This document provides information about source deductions for payroll, including:

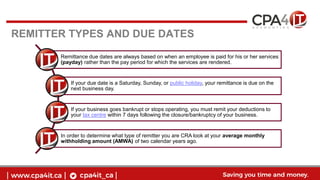

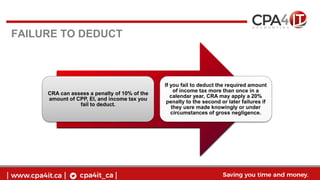

1) As an employer, you are responsible for remitting CPP contributions, EI premiums, and income tax deducted from employee pay, as well as the employer portion of CPP and EI. Remittances are due on or before the due date, which depends on the type of remitter.

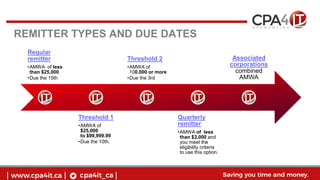

2) Remitter types include regular, threshold 1, threshold 2, and quarterly, depending on average monthly withholding amounts. Due dates are the 15th, 10th, or 3rd of the month.

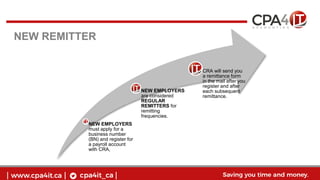

3) New employers must register with the CRA and are initially considered regular remitters.