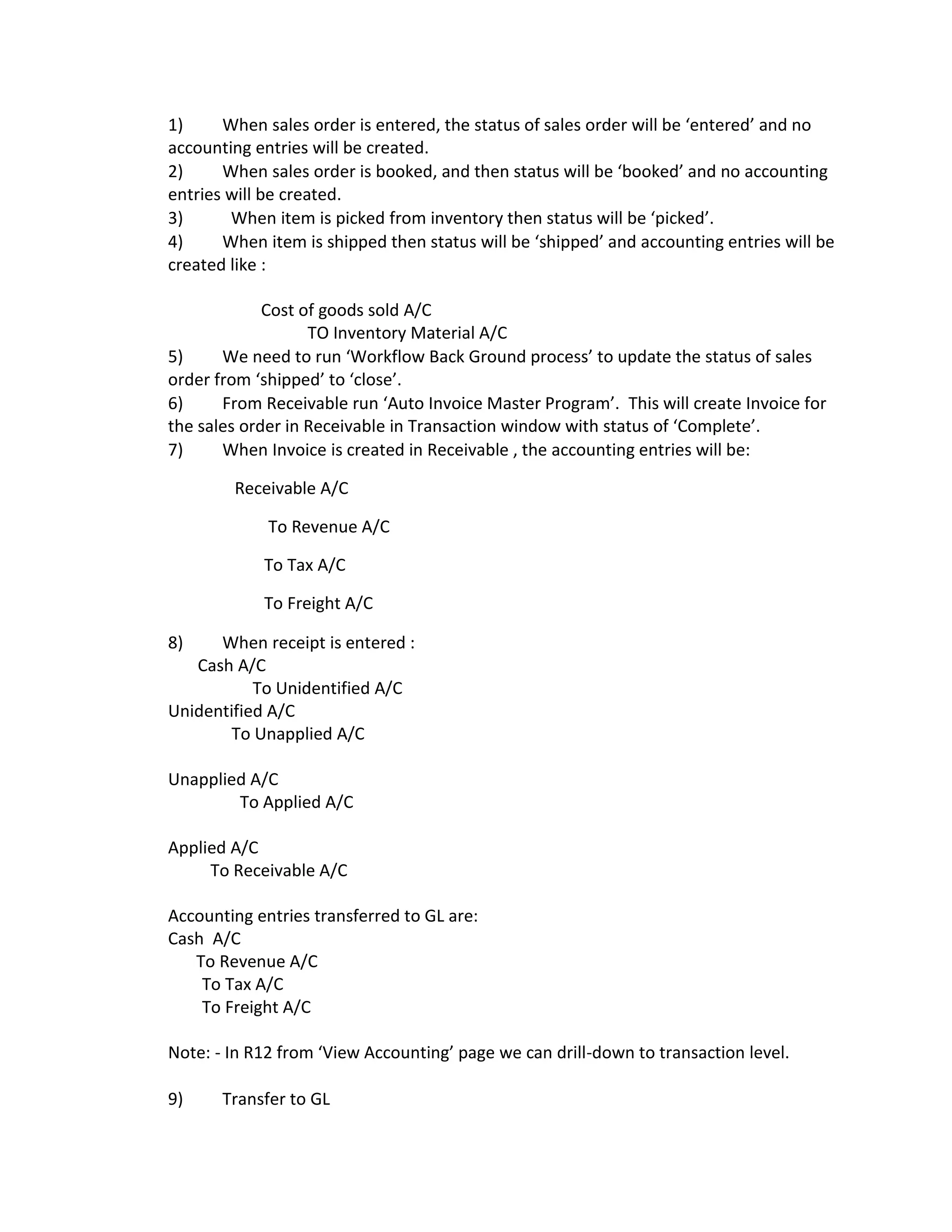

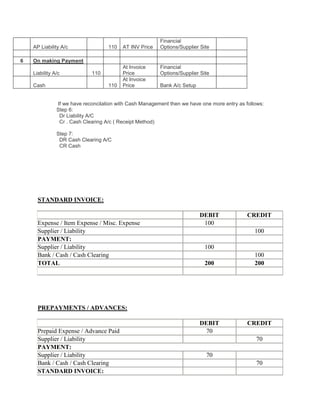

The document describes the accounting entries that are created at each stage of the sales order to cash receipt process in Oracle Receivables. It discusses the entries for sales order statuses changing, invoicing, receipts, adjustments, credit memos, and remittances. The various stages and transactions ultimately result in debiting accounts receivable and crediting revenue and applicable tax/freight accounts.