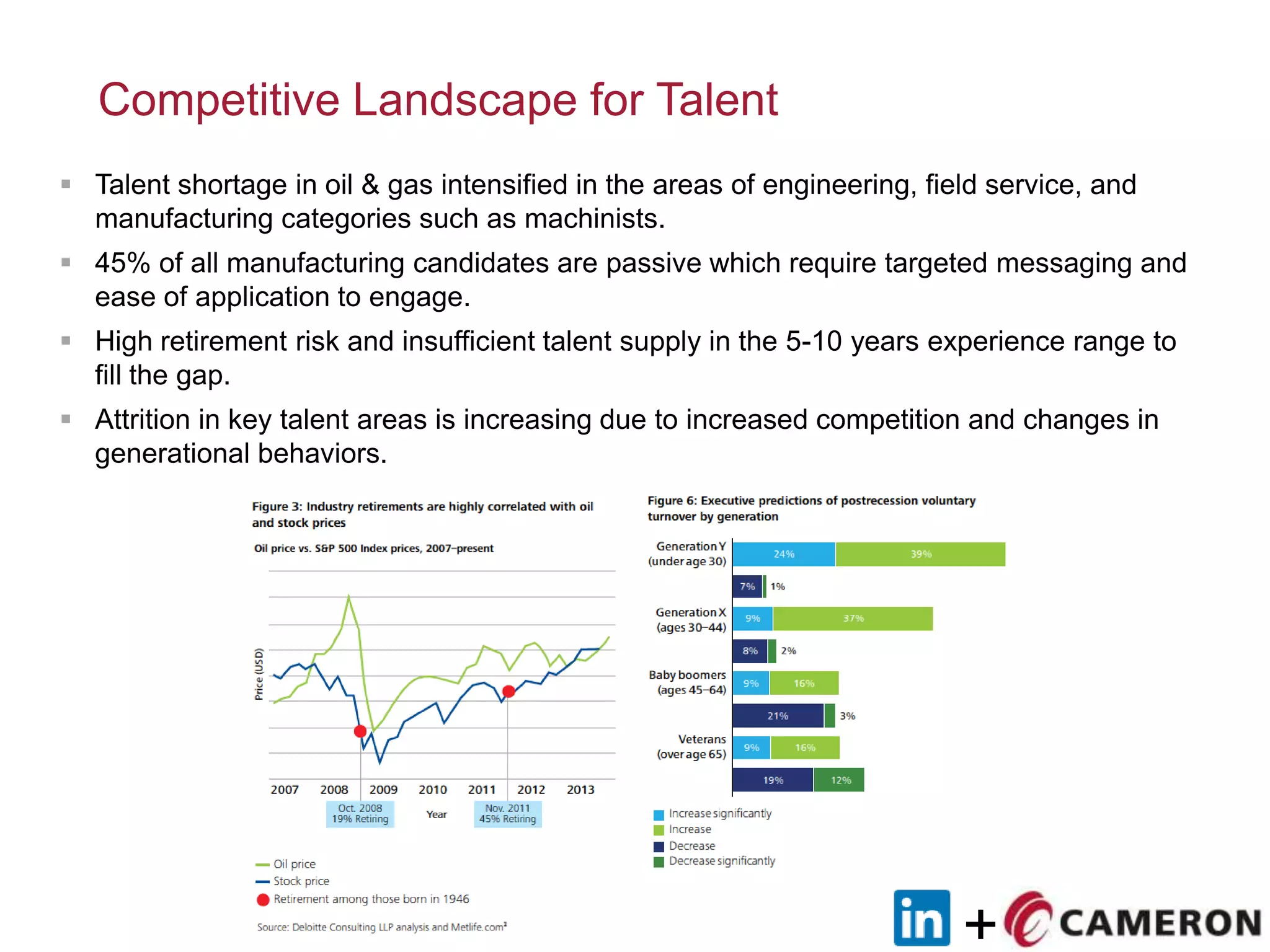

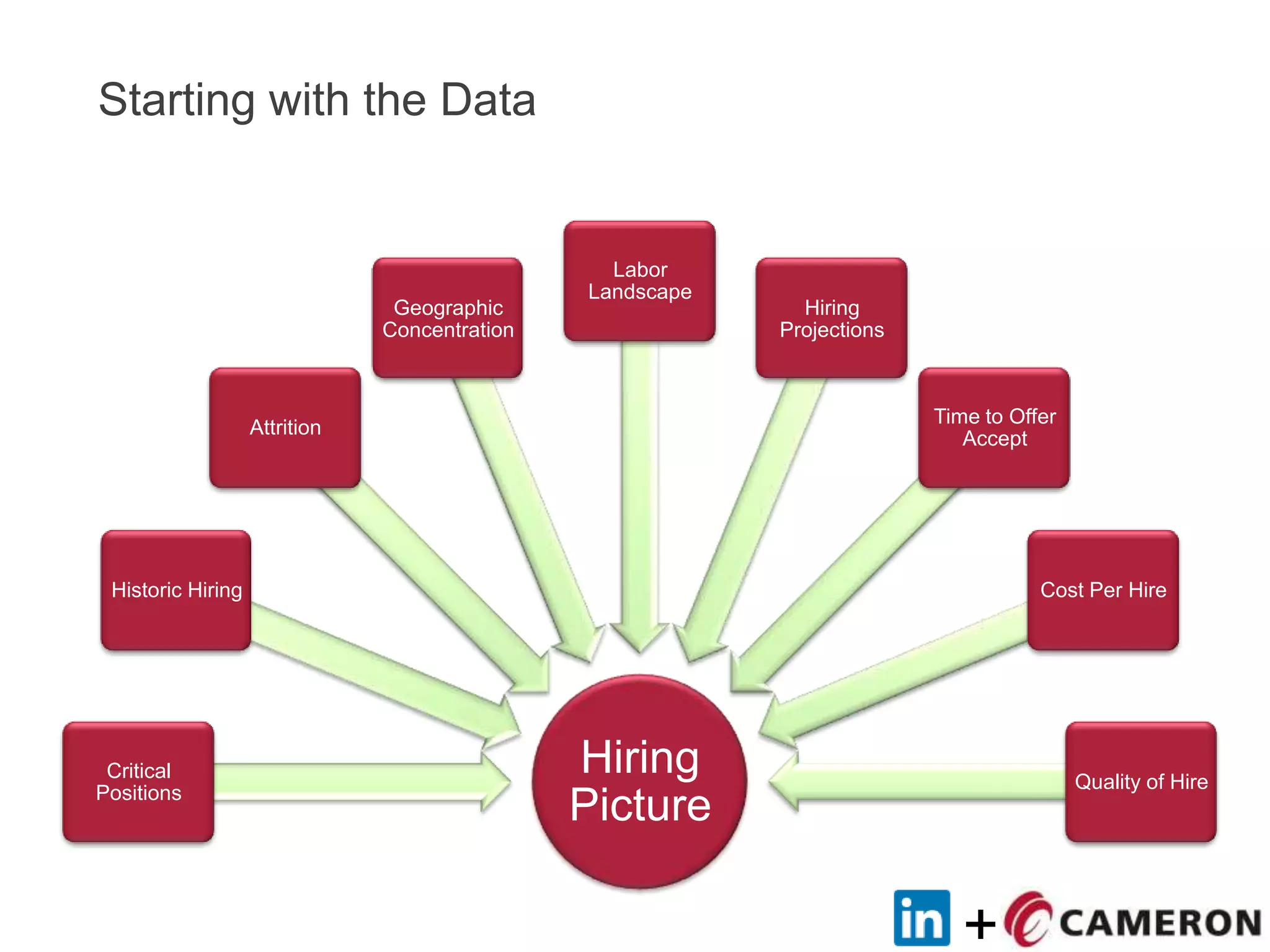

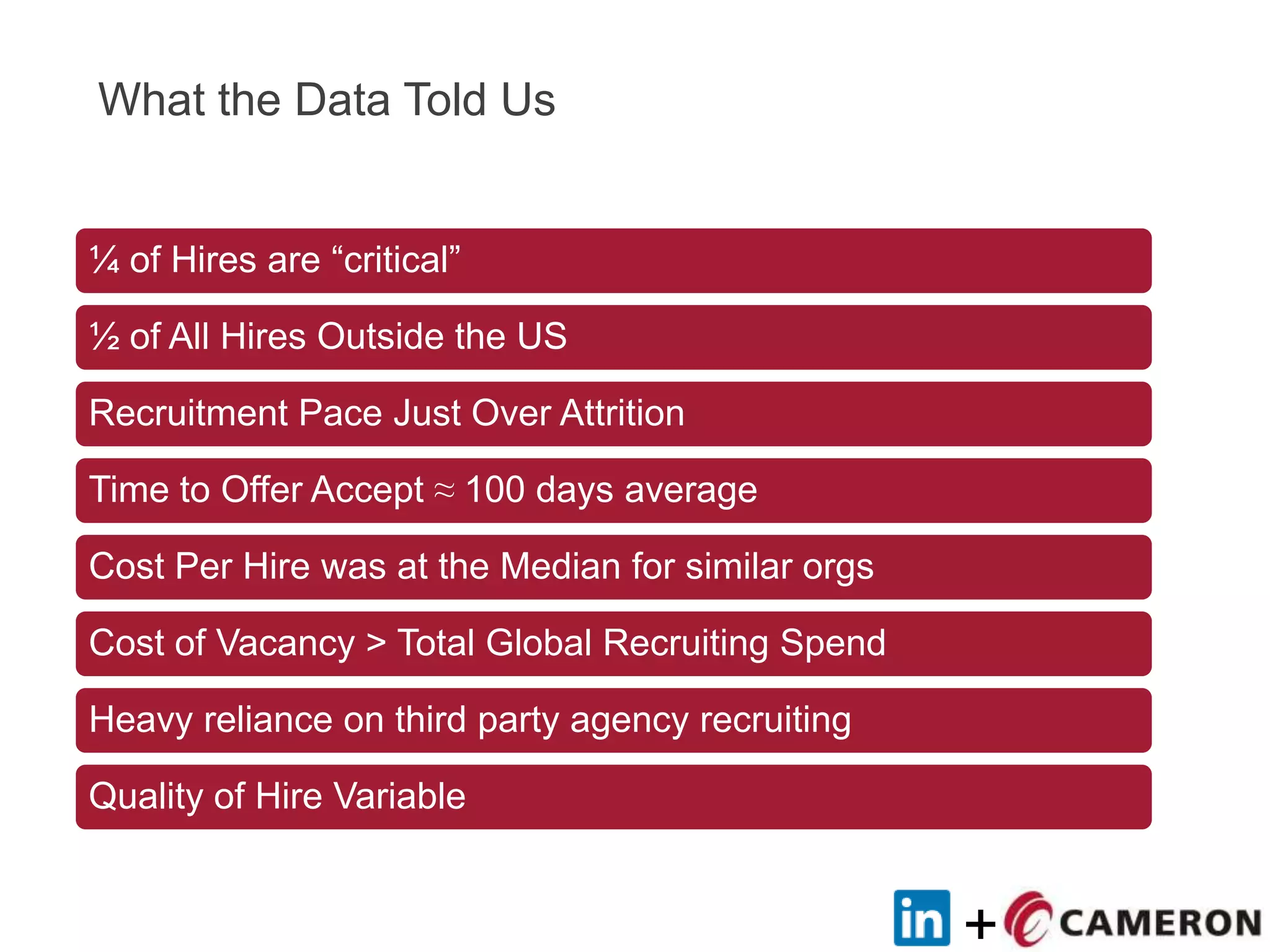

