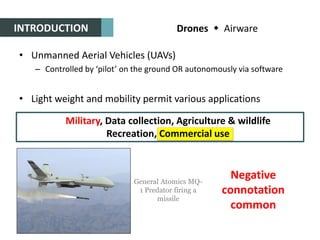

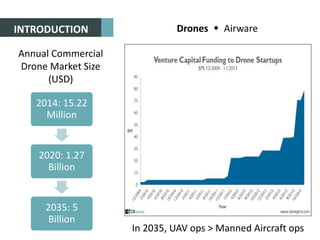

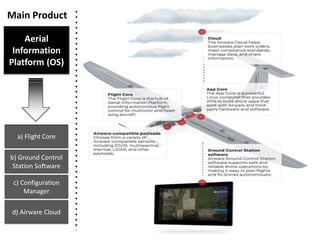

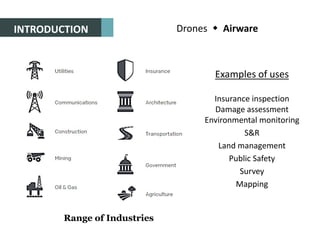

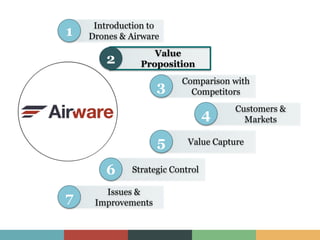

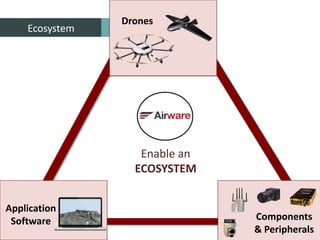

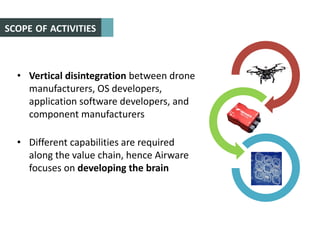

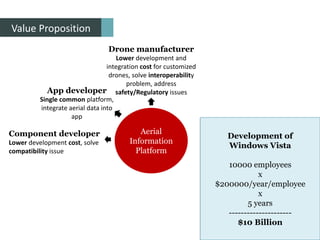

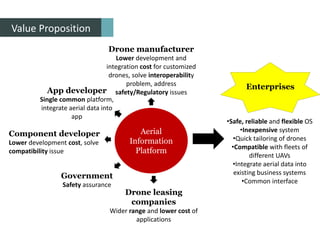

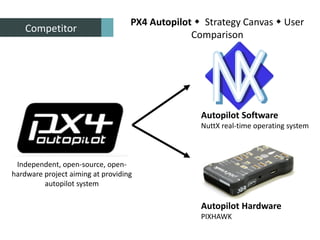

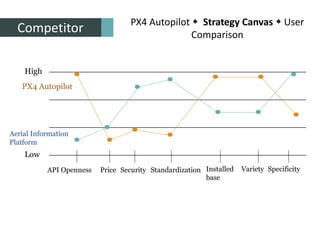

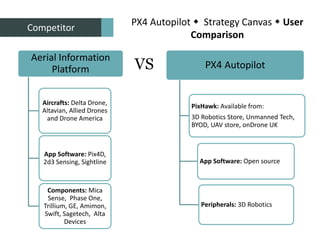

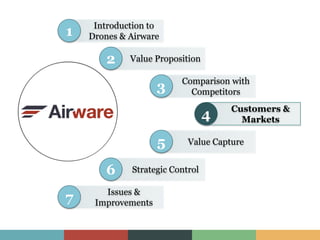

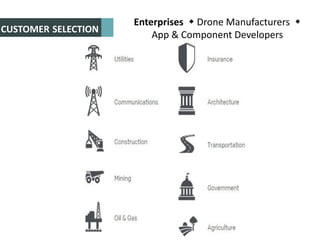

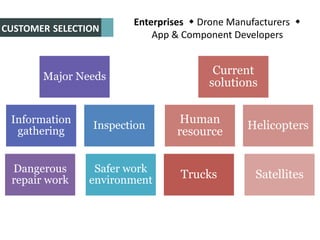

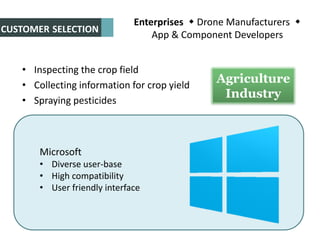

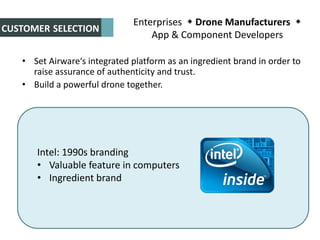

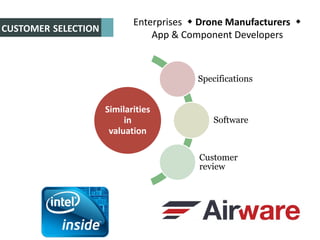

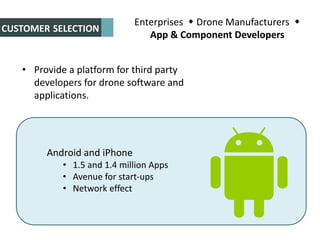

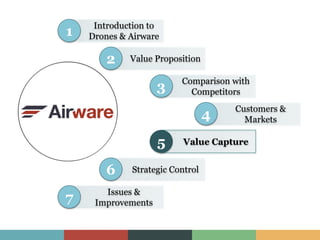

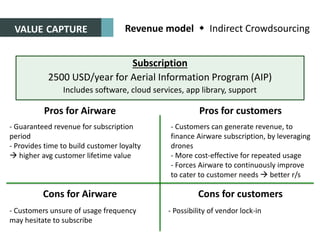

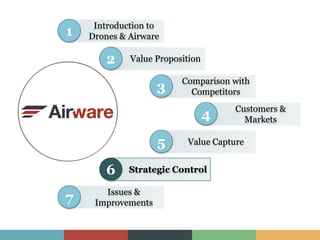

