The document discusses the GST clearing account, emphasizing that it is always considered a liability. It explains how businesses track GST transactions, including collections and payments, using various journals such as cash receipts, sales, cash payments, and purchases. Additionally, it includes examples of journal entries and discusses the accounting implications of GST clearing on a balance sheet.

![© Michael Allison. Author’s permission required for external use.

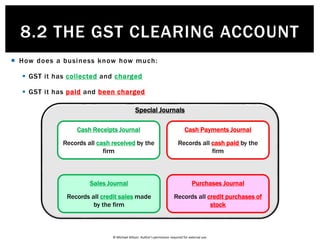

The GST transactions of the firm are posted to the GST ledger…

From now on, GST transactions are going to be posted to the GST Clearing

ledger…

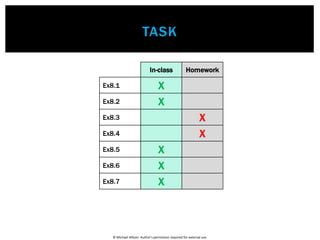

8.2 THE GST CLEARING ACCOUNT

GST [L]

GST Clearing [L]](https://image.slidesharecdn.com/8-150411080910-conversion-gate01/85/8-2-The-GST-Clearing-account-2-320.jpg)

![© Michael Allison. Author’s permission required for external use.

The GST Clearing account is always assumed to be a Liability…

GST Clearing [L]

8.2 THE GST CLEARING ACCOUNT

Debit Credit

Liabilities

Debit Credit

Liabilities

Debit Credit

Liabilities ](https://image.slidesharecdn.com/8-150411080910-conversion-gate01/85/8-2-The-GST-Clearing-account-3-320.jpg)

![© Michael Allison. Author’s permission required for external use.

Cash Receipts Journal

Date Details Receipt

Number

Bank Discount

Expense

Debtors

Control

Cost of

Sales

Sales Sundries GST

Jan 31 Total receipts 10100 2000 4000 7000 900 700

Sales Journal

Date Debtor Invoice

Number

Cost of Sales Sales GST Debtors

Control

Jan 31 Totals 2500 4000 400 4400

GST Liability [L]

Collect/charge GST

GST Liability

700

400

$1,100

8.2 THE GST CLEARING ACCOUNT](https://image.slidesharecdn.com/8-150411080910-conversion-gate01/85/8-2-The-GST-Clearing-account-5-320.jpg)

![© Michael Allison. Author’s permission required for external use.

Cash Receipts Journal

Date Details Receipt

Number

Bank Discount

Expense

Debtors

Control

Cost of

Sales

Sales Sundries GST

Jan 31 Total receipts 10100 2000 4000 7000 900 700

Sales Journal

Date Debtor Invoice

Number

Cost of Sales Sales GST Debtors

Control

Jan 31 Totals 2500 4000 400 4400

8.2 THE GST CLEARING ACCOUNT

Cash at Bank [A]

31/1 GST clearing 700

GST Clearing [L]

31/1 Cash 700

31/1 Debtors control 400

Debtors Control [A]

31/1 GST clearing 400

Debit Credit

Assets

Debit Credit

Assets

Debit Credit

Liabilities

Cash Receipts Journal

Date Details Receipt

Number

Bank Discount

Expense

Debtors

Control

Cost of

Sales

Sales Sundries GST

Jan 31 Total receipts 10100 2000 4000 7000 900 700

GST Clearing [L]

31/1 Cash 700

31/1 Debtors control 400

Debit Credit

Liabilities

Cash at Bank [A]

31/1 GST clearing 700

Debit Credit

Assets

Sales Journal

Date Debtor Invoice

Number

Cost of Sales Sales GST Debtors

Control

Jan 31 Totals 2500 4000 400 4400

GST Clearing [L]

31/1 Cash 700

31/1 Debtors control 400

Debtors Control [A]

31/1 GST clearing 400

Debit Credit

Assets ](https://image.slidesharecdn.com/8-150411080910-conversion-gate01/85/8-2-The-GST-Clearing-account-6-320.jpg)

![© Michael Allison. Author’s permission required for external use.

$1,100

GST Liability [L]

GST Liability

Pay/charged GST

Cash Payments Journal

Date Details Cheque

Number

Bank Discount

Revenue

Creditors

Control

Stock

Control

Wages Sundries GST

Jan 31 Totals 8300 100 2100 2000 3000 1000 300

Purchases Journal

Date Creditor Invoice

Number

Stock

Control

GST Creditors

Control

Jan 31 Totals 5000 500 5500

300500

$300

8.2 THE GST CLEARING ACCOUNT](https://image.slidesharecdn.com/8-150411080910-conversion-gate01/85/8-2-The-GST-Clearing-account-7-320.jpg)

![© Michael Allison. Author’s permission required for external use.

