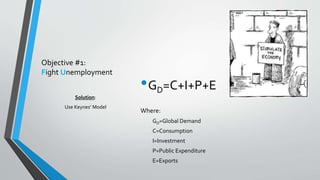

This document discusses alternative solutions to economic recession and slow global recovery from 2001-2015. It analyzes two main objectives: fighting unemployment and reducing public deficit. For the first objective, it recommends using Keynes' model of increasing global demand through reduced taxes, lower interest rates, higher public expenditure, and reduced exchange rates. However, it also notes that under some models, demand can negatively impact unemployment. For the second objective, it suggests increasing taxes and reducing public expenditure. The document also discusses Mundell's optimal currency zone model and concludes that during high unemployment, countries should use Keynes' model combined with salary flexibility linked to productivity rather than inflation.

![Objective #1: (cont.):

Fight Unemployment

Applying Keynes’ Model, Unemployment is Minimized by:

Maximizing Global Demand [GD] which implies:

1) Reduced Taxes to Promote Consumption [C]

2) Reduce Interest Rates to Promote Investment [I]

3) Increase Public Expenditure to assist Population needs [P]

4) Reduce Exchange Rate to Stimulate Exports [E]

Solution:

Use Keynes’ Model](https://image.slidesharecdn.com/economicskeynessalaryflexibility-141101124345-conversion-gate02/85/Economics-keynes-salary-flexibility-7-320.jpg)

![Objective #2:

Reduce Public Deficit

Reducing Unemployment is some times against reducing

Public Deficit.

Unfortunately this path is not helping those countries with

high unemployment rates (e.g. Greece [27.2%], Spain

[25.6%], Portugal [15.3%], Italy [13%])

Germany is following this path and forcing the Euro Zone to

shadow this route.

Solution:

Increase Taxes and Reduce Public

Expenditure

GD=C+I+P+E](https://image.slidesharecdn.com/economicskeynessalaryflexibility-141101124345-conversion-gate02/85/Economics-keynes-salary-flexibility-9-320.jpg)

![Optimal Monetary Zone

Mundell Model

[1999]](https://image.slidesharecdn.com/economicskeynessalaryflexibility-141101124345-conversion-gate02/85/Economics-keynes-salary-flexibility-10-320.jpg)

![Optimal Monetary Zone

(cont.)

Robert Mundell´s Model

[1999]

Mundell´s optimal monetary zone model calls for two

mandatory requirements:

1] Convergence of the macroeconomic magnitudes (e.g.,

Maastricht Agreement: Similar Inflation Rates, Similar

Interest Rates, Public Debt below 60% of the GDP, and

Public Deficit below 3% of the GDP).

2] Productive factors free movement (particularly, labor

force and capital).

This second obligatory requirement is the what mostly the

Euro Zone is lacking of, economic reality differs between

member countries (e.g., Spain with more than 25% of

unemployment vs. Germany with lest than 5% as of June

2014).](https://image.slidesharecdn.com/economicskeynessalaryflexibility-141101124345-conversion-gate02/85/Economics-keynes-salary-flexibility-11-320.jpg)