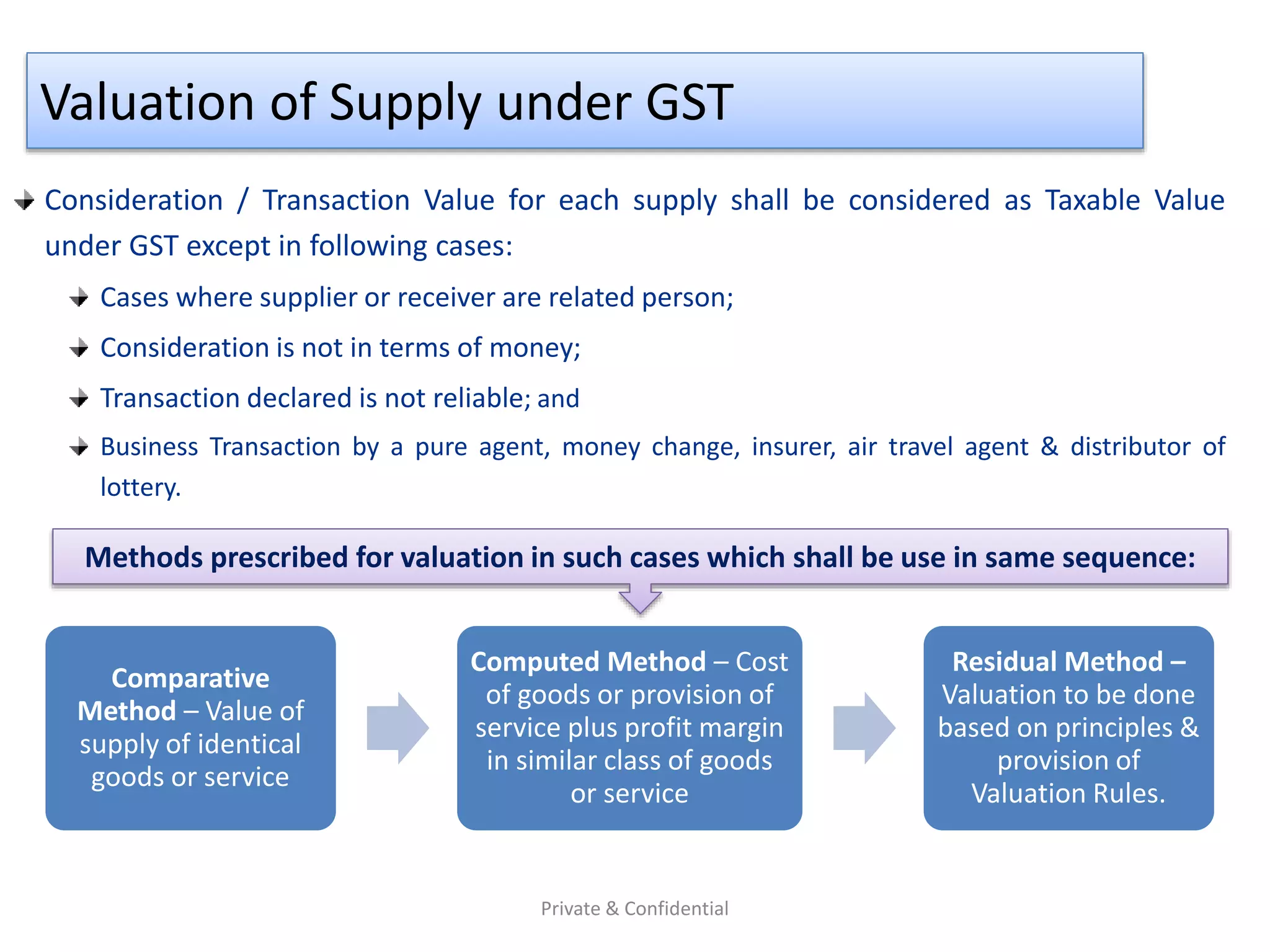

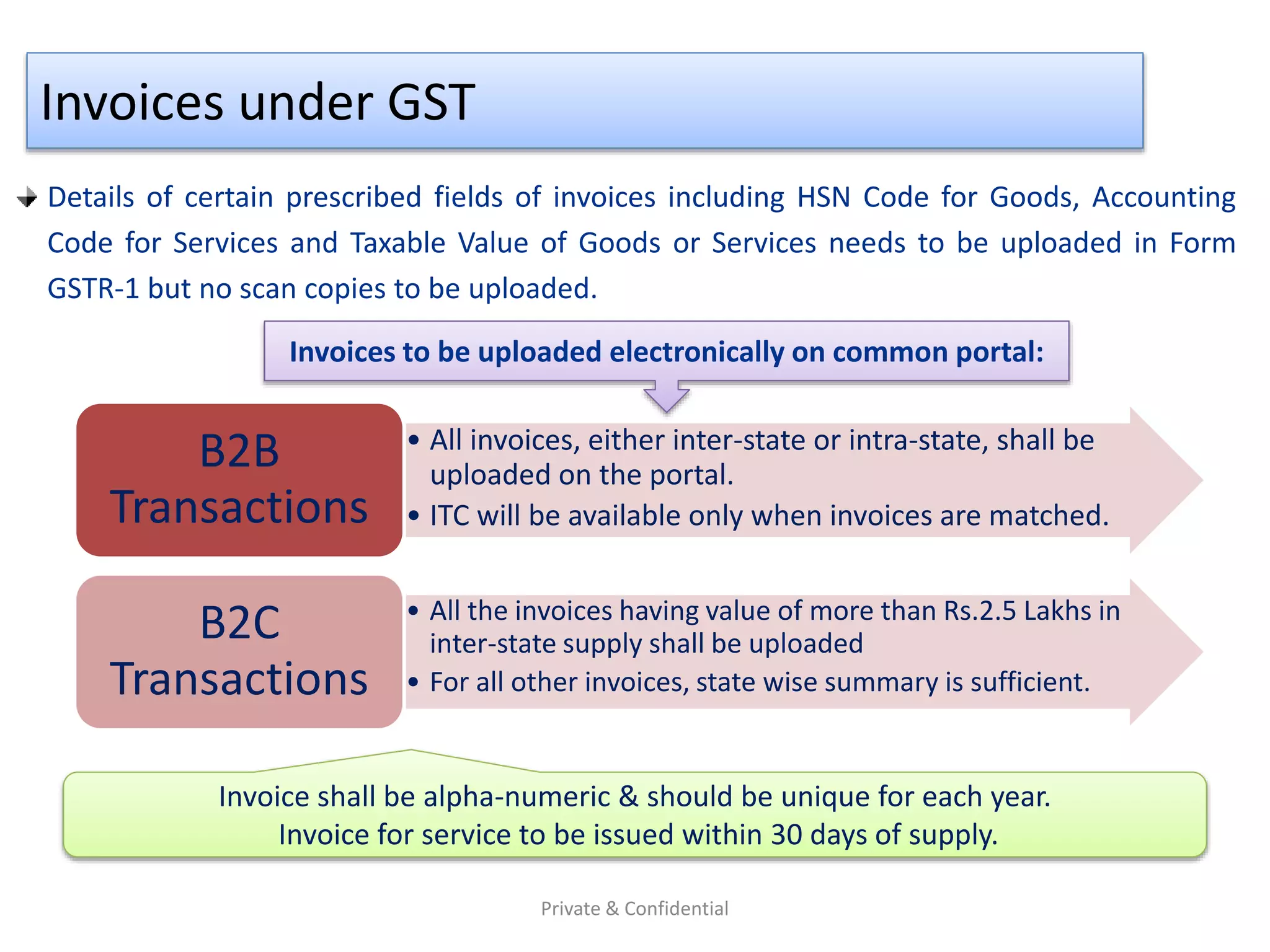

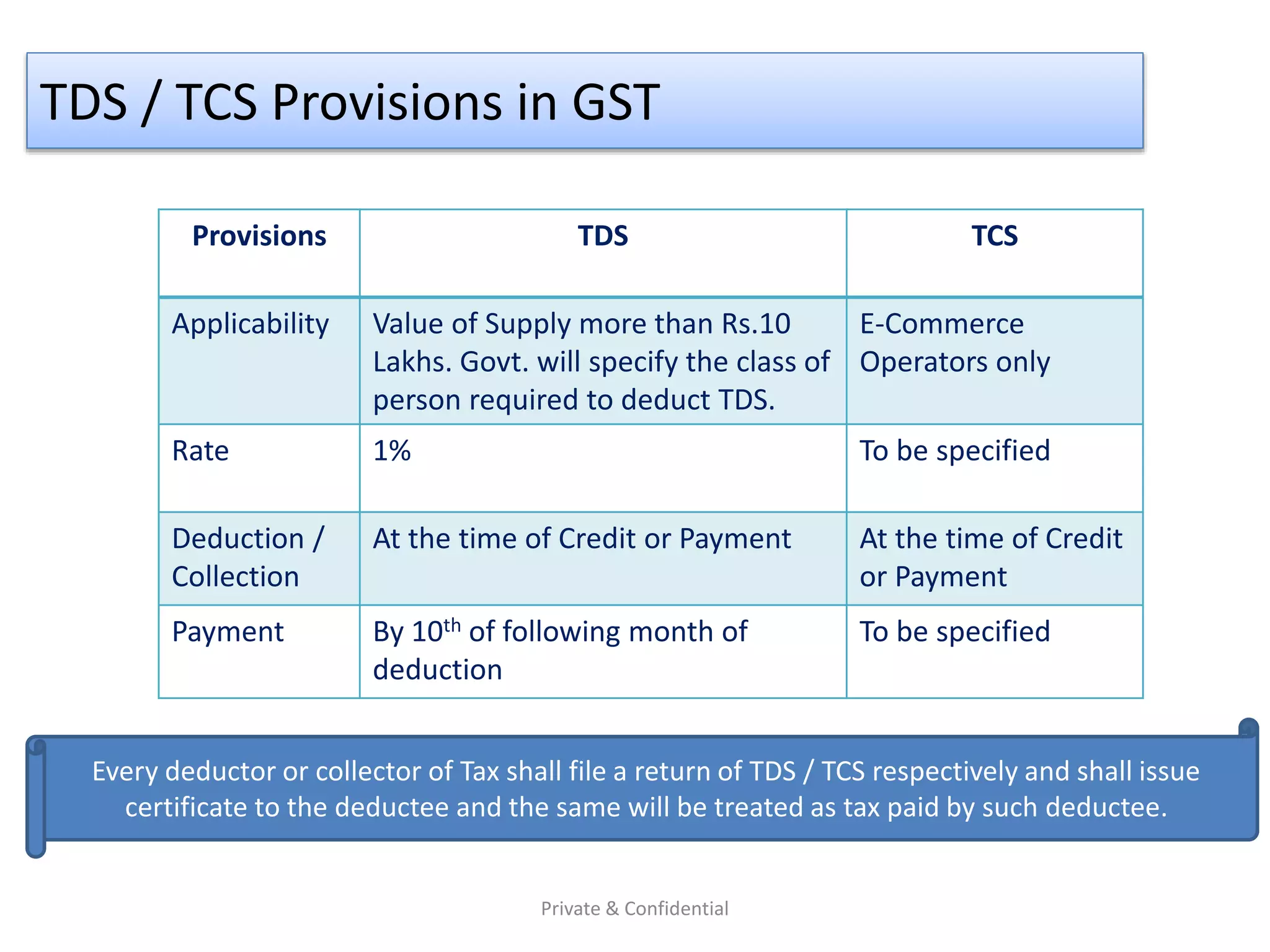

The document provides an overview of the Goods and Services Tax (GST) structure in India, detailing the transition from the existing indirect tax system to GST, which consists of Central GST, State GST, and Integrated GST. It outlines key concepts such as taxable events, time of supply, valuation of supplies, proposed GST rates, input tax credit eligibility, invoicing requirements, tax payment methods, and compliance processes for registered assessees. Additionally, it describes the migration process for existing taxpayers to the new GST framework and highlights the provisions for TDS/TCS under GST.