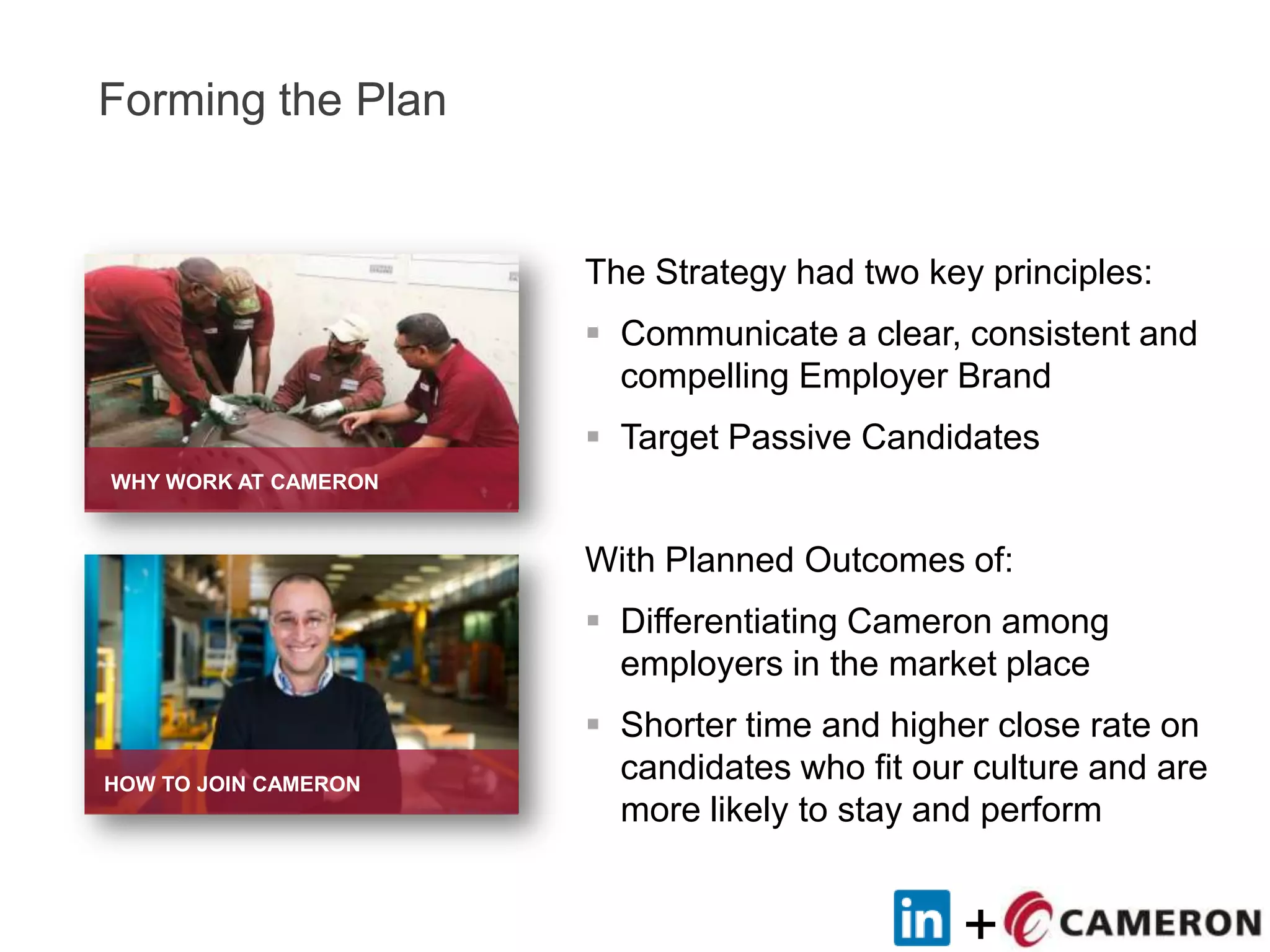

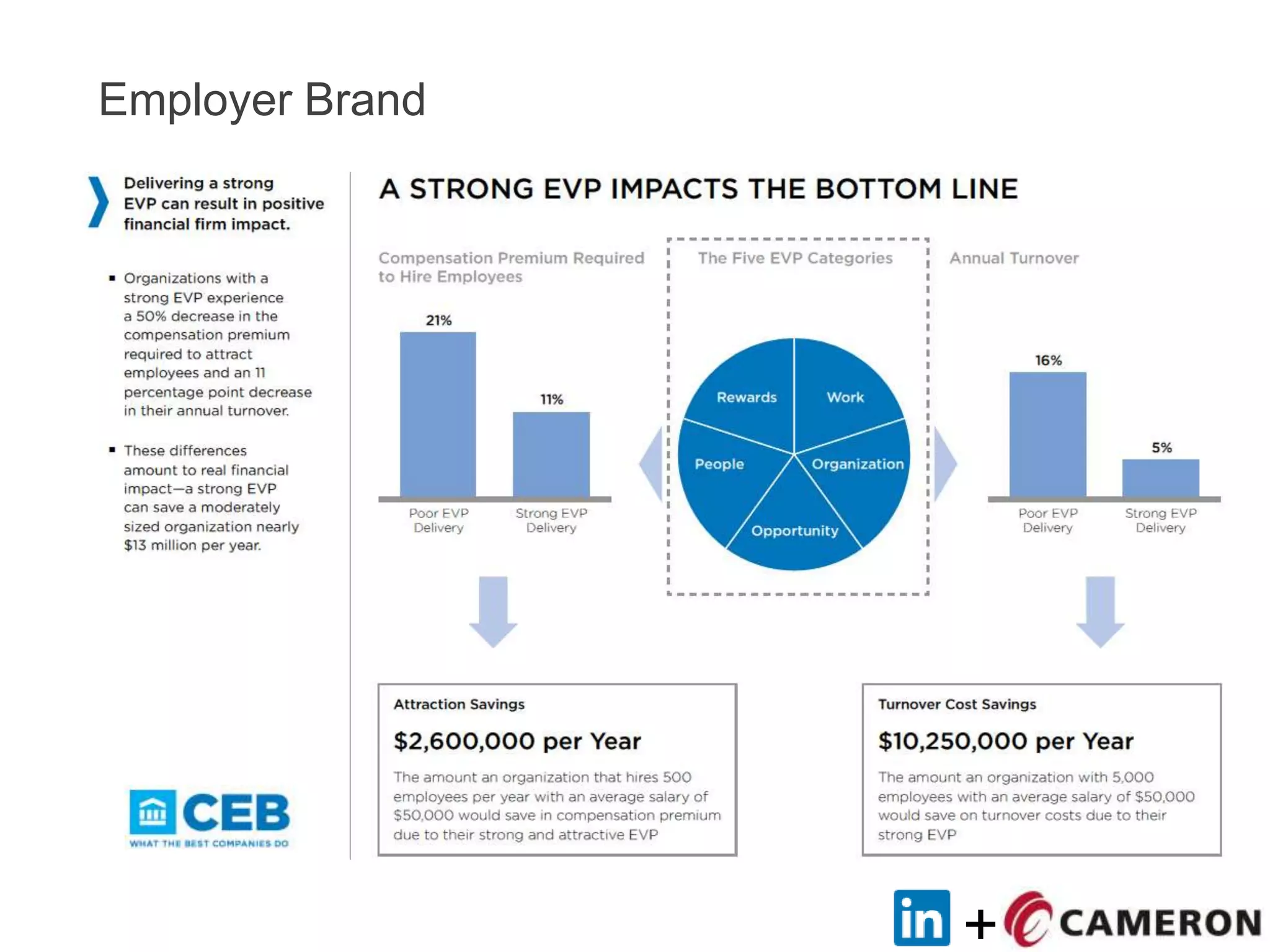

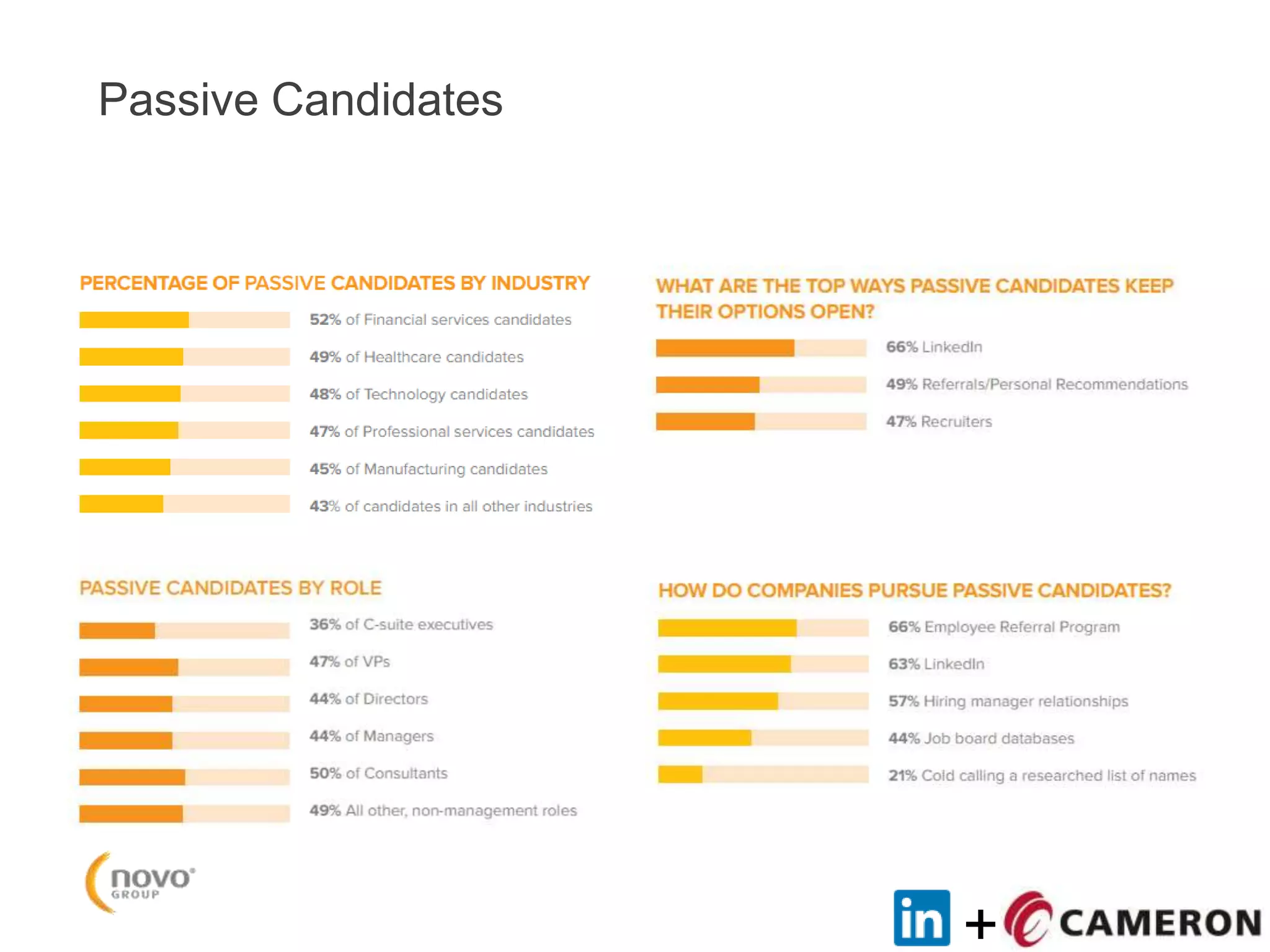

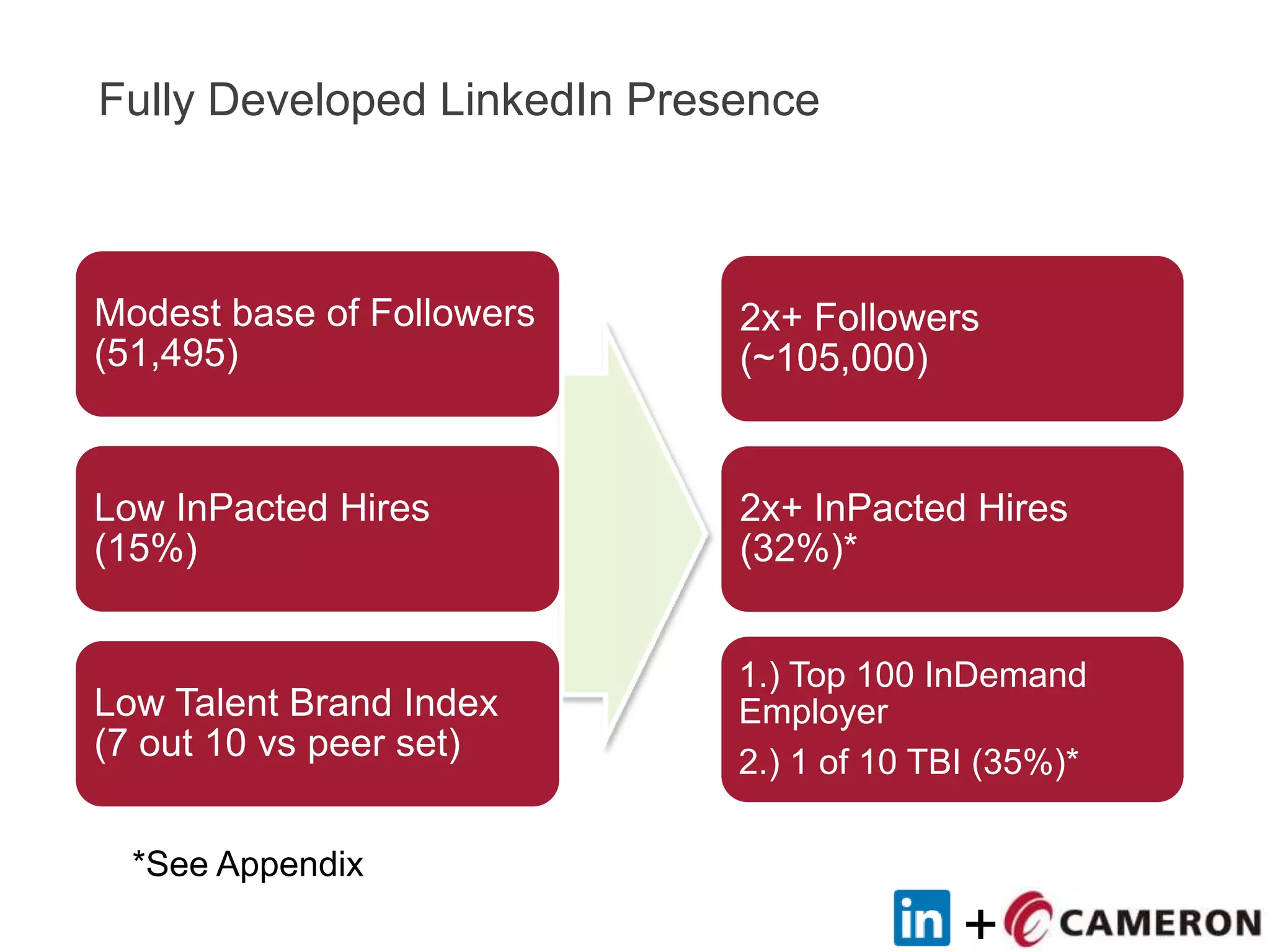

