1. The document defines various types of income such as agricultural income and tax-related terms. It discusses the aggregation of agricultural income with non-agricultural income for tax purposes.

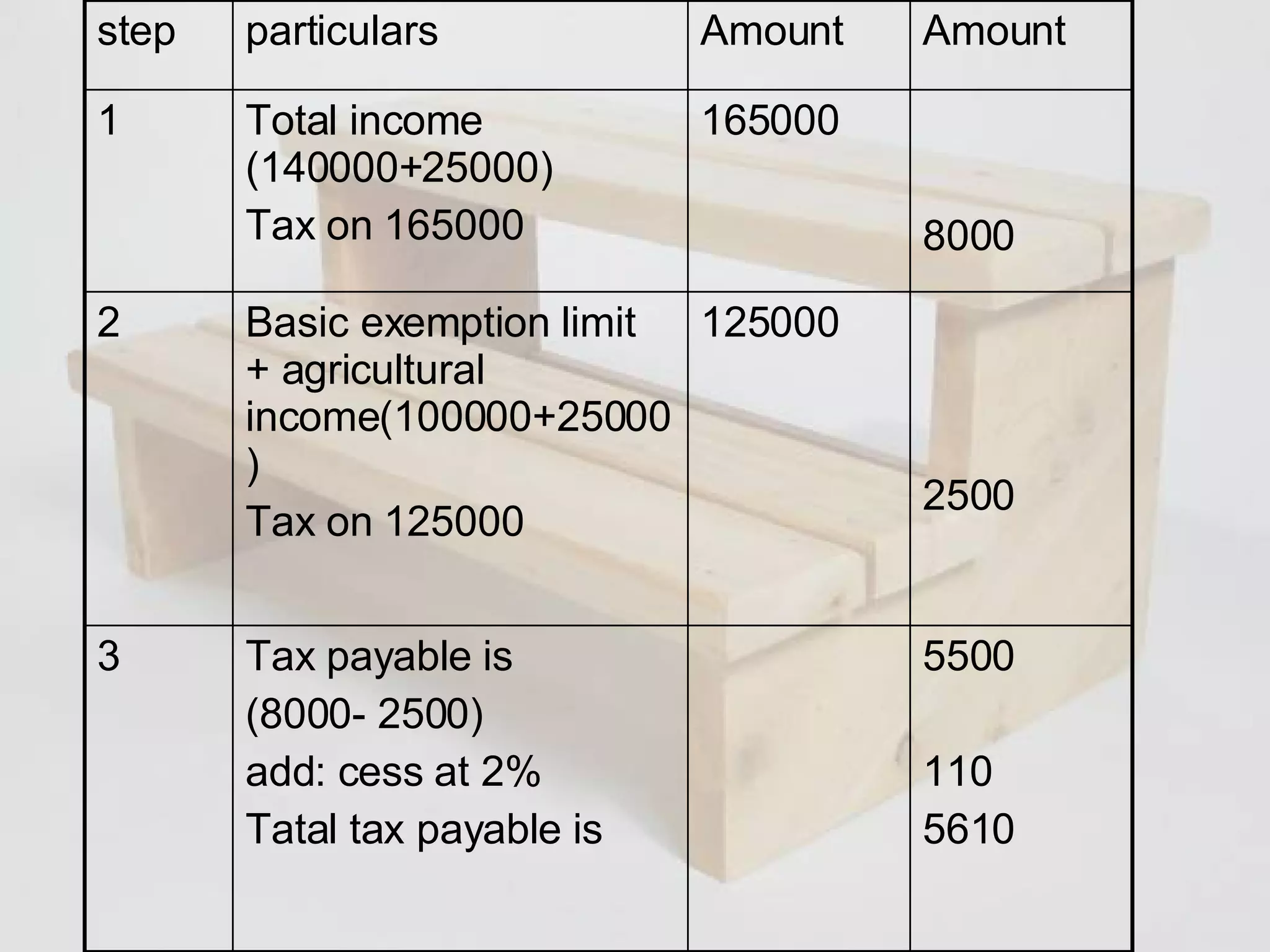

2. An example is provided to illustrate the calculation of appropriate tax payable after accounting for agricultural income.

3. The document also discusses what constitutes agricultural operations and income from them, as well as key court rulings related to agricultural land usage and tax treatment of life insurance policies.