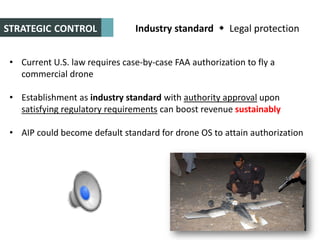

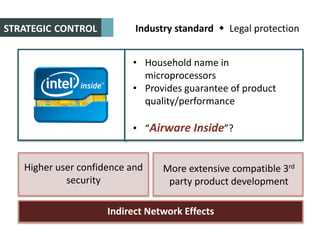

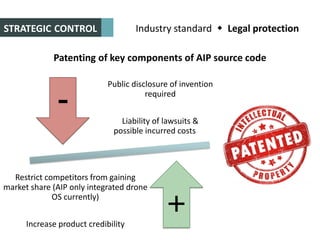

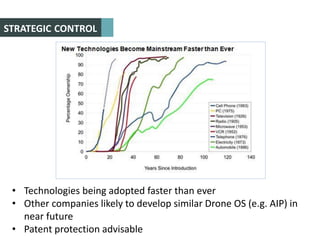

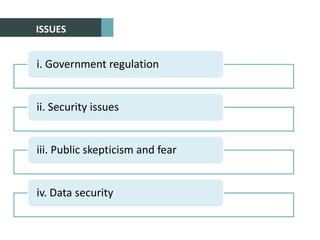

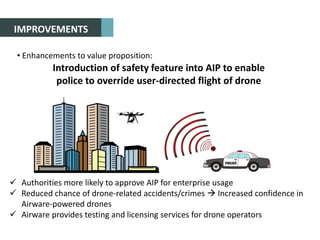

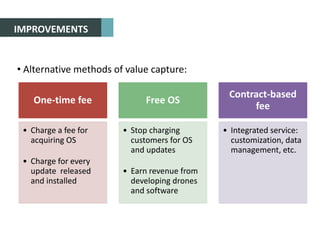

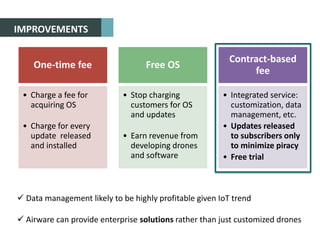

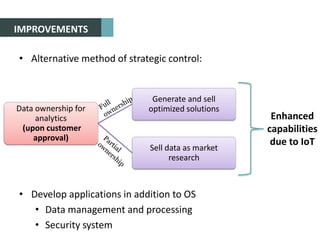

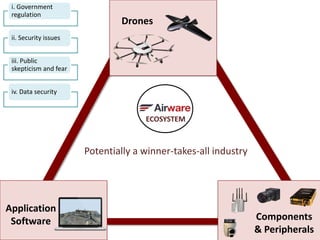

The document discusses the various aspects of Airware's aerial information platform for drones, highlighting its value proposition, competitive landscape, customer segments, and revenue models. It emphasizes the platform's benefits in reducing development costs and enhancing interoperability across different drone manufacturers and software developers. The document also addresses potential regulatory challenges and the need for technological improvements to increase user confidence and secure market positioning.