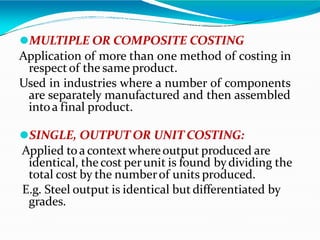

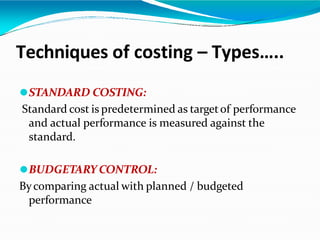

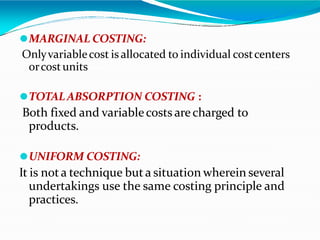

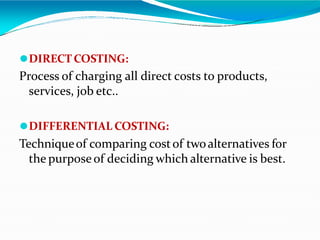

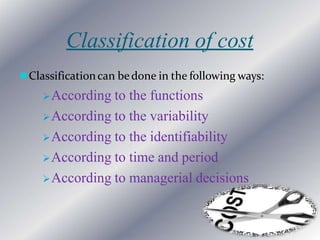

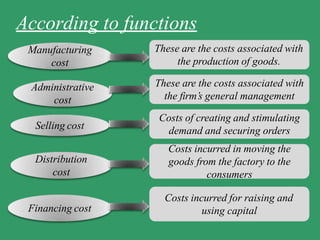

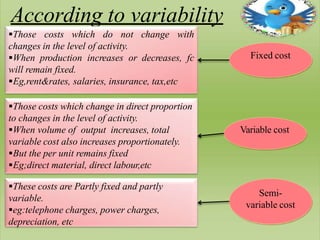

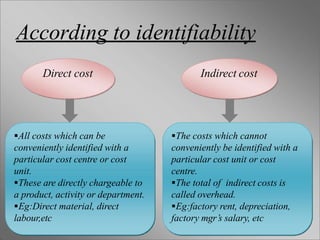

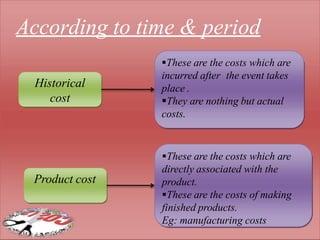

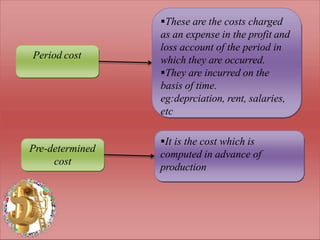

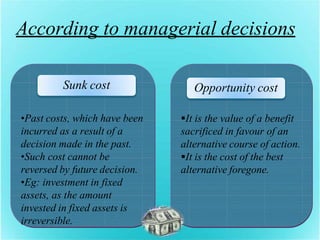

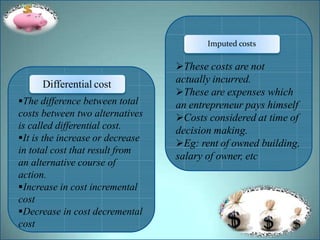

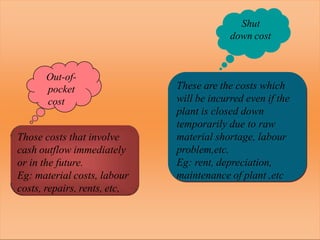

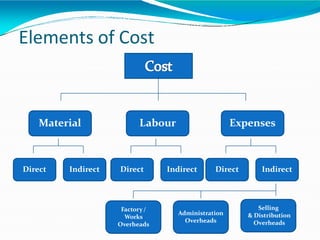

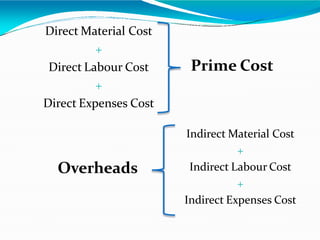

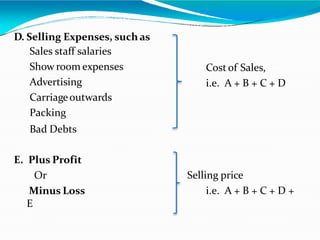

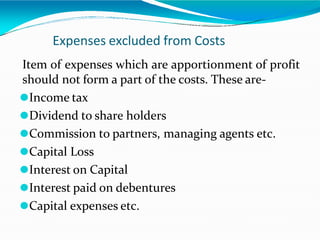

Cost accounting was developed due to limitations of financial accounting such as only providing past data, not showing profit/loss by product or process, and not measuring organizational efficiency. Cost accounting measures the resources consumed to produce products/services. It involves determining, controlling, and reducing costs to guide business decisions. Costs are classified by functions, behavior, identification, time period, and decisions to aid analysis. Cost accounting techniques include standard costing, budgetary control, and differential costing.

![7_C's_OF_COMMUNIOCATION[1].pptx](https://image.slidesharecdn.com/7csofcommuniocation1-230801063320-9af405b3/85/7_C-s_OF_COMMUNIOCATION-1-pptx-37-320.jpg)