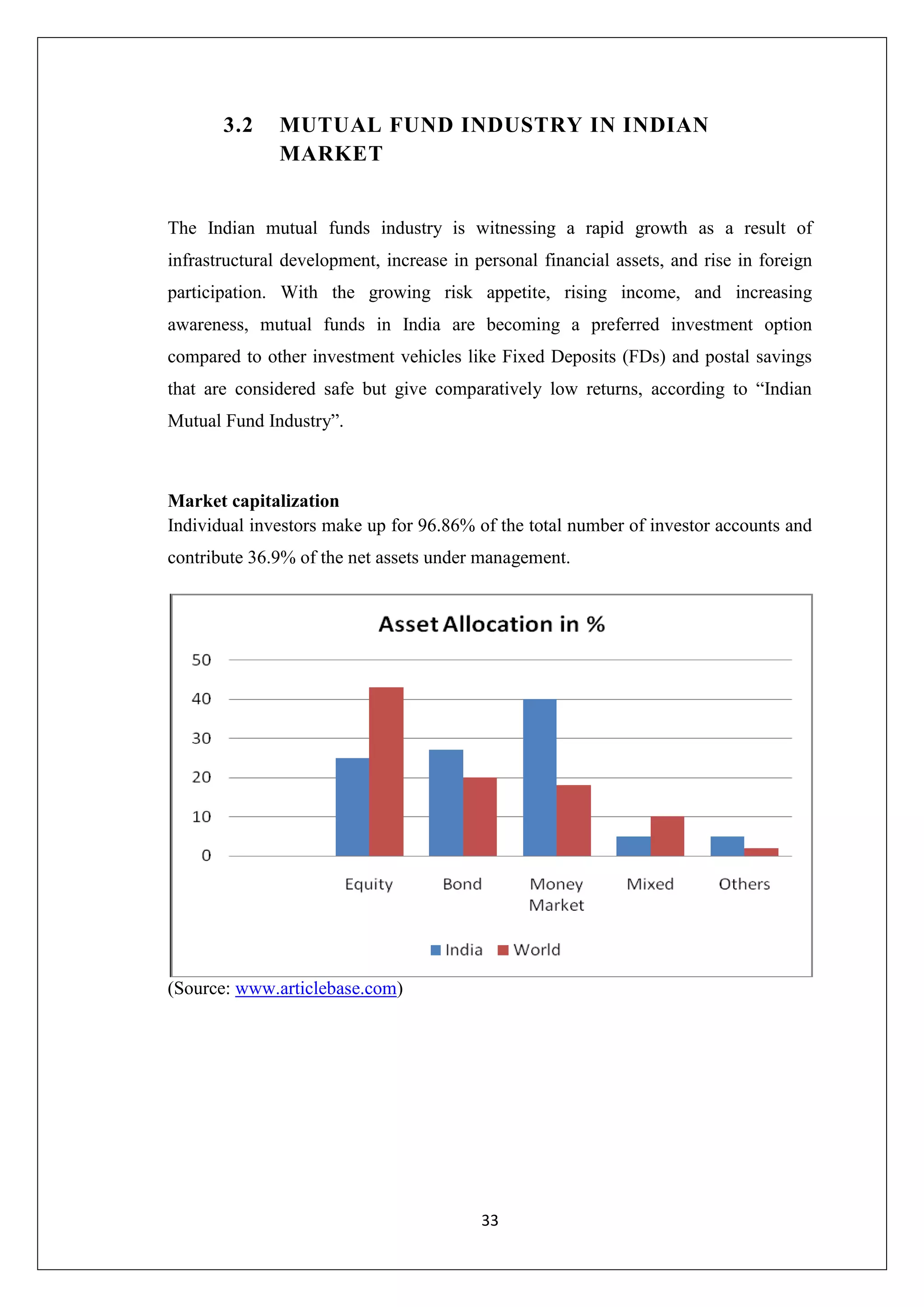

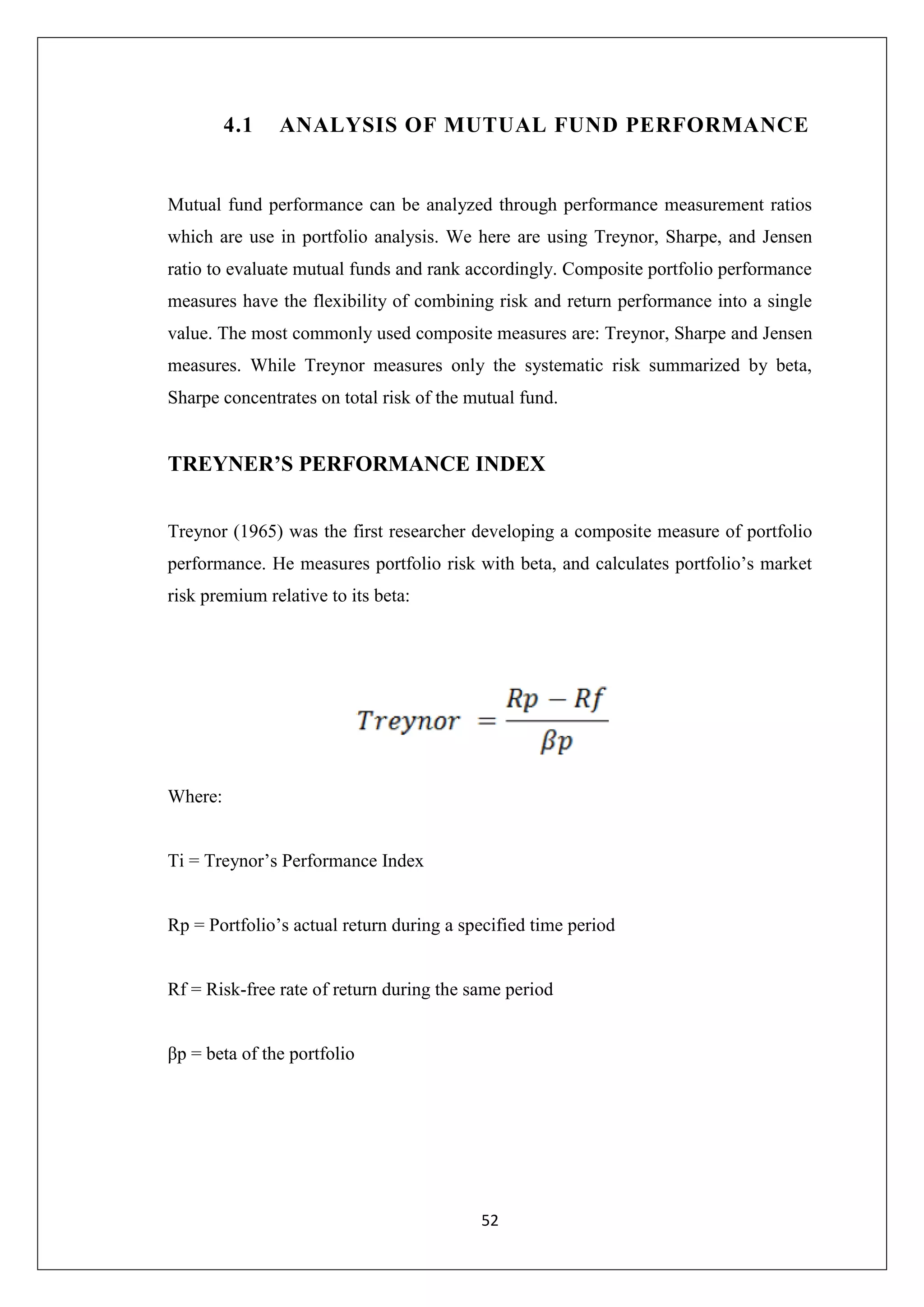

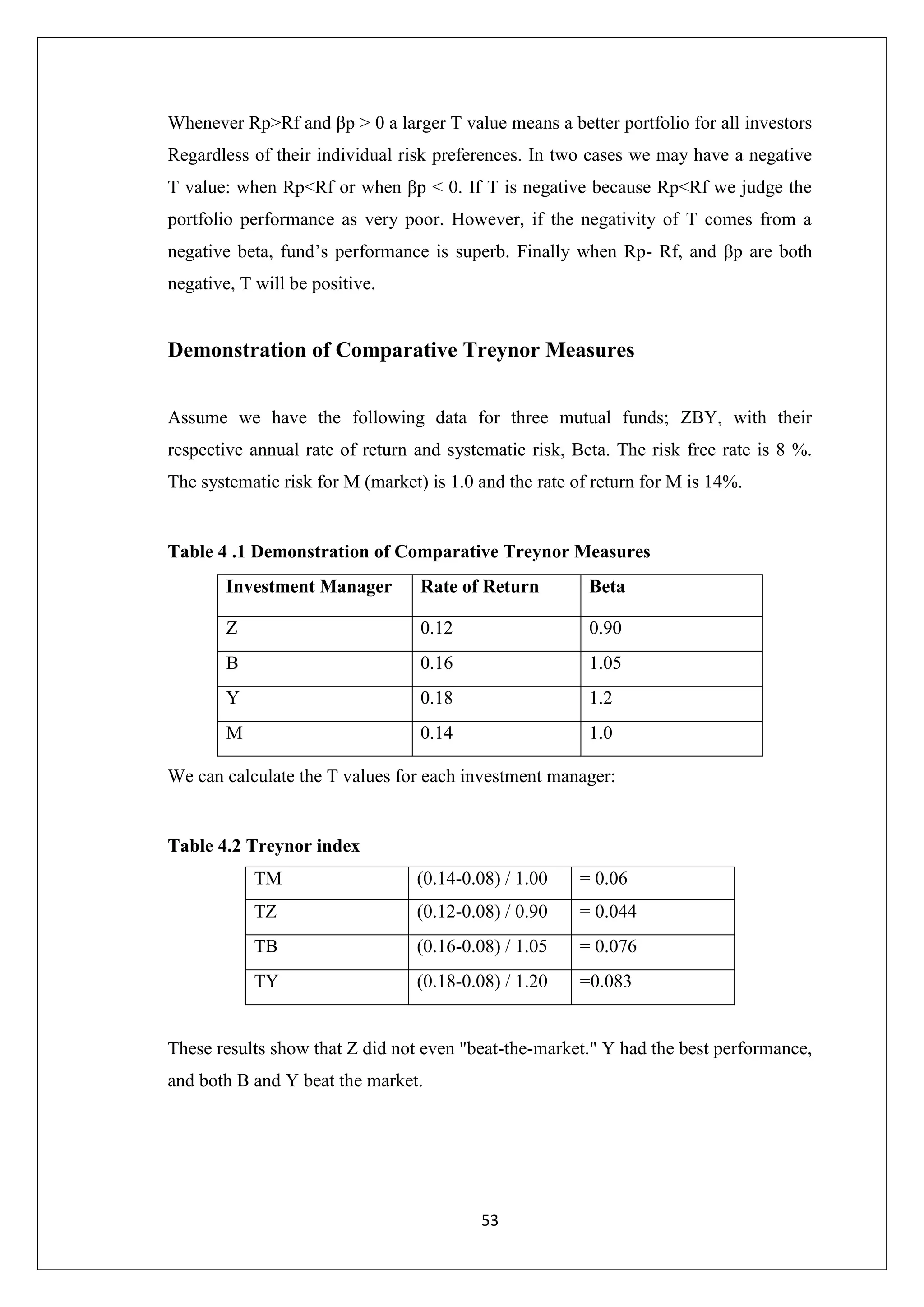

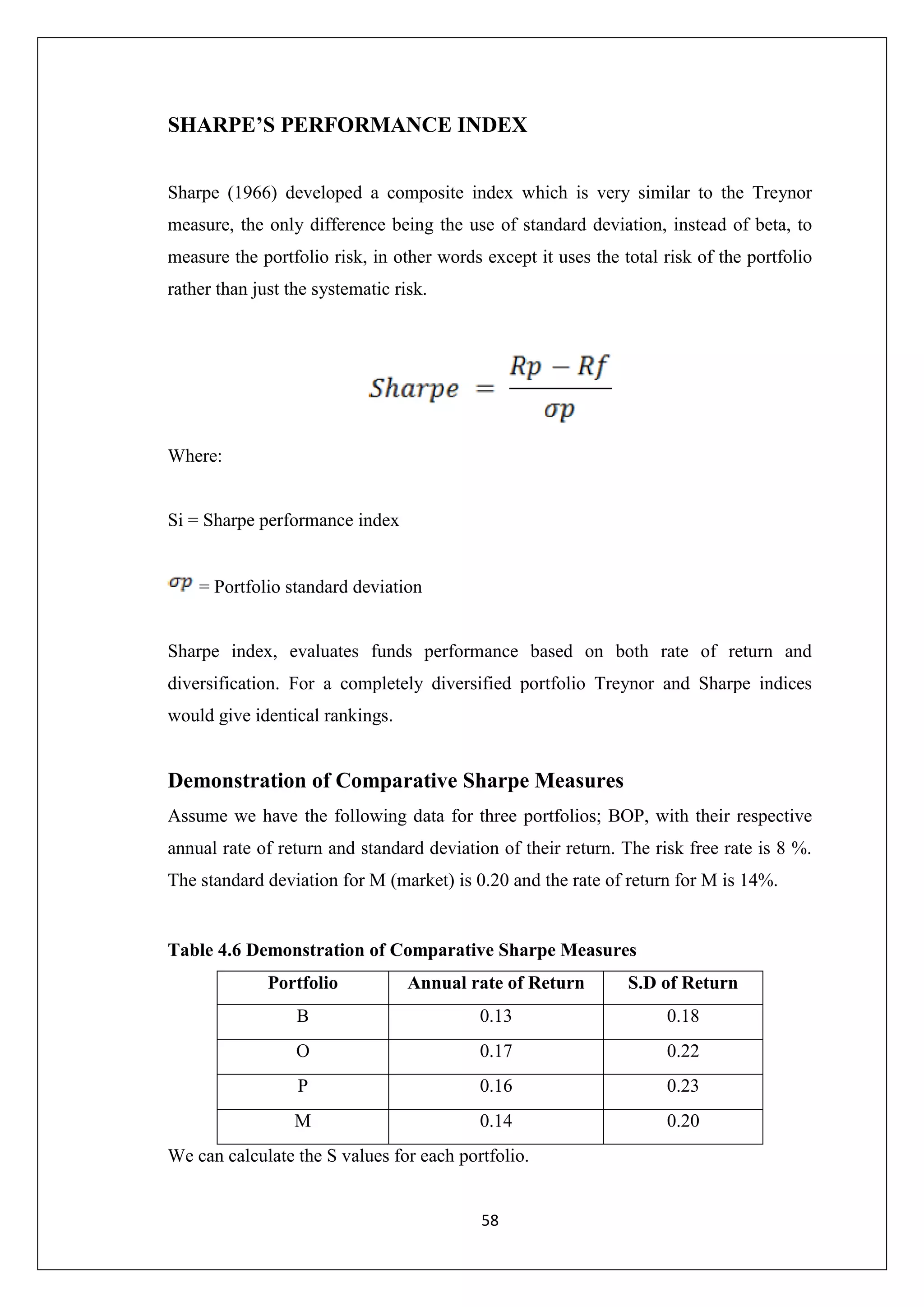

