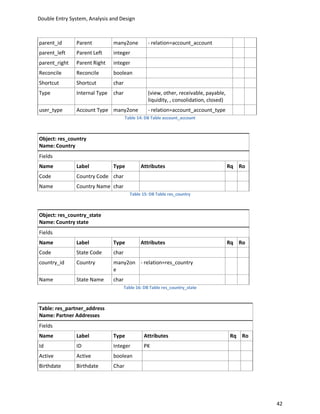

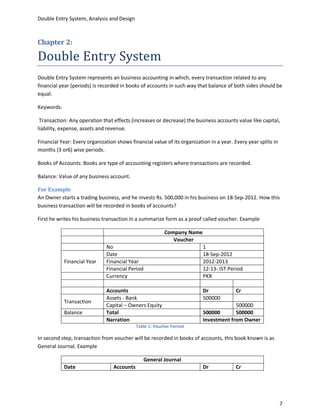

This document provides an in-depth analysis and design of a double entry accounting system, covering essential components such as transaction processing, workflow, reporting, data flow diagrams, and architectural design. It includes detailed explanations of voucher preparation, journal entries, accounting reports, and the roles involved in the process. Additionally, the document features various tables, figures, and forms that facilitate understanding the double entry system's functioning and management.

![Double Entry System, Analysis and Design

cheque no 34564]

19-Sep 2 Advance for Office - 25000

To Bank - 25000

[Advance

Payment of office

rent, cheque no

34565]

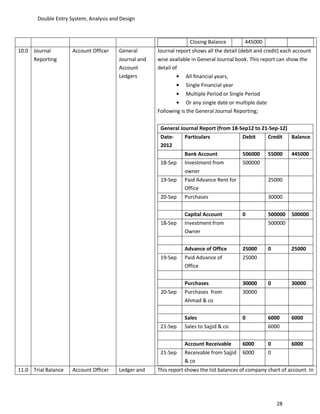

20- Sep 3 Purchases - 30000

To Bank - 30000

[Purchases from

Ahmad & Co,

cheque no 34566]

21-Sep 4 Acc Receivable - 6000

To Sales - 6000

[Sales to Sajid &

co]

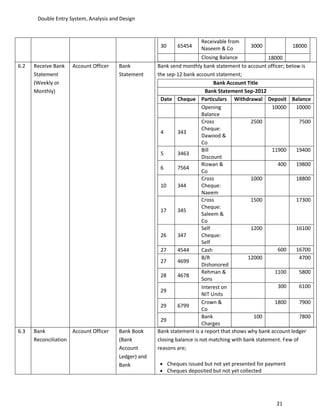

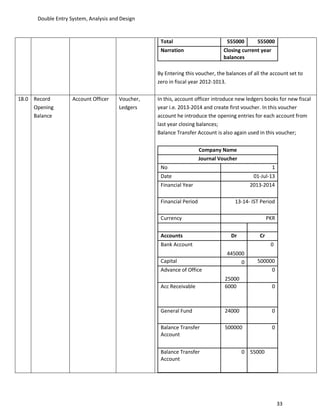

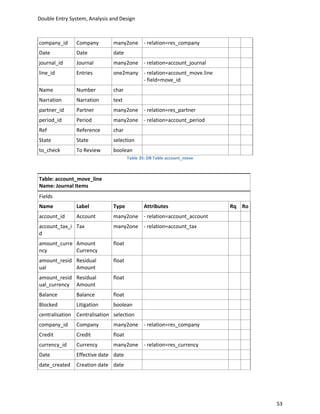

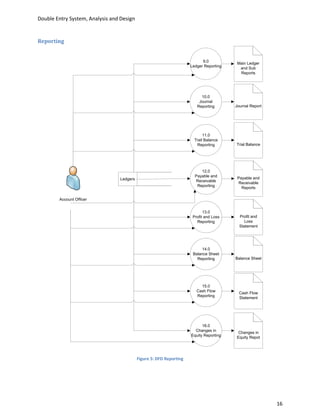

6.1 Prepare Account Officer Cheque Book For each payment to supplier, Account officer prepares cheque.

Cheque for Following are some payments by cheque and some receipts in

Payments bank account ledger report.

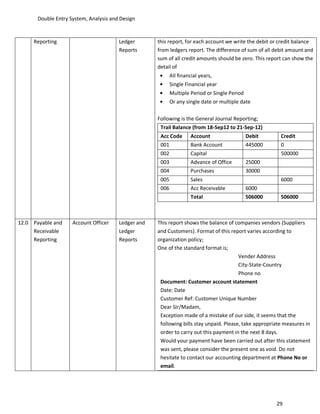

Bank Account Ledger Report (from 1-Sep- 12 to 30-Sep-12)

Date Cheque Particulars Debit Credit Balance

Opening Balance 10000 10000

Payable to

3 343 Dawood & Co 2500 7500

5 3463 Bill Discount 11900 19400

Payable To

9 344 1000 18400

Naeem

Receivable from

10 7564 Rizwan & Co 400 18800

Payable to

16 345 Saleem & Co 1500 17300

Receivable from

20 3446 Crown & Co 1800 19100

21 346 Payable to Asif 2000 17100

Receivable from

24 8695 Rafiq & Sons 4000 21100

27 347 Petty Cash 1200 19900

28 4544 Petty Cash 600 20500

Payable to

30 349 5500 15000

Ahmad

20](https://image.slidesharecdn.com/doubleentrydocument-121031054030-phpapp01/85/Double-entry-document-Analysis-and-Design-20-320.jpg)