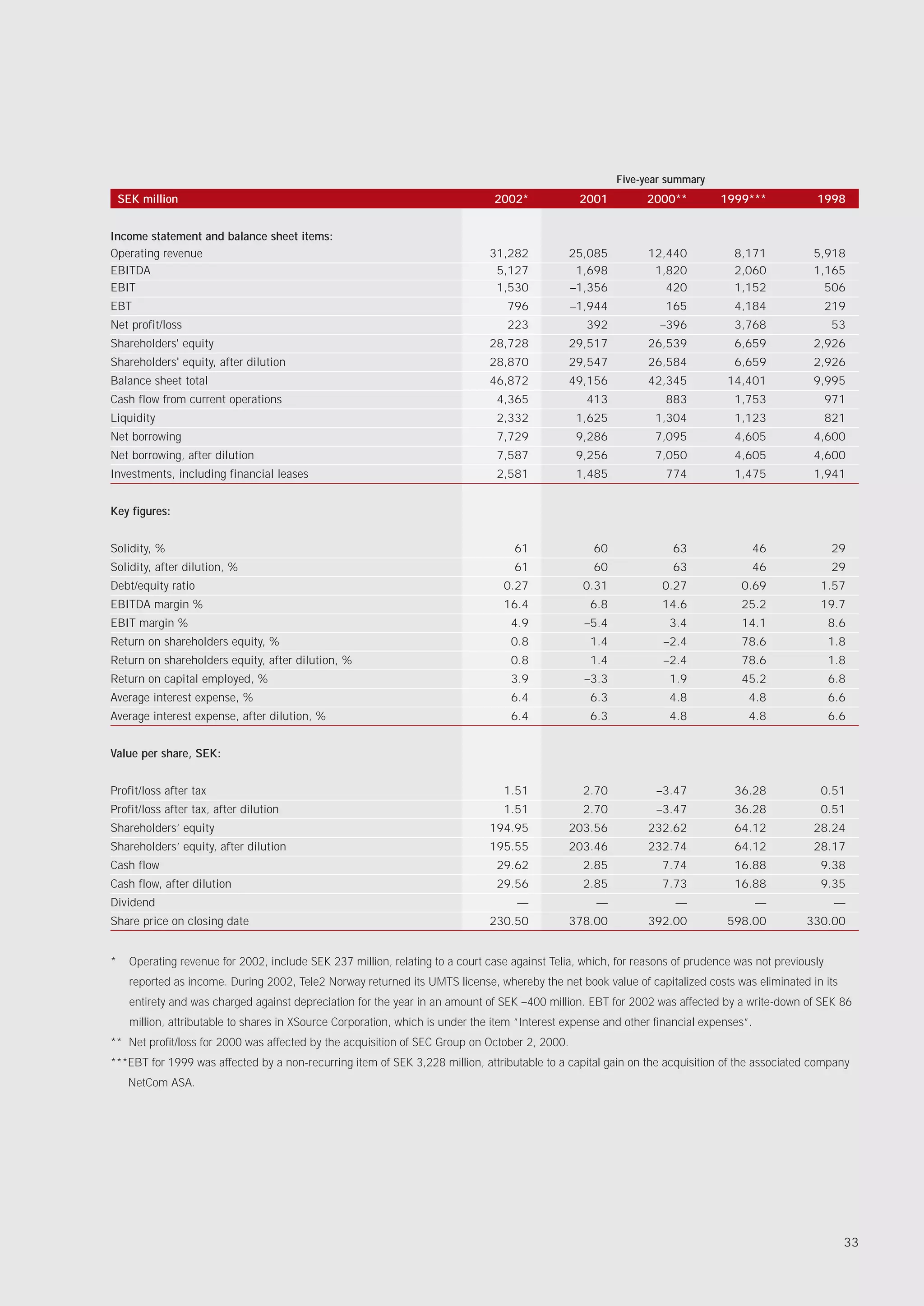

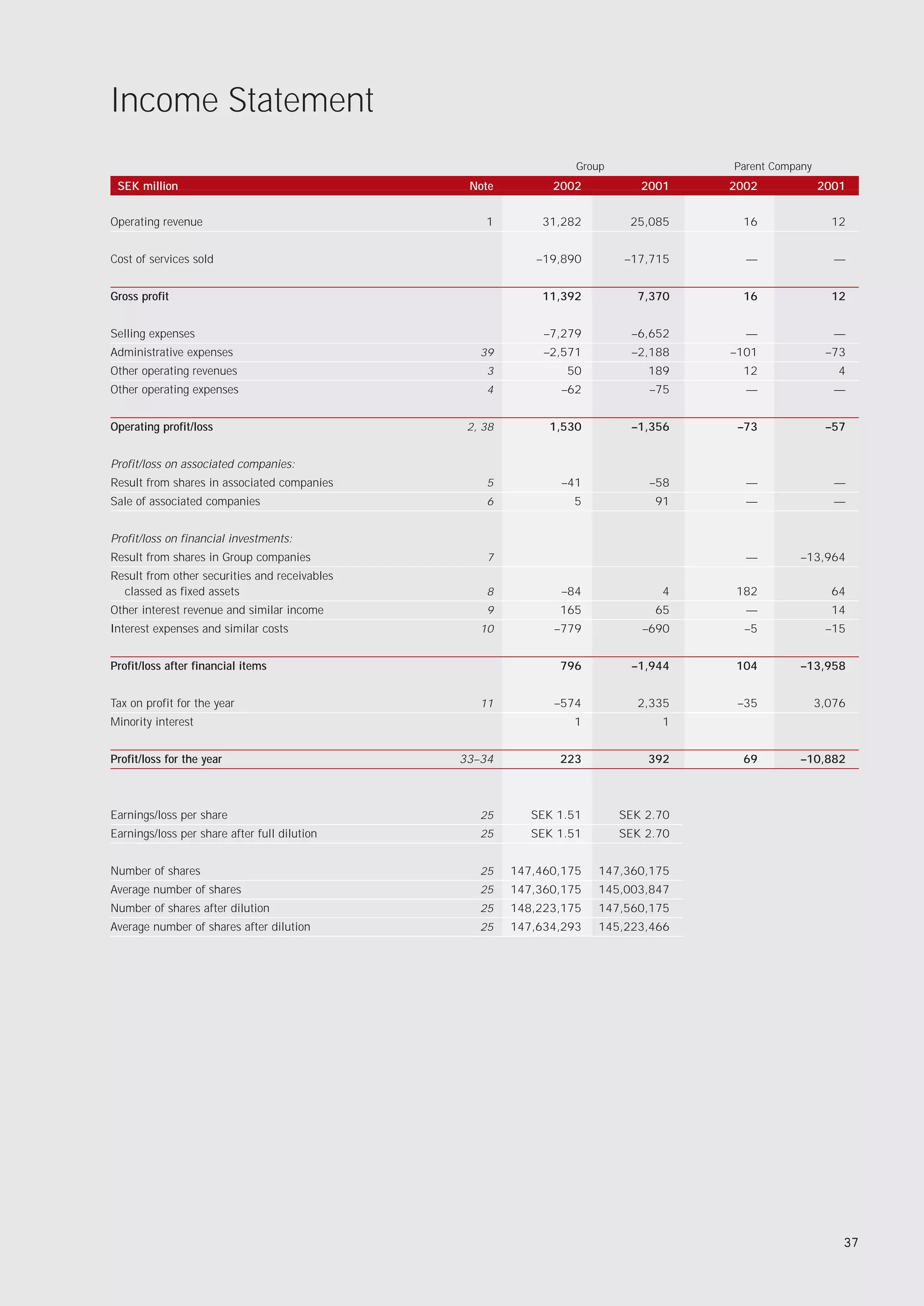

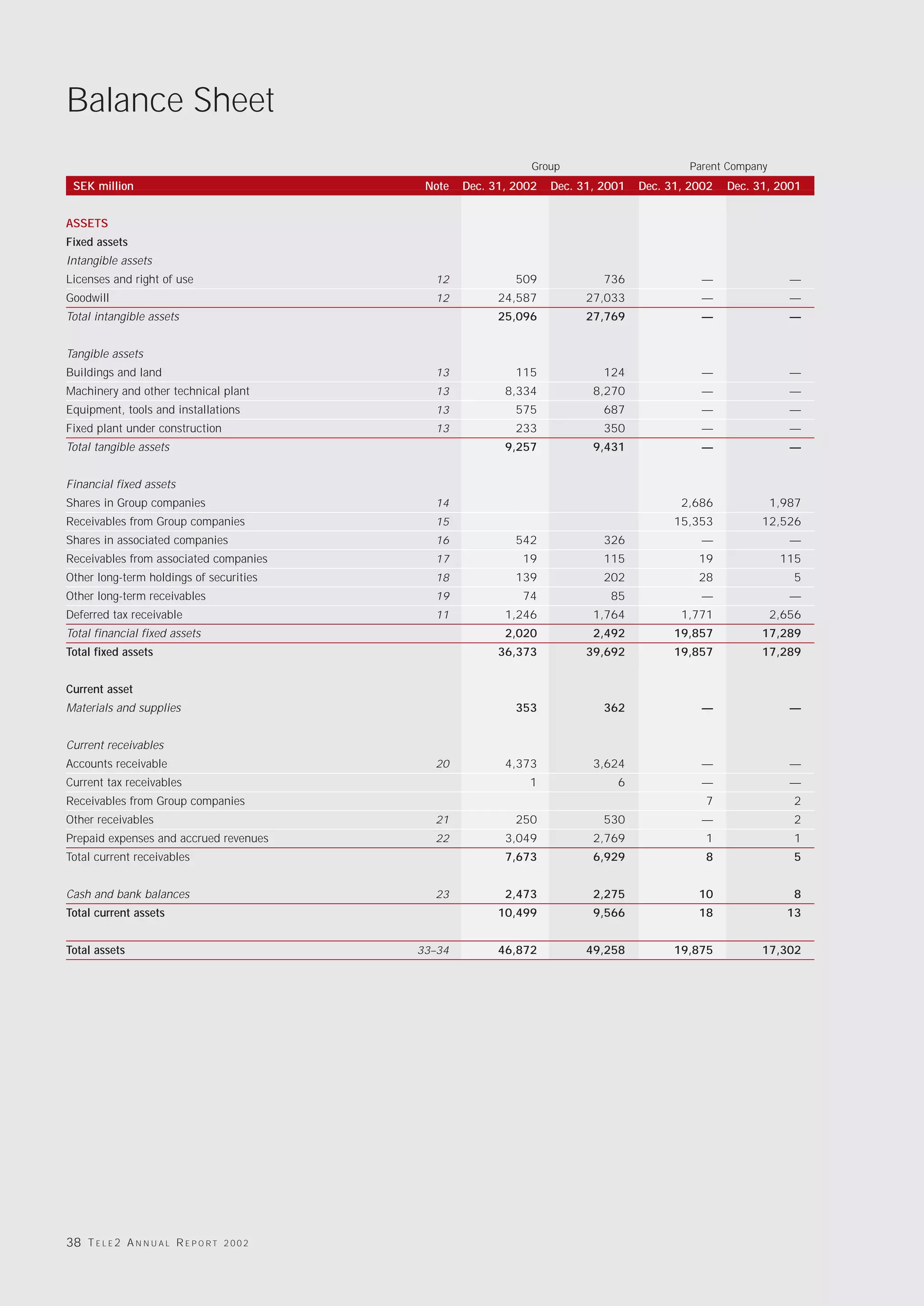