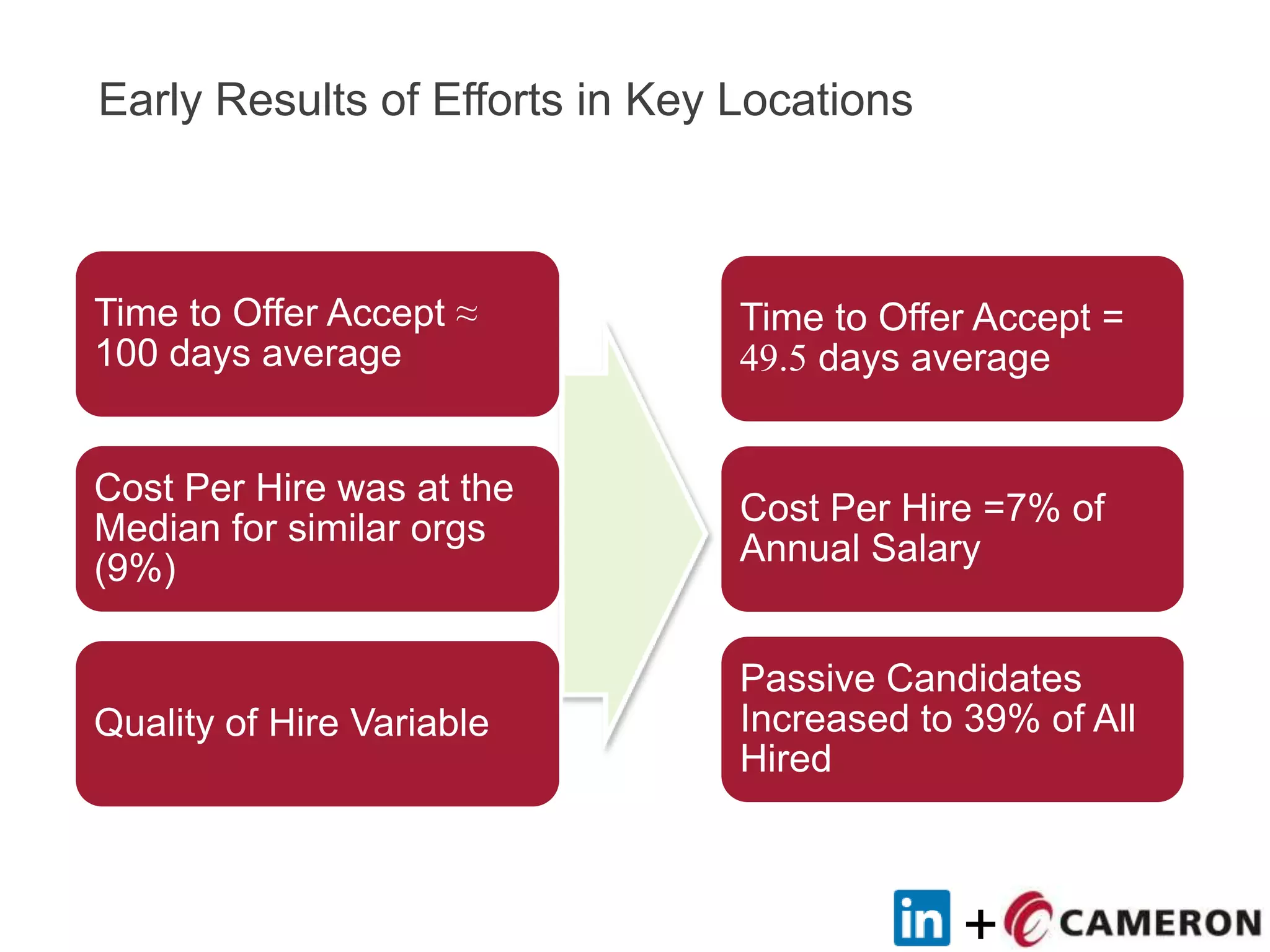

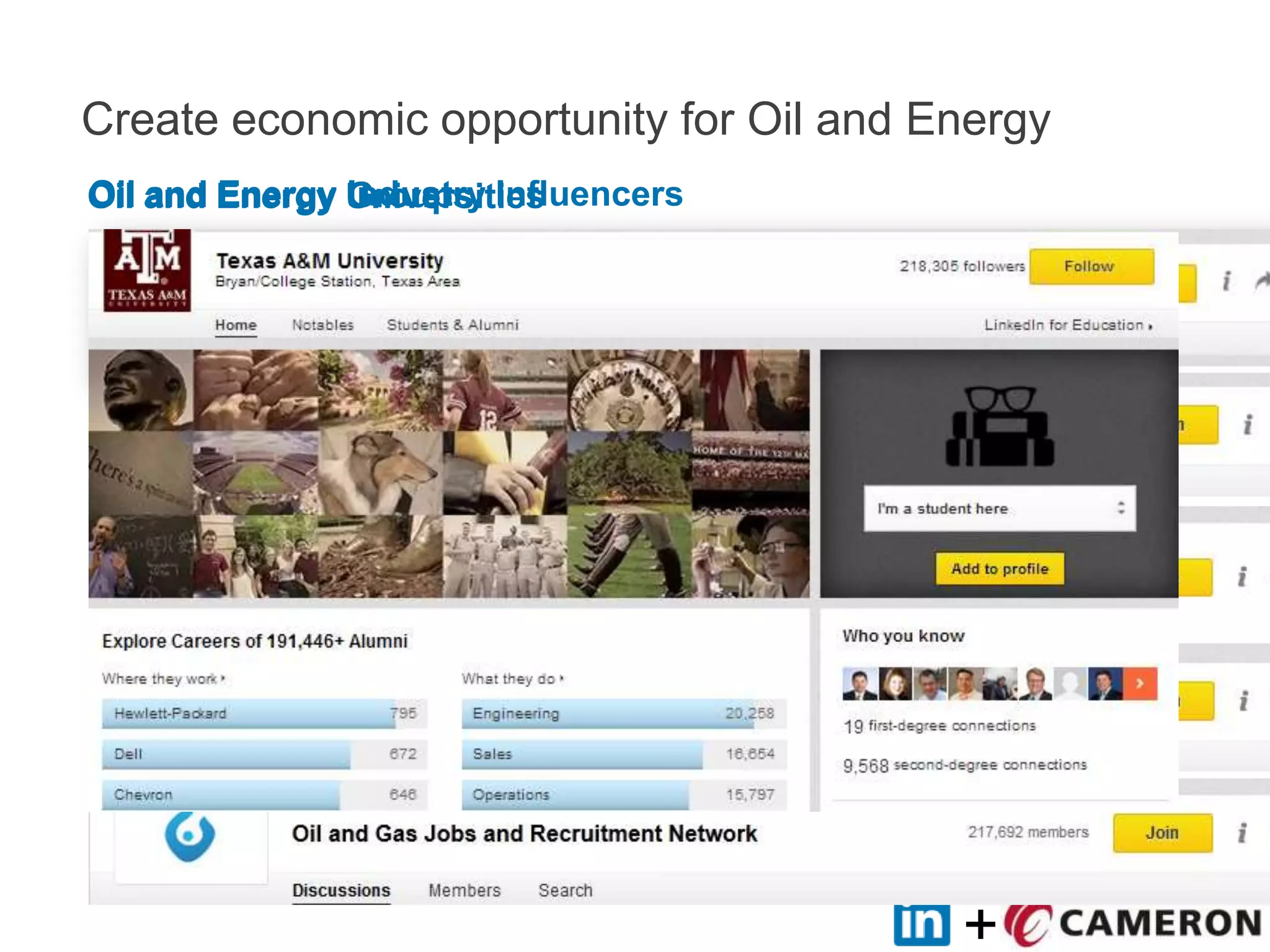

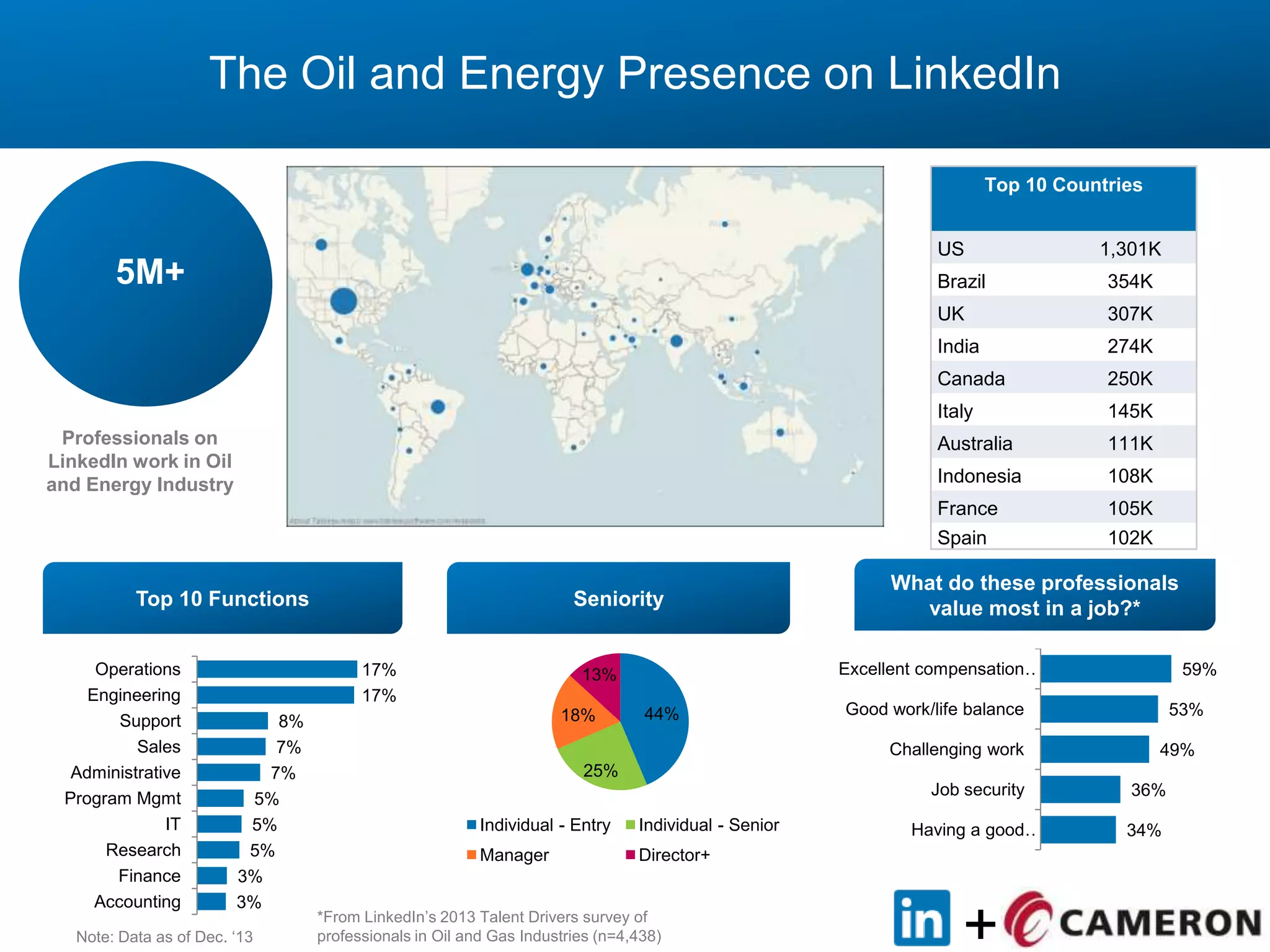

