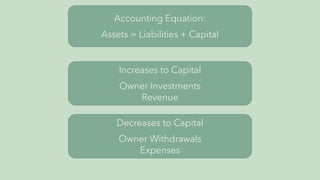

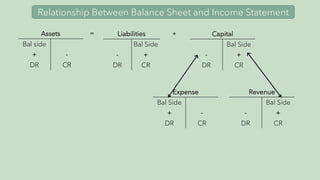

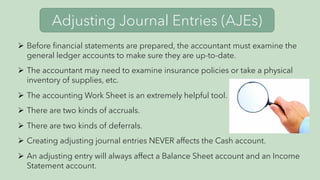

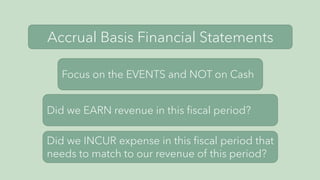

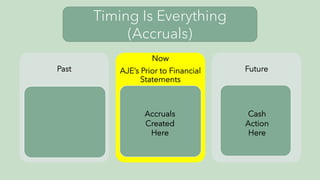

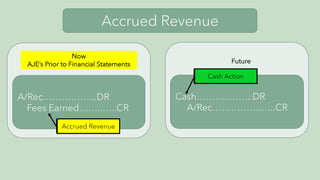

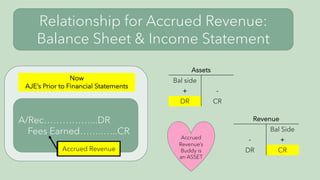

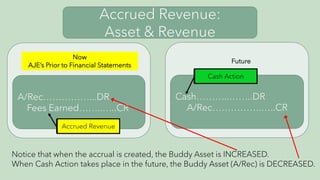

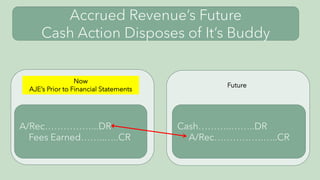

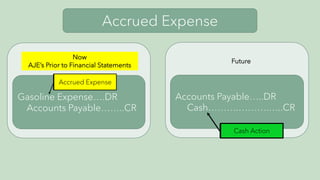

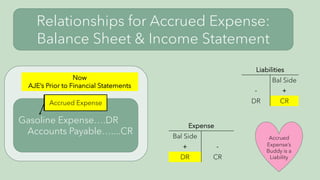

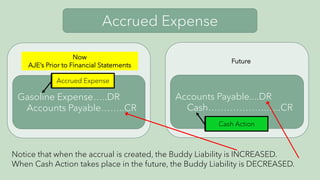

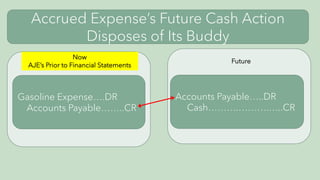

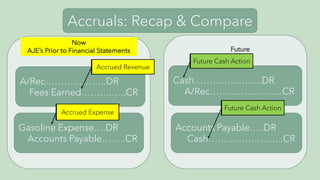

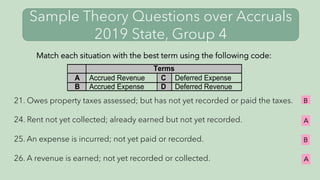

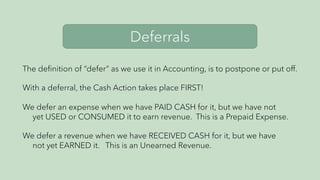

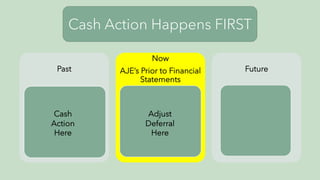

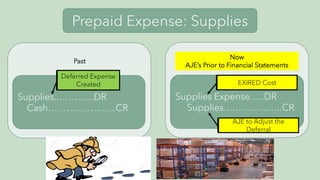

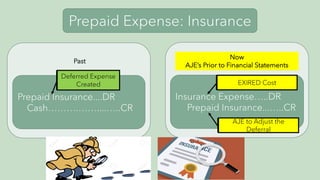

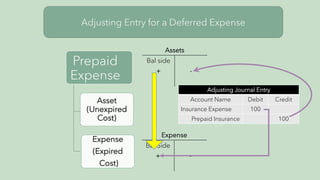

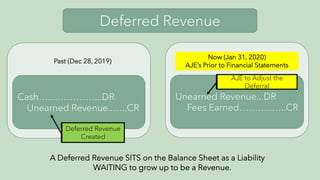

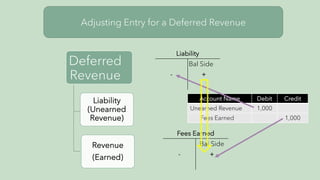

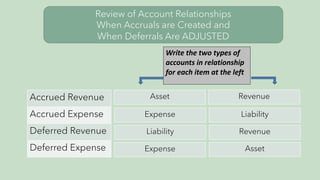

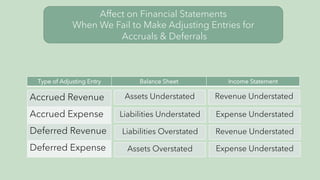

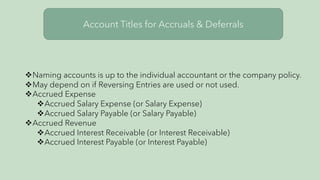

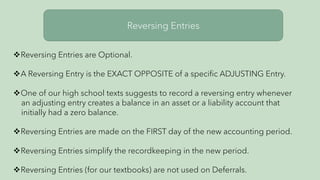

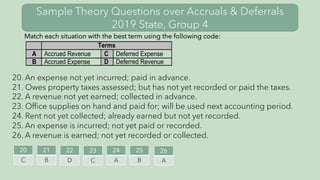

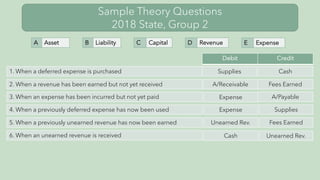

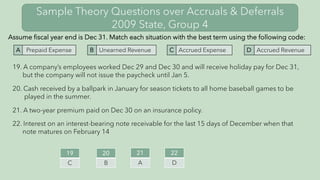

The document provides an overview and examples of accounting for accruals and deferrals. It begins by reviewing the basis of accounting, revenue recognition, matching principle, and accounting period cycle. It then discusses accruals, including accrued revenue and accrued expenses. Examples are provided to illustrate the adjusting journal entries and how accruals affect the balance sheet and income statement. The document also covers deferrals, such as prepaid expenses and deferred revenue. Again, examples demonstrate how deferrals are initially recorded and then adjusted through subsequent journal entries. Key terms and concepts are reinforced through sample exam questions at the end.