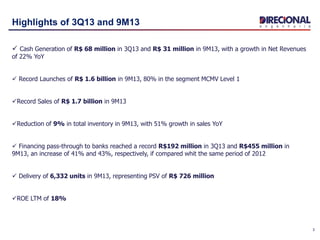

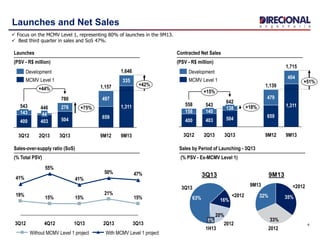

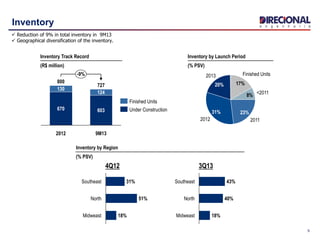

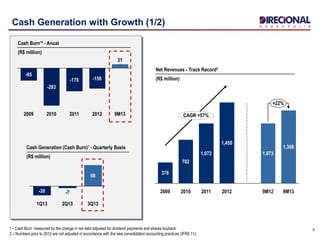

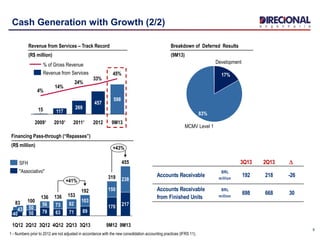

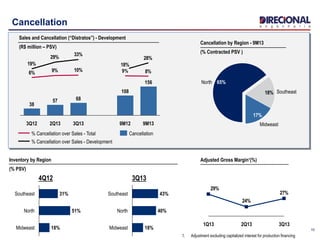

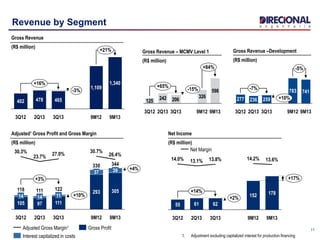

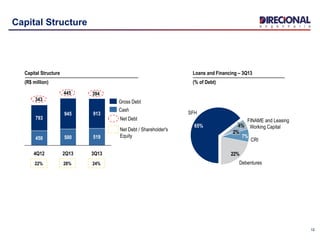

The document provides an earnings release and conference call agenda for a company's 3Q13 results. Key highlights included record launches of R$1.6 billion in 9M13, with 80% in an affordable housing program. Sales reached a record R$1.7 billion in 9M13, up 51% year-over-year. Inventory was reduced by 9% in 9M13, with continued focus on geographical diversification. Net income increased 17% to R$178 million in 9M13, with a net margin of 13.6%. The presentation provides additional financial details on revenues, costs, margins, and capital structure.