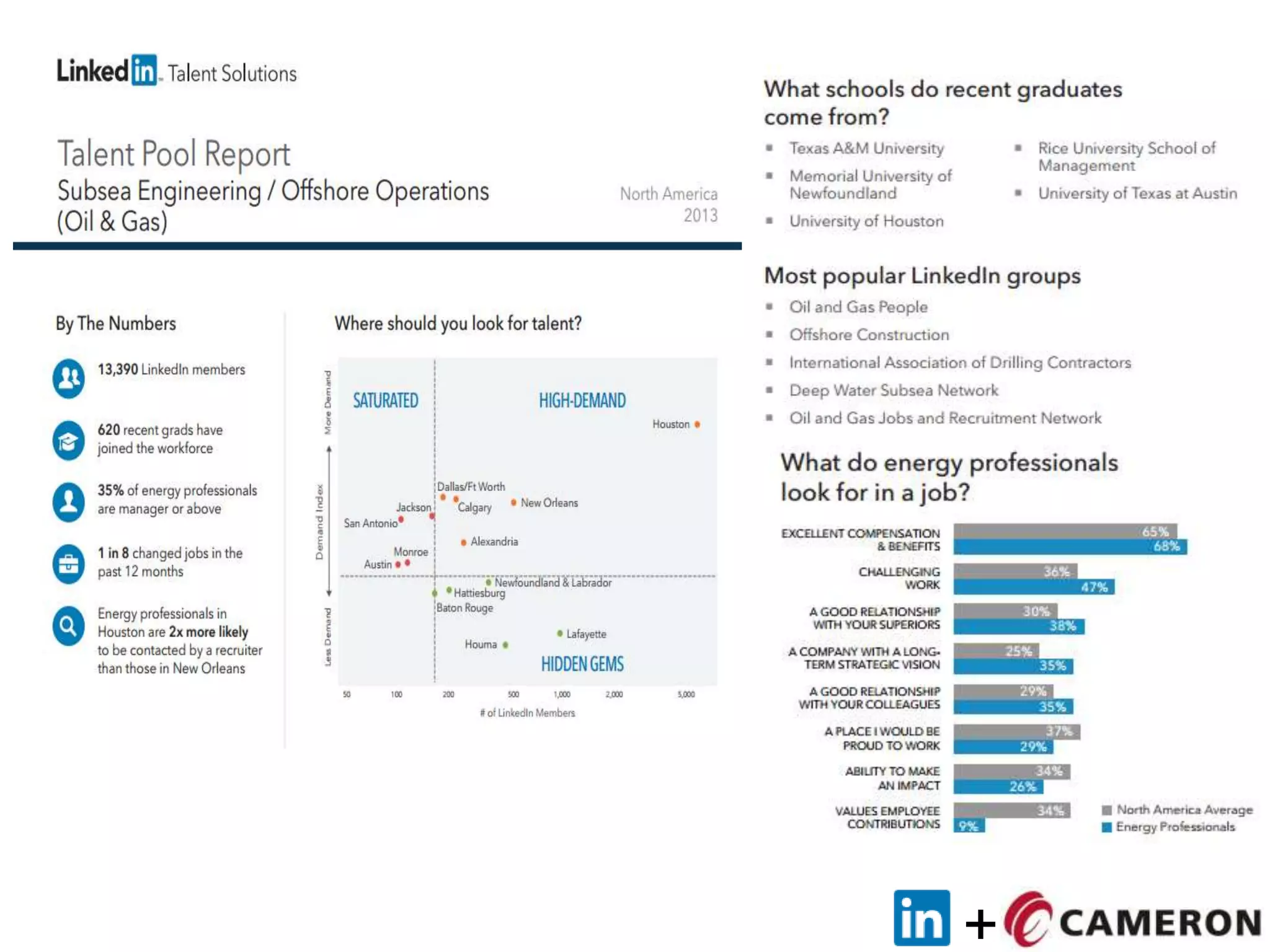

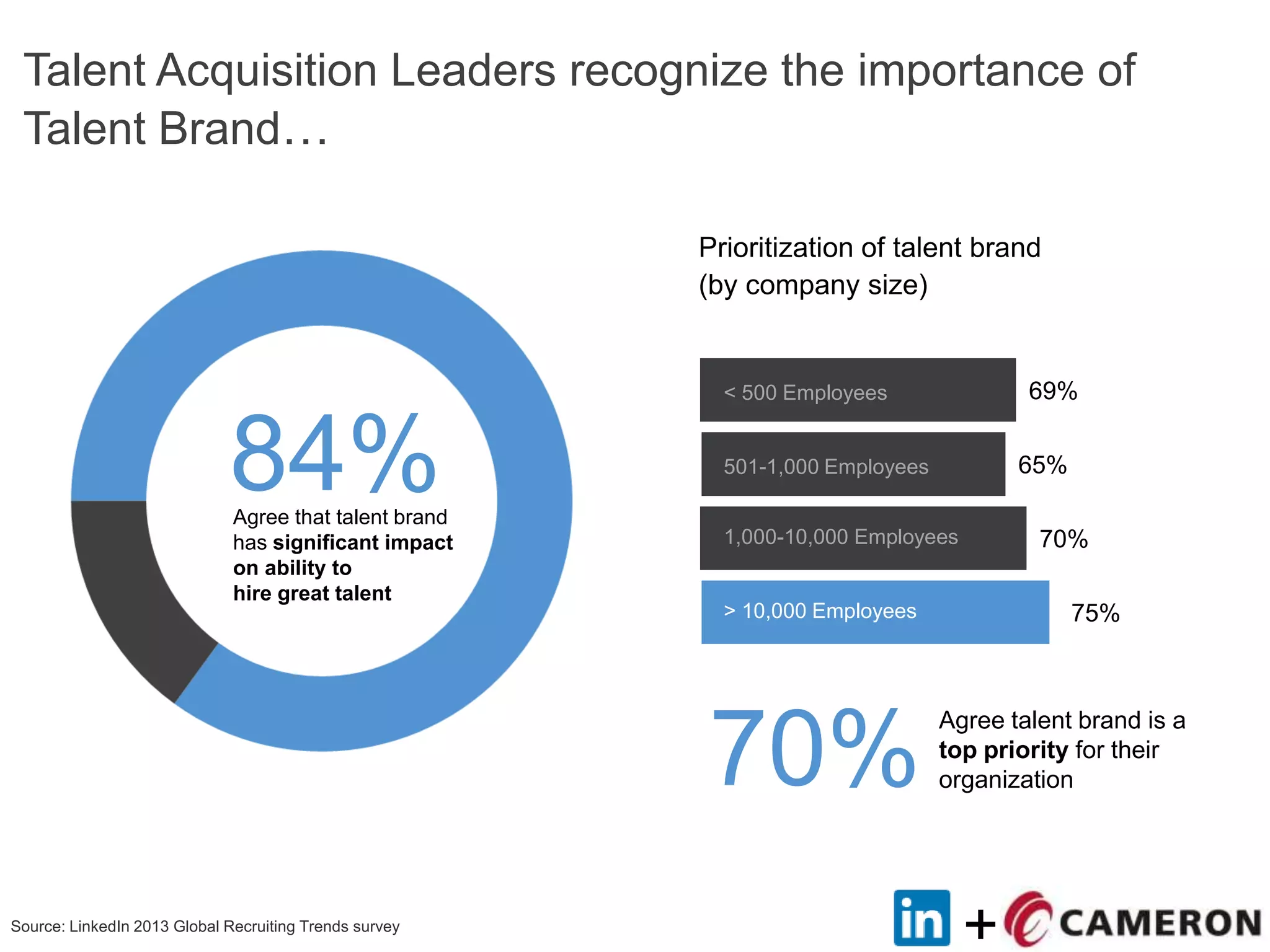

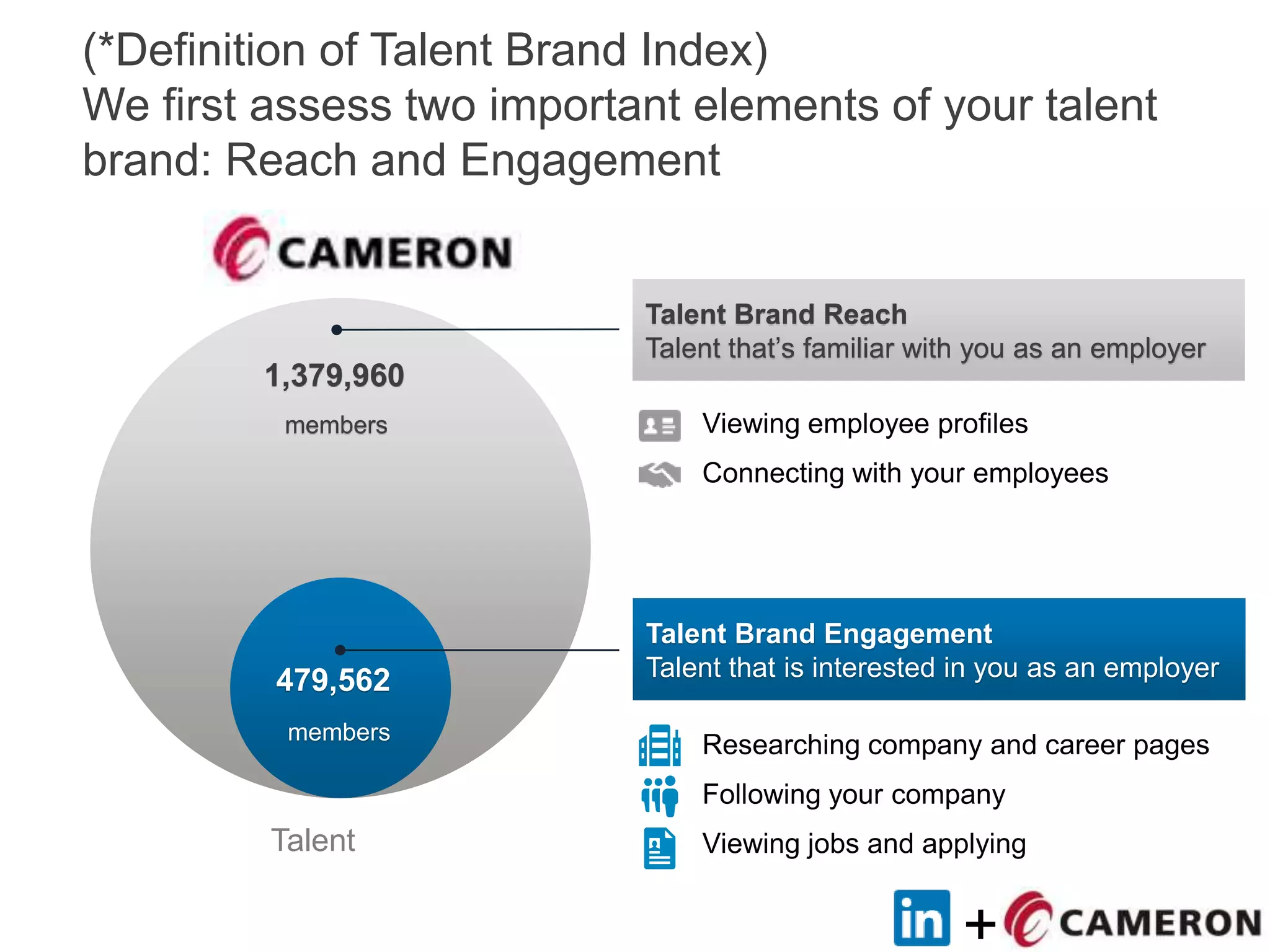

