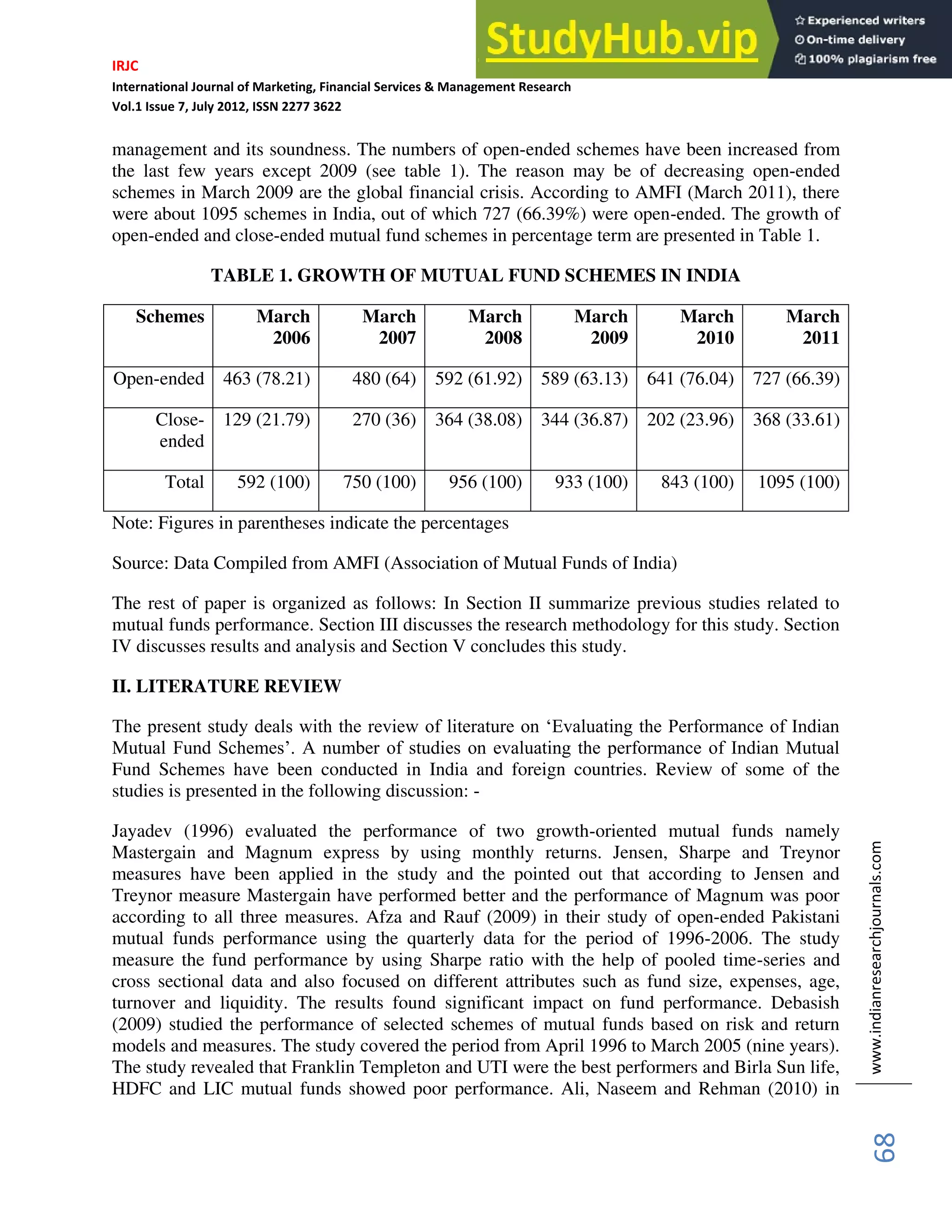

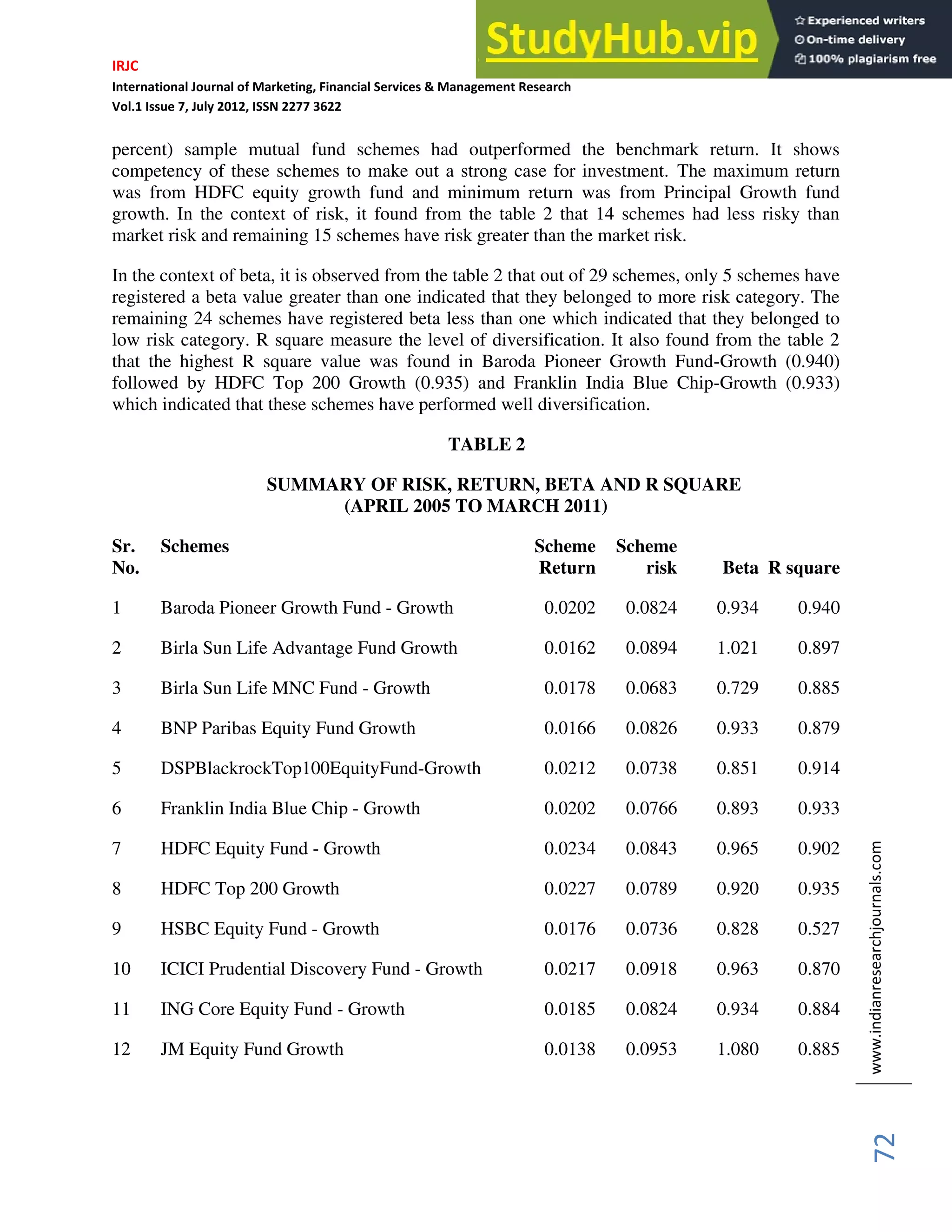

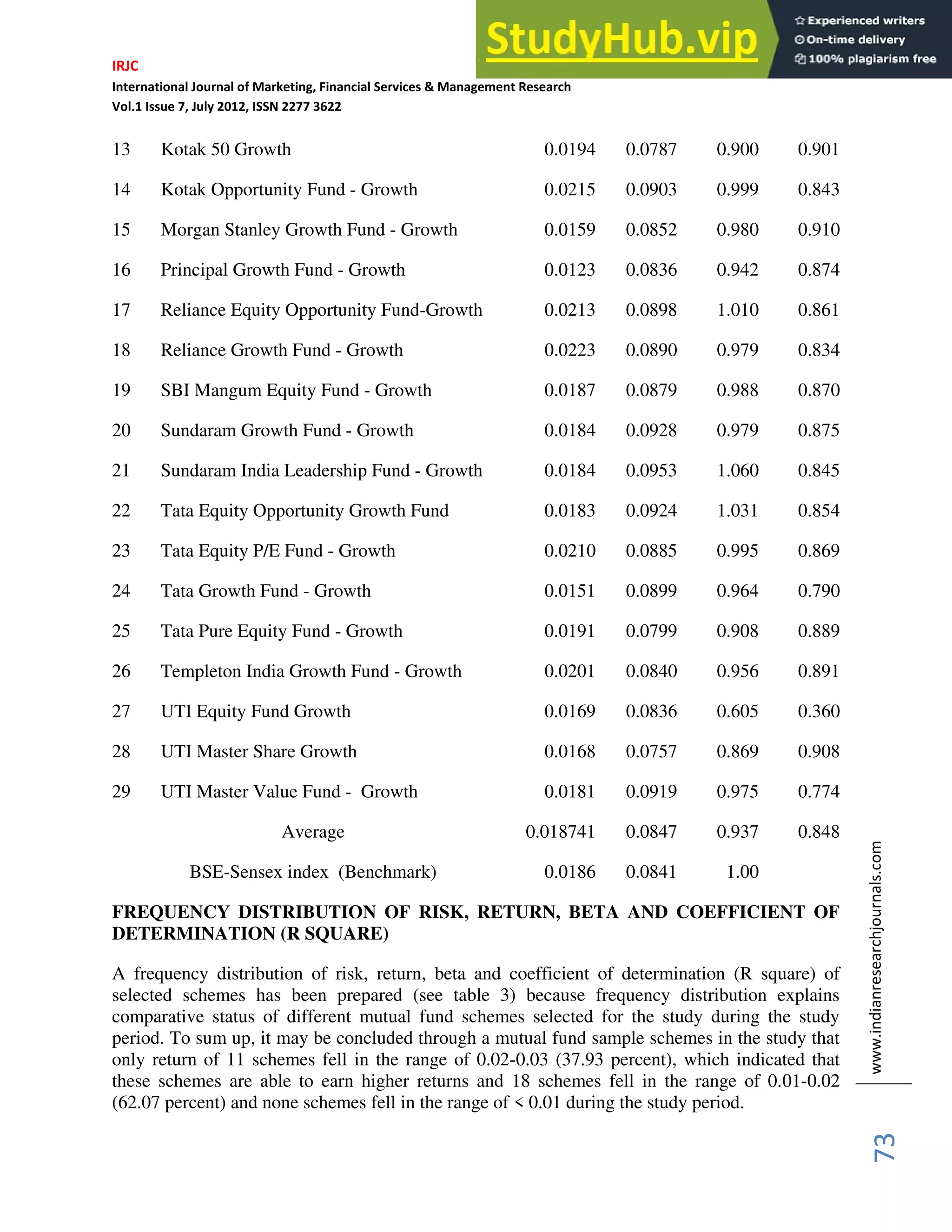

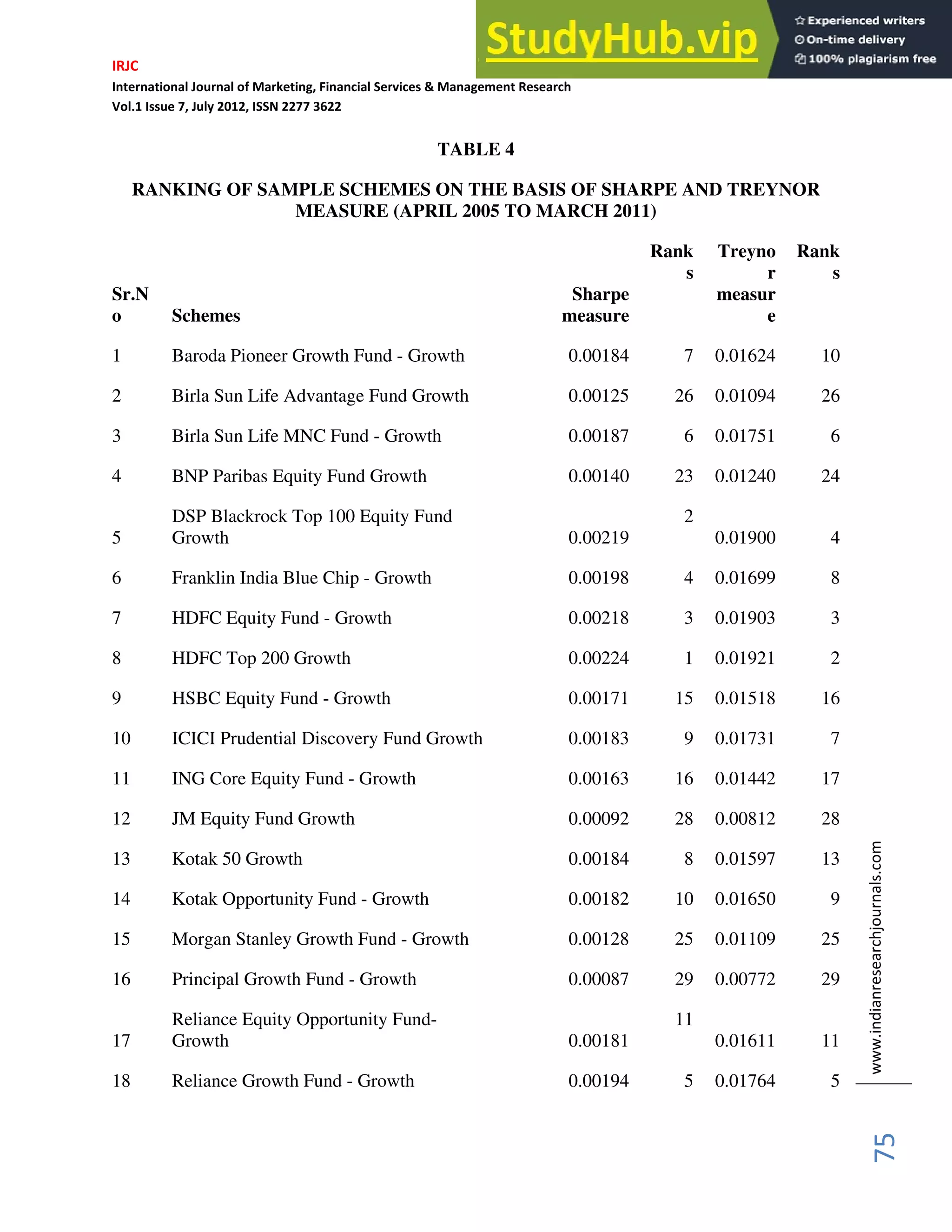

