Embed presentation

Downloaded 529 times

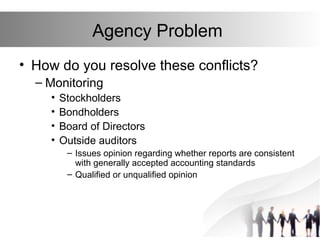

This document discusses agency problems that can arise in principal-agent relationships. Specifically: - An agency problem occurs when the interests of the principal and agent conflict, as the agent may act in their own interest rather than the principal's. - In finance, the two main agency relationships are between managers and stockholders, and managers and creditors. - Agency costs are incurred to try to align the agent's actions with the principal's interests, including contracting, monitoring, and losses from unresolved problems. Monitoring and compensation schemes aim to resolve these conflicts.