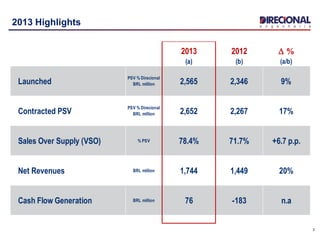

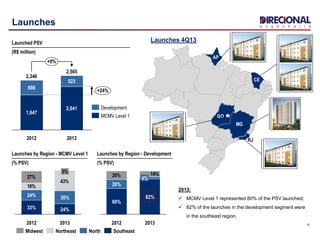

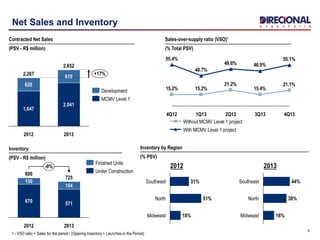

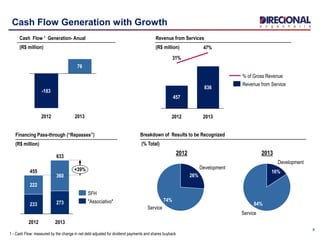

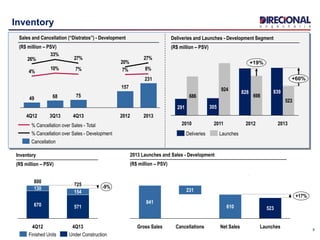

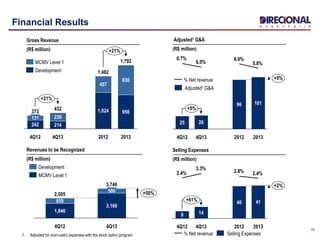

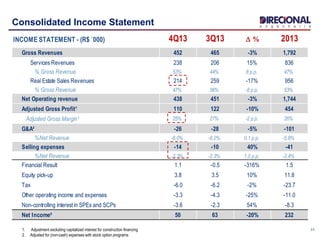

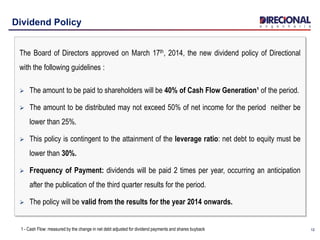

The document provides an earnings release and conference call agenda for a real estate company. It summarizes key operational and financial highlights for 2013, including a 17% increase in contracted sales, 20% increase in net revenues, and positive cash flow generation. A new dividend policy is announced targeting a payout of 40-50% of cash flow subject to leverage requirements. Contact information is provided for further questions.