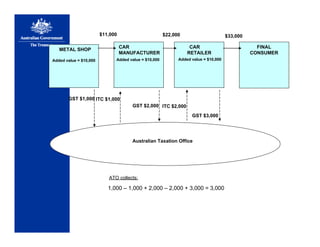

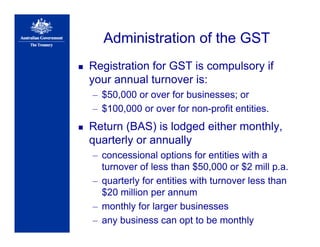

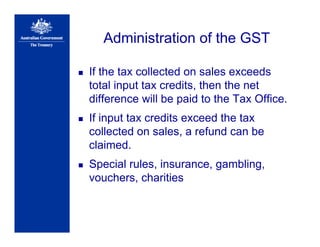

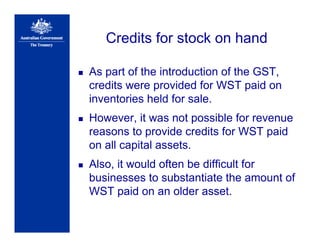

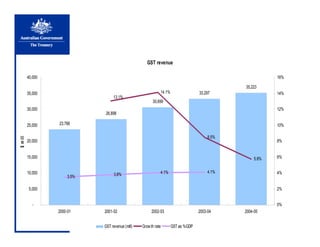

The Australian government introduced a Goods and Services Tax (GST) in 2000 to replace older sales taxes that were outdated, internationally uncompetitive, and complex. The GST is a 10% tax on private consumption that applies broadly to goods, services, and other supplies. It functions as a value-added tax where businesses can claim credits for GST paid on inputs. Various transitional policies were implemented to smooth the introduction of the new tax, which generated increasing revenue for state and territory governments in its early years.