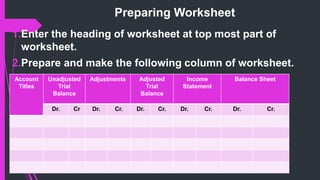

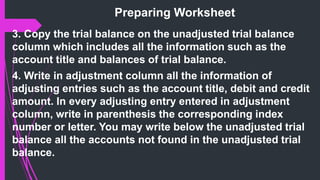

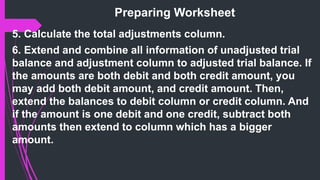

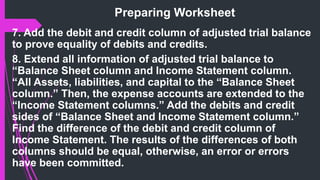

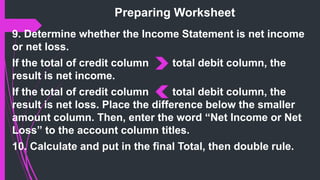

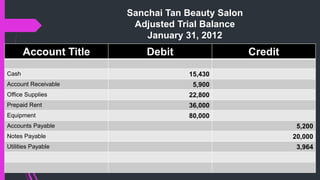

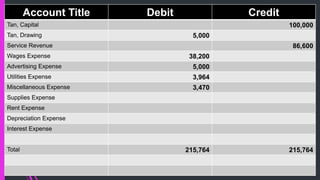

The document outlines the process of preparing a worksheet for financial statement preparation, detailing steps from entering headings to calculating adjusted trial balances. It includes guidance on recording unadjusted trial balance data, making necessary adjustments, and determining net income or loss. The example provided illustrates an adjusted trial balance for Sanchai Tan Beauty Salon as of January 31, 2012, with total debits and credits balanced at 215,764.