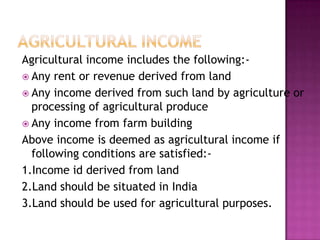

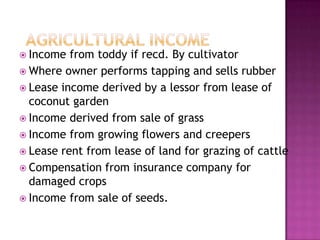

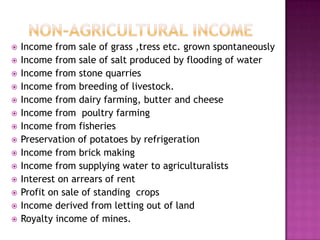

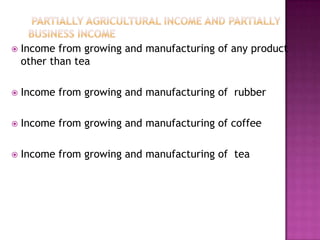

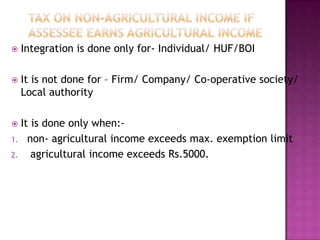

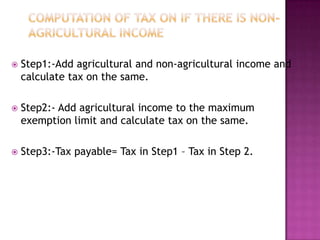

The document defines agricultural income and non-agricultural income for tax purposes. Agricultural income includes any income derived from land used for agricultural purposes in India, such as rent, crop sales, or farm building income. Non-agricultural income includes income from activities like stone quarries, dairy farming, poultry, fisheries, and brick making. Some incomes are partially agricultural and partially business. For individuals and HUFs with both agricultural and non-agricultural income, tax is calculated by integrating the incomes and comparing to the tax on agricultural income alone.