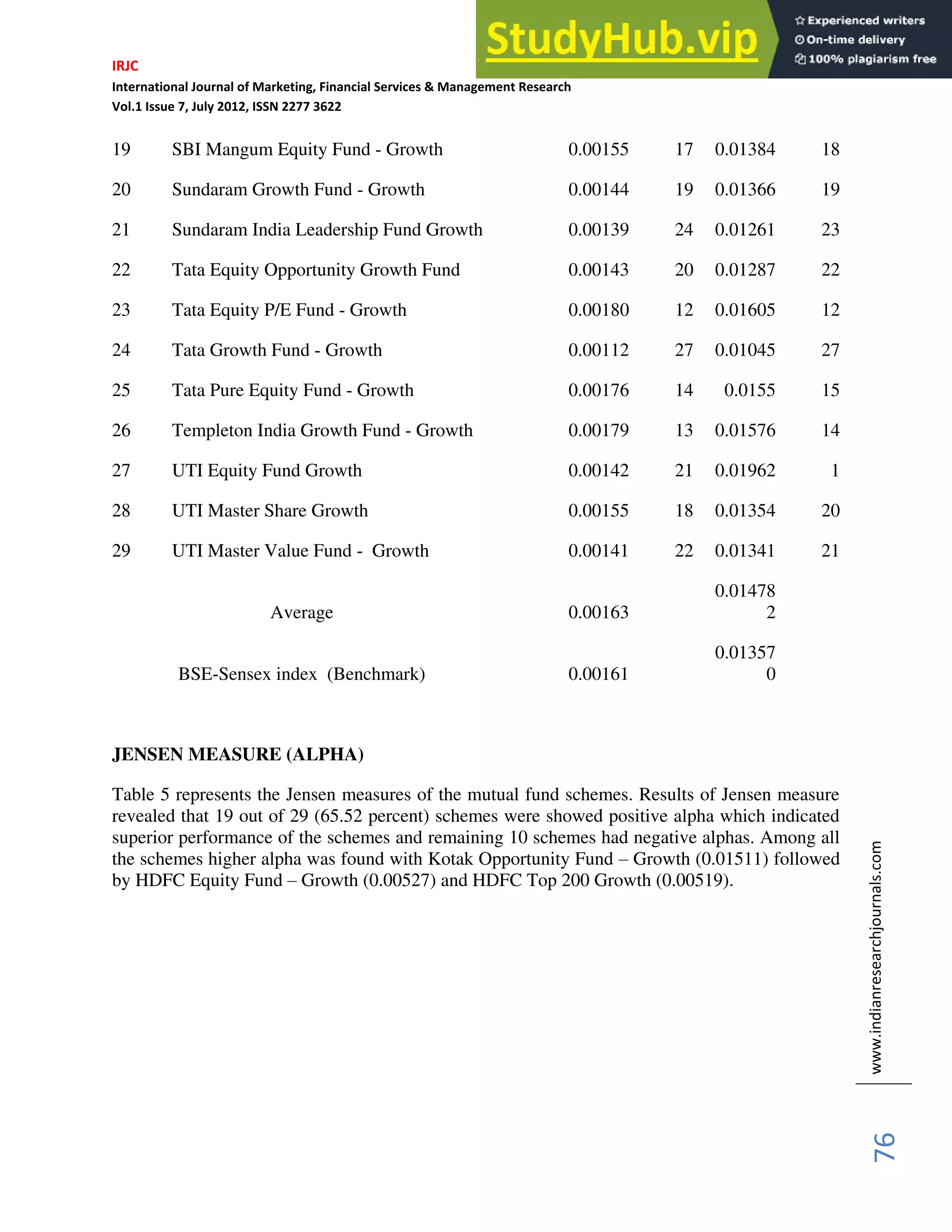

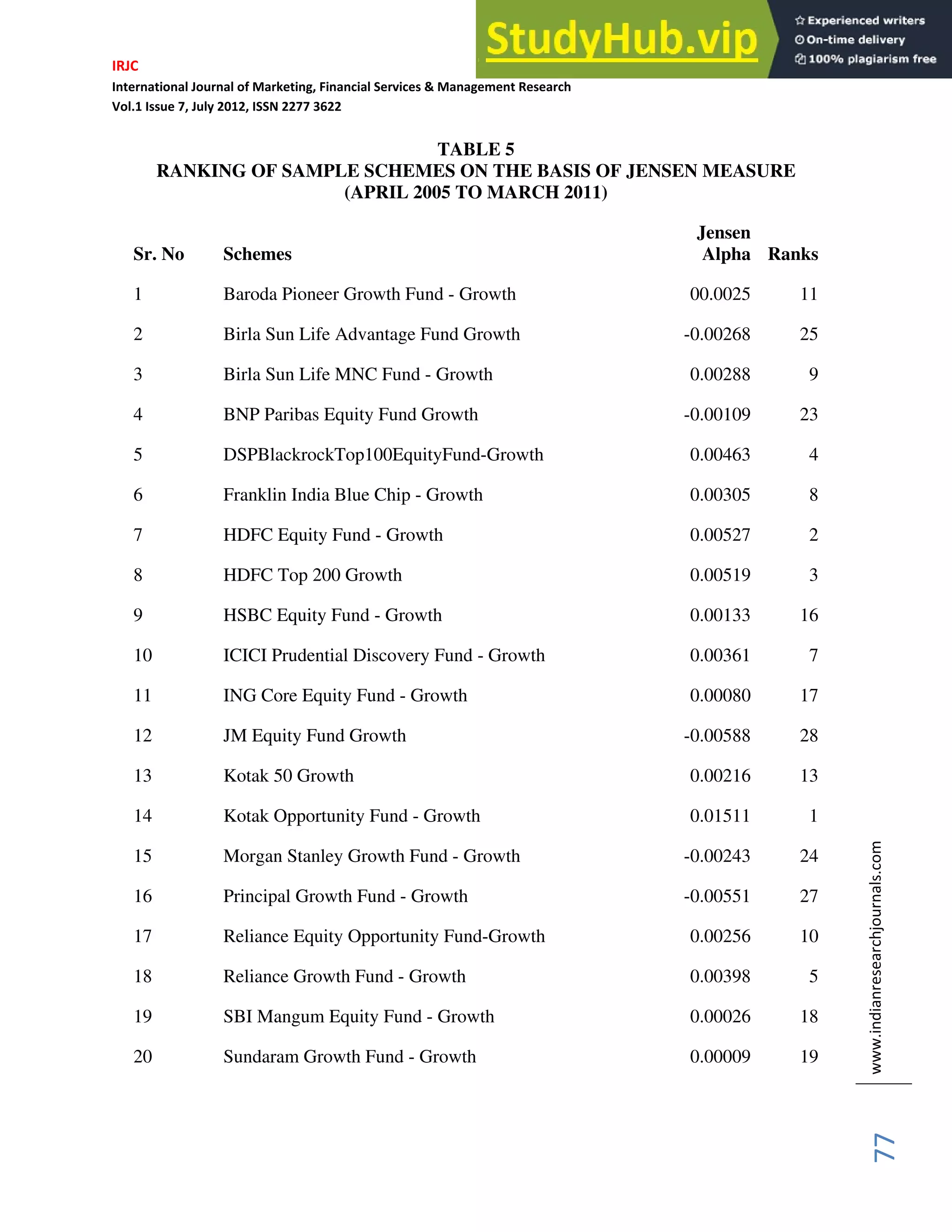

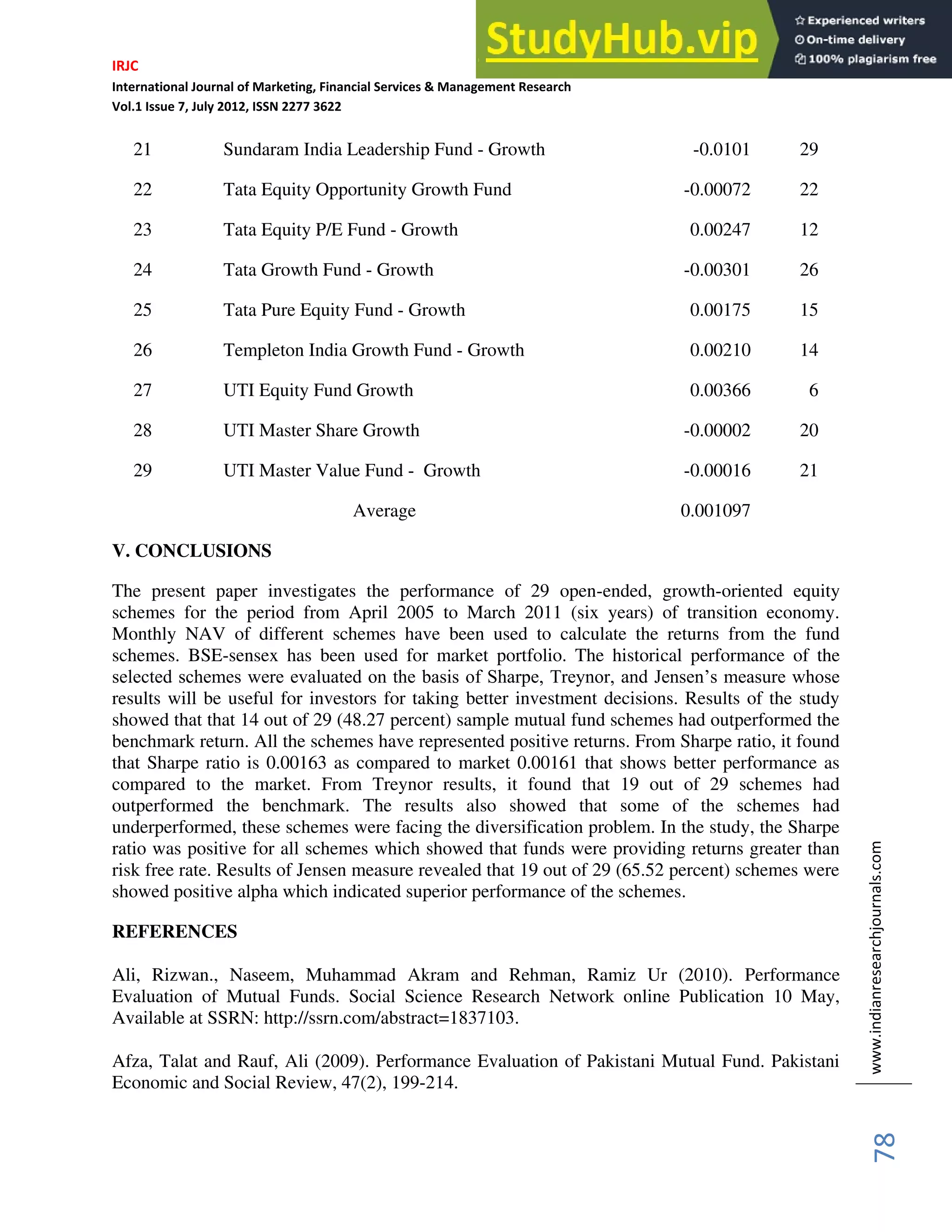

This document analyzes the performance of 29 Indian mutual fund schemes from April 2005 to March 2011 using various measures. It finds that 14 of the 29 schemes (48.28%) outperformed the benchmark index. The Sharpe ratio was positive for all schemes, indicating returns higher than the risk-free rate. Jensen's alpha was positive for 19 schemes (65.52%), showing superior performance. The study uses monthly net asset values to calculate returns and the BSE Sensex as the market portfolio for comparison. Various risk-adjusted return models like the Sharpe, Treynor, and Jensen measures are employed to evaluate the historical performance of the selected mutual fund schemes.