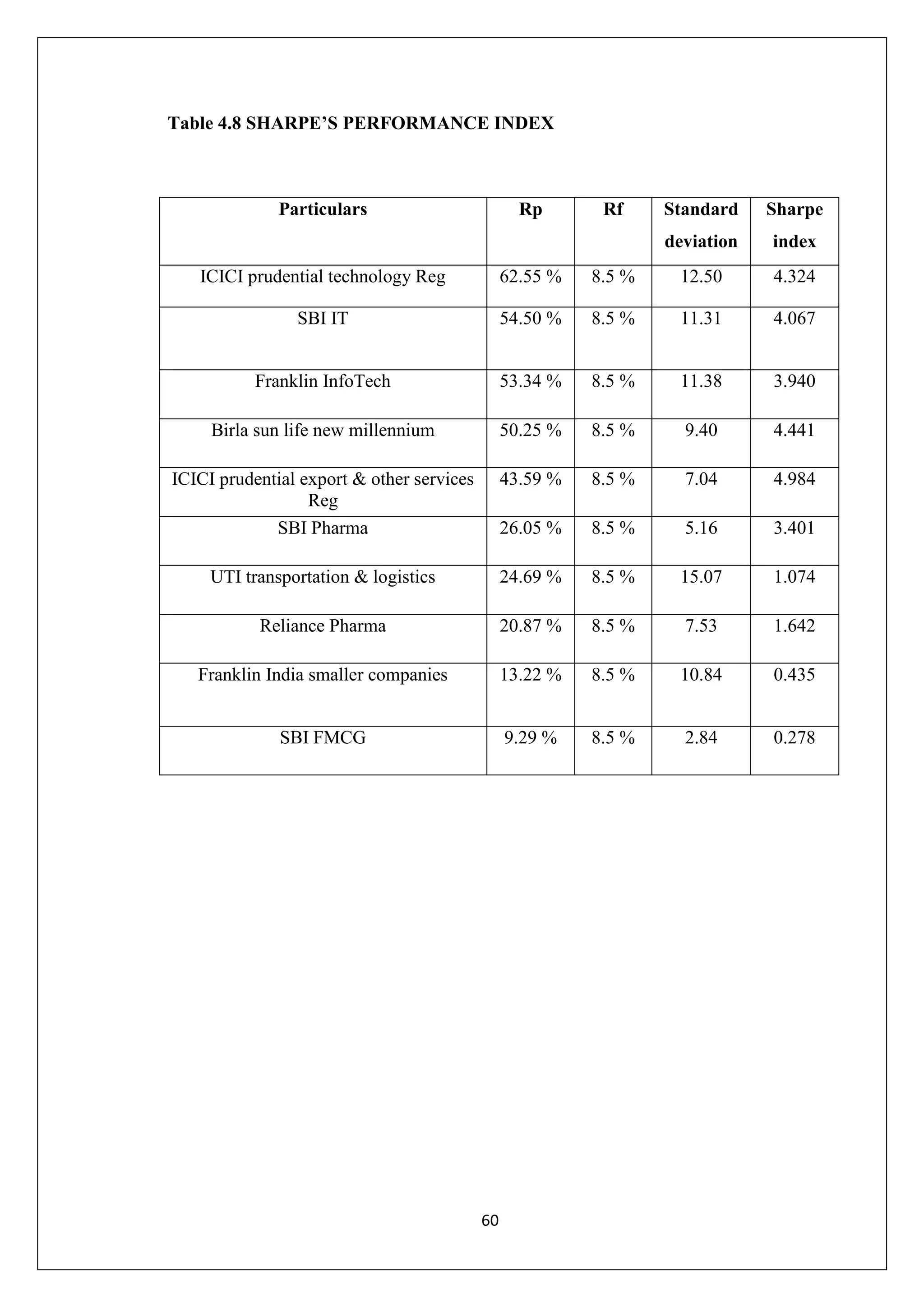

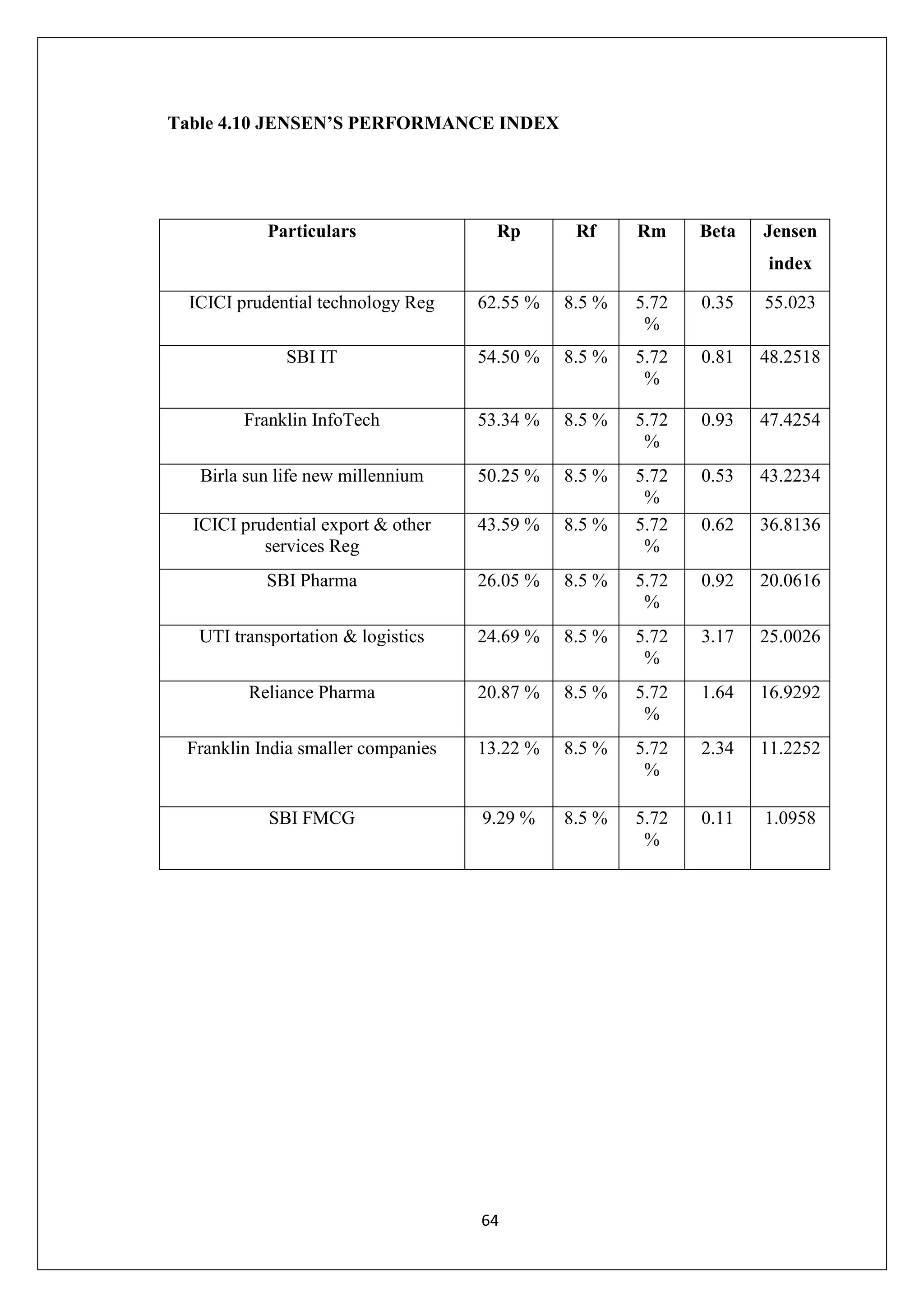

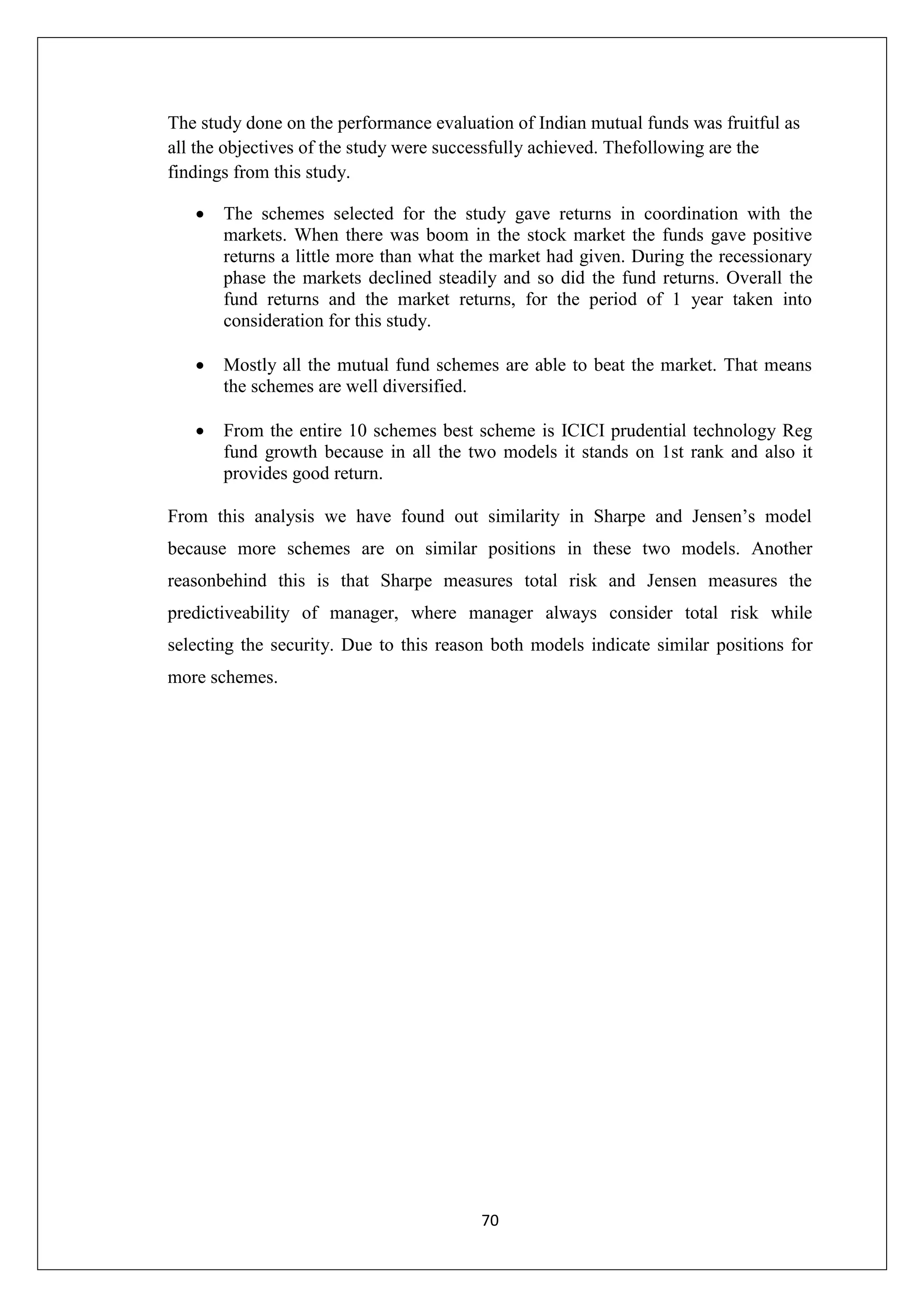

