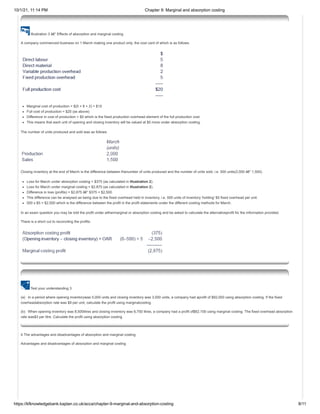

This document provides an overview of marginal and absorption costing concepts. It defines key terms like marginal cost, contribution, fixed costs, and absorption costing. The summary explains that marginal costing values inventory at variable costs while absorption costing uses full production costs, leading to different profit calculations. Examples are provided to illustrate how profits reported under the two methods can reconcile when inventory levels change from period to period.

![10/1/21, 11:14 PM Chapter 9: Marginal and absorption costing

https://kfknowledgebank.kaplan.co.uk/acca/chapter-9-marginal-and-absorption-costing 1/11

Home Kaplan Financial Kaplan Publishing +44 (0)161 259 7400

Contents [Hide]

1 Chapter 9: Marginal and absorption costing

Chapter 9: Marginal and absorption costing

Chapter learning objectives

Upon completion of this chapter you will be able to:

explain the importance of, and apply, the concept of contribution

demonstrate and discuss the effect of absorption and marginal costing on inventory valuation and profit determination

calculate profit or loss under absorption and marginal costing

reconcile the profits or losses calculated under absorption and marginal costing

describe the advantages and disadvantages of absorption and marginal costing

1 Marginal costing

The marginal cost of an item is its variable cost. The marginalproduction cost of an item is the sum of its direct materials cost,direct labour cost, direct expenses cost (if any) and

variableproduction overhead cost. So as the volume of production and salesincreases total variable costs rise proportionately.

Fixed costs, in contrast are cost that remain unchanged in a time period, regardless of the volume of production and sale.

Marginal production cost is the part of the cost of one unit of productor service which would be avoided if that unit were not produced, orwhich would increase if one extra

unit were produced.

From this we can develop the following definition of marginal costing as used in management accounting:

Marginal costing is the accounting system in which variable costsare charged to cost units and fixed costs of the period are written offin full against the aggregate contribution.

Note that variable costs are those which change as output changes– these are treated under marginal costing as costs of the product.Fixed costs, in this system, are treated

as costs of the period.

Marginal costing is also the principal costing technique used indecision making. The key reason for this is that the marginal costingapproach allows management's attention to

be focussed on the changeswhich result from the decision under consideration.

The contribution concept

The contribution concept lies at the heart of marginal costing. Contribution can be calculated as follows.

Contribution = Sales price – Variable costs

Illustration 1 – The concept of contribution

The following information relates to a company that makes a singleproduct, a specialist lamp, which is used in the diamond-cuttingbusiness.

Search](https://image.slidesharecdn.com/chapter9marginalandabsorptioncosting-211012061305/85/Chapter-9-marginal-and-absorption-costing-1-320.jpg)