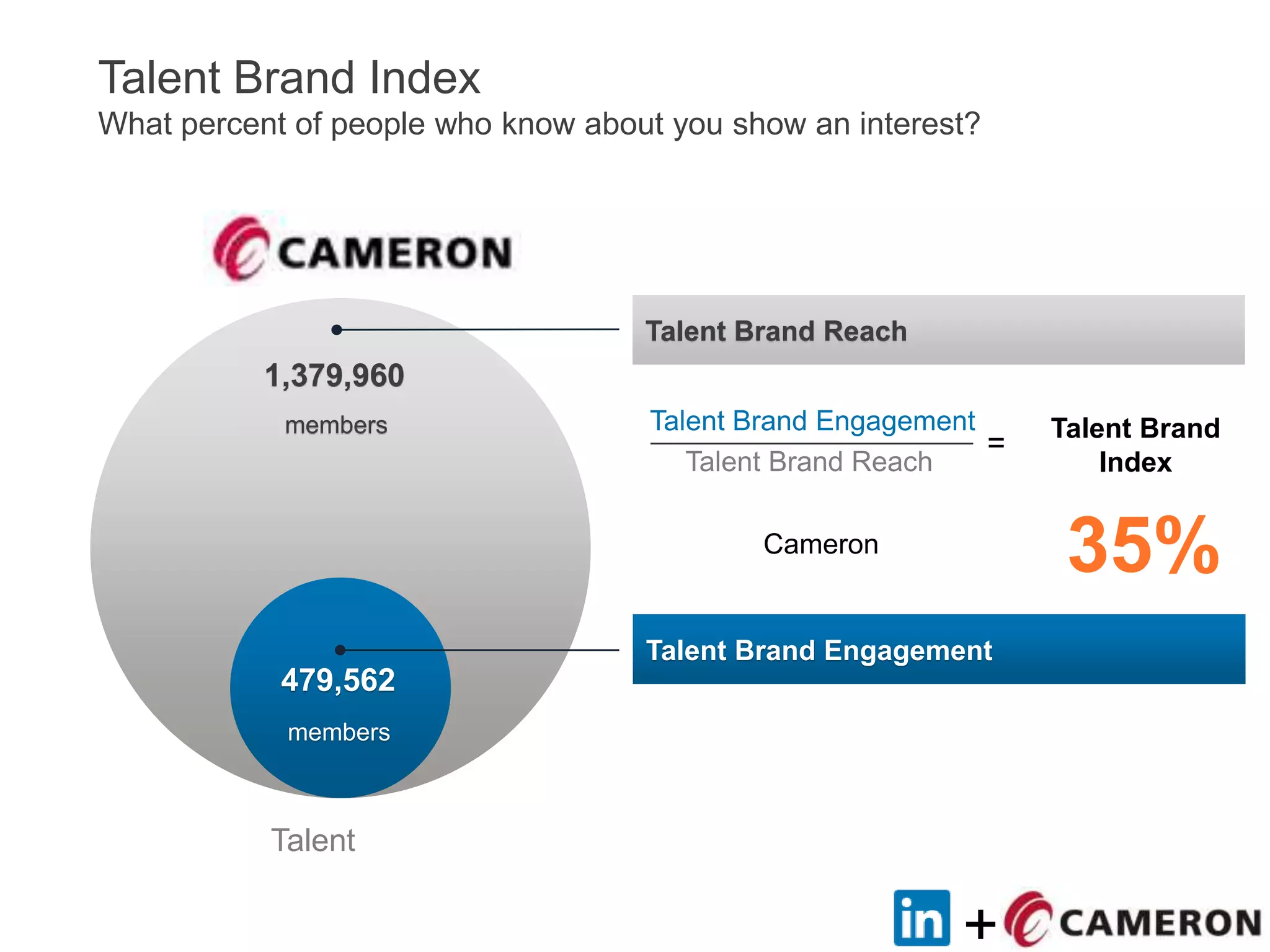

The document outlines strategies to address talent acquisition challenges in the oil and gas sector, emphasizing a shift towards relationship marketing and the importance of employer branding. Key issues include a talent shortage in engineering and manufacturing, with a focus on attracting and engaging passive candidates through targeted messaging and enhanced online presence. Recommendations include leveraging data, enhancing social media engagement, and building a strong talent community to improve recruitment outcomes.