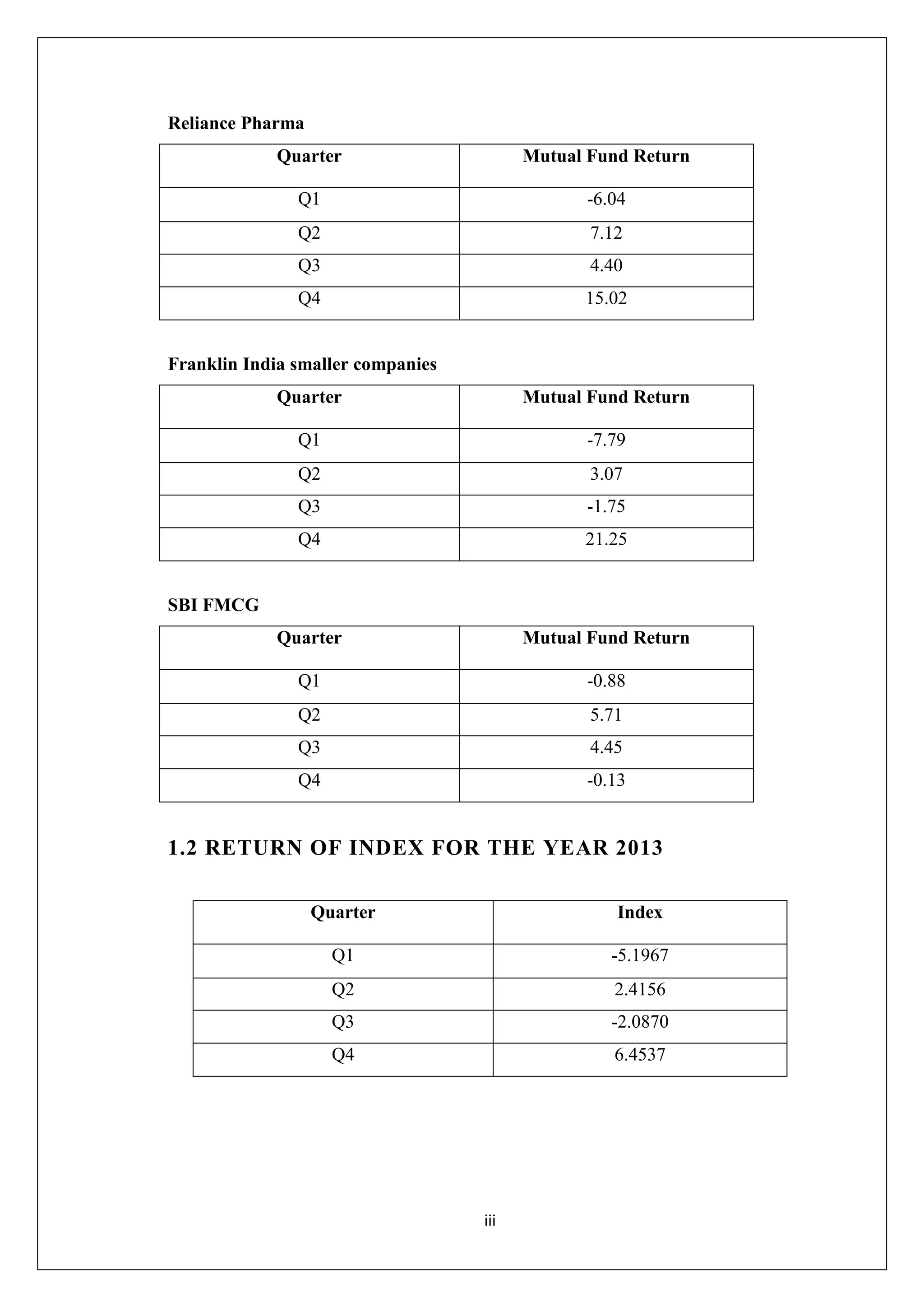

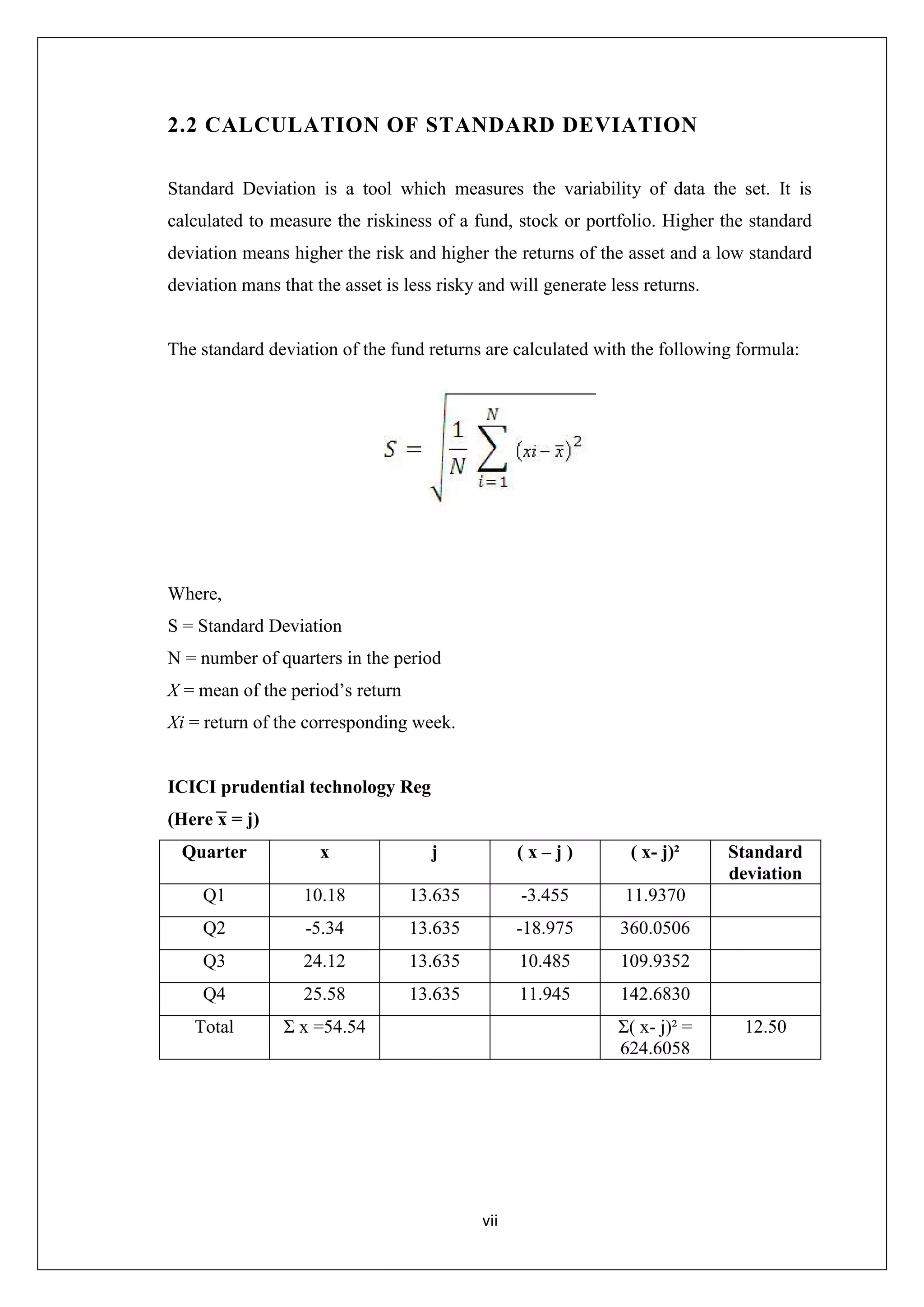

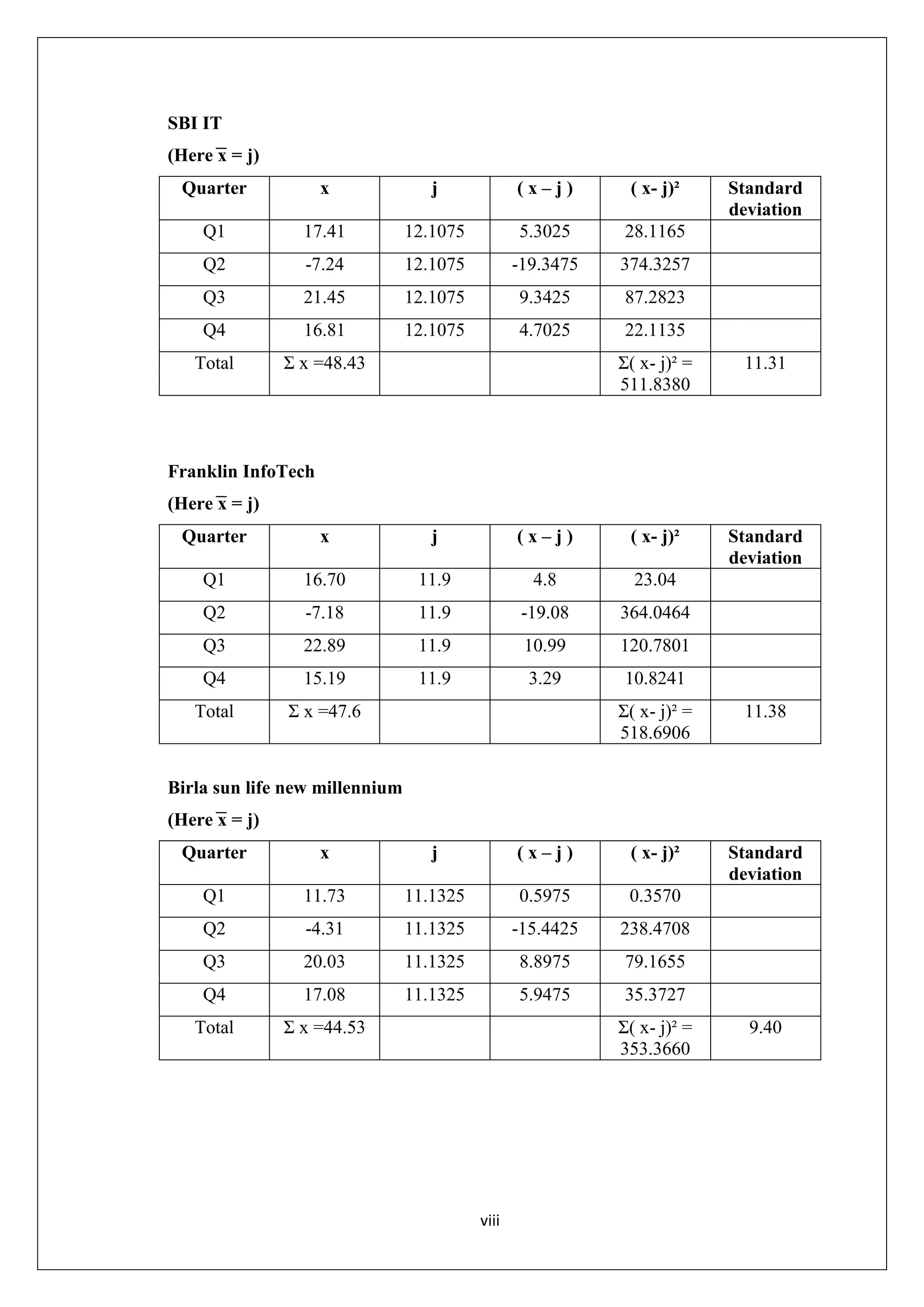

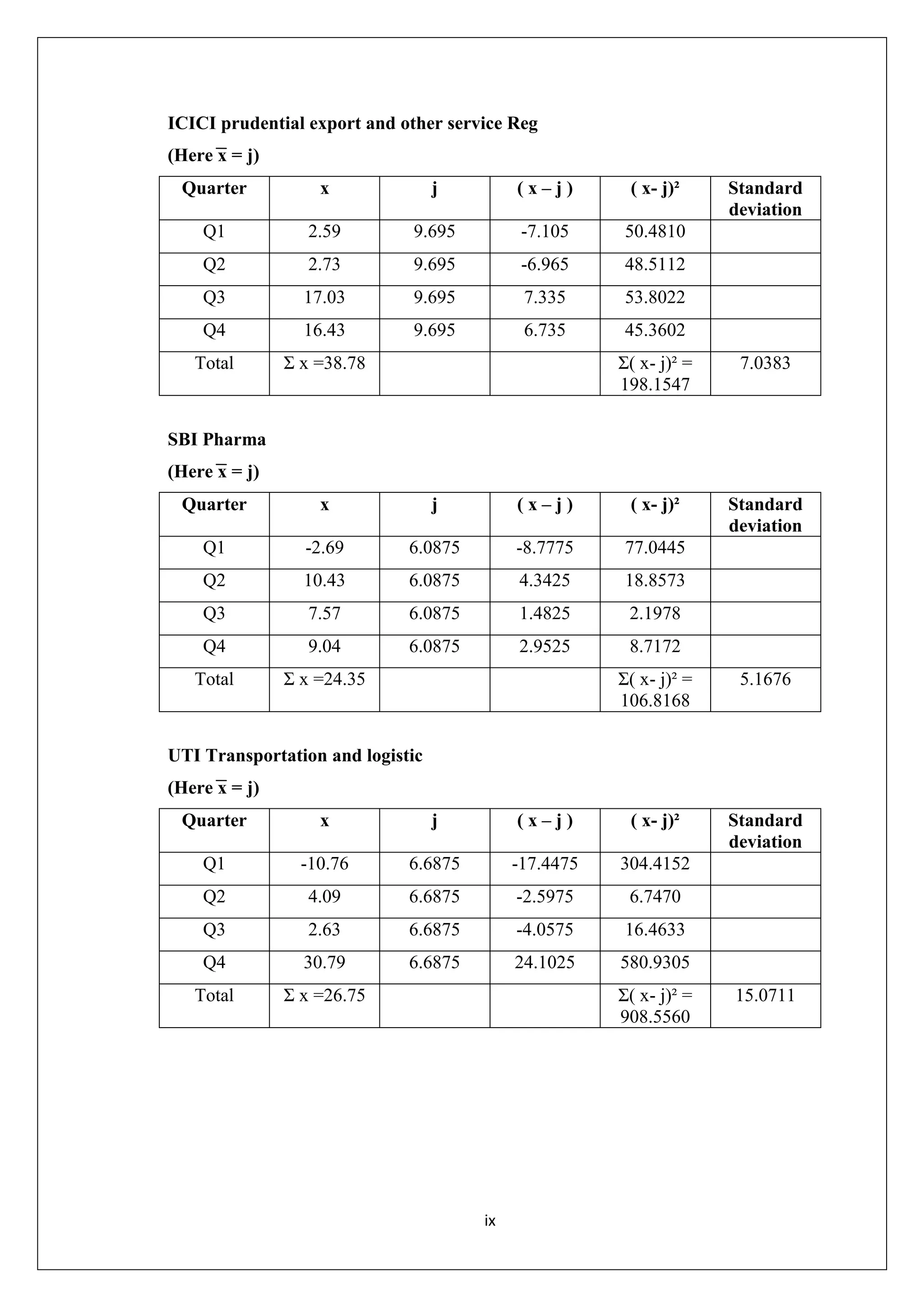

