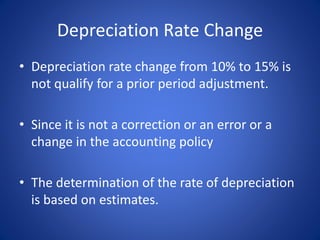

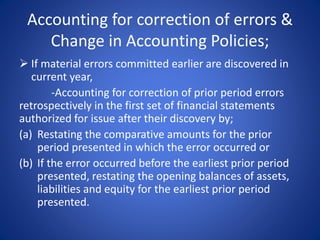

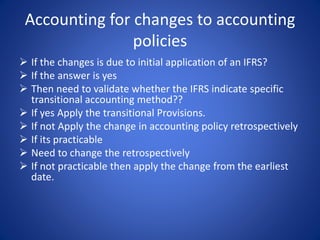

The document discusses prior period errors and adjustments. It defines a prior period error as an omission or misstatement in prior year financial statements due to a failure to use reliable information. Examples given are mathematical mistakes, incorrect accounting policy applications, and fraud. A prior period adjustment relates to a prior period, corrects an error or changes an accounting policy, and materially impacts financial statements. It does not apply to transactions accounted for using estimates, such as depreciation rate changes. The accounting treatment for corrections of prior period errors and changes in accounting policies is to restate comparative amounts retrospectively or adjust opening balances, depending on the period the error occurred.