The dissertation by Kushal Shah focuses on JSW Steel, a leading Indian steel manufacturer, analyzing its growth, marketing strategies, and financial performance from 2009 to 2018. The study highlights JSW’s capacity expansion plans, digital marketing initiatives, and the challenges facing the Indian steel industry. JSW Steel aims to increase its manufacturing capacity significantly by 2030 while maintaining competitive profitability and market positioning.

![12

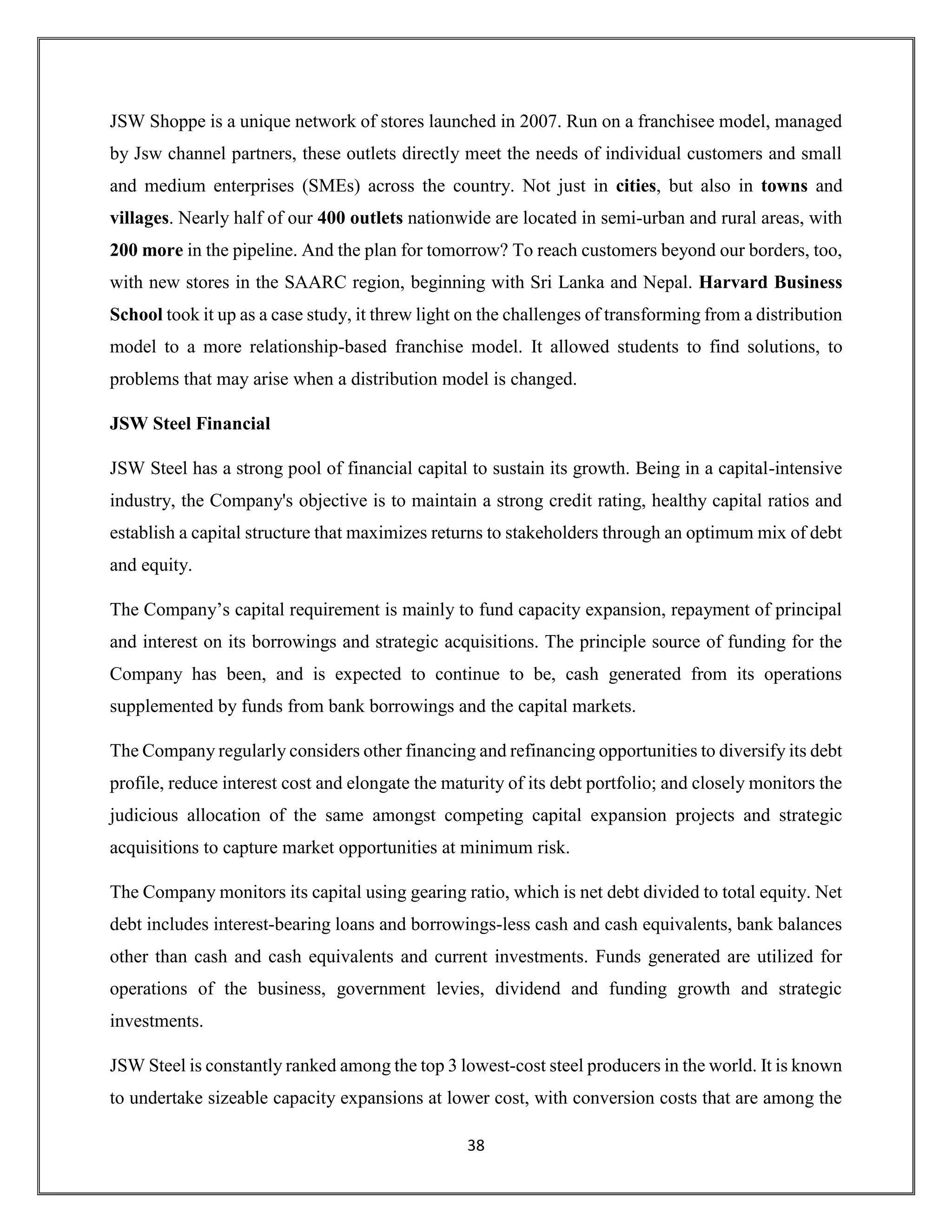

Crude steel production (million metric tons):

RANK

COUNTRY/REGIO

N 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008

Worl

d

1808.6 1675 1606 1620 1670 1649 1553 1490 1414 1220 1327 1351

1 People's

Republic of

China

928.

3

831.

7

786.

9

803.

8

822.

7

779

724.

7

683.

3

626.

7

573.

6

500.

3

— European Union

[15]

168.

2

168.

7

162.

3

166.

2

169.

3

166.

4

168.

6

177.

7

172.

8

139.

3

198.

2

2

India

106.

5

101.

4

95.5 89.6 87.3 81.2 77.3 72.2 68.3 62.8 57.8

3

Japan

104.

3

104.

7

104.

8

105.

2

110.

7

110.

6

107.

2

107.

6

109.

6

87.5

118.

7

4

United States

86.7 81.6 78.5 78.9 88.2 87 88.6 86.2 80.6 58.2 91.4

5

South Korea

72.5 71.1 68.6 69.7 71.5 66 69.3 68.5 58.5 48.6 53.6

6

Russia

71.7 71.3 70.5 71.1 71.5 69.4 70.6 68.7 66.9 60 68.5

7

Germany

42.4 43.6 42.1 42.7 42.9 42.6 42.7 44.3 43.8 32.7 45.8

8

Turkey

37.3 37.5 33.2 31.5 34 34.7 35.9 34.1 29 25.3 26.8

9

Brazil

34.7 34.4 30.2 33.3 33.9 34.2 34.7 35.2 32.8 26.5 33.7

10

Iran

25 21.8 17.9 16.1 16.3 15.4 14.5 13 12 10.9 10

Table 1 Top 10 steel manufacturers in the world

3.8 PRODUCTION

Steel industry was de-licensed and de-controlled in 1991 & 1992 respectively.

India is currently the 2nd largest producer of crude steel in the world.

In 2017-18, production of total finished steel (alloy + non alloy) was 126.85 mt, a growth of 5.6%

over last year. Production of Pig Iron in 2017-18 was 5.73 mt, a decline of 45% over last year.](https://image.slidesharecdn.com/dissertationgrandprojectreportkushalshah-190724043640/75/A-STUDY-OF-JSW-AN-INDIAN-STEEL-MANUFACTURING-COMPANY-20-2048.jpg)