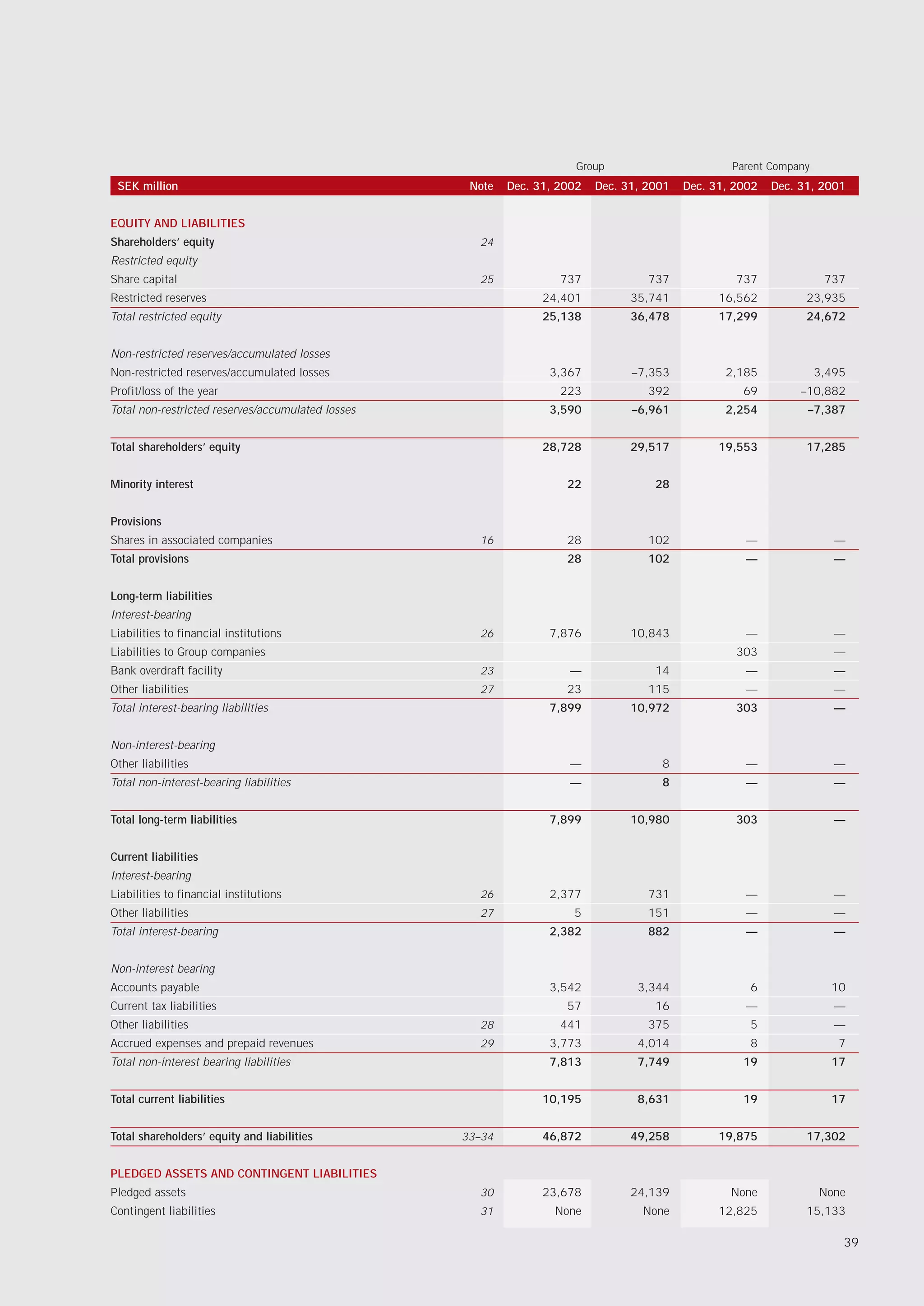

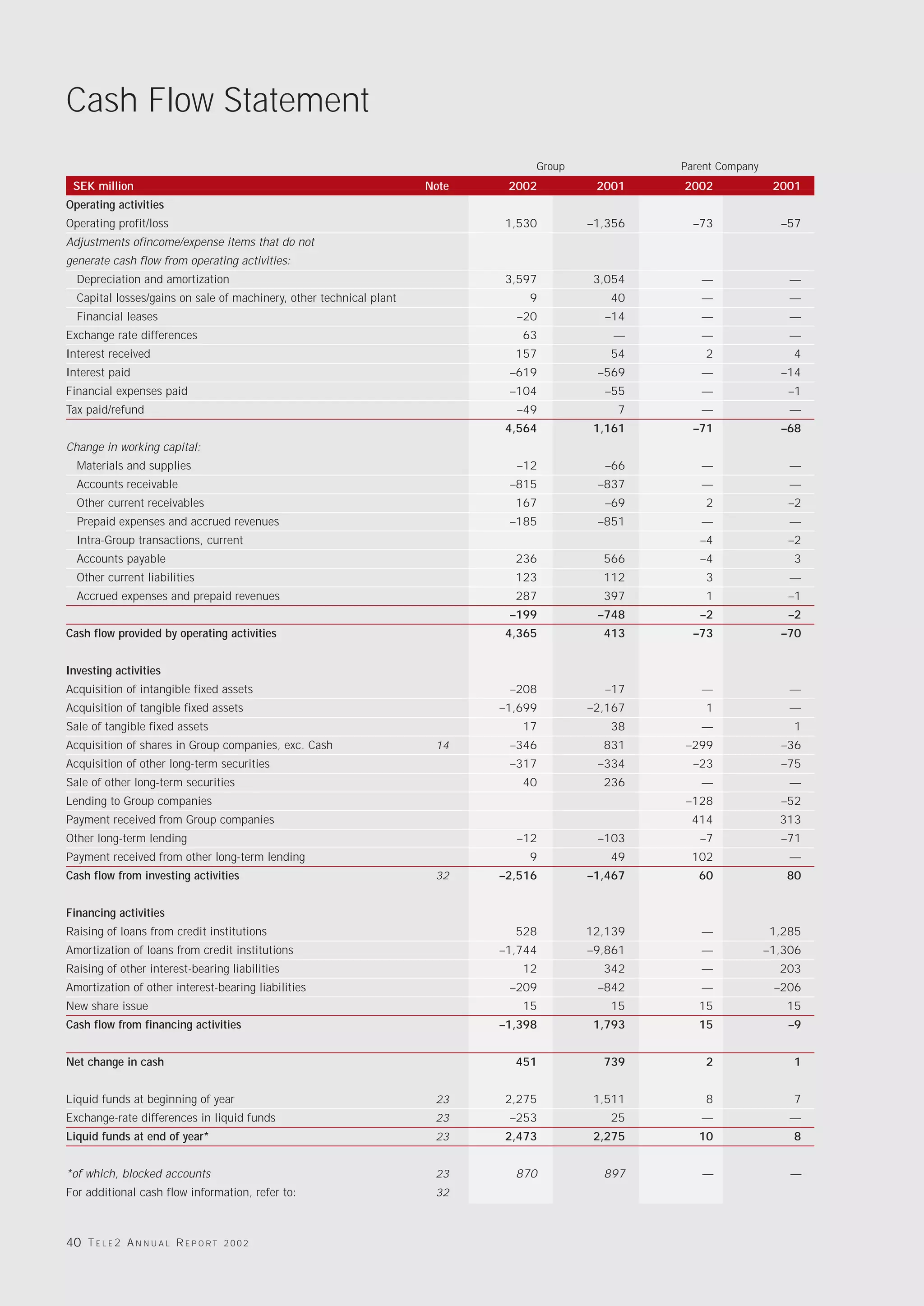

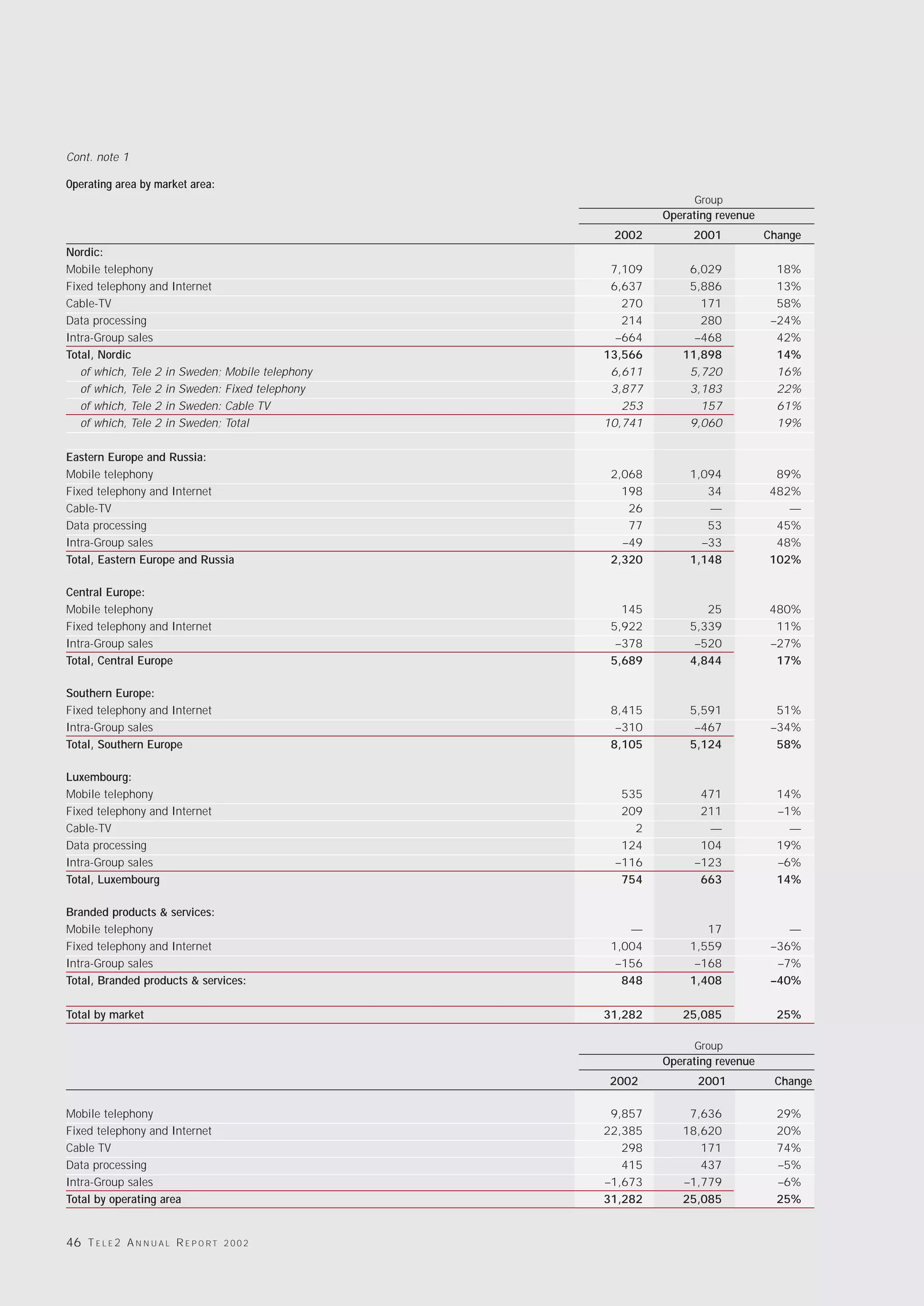

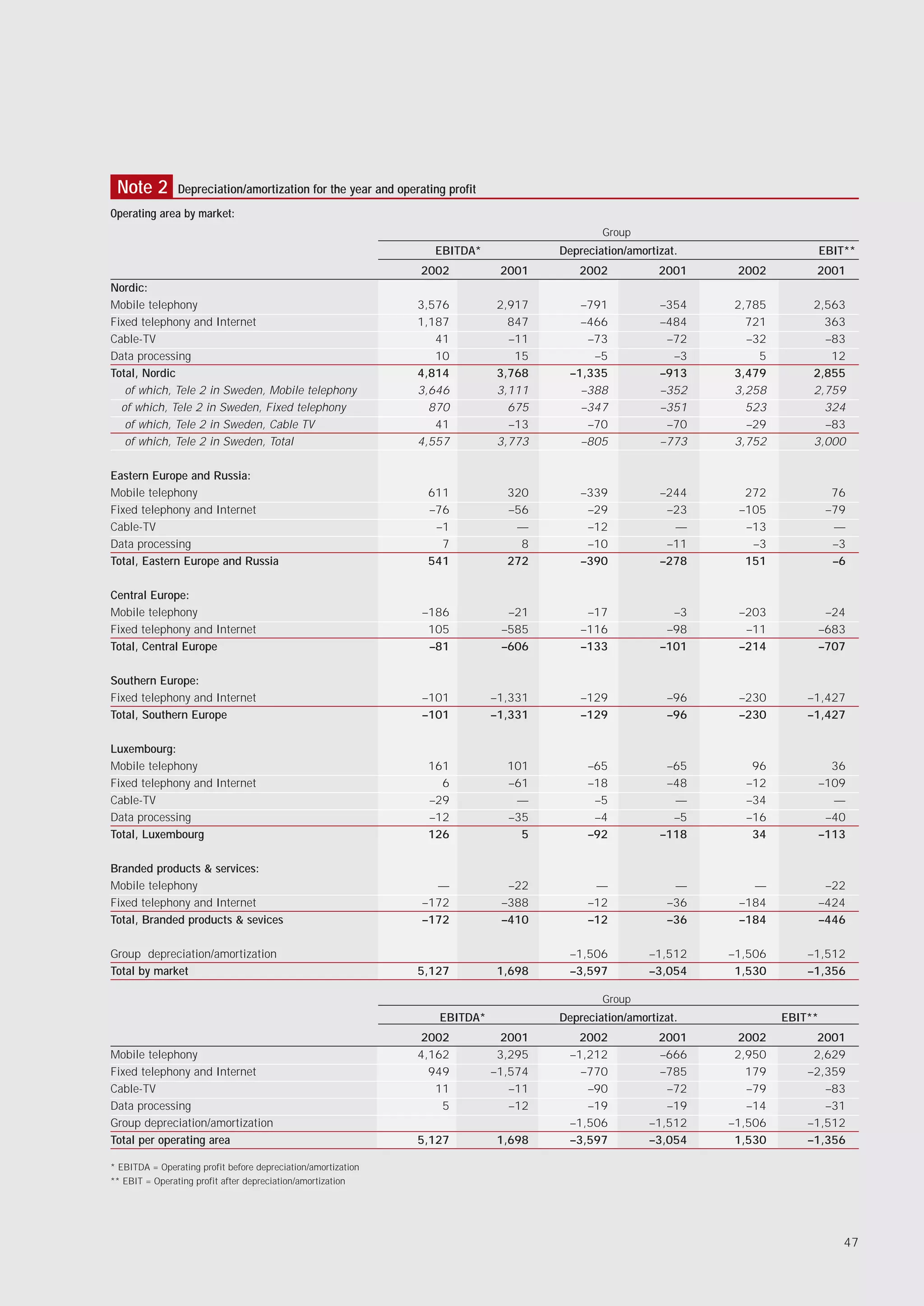

