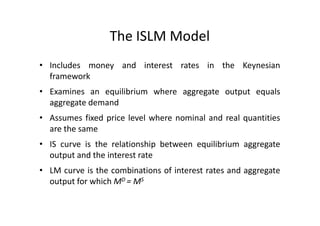

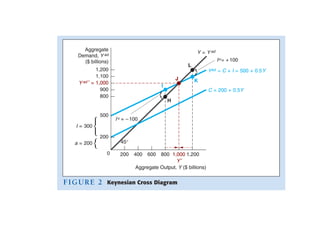

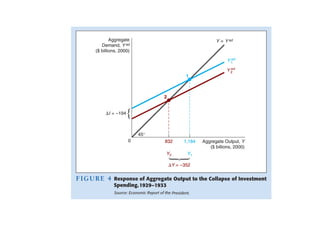

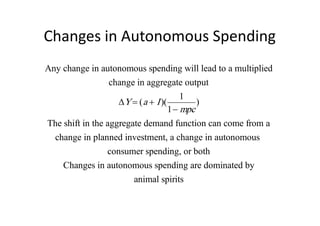

The document summarizes the IS-LM model, which examines macroeconomic equilibrium where aggregate output equals aggregate demand. It discusses:

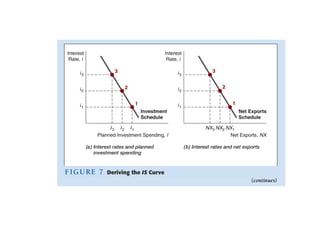

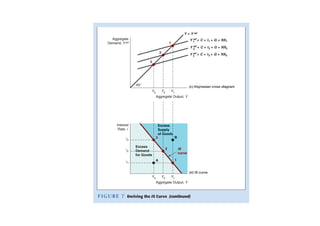

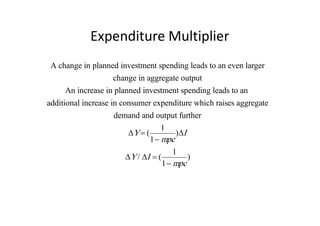

1) The IS curve, which shows the relationship between equilibrium output and interest rates based on investment spending and net exports.

2) The LM curve, which connects points where money demand equals money supply, showing the interest rate needed for equilibrium at each output level.

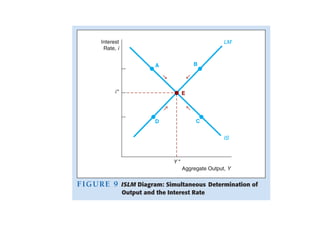

3) How the intersection of the IS and LM curves determines equilibrium in both the goods market and money market simultaneously, with output and interest rate satisfying both markets.

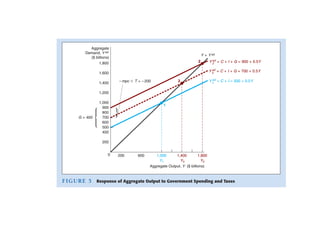

![Government’s Role

Government spending and taxes

can be used to change the position of the

aggregate demand function

Government spending adds directly

to aggregate demand

Taxes do not affect aggregate demand directly

C = a + [ mpc × (Y − T )] = a + ( mpc × Y) − ( mpc × T )

If taxes change, consumer expenditure changes

in the opposite direction

∆C = - mpc × ∆T](https://image.slidesharecdn.com/5islm1-120502144309-phpapp01/85/5-islm-1-12-320.jpg)