Cash Payments Journal

Date Details Cheque

Number

Bank Discount

Revenue

Creditors

Control

Stock

Control

Wages Sundries GST

Jan 31 Totals 8300 100 2100 2000 3000 1000 300

Purchases Journal

Date Creditor Invoice

Number

Stock

Control

GST Creditors

Control

Jan 31 Totals 5000 500 5500

8.2 THE GST CLEARING ACCOUNT

Debit Credit

Liabilities

Cash at Bank [A]

31/1 GST clearing 700 31/1 GST clearing 300

Debit Credit

Assets

GST Clearing [L]

31/1 Cash 300 31/1 Cash 700

31/1 Creditors control 500 31/1 Debtors control 400

Creditors Control [L]

31/1 GST clearing 400 31/1 GST clearing 500

Debit Credit

Liabilities

Cash Payments Journal

Date Details Cheque

Number

Bank Discount

Revenue

Creditors

Control

Stock

Control

Wages Sundries GST

Jan 31 Totals 8300 100 2100 2000 3000 1000 300

Debit Credit

Liabilities

GST Clearing [L]

31/1 Cash 300 31/1 Cash 700

31/1 Creditors control 500 31/1 Debtors control 400

Cash at Bank [A]

31/1 GST clearing 700 31/1 GST clearing 300

Debit Credit

Assets

Purchases Journal

Date Creditor Invoice

Number

Stock

Control

GST Creditors

Control

Jan 31 Totals 5000 500 5500

Creditors Control [L]

31/1 GST clearing 400 31/1 GST clearing 500

Debit Credit

Liabilities

GST Clearing [L]

31/1 Cash 300 31/1 Cash 700

31/1 Creditors control 500 31/1 Debtors control 400](https://image.slidesharecdn.com/8-150411080910-conversion-gate01/85/8-2-The-GST-Clearing-account-8-320.jpg)

![© Michael Allison. Author’s permission required for external use.

Does this firm have a GST Asset or Liability?

GST Clearing [L]

31 Jan Cash 300 31 Jan Cash 700

31 Jan Creditors control 500 31 Jan Debtors control 400

GST Clearing [L]

31 Jan Cash 300 31 Jan Cash 700

31 Jan Creditors control 500 31 Jan Debtors control 400

1100

GST Clearing [L]

31 Jan Cash 300 31 Jan Cash 700

31 Jan Creditors control 500 31 Jan Debtors control 400

1100 1100

GST Clearing [L]

31 Jan Cash 300 31 Jan Cash 700

31 Jan Creditors control 500 31 Jan Debtors control 400

31 Jan Balance 300

1100 1100

GST Clearing [L]

31 Jan Cash 300 31 Jan Cash 700

31 Jan Creditors control 500 31 Jan Debtors control 400

31 Jan Balance 300

1100 1100

1 Feb Balance 300

Balance Sheet as at 31 December 2015

Current Assets $ $ Current Liabilities $ $

GST Liability 400

Balance Sheet as at 31 December 2015

Current Assets $ $ Current Liabilities $ $

GST Clearing 300

Business Government

$300

Listed as “GST Clearing” in the

Balance Sheet, not “GST Liability”

8.2 THE GST CLEARING ACCOUNT](https://image.slidesharecdn.com/8-150411080910-conversion-gate01/85/8-2-The-GST-Clearing-account-9-320.jpg)

![© Michael Allison. Author’s permission required for external use.

Does this firm have a GST Asset or Liability?

GST Clearing [L]

31 Jan Cash 1000 31 Jan Cash 600

31 Jan Creditors control 400 31 Jan Debtors control 300

Balance Sheet as at 31 December 2015

Current Assets $ $ Current Liabilities $ $

GST Clearing 300

GST Clearing [L]

31 Jan Cash 1000 31 Jan Cash 600

31 Jan Creditors control 400 31 Jan Debtors control 300

1400

GST Clearing [L]

31 Jan Cash 1000 31 Jan Cash 600

31 Jan Creditors control 400 31 Jan Debtors control 300

1400 1400

GST Clearing [L]

31 Jan Cash 1000 31 Jan Cash 600

31 Jan Creditors control 400 31 Jan Debtors control 300

31 Jan Balance 500

1400 1400

GST Clearing [L]

31 Jan Cash 1000 31 Jan Cash 600

31 Jan Creditors control 400 31 Jan Debtors control 300

31 Jan Balance 500

1400 1400

1 Feb Balance 500

Balance Sheet as at 31 December 2015

Current Assets $ $ Current Liabilities $ $

GST Clearing 500 GST Clearing 300

Listed as “GST Clearing” in the

Balance Sheet, not “GST Asset”

Business Government

$500

8.2 THE GST CLEARING ACCOUNT](https://image.slidesharecdn.com/8-150411080910-conversion-gate01/85/8-2-The-GST-Clearing-account-10-320.jpg)

![© Michael Allison. Author’s permission required for external use.

GST Clearing [L]

Cash Receipts Journal

Sales Journal

Cash Payments Journal

Purchases Journal

8.2 THE GST CLEARING ACCOUNT

Debit Credit

Liabilities ](https://image.slidesharecdn.com/8-150411080910-conversion-gate01/85/8-2-The-GST-Clearing-account-11-320.jpg)