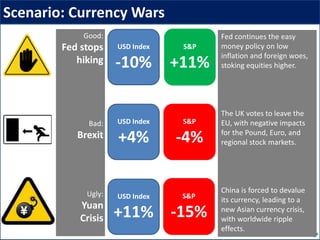

This document discusses potential scenarios in the ongoing "currency wars" and their effects on currencies and markets. It analyzes factors like the Fed's interest rate decisions, Brexit, and a potential Chinese yuan devaluation crisis.

The good scenario has the Fed continuing its dovish policy, boosting equities. The bad scenario involves Brexit negatively impacting European currencies and regional stocks. The ugly scenario is a Chinese yuan devaluation triggering a new Asian currency crisis with global spillovers, causing stocks and commodities to plunge while the USD surges.