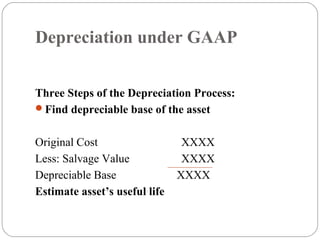

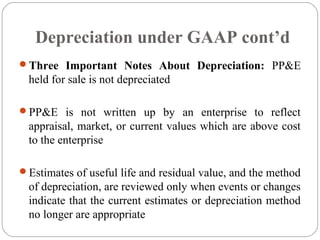

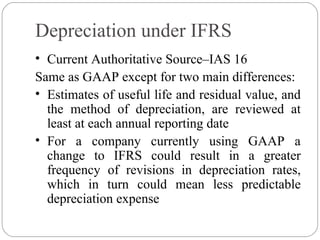

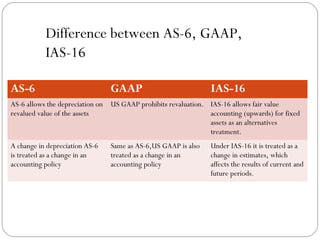

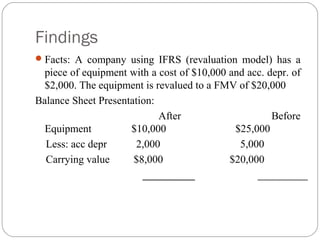

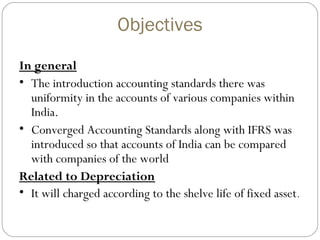

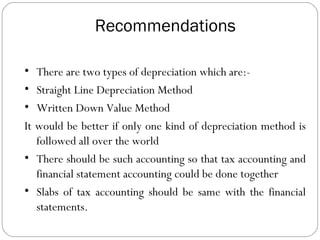

This document discusses depreciation accounting under Indian Accounting Standard AS-6, US GAAP, and IFRS. It defines depreciation and outlines the key differences between the three standards. AS-6 allows revaluation of assets while GAAP prohibits it. A change in depreciation method is treated as a change in accounting policy under AS-6 and GAAP, but as a change in estimates under IFRS. IFRS also allows use of a revaluation model where assets can be revalued to fair market value.