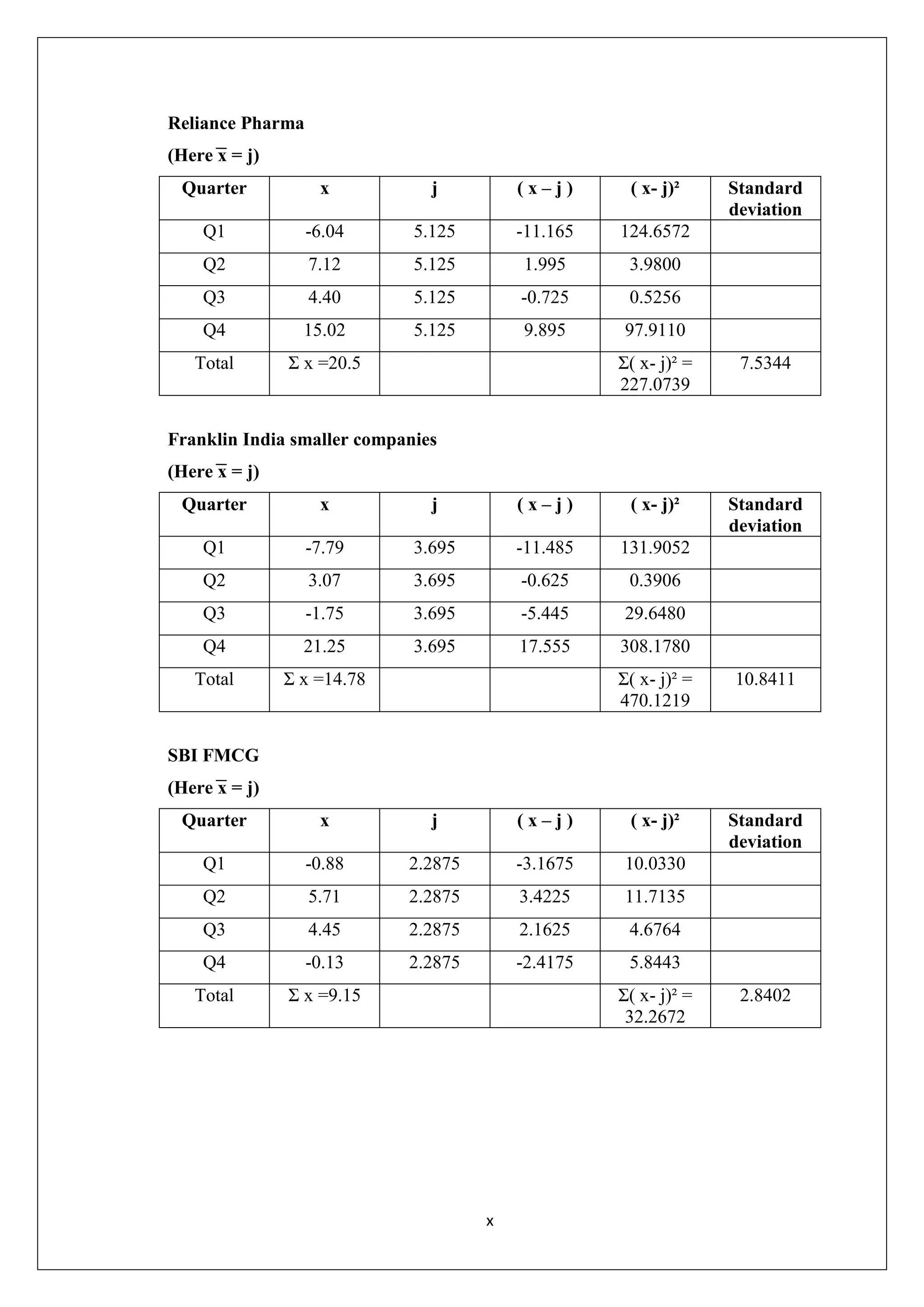

This document provides a comprehensive project report on evaluating the performance of mutual funds in India. It analyzes data on 10 equity mutual funds over a one year period from 2013. Various statistical tools are used to calculate the average returns, standard deviation, beta, Treynor's performance index, Sharpe's performance index, and Jensen's alpha for each fund. These metrics are compared to those of the market index to assess how well the funds performed relative to the overall market. The results and findings determine which funds generated the highest returns and beat the market performance. The project aims to help investors understand mutual fund performance evaluation and identify the best performing funds.