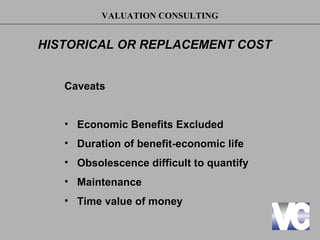

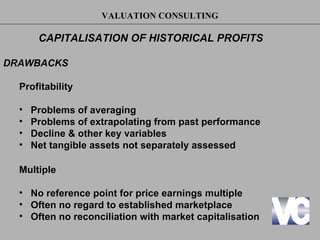

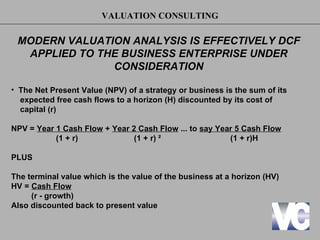

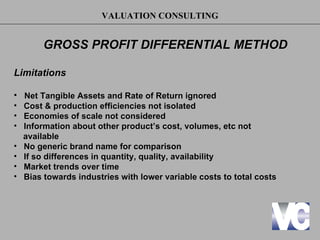

The document discusses various methods for valuing intellectual property, including market-based comparable transactions, cost-based historical cost replacement, and income-based approaches like discounted cash flow analysis and excess profits methods. It notes challenges with each method and emphasizes that modern valuation commonly uses a discounted cash flow approach to determine the net present value of a business's expected future cash flows.