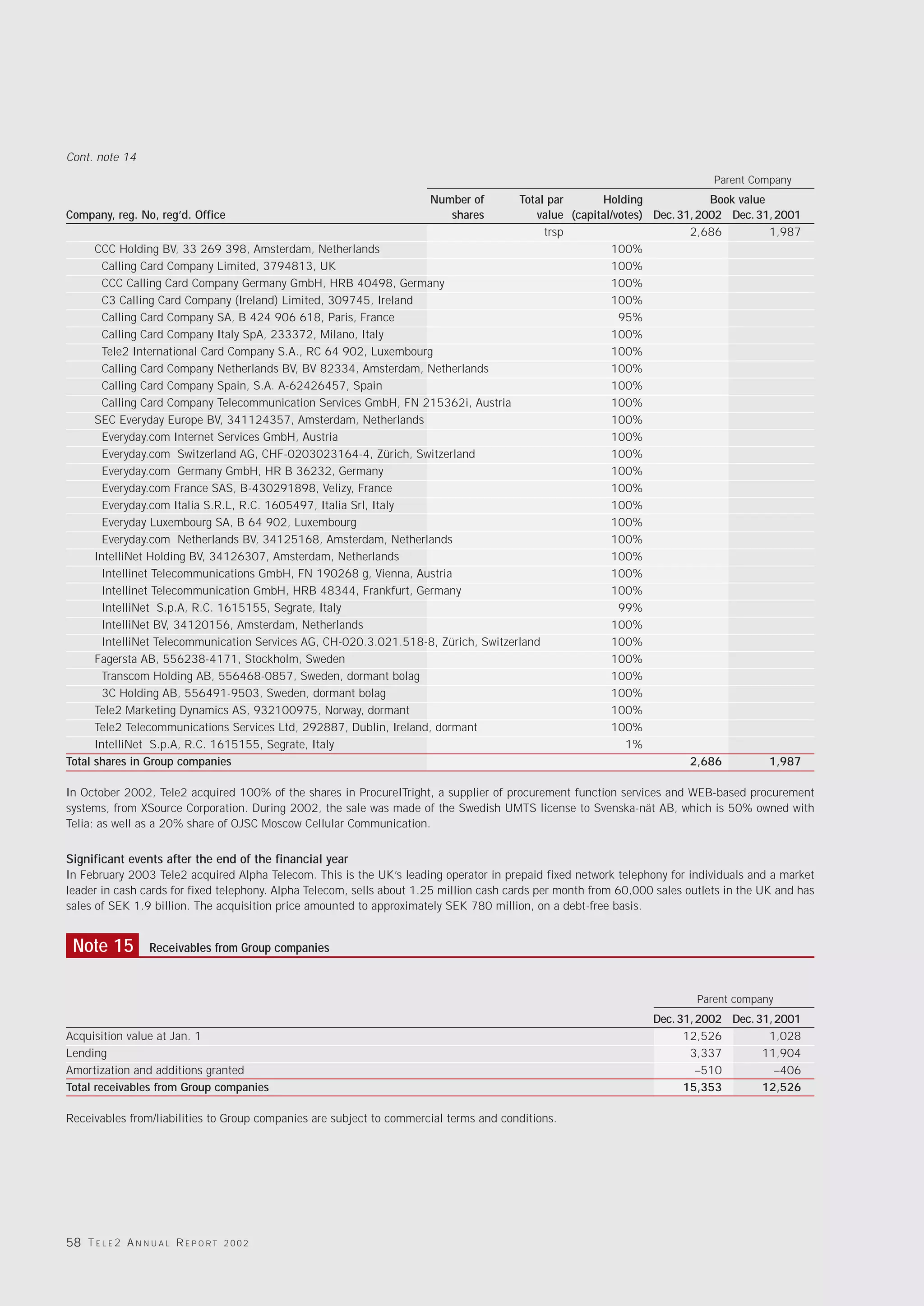

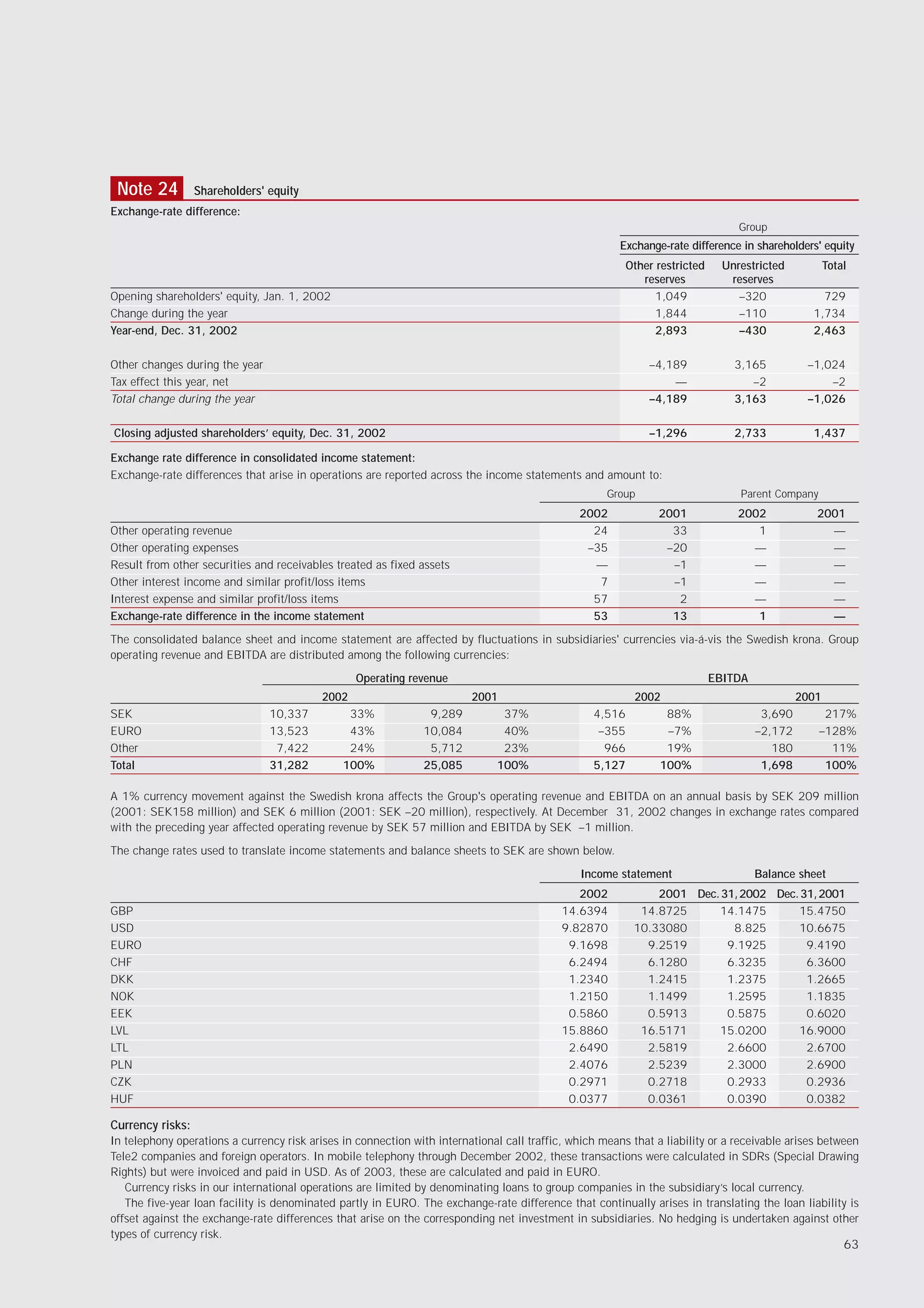

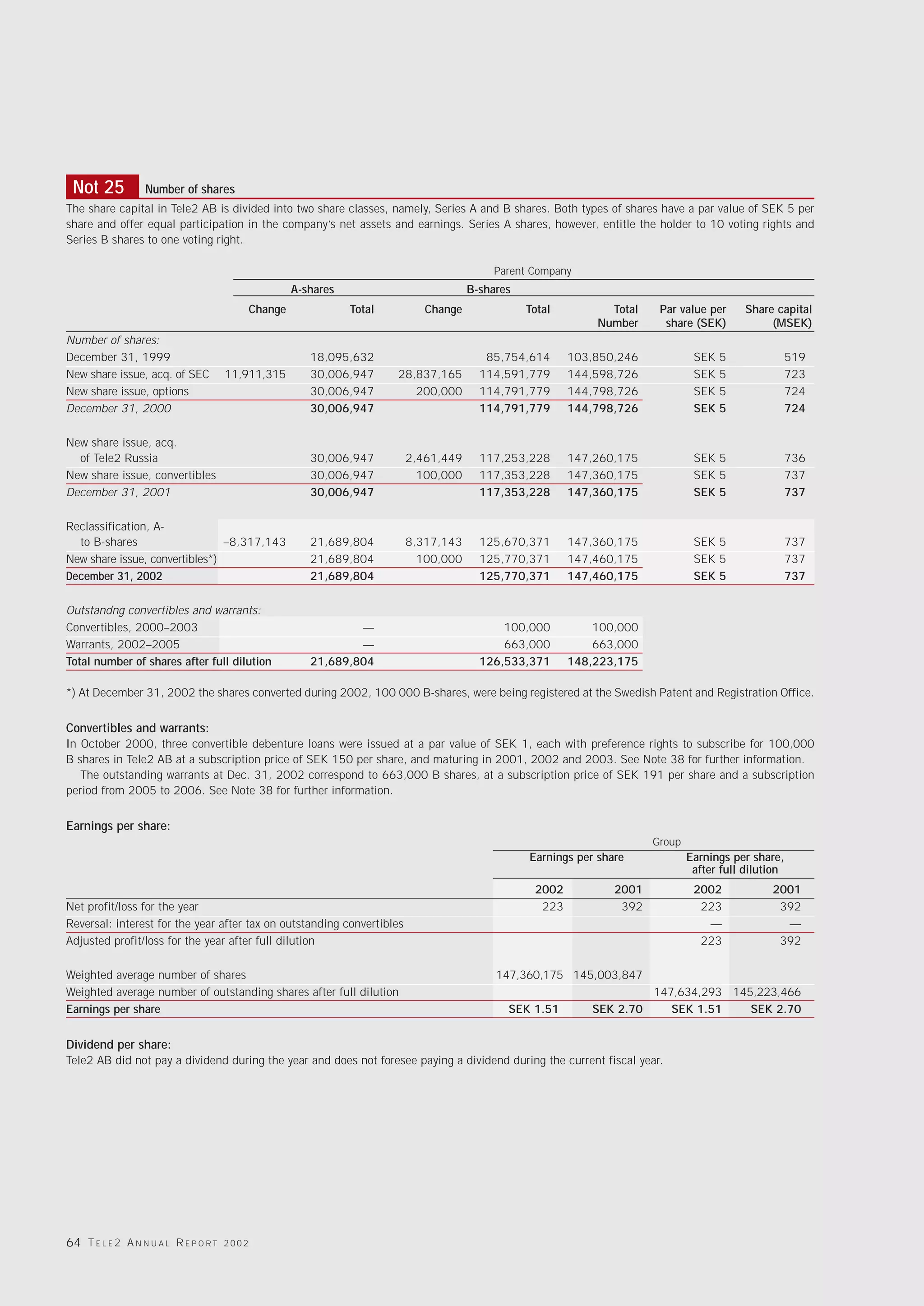

