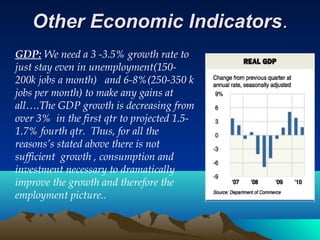

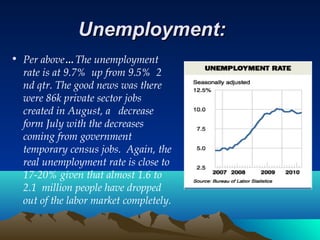

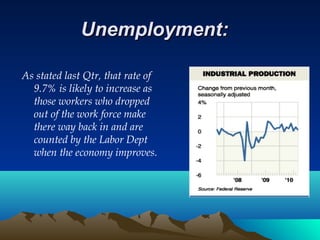

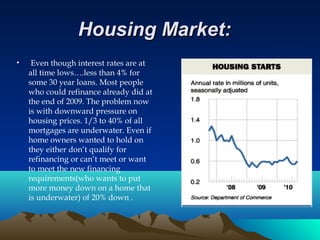

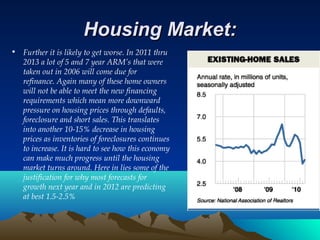

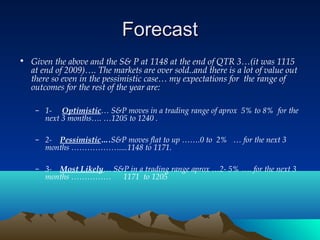

The US economy grew at a decreasing rate in the third quarter of 2010, with GDP growth estimated to fall between 1.5-1.7% and average GDP growth for the year downgraded to 2.5-2.7%. While businesses have healthy balance sheets and cash reserves, uncertainty around taxes, regulations, and health care have discouraged hiring and investment. The Federal Reserve is expected to pursue further quantitative easing to lower interest rates and stimulate the economy. However, the main issues remain lack of business investment due to policy uncertainty and weakness in the housing market, with the unemployment rate remaining high at 9.7%. Upcoming midterm elections could improve optimism if they result in a Republican-controlled House and split Senate.