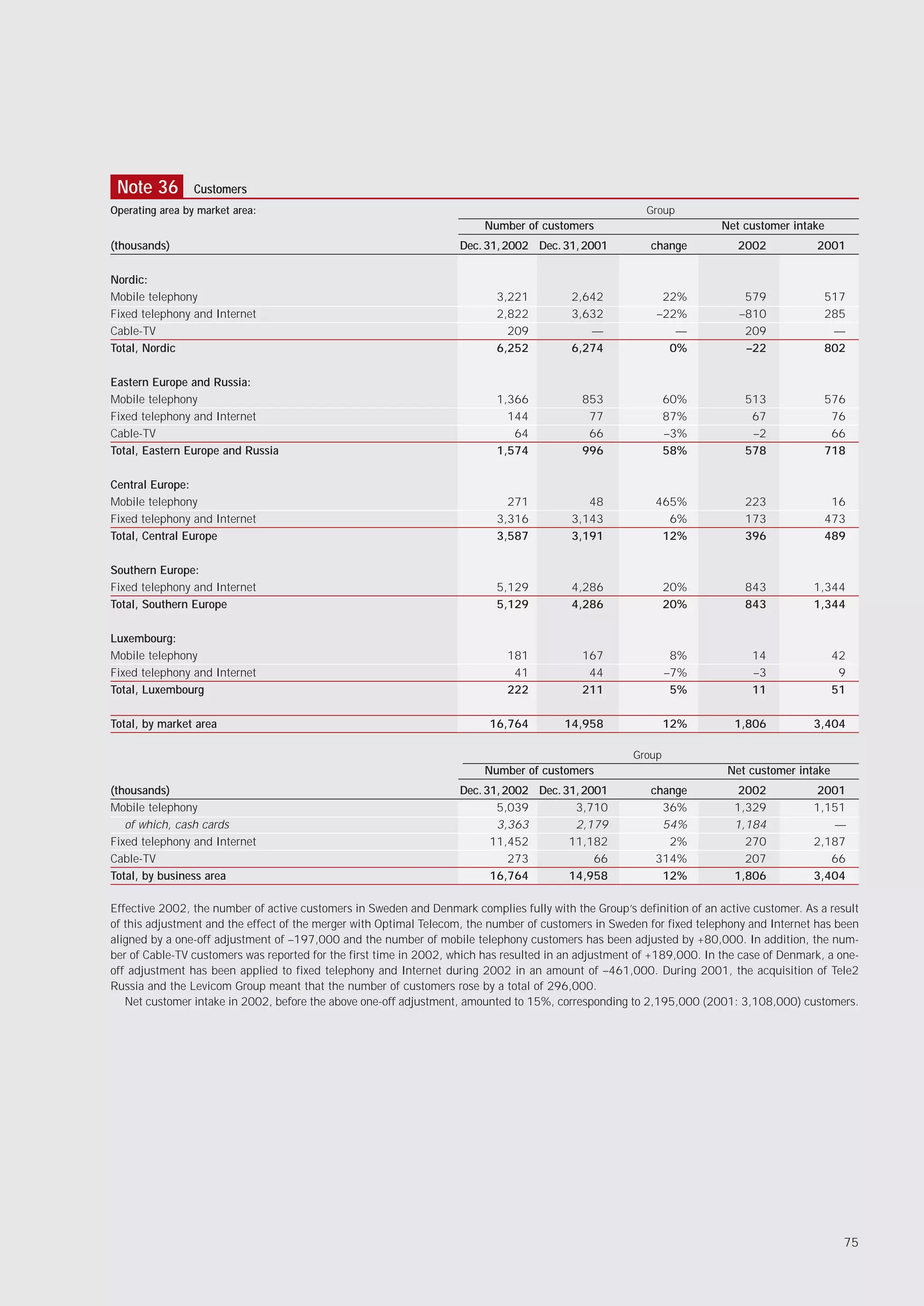

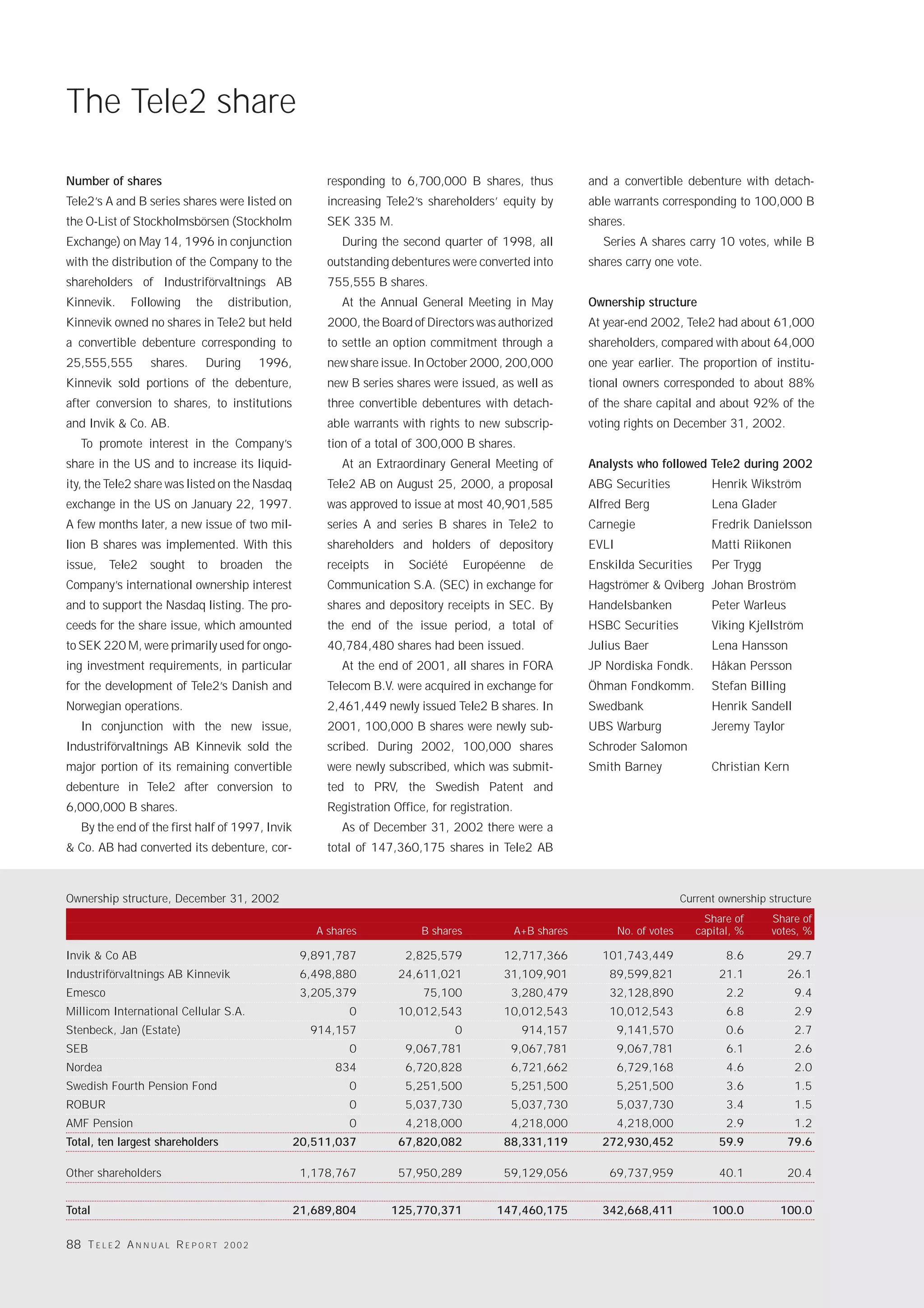

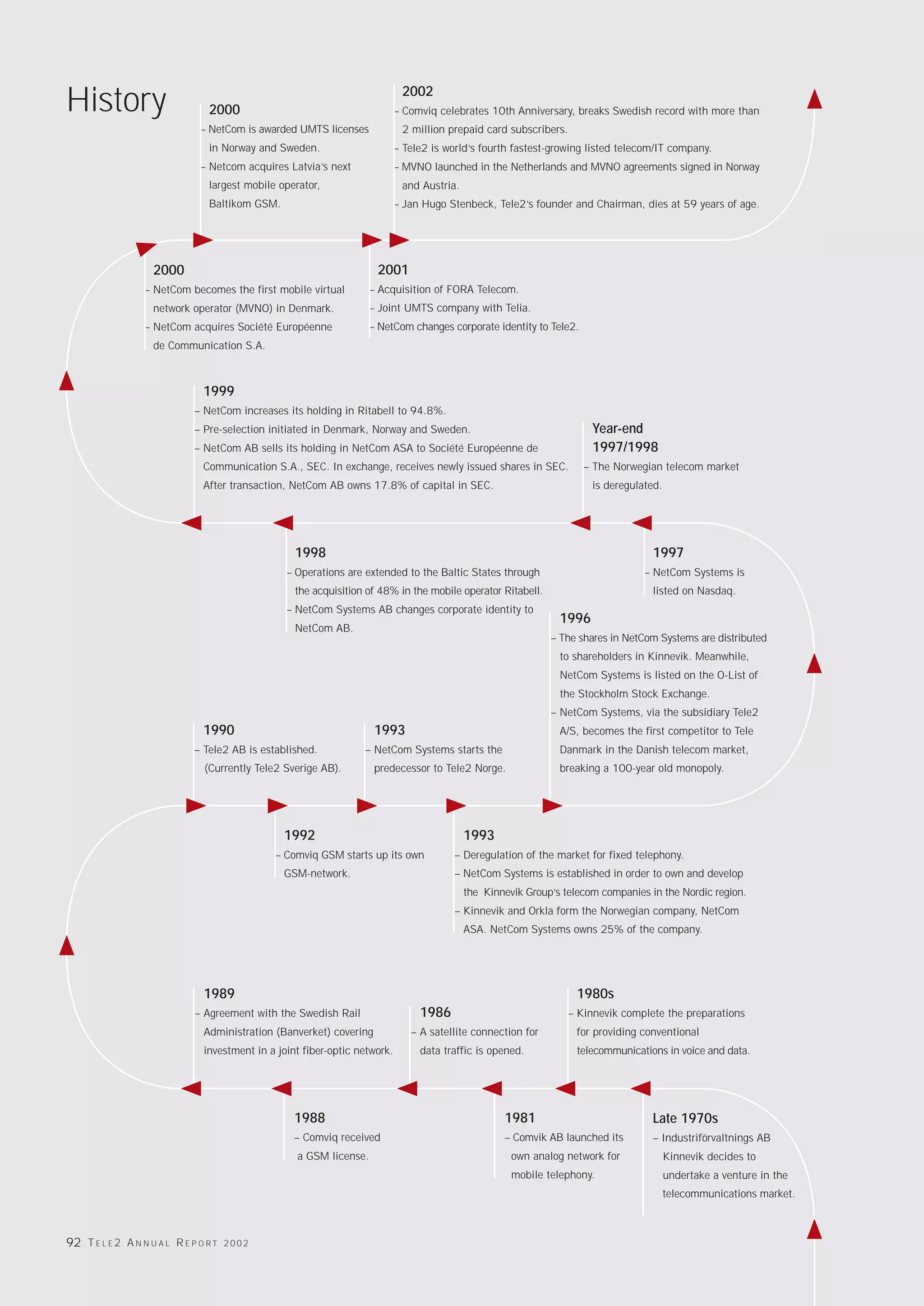

Tele2 is a leading alternative pan-European telecommunications company offering fixed and mobile telephony, internet, and data network services to over 16.8 million customers across 22 countries in Europe and Russia. In 2002, Tele2 saw significant growth and improved financial results, including a 25% increase in operating revenue to SEK 31.3 billion and positive EBITDA of SEK 5.1 billion compared to SEK 1.7 billion in 2001. Tele2 also ended the year with 16.8 million customers, an increase of 12% over 2001. At the beginning of 2003, Tele2 acquired the British company Alpha Telecom to further expand its business.